Inflation & Hidden Gold Taxation: 3 Historical Case Studies

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

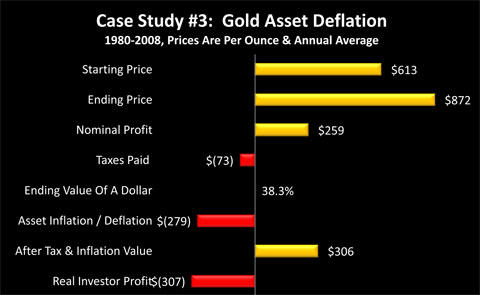

If we had bought gold at the market average price of $613 an ounce in 1980, and sold it at the average price of $872 an ounce in 2008, then on the surface it looks as though we made a profit of $259 an ounce. Viewed from the simplistic inflation-versus-deflation perspective, this 42% increase in price is clearly an example of inflation in gold.

Until we adjust for the difference in purchasing power per ounce. By 2008 a dollar would only buy 38 cents compared to what it purchased in 1980, and when we adjust our $872 price down by 62%, then our inflation-adjusted price falls to $334 an ounce. We didn't have a 42% positive return, we instead had a 46% negative return.

This is an example of simultaneous monetary inflation and asset deflation. Between 1980 and 2008, 62% of the purchasing power of the US dollar was destroyed. However, this destruction of the value of the dollar in no way protected the value of investment assets, meaning inflation did not prevent deflation. Gold experienced powerful asset deflation in real terms.

The next step is crucially important for precious metals (and other) investors to understand. The dollar fell 62% in value, and gold fell 46% in value. Because the destruction in the purchasing power of the dollar exceeded the destruction of the purchasing power of gold - the price of gold rose. Which brings us back to government tax policies.

As investors, we would have lost 46% of the real value of our investment, but not one penny of this loss would have been deductible because the destruction of the value of the asset was entirely covered up by the destruction in the value of our money. Indeed, the destruction of the value of money was so thorough that our losing nearly half our net worth was transformed into profits of $259 an ounce on our tax return.

To add insult to injury, our entirely fictitious "profits" are taxed at a punitive tax rate, and we must pay $73 an ounce in taxes to the government. When we convert that back to 1980 dollars, then on an after-tax and after-inflation basis we went from $613 an ounce to $306 an ounce, meaning we lost half of the purchasing power of our investment.

That is real history, and it is the history of more than just gold. Stocks are also vulnerable, and as covered in my article, "Deadly Dow 36,000 & The Secret History Of A 70% Market Loss" (link below), simultaneous monetary inflation and asset deflation in an environment of inflation taxes dominated the stock market the last time we had high unemployment coupled with high inflation, and led to devastating investor losses that were hidden by the destruction of the value of money - and in some cases, the payment of income taxes on those losses.

http://danielamerman.com/articles/2012/Dow36C.html

Case Study Summary

Every one of our long-term case studies shared four items in common:

1) Most of the value of the dollar was wiped out by inflation;

2) The price of gold surged in response;

3) The surge in the price of gold (and investment assets in general) was a lucrative source of government tax revenues; and

4) The gold investor ended up with less than they started with.

Whether gold acted as a perfect inflation hedge, or experienced asset inflation, or asset deflation - the investor's purchase of gold was quite profitable for the government, and the gold investor not only had all real profits taken, but part of their starting net worth as well.

These results are in no way, shape or form a coincidence or an accident. They are how the system is set up, they are inside the very framework of the monetary and tax system, and the government plays the game on a more sophisticated level than most people realize.

Knowledge Is The Solution

Precious metals can be highly profitable and even essential investments in a time of financial crisis. They have great potential to deliver both return and security. While we reviewed real world case studies of how gold investors can appear to make money on the surface even while losing net worth in reality, those examples by themselves do not negate the advantages of owning gold in times of monetary crisis. Instead, the three case studies serve to illuminate the true playing field for precious metals investment.

Yes, it is outrageous and unfair that the playing field has been so thoroughly rigged that some of the most popular means of protecting what you have from the government, in fact, turn out to be methods for delivering what you have to the government.

It is also reality.

Just as it is also reality that in this time of fantastic and unsustainable government deficits, in which the financial system and economy on a global basis are being held together by the central banks creating vast sums of money out the nothingness - there is a good chance that the greatest bull market in precious metals in the modern era still lies ahead of us.

Both realities are true, simultaneously.

How do we bridge the two realities?

The first step is to understand and accept that these are merely two aspects of one central reality - which is the government. Creating inflation and taxing inflation are not two unrelated forces, but are the left and right hands of government, and they are quite deliberately set up to work as a team. If all you see is the left hand of inflation, and that is all that you are fighting, then that right hand of inflation taxes is going to come out of nowhere to knock you down to the floor, hard, and it is going to do it every time.

Unfortunately, even most financial professionals are only partially informed in this area, and the overwhelming majority of the general public simply has no idea. It is this lack of awareness that the government is counting on, because you can't defend yourself against what you don't see coming.

Common sense points us to the necessary solution, which is education and learning to see both the right and left hands of the government with equal clarity.

Once we adjust our vision - then we can turn the government's game upside down. We do this by constructing a financial profile and strategy that is very different from those around us, and positioning ourselves to benefit from the redistributions of wealth that are impoverishing those following more conventional investment strategies.

We reverse monetary inflation, so that the greater the destruction of the currency, the more wealth that is redistributed to us.

We reverse asset deflation, so that the greater the destruction of the value of many investment assets, the more wealth that is redistributed to us.

We also take a last step that is absolutely essential: we look at the government blindness that creates inflation taxes, we understand that a blind opponent is a weak opponent, and we find a counter-intuitive way to turn the government's blindness against itself. Using that knowledge, we reverse inflation taxes, so that instead of paying real taxes on illusory income, we are quite legally paying illusory taxes on real income.