20 Global Implications Of French Presidential Election

By Daniel R. Amerman, CFA

Forget the anemic latest US jobs report - the world is in play, and the election of Francois Hollande as the President of France may do more to determine US unemployment rates (and global investment results) in the next year than anything that Ben Bernanke and US government policies will accomplish.

There is a near-term risk that a process has been set in motion that could plunge the entire globe into currency chaos and economic depression within the next year, with the failure to form a government in Greece acting as only one of a number of possible triggers.

This outcome is not preordained, however, and the world could also quickly move the other direction, which is ever greater government controls over markets and currencies accompanied by persistent inflation. While this alternative would avert immediate catastrophe, the pain for investors would not be avoided, but merely stretched out, with a steady erosion of wealth over potential decades of inflation and financial repression.

Regardless of which path the future takes, the bottom line is that the election of Francois Hollande has increased global economic volatility in 2012, while likely decreasing the remaining lifespan of the unsustainable veneer of normality in US and global financial markets.

In this analysis, we will examine twenty potentially world-changing economic and financial implications of this change in direction in France and Europe. These include the exacerbated near-term meltdown risk, the worsening of the long term outlook, the potential global political shift, the rapid redistribution of European wealth, and the impact on US unemployment, financial sector solvency and stock market returns, as well as US deficits and Federal Reserve monetization.

1. Putting The Pedal To The Metal

France, like the rest of Europe, the United States, and much of Asia, has a building demographic crisis. Simply stated, there won't be nearly enough young people to support the old people in the retirement style which they have promised themselves. This is the underlying reason why nations are talking about raising retirement ages around the world.

France has a particular problem because its European-style social safety net (i.e., transfer payments) is more institutionalized than in many other nations. As a result, only 56% of the French working age population is actually in the labor force (either employed or looking for work), as compared to 60% in Germany, 64% in the United States, and 67% in Canada (per the World Bank).

So the situation is that only a little more than half of France's working age population is working or seeking work, while there is a building demographic crisis with fewer young French workers to support each French retiree - and a new French president was just elected on a promise of lowering the retirement age from 62 down to 60 years old.

From an economics perspective, this is amazing stuff. For decades, politicians in Europe as well as in the US and other nations have been getting elected by making impossible promises about the future and retirement. The 1-2 combination of declining fertility rates and growing retirement promises created an oncoming cliff that has been in plain sight for decades now, for those who cared to look. However, as long as it was comfortably far off in the future, few people really worried about it, not while there was political advantage to be gained today by making promises that a different generation of politicians would have to eventually deal with.

A short-hand way of describing the current Eurozone crisis is that the cliff is no longer in the distance, it is no longer five years away, but it is in clear view here and now. There is more to the cliff than retirement ages, as expensive promises have been made in many ways, but the core of the Eurozone debt crisis is that nation after nation is finding out they've crossed the line in the here and now, and can't pay for the politically popular promises they made to themselves.

While austerity was effectively saying "let's slam on the brakes", the platform that Francois Hollande campaigned upon was "let's put the pedal to the metal instead" and accelerate towards the cliff. And he won the election.

2. Bringing Forward The Global Retirement Dilemma

There are some powerful global implications of the decision the voters of France made when they decided that lowering their collective retirement age sounded a whole lot better than this cutting benefits unpleasantness.

One implication is in the area of fundamental economics, and it is that when it comes to paying for retirement promises, the day of reckoning for the US and Europe has likely been moved forward. Before the election, France was counted in the "positive" column, in that France along with Germany could apply their economic power to help struggling Greece, Portugal, Spain and Italy.

Now this was always a bit marginal from a long term reality basis, as France has always had its own appointment with debt and demographic destiny coming up (as does Germany), even if it was considered far enough off in the future that it could be ignored, while interim solutions were being patched together for the crises of today.

However, through not just rejecting austerity for itself, but by voting to put the national "pedal to the metal" and bring forward the day when France flips into the "negative" column, France has also brought forward the day when either the rules must all change, or all of Europe goes sailing over the financial cliff together. Germany never could rescue Italy, not by itself. Germany most certainly can't rescue both Italy and France together. And now that France has officially decided to be, well, French, and relax and enjoy life in the here and now, instead of this sternly-determined Germanic rescuing the world business - none of the current Eurozone "solutions" work anymore. It is a just a matter of how much time it takes for that to be recognized and accepted.

