Arbitraging Fed Policies With Rental Housing Cash Flows

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

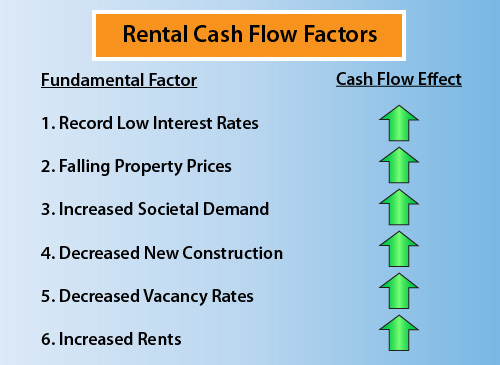

1) Increasing Demand. According to the Census Bureau, the maximum rate of home ownership in the US peaked between 2004 and 2007, reaching at least 69% in one quarter each year. By the 4th quarter of 2011, this number had fallen to 66%.

Now, if we turn the numbers around, the percentage of the population needing a place to rent went from 31% to 34% between the housing bubble and today. This means there has been an increase of 10% in demand (and more than that when we include population growth).

There is a basic shift that has been occurring as home ownership decreases while rentals increase. This shift strongly favors real estate cash flow investors.

2) Decreased New Construction. The number of new construction rental units becoming available each year remains at near-record lows, along with single family housing starts and construction sector employment. This could be changing soon in some metro areas, as new multifamily housing construction began to surge in the second half of 2011. However, this is a surge from a very low floor, as overall bleak conditions in the housing sector have prevented what would otherwise be a flood of new units responding to increased demand, low interest costs, falling vacancies and rising rents.

3) Decreasing Vacancy Rates. Also according to the Census Bureau, the rental vacancy rate for the nation as a whole, including single family homes that are available for rental, fell from a peak of 11.1% in 2009, to 9.4% by the 4th quarter of 2011, a decrease of 1.7%.

When we look just to apartment vacancies in major metropolitan areas, then the vacancy rate fell to 5.2% by the fourth quarter of 2011, according to property research firm Reis, Inc. This was down from a peak of 8% at the end of 2009. Vacancy rates are down to 2.4% in New York City, and 3.6% in San Francisco, according to "The Economist" magazine.

This decrease in vacancy rates is exactly what we would expect given that there is an increasing demand for units, and construction is still lagging compared to historical averages, and the benefits go straight to the margin - resulting in increased owner cash flows.

4) Rising Rental Income. According to Reis, apartment rents rose by 2.3% during 2011. Expectations in 2012 are for increases that are potentially well above the official rate of inflation in some major metropolitan areas such as Seattle and Washington, DC.

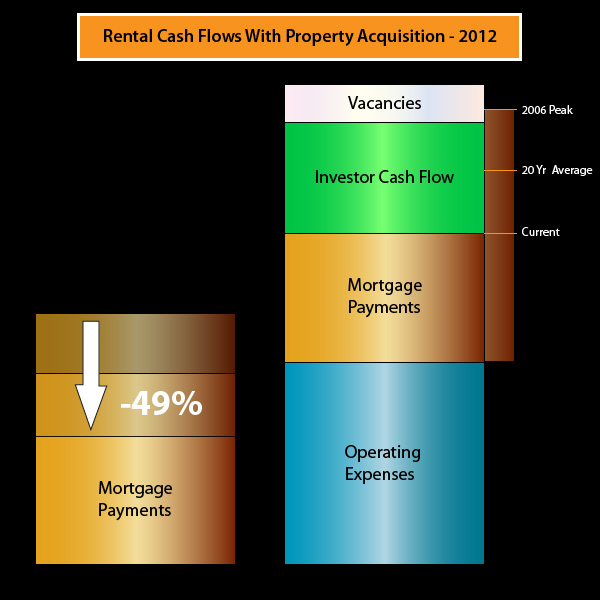

Putting it all together and as shown above, we are currently in the extraordinary place where six factors are working together to increase the margin that is owner cash flows.

