Retirement Planning Out Of The Box

Six DVD Tutorial Set With Accompanying Manual

Retirement Planning Out-Of-The-Box is a solutions-intensive video course that takes a look at the greatest challenges faced by retirement investors in today's financial environment, and in step-by-step detail – shows how to overcome them.

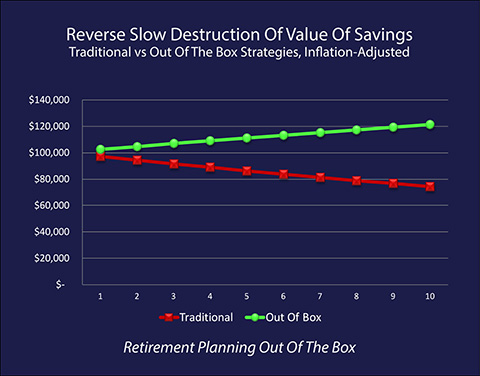

1) Reverse The Slow Destruction Of The Value Of Savings

Retirees and retirement investors face a natural enemy – inflation. Ever since the 1930s, the Federal Reserve and other central banks around the world have openly pursued a policy of seeking to create annual rates of inflation that slowly but steadily erode the value of money.

It is very difficult to defend against this process while using normal retirement investment strategies, particularly in the current low yield environment we've been experiencing these last several years. The slow destruction of the value of money and savings over time is illustrated by the red line in the graph below, which translates to an ongoing loss of standard of living and financial security.

Step by step, the Retirement Planning Out-Of-The-Box DVD tutorials shows how to reverse this negative flow of wealth, and achieve the positive flow of the green line instead, where this background inflation actually works to our advantage. And the further we go out in time then the greater the purchasing power of our savings, the higher the quality of the lifestyle that can be afforded, and the greater the financial security.

2) Overcome Very Low Interest Rates

One of the biggest challenges faced by retirement investors today is how to overcome the very low interest rates that have been deliberately created by central banks on a global basis, as explored here. Given that one of the foundations of traditional retirement planning is to steadily shift from equities into interest-bearing instruments as one grows older, traditional retirement investments are therefore disproportionately damaged by these low rates.

The Retirement Planning Out Of The Box video course walks you through step by step, number by number and graph by graph how to take this exact same environment and turn it to the retirement investor and retiree's strong financial advantage. And as conceptually explored, the lower that interest rates are, the greater that retiree and retirement cash flow can be, through utilizing this thoroughly unconventional approach to retirement investing.

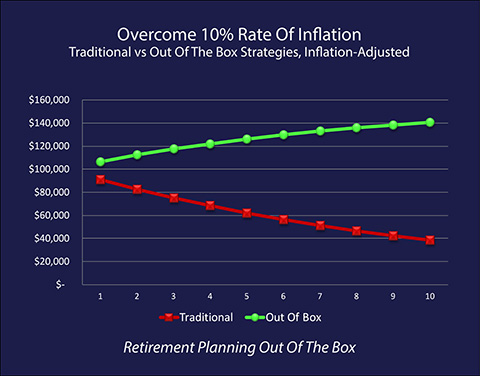

3) Thrive With Higher Rates Of Inflation

As inflation is a natural enemy of those that rely on a fixed income, as well as most retirement investors in general, higher rates of inflation can quickly become painful and then catastrophic, as shown in the red line in the adapted graphic below.

However, as explored in this free book, what needs to be understood is that inflation is not actually a destruction of wealth, but rather a redistribution of wealth from one part of society to another part of society. And if there is one group that needs to be acutely aware of how this negative flow of wealth works – it is retirees. Yet few are aware, unfortunately, and so the natural role for retirement investors is to be the one whose wealth is being redistributed.

Retirement Planning Out Of The Box teaches you how to entirely reverse that redistribution and achieve the green line instead, whereby the higher the rate of inflation – the more real wealth that flows to you in purchasing power terms, thereby increasing both quality of life and financial security.

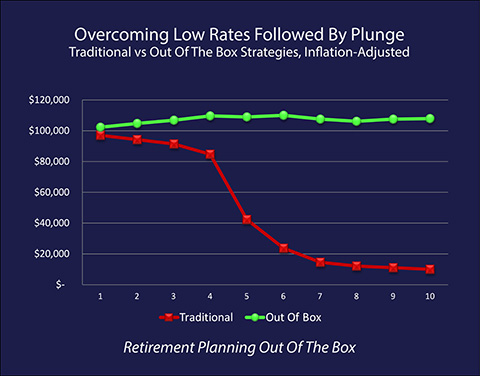

4) Overcome Very Low Interest Rates Followed By A Market Plunge

Perhaps the most dangerous threat to traditional long-term investments today is when very low interest rates create asset bubbles. It's bad enough that with interest rates being kept artificially below the rate of inflation, the purchasing power of savings is slowly destroyed year by year. But on top of that, these low interest rates can spur the creation of asset bubbles in terms of highly overvalued stock and bond markets, as we're currently seeing in the United States.

Until eventually, the almost inevitable correction occurs. And in having primarily stocks and bonds as investments, this leaves conventional retirement investors in the acutely precarious position of steadily losing the purchasing power of their savings in small increments each year, until most of that purchasing power is potentially abruptly lost in a future market plunge.

As illustrated by the red line in the adapted graph above, the results of this all-too-possible future are effectively catastrophic when it comes to long term standard of living and long term financial security.

It is public knowledge that we do have interest rates that are deliberately kept below the rate of inflation as a matter of policy, as explored here. And the leading economists of the world are perfectly well aware that this situation is likely to create asset bubbles, as discussed here. Meanwhile there is an almost daily debate in the financial media, where one authority will assert that the stock and bond markets are in a bubble, or are otherwise divorced from the underlying fundamentals, even while another authority will insist they are not.