3. Near-Term Eurozone Meltdown Risks Sharply Higher

The Eurozone was already in deep danger. The rapidly evaporating "solution" for Greece doesn't work for the larger problems of Spain and Italy, and everyone knows it. Even when Germany and France were in alignment in insisting upon austerity as the solution - in practice, working out a series of interim solutions came right down to the wire and nearly failed, time and again during 2011. If Spain can't sell its bonds in the next few months, and Germany and France now have 180 degree different approaches to the appropriate solution - exactly what happens next, and how does the process work?

For a guide to the toxic intersection between dysfunctional politics and extraordinary deficits, one need look no further than the US government. Short-sighted, partisan bickering and power plays entirely unnecessarily placed the United States in danger of defaulting on its debt in 2011. These same dysfunctional politics created the looming "fiscal cliff" for the US government at the end of 2012 that could crash the economy, send taxes soaring - or even both.

There is no reason for this arbitrary "solve or self-destruct" deadline for the US, except that the political leadership agreed that because partisan differences between the two sides couldn't be solved even in the name of preventing national bankruptcy, the best "solution" was to defer - but force - a later solution through creating an artificial deadline with severe risks for the nation.

In some unfortunate ways - Europe just became the United States. That is, there is effectively a co-presidency between Germany and France when it comes to the debt crisis, and there is now a split government, with the co-presidents belonging to opposing parties.

In other words, an already dysfunctional process with extraordinary underlying problems just became much more likely to get derailed by political battles and brinksmanship. And given that the multi-government / single currency structure of the Eurozone is inherently much less stable than a single government / single currency structure, the dangers of an accidental - and completely unnecessary - breakdown are substantively higher than they were before.

This is not to say that the Eurozone is doomed. There are solutions, but they are political rather than economic. Given the extraordinary power of governments to control laws, banks, and the nature and value of money itself, and thereby rewrite the rules book, the Euro and the Eurozone can still be "fixed". However, when the solutions are political, and the political leadership just fractured, then the chances of finding a solution in the midst of crisis just diminished markedly.

Absent such a solution, then the next major crisis (or the one after that, or after that) could indeed bring about a Euro collapse scenario.

4. Latest Greek Election Compounds Danger

As of April, 2012, the German, French and Greek governments were in agreement on pursuing an austerity approach. All three corners of the triangle have now shifted with the recent elections.

Greece has moved towards breakdown with the failure to form a government, even while the German opposition, the Social Democrats, won a major regional election. With austerity parties losing by wide margins in Greece, and an "ally" winning in France, the chances that Greek voters will elect a party that will even attempt to pay the bills seems to be diminishingly small.

In other words, all deals are off, and this may very well force the issue within the next month to few months. In theory, Europe has been preparing for Greece defaulting and leaving the Euro for some time now, and absent major political blunders, the Eurozone should at least temporarily survive a Greek collapse.

But, as always, Greece isn't the point. For some time now, the world accepting the solvency of Spain and Italy hasn't been about the economics of money coming in versus money going out, but rather this acceptance has been based on a set of beliefs about how European governments will function together. If a spectacular failure occurs with Greece, then the belief system breaks, and it is then not just that a failure grows more likely with Spain or Italy, but the magnitude of the event needed to trigger such a failure may be both smaller and nearer in time.

5. Global Political Implications

Another immediate global implication is profoundly political. The political leaders in every nation around the world just watched one of the two most powerful political leaders in Europe lose his job, even while another took his place.

There were of course many issues driving the election results, and not everything was economic. But the ending bottom line was that the leader talking about making tough choices became personally unemployed himself, and the leader who told the people exactly what they wanted to hear is now in power. At the same time, politicians advocating fiscal responsibility were also voted out of office in Greece and Italy.

This was all carefully noted in Washington, D.C., Berlin, London, Canberra, Ottawa, and many other capitals.

Now, Hollande has no more ability to wave his hand and make the Eurozone debt crisis go away - or change the fundamentals of resources and the number of workers per retiree - than Sarkozy did. But, there is a choice for governments in how impossible promises get broken.

A government can tell the truth by saying belts must be tightened, and everyone's standard of living must fall - and then get promptly voted out of office.

