| Daniel Amerman & The Turning Inflation Into Wealth Mini-Course | |||

| Home | Inflation & Wealth | Author Info | Crisis, Books & DVDs |

| VIDEO: Real Wealth & Retirement (2:32) | VIDEO: The Financial Reset Button (2:51) | VIDEO: Meet Dan Amerman (2:50) | OTHER VIDEOS |

Bailout

Lies Threaten Your Savings

Daniel R. Amerman, CFA, DanielAmerman.com

There is a headline that has been

all over the media ever since September 2008:

“Bank Bailout Will Soak Taxpayers.”

As obviously true as this headline appears to be, it is in fact,

dangerously misleading. Indeed, as we

will cover in this article, the idea that taxes will pay for the bailout is

ludicrous, an insult to both your intelligence – and your net worth.

|

If the video above doesn't load, it can also be seen here |

Instead, the real source of the bailout monies will not be the taxes you pay, but the value of your

savings. The value of your checking

account, the value of your IRA or Keogh, and the value of all your investments

are the true source of payment for Wall Street’s reckless mistakes. When we combine the bailout with the trouble

the US was already in, the result could be a 95% reduction in value for all of

our savings, retirement and otherwise, as we will illustrate step by step in

this article.

There are things you can do. Actions you can take. Ways to defend the value of your savings, as

we will discuss later. But before we

talk about solutions, first we need to understand why taxes won’t pay for the

bailout. Because it is only when we

understand the real danger, that we can take effective action to protect

ourselves.

Let’s start by placing things in

perspective. This financial crisis has

not been happening in isolation. The United

States government was already in an impossible financial situation before this

crisis ever hit.

Looking at Social Security and

Medicare, when we take a long term perspective, the projected excess of

expenditures over taxes is at least $59 trillion according to a fairly well known

and accepted study that appeared in USA Today. This isn't the total cost - it's the present

value shortfall after taking out projected taxes at current levels.

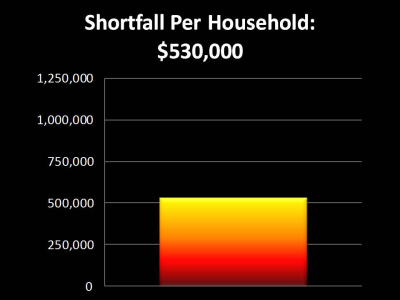

Now, there are approximately

111,000,000 households in the United States.

So if we take the total shortfall and we divide it by the number of

households, we come up with a shortfall of over half a million dollars per

household, and that number is reasonably well accepted these days.

Okay, you’ve probably seen that

number before, or something like it. Now

let’s very quickly do a few things you probably haven’t seen before.

Our first step is to take the 11

million households that are below the poverty line and subtract them out. These

households are already not really paying the federal government, they're

getting paid by the federal government on a net basis, so we can't

realistically expect them to come up with any of the money for Medicare or

Social Security. When we take them out we're left with something very close to

100 million households.

Divide $59 trillion by 100 million

households and our shares of the shortfall just jumped to $590,000 per

household.

Step two is, do we expect retiree

households to pay for their own retirement? Because when we say there's 100

million households, well, we’ve got quite

a few retiree households already, and that number is going to be growing fast

over the next 10 to 15 years as an average of 4 million baby boomers retire each

year between 2010 and 2029. So if we

look out over the decades ahead as the baby boom retires, and we adjust for the

rapidly building number of retiree households who will be the beneficiaries of

Social Security and Medicare – who will be receiving benefits rather than

paying in – then we're left with an average of about 79 million households.

The 79 million households could be

termed on average the number of households in which the primary source of

income is someone who is below retirement age and actively working at a job

that keeps them above the poverty line. In

other words the people who can realistically make the economic contribution to

pay significant taxes.

Divide 59 trillion by 79 million,

and we all have to come up with $747,000 per household. We’ve now spent an additional $217,000 per

household, compared to the USA Today number, but we’re not done yet.

Step three is to say there's a lot

more to the expenses of paying for retirement for the baby boom than just

Social Security and Medicare. Legally binding promises for pensions have been

made by all levels of state and local government as well as major corporations,

which are going to require the cashing out of tremendous amounts of retirement

investments. As well as the cashing out of those tens of millions of IRAs and

Keogh accounts. Someone has to come up

with money, or more accurately the real goods and services to do so.

So when we add in the cost of

cashing out pensions and retirement accounts, we come up with a total figure

per able to pay, non-retired household, including Social Security, Medicare, pensions

and cashing out retirement investments, of $1,060,000 per household. (That

was a quick derivation of Steps One through Three, much more thorough detail is

available through my free mini-course.)

Now you might think spending a

million dollars per US household in one short article would cover it all, but

we’re still not done here, we’ve got a bailout and stimulus to pay for. How much is that going to cost?

The best answer is that no one knows

for sure. Because the true cost of the

bailout is so tightly interwoven with what is going on with the overall economy,

as well as with the extremely complex and volatile market of over $400 trillion

(still outstanding) in derivative securities contracts that have been entered

into by banks around the world. Since

the governments are guaranteeing the banks, that means they are guaranteeing

the hundreds of trillions of dollars in derivatives, and we don't know what

that’s going to end up costing.

Some people are saying no problem,

we’ll get out of this for $1 or $2 trillion max, and by and large those are the

same financial pundits who would have quite confidently assured you two years

ago that a crisis like this was categorically impossible, something only a delusional

paranoid would believe could happen.

Speaking not as a financial pundit,

but as someone who actually structured derivative securities as an investment

banker, who wrote a McGraw-Hill book on the subject in 1995, and who later forecast

the steps in which the current crisis would unfold with uncommon precision - we’ve

been lucky so far. We’re holding a

tenuous line against a wider derivatives disaster that could make 2008 look

like a cakewalk, and that line could crumble at any time.