An Unparalleled Opportunity

I structured my first closed multifamily financing in 1983 within a few months of finishing graduate school. Over the two decades that followed, working first as a financial analyst, then an investment banker and later as an independent quantitative analyst, I structured closed financings for many thousands of rental units around the nation, for clients ranging from private investors to Trammell Crow and state housing finance agencies. I also wrote a couple of books about mortgage securitizations and derivatives in the 1990s, that were published by McGraw-Hill (and subsidiary).

And in all that time, and all those deals, and all those endless computer printouts of cash flows and debt service coverage ratios - I never saw anything like the current situation.

Many people are so focused on prices and the headlines that they are failing to see the bigger picture.

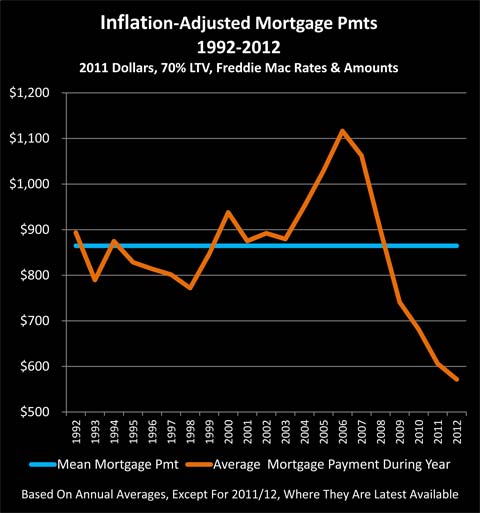

Yes, the market is terrible, but prices aren't actually that low when we take a long term perspective. In inflation-adjusted terms, prices (for comparable properties) were lower through most of the 1980s and 1990s.

Prices had to be lower back then because interest rates were much higher, and the only way one could get the cash flows to work was to pay less per unit in inflation-adjusted terms.

The truly remarkable development is the back door that the Federal Reserve has unintentionally opened for individual investors, while trying to cope with the aftermath of the long series of mistakes committed by the Federal Reserve itself, Wall Street, the mortgage banking industry, and the federal government.

The Federal Reserve has directly and openly manipulated interest rates in general - and the mortgage market in particular - resorting to the direct creation of money out of the nothingness on a massive scale when necessary, specifically to make sure that mortgage interest rates are well below free market levels.

While this policy of deliberate and massive market manipulation steals from many millions of people - it gives with both hands to others.

For retirees, retirement investors and the pension funds who were depending on the payment of market interest rates - this is a policy of theft. Deliberate government choices and interventions are keeping yields below the real rate of inflation, as I have written extensively about in my series on Financial Repression (linked here). The price is being paid every day by millions of people when it comes to their standard of living or their ability to ever retire.

The main beneficiaries of this largesse from the Federal Reserve is the Federal government (deficits would be far higher with market interest rates), Wall Street, private equity firms, and other privileged insiders.

However, a more or less accidental side effect of this massive manipulation is the giving with both hands to real estate cash flow investors.

Seeing Both Halves

Indeed, the Federal government interventions over the last 10 years have had 180-degree-different results for short term price appreciation investors versus cash flow investors. Federal government market distortions in multiple areas helped feed the rise in real estate prices that created short term sizzling yields for price investors, even as the cash flow market was put in the deep freeze.

On the flip side, the market which since 2006 has been ruinous for many real estate price investors, has had the 180 degree opposite effect for cash flow investors, creating what looks to be the best environment for real estate cash flow investment in our lifetimes.

Those who lump short term price speculation together with long term cash flows into one "Real Estate Investment" category (and much of the general public does), will never see this opportunity, because they can't see the two distinct halves. However, those who can look beyond short term price fluctuations and see the bigger picture will see something entirely different: an accidental by-product of massive government manipulations which offers potentially lucrative cash flows in a yield-starved world.

Now don't get me wrong - long term cash flow investors want to see eventual price appreciation every bit as much as short term speculators. That's the "kick" that delivers what many investments don't - not only potentially better cash flow in the interim which rises with inflation, but a potentially massive gain on the back end.

And the good news when we look at the inflation-adjusted housing prices graph is that real estate is available at the lowest prices since 1998. Which means the chances for maximum price appreciation are the greatest in 14 years as well, when the market eventually normalizes in some future year.

In closing, I'm going to repeat two extraordinary graphics, of a situation - and an opportunity - that we have never seen before.

And may never see again.