Or a government can create inflation, use statistical manipulation to report official inflation rates that are beneath the true rate of inflation, keep interest rates and cost of living adjustments beneath that true rate of inflation, and steadily inflate away the value of outstanding government debts while breaking impossible promises in substance, but not in form. In other words, pay the retirees and other transfer payment beneficiaries in full every year, but do it with currency that is worth less every year.

If that situation sounds familiar for US readers - it is because that is the reality that is happening all around us. All any of us has to do is personally compare the cost of groceries between now and several years ago, or gasoline, or utilities, or health insurance, or college tuition for our children - and the truth is plain to see. Inflation is higher than what is officially reported, and neither cost of living adjustments nor interest rates reflect the true rate of inflation.

The bottom line with inflation in an environment of financial repression is in many ways the same as "austerity". Retirees, public workers and other transfer payment beneficiaries are all gradually impoverished as their payments and salaries will buy less every year. At the same time, savers and investors also see the after-inflation and after-tax value of their net worth steadily eroding away and buying a little less each year, instead of compounding for retirement and buying a little more each year (the way all the financial planning models show it).

One could say that this is a terrible deception by politicians and governments. One could also say that if bitter medicine is what is required, that this is the way the voters themselves will demand it be served. Many tens of millions of voters around the world share deeply held beliefs that they are absolutely entitled to a certain standard of living, with certain basic prerogatives that come from living in a civilized society including retirement at a comfortable age. Technicalities like real goods and services and workers per beneficiary are of little interest to the very substantial portion of the population with this mindset, when it comes to their fundamental rights as human beings.

One could even say that the citizens in France and elsewhere will get exactly what they demand from those they vote into office: glowing promises on the surface - which are impossible to keep in substance over the long term - which then require deep levels of deception beneath the surface that steadily break the impossible promises in a manner that is sufficiently complex that the average voter will never really understand what is going on.

I've been studying this area of economic reality versus retirement promises and the impact on public and private retirement investments for about twenty years now. In anticipating this time of a seemingly impossible conundrum, it has long been clear that it was the political considerations which would define the most likely path: one of governments inflating away obligations while manipulating the inflation indexes, which would destroy the value of savings even while impoverishing investors who followed conventional retirement investment approaches.

In my opinion, the election of Francois Hollande as President of France means that the French have effectively committed to follow the United States down a path of inflating away debt and promises, so that the political requirement to meet popular but impossible promises will be kept in form - but not in substance. Economists refer to this process as "Financial Repression", and three tutorials can be found at the link below:

Financial Repression Tutorials

6. Resolving The European Leadership Conflict

In looking at the leadership conflict from a broad, global context, the next step looks obvious: it must be Merkel and Germany who give, and follow France's lead, the secondary strength of France's economic muscle notwithstanding. Hollande was just elected after all, so it would be quite difficult for him to completely renege on his campaign promises in a highly public manner. Other European elections seem to be confirming the mood of France's electorate, and the media coverage of the swing away from austerity has been generally positive as well. If Hollande does get most of Europe behind him, then either the Germans give way - or the Eurozone implodes.

However, logic doesn't necessarily rule here, and there are ample opportunities for any number of political leaders to do something that might make sense to them at the time, but will quickly turn out to be a remarkably bad idea. Angela Merkel is the head of the most powerful nation in Europe, she retains enormous power, and she has her domestic political interests to consider. All it takes is a bit of gamesmanship for political advantage gone awry when the Eurozone is on the brink - and there could be an accidental breakdown that quickly spirals out of control.

If and when Europe unites behind a "printing" and inflation-driven approach to solving its problems (even while every nation uniformly and steadfastly denies any such plan), then the crises may pass, and Europe could get down to a reasonably stable process of defrauding its creditors and domestic population through a combination of inflation, inflation-index manipulation and financial repression. Thus, there is no certainty that either the Euro or the Eurozone will collapse.

However, so long as the political leadership remains divided, then all it takes is the combination of one flash point, combined with one remarkably bad political decision, and the Eurozone could go down at any time. Which would then be highly likely to lead to a soaring US dollar, which could devastate US employment and the US economy. This in turn could create a double-crested tidal wave slamming into Canada, Australia and other nations which trade heavily with both Europe and the United States.