So the cost will likely be somewhere

between $1 trillion and global financial collapse, but we do need a guess to

work with, and maybe a place to start are the official actions of the United

States government. According to the New

York Times the total cost of the bailout including commitments for spending,

loans and guarantees is $12.2 trillion, mostly in the form of Federal Reserve

commitments. To that total we need to

add in the cost of the stimulus package of approximately 8/10 of $1 trillion so

far.

Add bailout and stimulus, and we get

a total for official commitments at this time of approximately 13 trillion

dollars.

Take the $13 trillion, and divide it

by the 79 million households, and we come up with a total of about $165,000 per

non-retired, able to pay household. That is a fantastic sum of money and there

are good reasons why you never see the government present it in that way, and

rarely see the mainstream media do so.

That’s almost enough money to buy a house in many states!

In fact, according to the National

Association of Realtors, the median sale price of an existing home in the first

quarter of 2009 was $169,000. So if we

look at the cost to the average household of the bailout package, we could have

quite literally bought an average American home with each of our shares of the

cost.

When we add the cost of each of our

non-existent new houses to the trouble we were already in, we come up with the

sum of $1,225,000 per non-retired, able to pay household.

Now here’s my question for you. This is an important question, because the

answer could change your standard of living for decades.

At what point did you stop believing

that you and your family could pay your share?

Was this final $165,000 the straw

that broke the camel’s back? The $60,000? The $217,000?

Or was it that first half million, the very well accepted half million,

that passed your personal ability to pay?

Your answer is vital because once we

accept that the average household can’t pay, with not even a remote chance of

doing so, then we have to accept that tax increases can’t pay. Meaning these newspaper headlines about

taxpayers paying for the bailout are an insult to your intelligence.

So, does this mean the US is

bankrupt? No. Long story short, nations that can borrow in

their own currency don’t go bankrupt.

Not when they can create trillions of dollars out of thin air at will, Shazaam!,

much like the Federal Reserve has been doing ever since the crisis hit.

So taxes can’t pay, it’s ludicrous

to think they can, and the US doesn’t declare bankruptcy, just how do we cover

the gap?

Again, very short version. Pay in full, but make the dollar worth five

cents. Drops the per household cost for

everything from $1.2 million down to about $60,000. Painful, but manageable over a period of

20-30 years.

The problem is that this solution

also drops your savings to a value of 5 cents on the dollar. Meaning that the $100,000 in savings you have

just became effectively worth $5,000. To

cover your entire retirement.

Historically, a collapse in the

value of a currency necessarily forces a major redistribution of wealth, and

the segment of the population that is most devastated by this seems to always

be the same. It’s the retirees, and the

people close to retirement. When we look

to Germany, when we look to Argentina, when we look to Russia – it is the

pensioners who are impoverished more than any other group.

Unfortunately, history is repeatingitself again. When we look at the

headlines about the destruction of retiree investment values, pension assets

and so forth, we're really just seeing the beginning. Because the crisis

"solution" that is being chosen, which is creating dollars without the

ability to pay for those dollars, essentially represents the annihilation of

most of the retirement dreams of the baby boom generation, even if that is not

yet recognized. There is not an even

cost that is being born by society as a whole, rather some segments are bearing

much more of the burden than others. If

your peer group (particularly Boomers and older) is headed for disproportionate

financial devastation, then happenstance is unlikely to offer a personal way

out. Instead, you must instead take

quite deliberate actions to change your personal financial position so that

wealth is redistributed to you, rather than away from you.

To get out of step with your

generation, and have wealth redistributed to you even as your peer group is

being devastated by this extraordinary destruction of wealth, you need to start

with an essential and irreplaceable step:

education. You need to gain the

knowledge you will need to turn adversity into opportunity. This will mean looking inflation straight in

the eye and saying: “Inflation, you are

likely to play a big role in my personal future, and instead of ignoring you or

thoughtlessly flailing away at you – I will study you and your ways. I will learn the deeply unfair ways in which

you redistribute wealth, and the counterintuitive lessons about how some

investors will be destroyed by inflation and repeatedly pay taxes for the

privilege, even while other investors are claiming real wealth on a tax-free

basis. I will learn to position myself

so that you redistribute wealth to me, and the worse the financial devastation

you wreak – the more my personal real net worth grows.”

|

|

| Sign-up for an innovative, free, solutions-based book that will be delivered in a series of 10 to 15 minute long readings. | |

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will

redistribute real wealth to you, and the higher the rate of inflation – the

more your after-inflation net worth grows?

Do you know how to achieve these gains on a long-term and tax-advantaged

basis? Do you know how to potentially

triple your after-tax and after-inflation returns through Reversing The

Inflation Tax? So that instead

of paying real taxes on illusionary income, you are paying illusionary taxes on

real increases in net worth? These are

among the many topics covered in the free “Turning Inflation Into

Wealth” Mini-Course. Starting simple,

this course delivers a series of 10-15 minute readings, with each

reading building on the knowledge and information contained in previous

readings. More information on the course

is available at DanielAmerman.com or InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

This article contains the ideas and

opinions of the author. It is a conceptual exploration of financial

and general economic principles. As with any financial

discussion of the future, there cannot be any absolute certainty. What

this article does not contain is specific investment, legal, tax or any other

form of professional advice. If specific advice is

needed, it should be sought from an appropriate professional. Any

liability, responsibility or warranty for the results of the application of

principles contained in the article, website, readings, videos, DVDs, books and

related materials, either directly or indirectly, are expressly disclaimed

by the author.