Yet, the only response to this extraordinary risk with traditional financial planning is to simply assume it out of existence. To assume that the current environment is an aberration, and that market interest rates will necessarily return. To assume that a massive and sustained market plunge is not possible, because of the theory that rational investors don't allow markets to achieve irrational valuations (actual financial history notwithstanding).

Rather than effectively shutting one's eyes to the current situation and crossing fingers in the hope that things will eventually work out, the Retirement Planning Out Of The Box video course shows how to proactively reverse both flows of wealth. So that 1) very low interest rates work to the direct advantage of the retirement investor for as long as they last; and 2) financial crisis is also turned to advantage should it occur, whether it be this year, or five or ten or ten years from now. This 1-2 combination is represented by the green line in the graphic.

5) Participate In The Good Times

The usual defensive investment strategies are heavily oriented towards protecting retirement investor assets in the event of a future downside scenario. But the problem is that while they do typically fare better than traditional strategies in such a scenario, they tend to be very low performing or may even steadily lose yield if the future works out to be a far more desirable one.

Generally speaking, then, if we get what we all hope for in the form of a prosperous future for ourselves and our children, defensive investors are generally left on the sidelines and not participating.

What the Retirement Planning Out Of The Box video course teaches – step by step, number by number, and concept by concept – is how to reverse that relationship. So if prosperous times return – there is no give up, and in fact the yields from the strategy in such an environment are highly attractive indeed.

6) Overcome The Risk Of Outliving Our Money

One of the most difficult and troubling challenges faced by retirees and retirement investors centers around the otherwise highly positive situation of living a long and healthy retirement. Because if we live longer than we have savings for, it can very difficult if not impossible to find a solution other than reducing our standard of living. And the longer we live, the bigger hit to our standard of living. For good reason then, one of the most common fears of retirement investors is outliving their money.

Again, step by step and number by number– along with the use of intuitive concepts – the video course teaches you a strategy to overcome this risk, whereby cash flows sharply accelerate later in retirement. So at a time in which other investment assets have potentially been depleted, the strategy effectively steps forward and delivers the cash flows – and the asset value – that take someone through the later years of a long retirement with a higher standard of living and substantially higher financial security than they would otherwise have had.

Where To Start?

Now because these solutions are so very different from the usual choices, they can't be adequately described in just a few sentences or paragraphs. For a more in-depth understanding, if you're not already familiar with it, a good place to start is with our free e-book, Finding Wealth In Unexpected Places. As each chapter is delivered to you, you will learn more about the many different currents of wealth, and how they can be turned to your advantage in often unexpected ways.

The free book is not a "teaser", but rather it is a valuable resource in its own right, that based on the feedback we've received has by itself already changed many people's lives. It is also a mutually beneficial "screen" of sorts. That is, the approaches to wealth creation explored in the book are a genuine and major shift in paradigm from the personal finance mainstream approach. And when it comes to the real deal of actual paradigm change – some people get intrigued, while others just get uncomfortable.

If the new paradigm doesn't work for you – then you can simply unsubscribe from the readings at any time. On the other hand, if it resonates – if you find yourself intrigued with the insights offered and want to learn more – then there are indeed places to go with this approach, that go far beyond what is in the free book.

The Teaching Method

Each retirement investment challenge – and how to overcome it – is explored using the following basic sequence:

1) Concrete examples with simple dollars are presented on the screen (and in the manual), while the oral narrative explains which numbers are important and what matters.

2) A visual simple dollar summary is presented in the form of one or more graphs.

3) Maintaining purchasing power requires a more advanced approach, so inflation-adjusted numbers are presented, while the oral narrative explains what is important, why it matters, and exactly how the (often) initially counterintuitive solution works – and works so well.

4) A visual inflation-adjusted dollar summary is presented in the form of one or more graphs.

5) Using a combination of visual exhibits and conceptual discussion, the Retirement Planning Out Of The Box strategy – and how and why it works – are summarized and explained in a more intuitive manner.

6) As each challenge and its solution are explored in sequence, familiarity builds, and while the underlying numbers are there throughout, the conceptual and the intuitive become ever more important with each successive DVD.

Aiding in the comprehension and retention is the 220 page manual which consists of financial schedules for everything seen on the screen (and much more) as well as the accompanying graphics. This allows for paper clipping, highlighting and note taking to the extent desired.

By the time the video course is completed, the viewer has a thorough and even intuitive understanding of an entirely different approach to retirement investing. With the course being an ongoing resource that can be returned to again and again over the years, as needed.

While appropriate for the general public, the educational materials are also quite suitable for financial professionals, particularly including financial planners and financial advisors.

Please note that this DVD tutorial is studio-based, in a similar format to the Profiting From Government-Dominated Markets and Creating Win-Win-Win Solutions sets. That is, rather than the live workshop video of the earlier sets, this is studio-created audio with text and financial schedules on the screen, supported by the written manual.

Purchase the DVDs

Satisfaction guaranteed or your money back.

(30 day return period, see DVD purchase page for more information.)

Other DVD Sets & Collections

Click below to learn more about other DVD sets, as well as how to enjoy substantial savings by purchasing two or more DVD sets at the same time.

Disclaimers

Please note that the DVDs and companion manual are of a strictly educational nature, rather than the rendering of professional advice. The future is uncertain, and there are no guarantees or promises of success or particular outcomes. As with any financial decisions, there is a risk that things will not work out as planned, and with hindsight, another decision would have been better.

The DVD set and printed manual will not include specific investment, legal or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the specific results of the application of the general educational principles contained in the DVDs and the written materials, either directly or indirectly, are expressly disclaimed by Daniel Amerman.