7. German Windfall Profits & Rapid Redistribution Of Wealth Within Europe

If the Euro collapses, it may create an enormous financial windfall for millions of individual Germans as well as German companies, not to mention the German government. While leaving the monetary union is still far from certain, as Germany also has strong economic and political incentives to stay in the EMU, the analysis linked below says “what if” and explores some of the startling benefits - as well as the many perils - for nations and individuals that can result from quickly exiting a failing monetary union.

The implications go far beyond Germans and Germany (although there are very important implications for arbitrage opportunities with German companies). That is, in this world of financial crisis and sovereign debt crisis, there are powerful related wealth and financial security implications for individuals in every country.

European Redistribution Of Wealth

8. US Dollar, Short Term

If the one former major competitor to the dollar as reserve currency – the euro – were to effectively implode, then the US dollar's value as the world's reserve currency is likely to be substantially strengthened in the short term, as a panic-stricken globe seeks refuge from the euro collapse.

The short term effect of being the world's sole remaining reserve currency in a time of crisis might be a flood of foreign funds being sent into US dollar-denominated investments in general, and US Treasuries in particular. This could involve not only the rapid pulling out of funds from Europe, but many other investors may reduce exposures to their own currencies and make a move to the dollar as well, in an unprecedented flight to perceived safety. The buying power of the US dollar may surge in this global rush for safety.

9. Consumer Prices

The rapidly rising value of the US dollar would have the immediate effect of making almost all imports cheaper to buy, and so a trip down the aisles of Wal-mart may, for a brief period, become less expensive for the American consumer. The price decreases could be exacerbated by exporters from around the world engaging in vicious price competition within the US market, trying to keep their factories going and to offset the loss in consumption in Europe.

10. Unemployment

If this political divide brings down the Euro and Eurozone economies - then the latest poor jobs report in the US becomes inconsequential trivia, as a crisis greater than the Great Depression of the 1930s slams into a weak and structurally unsound US economy and continues on into Asia.

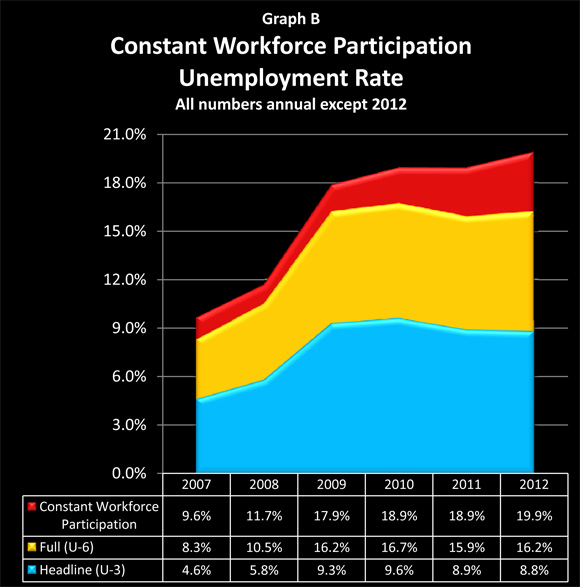

The US economy is already in the worst shape that it has been since the 1930s, with real unemployment in the 20% range. The headline unemployment rate is kept below 10% only through statistical manipulation, as covered in detail in my analysis, "Making 9 Million Jobless 'Vanish': How The US Government Manipulates Unemployment Statistics", linked below.

Making 9 Million Jobless Americans Vanish

Because of the combination of the surge in the value of the US dollar and the reduction in the size of the European economy, US workers may face devastating job losses in two major categories: exports to other nations, and goods consumed in America.

American workers in export-driven industries will lose jobs because dollar-priced US goods will be more expensive for the rest of the world to buy. This decreasing competitiveness will be compounded by a drop in consumption in the huge European markets, resulting in less US exports. There is also the third danger of a drop in overall global consumption, due to increasing unemployment in exporting nations.

In a global scramble to maintain employment even as consumption falls, the last thing workers want is to be handcuffed by having their products priced in the world's "reserve currency" - and that is the exact situation that American workers will be in.

The second major category of job losses will be found among the producers of goods consumed in the US. Because the dollar is more expensive, American workers will be undercut by other workers around the world, as imports grow cheaper and more difficult to compete with. These lower-cost goods mean that there may be a brief "Indian Summer" of lower prices for American consumers.

However, this will sadly likely be accompanied by a fundamental weakening of the US economy as unemployment surges, and fewer people can afford to make the purchases at all. Which then further reduces overall global consumption, intensifying the competition among exporters.

There may also then be increased "outsourcing" as American corporations seek to lower production costs by moving employment out of the US.

11. Gasoline & Energy

As a result of a likely depressed global economy leading to reduced energy usage, most nations are likely to see a declining cost of energy imports (with the exception of Europe, depending on how devastating the currency damage turns out to be). Because the US will benefit in this regard from the 1-2 combination of a higher valued currency and decreased global demand, the decline in the cost of energy may be particularly sharp in the United States. This cheaper energy will be an offsetting factor when it comes to global competitiveness for US firms, but likely not nearly enough to overcome the dollar's strength.

12. US Financial Institutions

Up to this point, the markets have been focusing on the US financial institutions which have the greatest direct exposure to Europe and European banks. However, in the months following a potential Eurozone collapse, the secondary or ripple effects are likely to dwarf the first round of primary effects – and few major banks will be positioned to withstand it. After all, the US economy is still reeling from the last financial crisis, and there has been no real recovery to date.

A new second round of depression slamming into the global and US markets means a potentially massive increase in unemployment, with delinquencies soaring in all categories of consumer credit along with bankruptcies. There will also be dire financial implications for firms relying on exports or US consumer sales - and those two categories cover most of the private economy. This could all lead to a rapid increase in corporate loan losses. Most important of all could be the extraordinary effects upon the derivatives markets (see "Derivatives" below).

Over time, and as the interrelated negative effects compound upon each other, the direct and indirect effects of a Eurozone collapse are likely to be a "doomsday" event for the major US banks, absent another likely round of massive government interventions (see "US Deficit & Credit Rating" below).

13. Derivatives

A potential euro collapse threatens the possible near term annihilation of the financial system through both credit derivatives and interest rate derivatives losses. The near criminal insanity of investment bankers writing themselves massive bonus checks for effectively standing in a circle and making promises to each other that none of them have ever had the capital to back up (in the event of genuine systemic crisis), will be brought to the fore.

Absent massive government interventions, we may have a bankrupt financial system where none of the highly leveraged big players have any real capital remaining because their loan and investment portfolios went bad, but they still owe massive amounts of money to each other as counterparties on the hundreds of trillions of dollars in derivatives contracts.

The nominal sum of derivatives contracts outstanding is about $700 trillion, while the global GDP is estimated to be about $63 trillion. If the governments assume and honor the derivatives contracts, then they could be on the line for a cumulative bailout that exceeds the size of the global economy (though this would be reduced by the netting out of offsetting contracts). As a more likely alternative, there would be attempts at a legal "fix" of some sort, where governments use their lawmaking, regulatory and monetization powers to maintain a functional banking system, but would effectively set aside the rule of law (in one way or another) when it comes to derivatives contracts.

14. US Deficit & Credit Rating

If the Eurozone economy collapses, then the US government is likely to face a situation of soaring unemployment, a failing economy, and a bankrupt financial system. Given the political realities and the track record, the reaction of the US government is all too predictable:

1) Spend federal money like there is no tomorrow in an attempt to boost employment levels;

2) Run federal deficit spending up to all new levels as the money is spent but taxes aren't increased;

3) Massively bailout the US financial industry;

4) Bailout other US major corporations as needed; and

5) Create trillions more dollars out of thin air to finance the above (see "Federal Reserve & Monetization" implications below).

This radical increase in the federal deficit accompanied by "printing" ever more money should "downgrade" both the US dollar and the entire US financial system as well as the US government.

15. Federal Reserve & Monetization

The Federal Reserve's responses to the events of late 2008 and beyond may serve as a guide to some of the strategies that could be deployed in a new crisis. There are likely to be multiple key stages in a developing crisis, where the Fed will use its unique powers to create and give out trillions of dollars - with little public attention - either in asset purchases (at non-market prices), or in actual and contingent lines of credit, or in dollar swaps, or in hidden bailouts that are only limited by the imagination of the Federal Reserve.

The Fed will again want to move quickly and without Congressional approval, and will particularly seek to avoid openly including the bailouts in the federal budget. Beneficiaries are likely to include US banks, foreign banks, and major US and foreign corporations.

There may also be massive monetary-creation events for the dual purposes of funding radically increased US deficit borrowing, while still keeping borrowing rates below the rate of inflation.

Rather than another TARP-type program for troubled assets that have not actually defaulted, look for the Federal Reserve to take to all new levels its program of directly creating money and using that to purchase investments from banks at non-market prices. This is likely to contribute to the "hollowing out" of financial institutions on a global basis, as performing economic assets are increasingly replaced by central bank reserve balances which have no inherent economic value.

Primer On Monetary Creation & Hollowing Out Banks

16. US Dollar, Long Term

After the immediate crisis and panic-induced global dash for safety is over, then the United States will be in a highly unstable and precarious position, with an effectively artificial economy that is not putting out the goods needed to pay for what it consumes. There will be massive paper money creation as the US engages in currency warfare to bring down the value of the dollar, even as artificially-funded jobs are created all across the country. Something will have to give - as historically, it always eventually does.

From one source or another there will be a push. That push could have a domestic origin, or more likely an international origin. Either way, because the underlying fundamentals will have already collapsed, and all that will be holding up the value of the dollar is a collective belief system, then once the fall of the US dollar gets going and the rest of the globe heads for the exits, it could be very rapid and near impossible to stop.

We could see a whipsaw in import costs if this scenario occurs. There will be a soaring cost of energy and gasoline as the dollar implodes and oil-exporting countries no longer want US dollars that are plunging in value. We could see a sudden spike in the cost of virtually all the imports that are consumed by the US, with that external supply shock inflation rapidly becoming internalized, and domestically produced goods and services soaring in price as well.

This very high rate of inflation would be economically devastating, and ultimately the only way to stop the damage will be to stop the monetary creation and stop the stimulus spending. Which means that more millions of people would become unemployed as the economic damage that was done to the corporations, banks, and state and local governments must finally be recognized.

17. State & Local Governments

State and local governments in the United States are likely to face a deadly combination of soaring unemployment which increases expenditures, even while income and sales tax revenues are falling with employment and consumption. This may be compounded by highly adverse results in pension investment portfolios, thereby pushing highly stressed states and cities into insolvency across the nation. What is more likely than this scenario of nationwide state and local government bankruptcies, however, is a massive Federal government bailout, that would likely be financed through the Federal Reserve creating still more money out of thin air.

18. Long-Term Investment

Even a partial Eurozone currency and economic collapse would have serious negative implications in multiple categories for US investments. Corporate earnings growth rates could turn negative on a global basis as a result of the new global depression, thereby slashing stock market values.

As discussed previously, the likely US response of trying to cover over negative short-term economic developments by simply creating more money, has highly negative implications for the long-term value of the US dollar. Quite simply, the more money that is created in the attempt to prop up an artificial economy, the greater the long-term damage to the US dollar, and the higher the likely future rate of inflation.

This would mean that both bonds and stocks - the two cornerstones of conventional long-term investment strategies - could face devastating and sustained losses, which might never be recovered.

As discussed in the analysis linked below, the eventual US response to a new unemployment crisis is likely to effectively be currency warfare, which may have particularly unfortunate consequences for retirees and retirement investors.

19. Inflation, Unemployment, Stocks & Inflation Taxes

There was one more political signal sent out of Paris that went around the world. Francoise Hollande was elected on a promise to tax the wealthy at a 75% tax rate.

In this extraordinary economic and political environment, the voter appeal of promising to increase benefits while raising taxes on the wealthy has just been proven in the most concrete of terms.

This sets up what could be called a worst case scenario for stock investors on a global basis. While little appreciated, the three way combination of high unemployment, high inflation and high taxes could effectively confiscate most of global stock investor wealth on a real basis - while appearing to generate a powerful bull market on the surface.

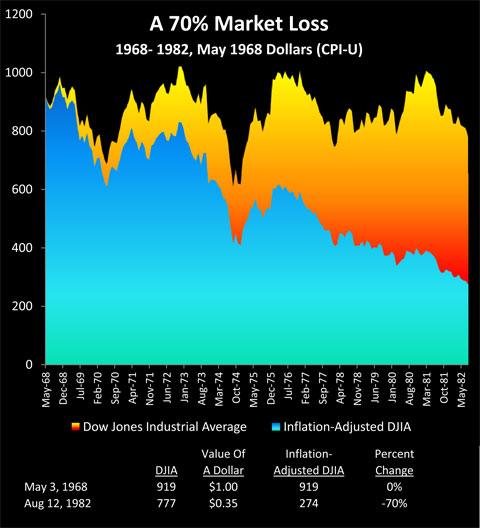

The Secret History Of A 70% Market Loss

As explored in the detailed analysis linked above, the last time we had sustained high inflation, high unemployment and higher tax rates than today, US stock investors lost on average 70% of their portfolio value in after-inflation and after-tax terms - even though most of their losses were hidden by inflation destroying the value of the dollar.

We face the potential toxic combination of higher unemployment than the 1970s, higher future inflation than the 1970s, and a return to higher tax rates. If this should occur, then real losses in after-tax and after-inflation terms may be substantively greater than the historical experience of a 70% long-term loss, particularly when compounded by a growing wave of boomer stock sellers who are liquidating into the smaller and increasingly unemployed group of investors behind them.

20. The Destruction Of The Conventional Investment Paradigm

The election of Francois Hollande as President of France may be setting into motion not only the end of a financial era, but also the end of a financial paradigm when it comes to the conventional wisdom about investing.

There could be a near term collapse of the Euro and European economy that could send the world plunging into depression and currency chaos. Or, order could be established - which would most likely set in motion a long-term process of inflation and punishing inflation taxes on investors. Either way - the results are deadly for those pursuing conventional investment strategies. Indeed, either way, the end results are likely to be the annihilation of the purchasing power of retirement savings and other long-term investment assets.

I do believe that there is one investment asset category that will outperform all others in the months and years ahead, and that investment is knowledge.

When I say "knowledge", I don't mean the study of the conventional wisdom about finance and investing, because that hasn't been working out too well. Instead, we need to aggressively challenge the conventional wisdom - and for most of us, that means leaving our personal comfort zone.

It is hard to change a lifetime of looking at things in the way that we have been educated to believe is the correct way. If we look at an average investor in their 50s, who has spent 30 years building their knowledge of how investments work - most people won't be able to do that. And the consequences are likely to be unfortunate.

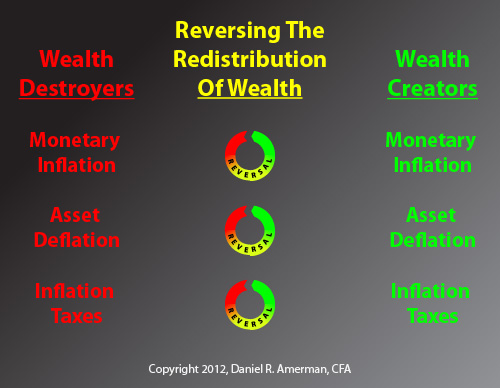

For those who are willing to take the challenge, and to be flexible and rethink what they know, then the following are three questions to think about:

How can I personally and realistically change my financial profile and strategy so that monetary inflation redistributes wealth to me? And the higher the rate of inflation, the higher my real wealth grows?

How can I change my strategy so that asset deflation becomes a profit opportunity rather than a wealth destroyer?

How can I take advantage of the government's blindness to inflation and reverse inflation taxes, so that instead of paying real taxes on imaginary income, I am (perfectly legally) paying imaginary taxes on real income?

These are not the usual questions.

But they are the essential questions.

Because when we successfully answer all three questions, and reverse all three wealth destroyers, then we have three wealth creators instead. These wealth creators can then build upon each other, and transform our personal finances in a time when paper wealth is being destroyed all around us.

We all need to get deeply uncomfortable with everything that we think we know about long-term investing. We need to seek out genuinely different ways of looking at things, perspectives that challenge what we may have accepted as being the truth for decades now.

We need this, because if sustained high monetary inflation, severe asset deflation and inflation taxes do return - or if the Eurozone does collapse and global depression is the result - then those who do nothing to change their "normal" financial profiles will face year after year of pervasive and sustained financial pain, with declining wealth and potentially declining standards of living. Change is coming upon us all, and we either adapt or we pay the consequences.