Making 9 Million Jobless "Vanish": How The Government Manipulates Unemployment Statistics

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

The Young, The Old & Workforce Participation

For the comparatively few who follow workforce participation rates, the government does have an easy explanation. It's all those Boomers in their vast hordes, getting old on us. Older people retire, so the higher the proportion of old people in a nation, then the lower the workforce participation rate should be, right? This is an intuitively appealing explanation - and in truth, over each one of the next 15 years this fundamental force of a declining number of workers per retiree will indeed come to dominate the economy to an increasing degree, with likely devastating implications for not just Social Security but the stock market as well.

However, this growing pressure is still in the early stages, and is nowhere near the dominant influence it will become within the next five to ten years. The real explanation for what has been happening over the last five years doesn't revolve around the old, but the young.

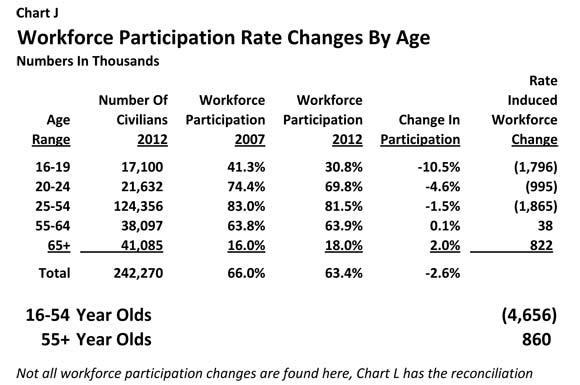

Consider the chart below, which breaks the civilian population out into age groups, and looks at jobs and workforce participation (all raw data is from the Bureau of Labor Statistics, as is everything else in this analysis unless otherwise specified). The starting period is 2007, the last year before the bottom started dropping out, and the ending period is January of 2012.

If it were an aging population that was driving the percentage changes in labor force participation rates, then we would expect to see nothing happening with people below age 50, and the declining rates would be with people in their 50s, 60s and over. But that isn't what is happening at all.

On a percentage basis, the largest number of people "defined out of the workforce" by the government were 16-19 year olds. In 2007, 41.3% of teens were counted for employment and unemployment purposes, but by January of 2012, it turned out that only 30.8% were in the labor force, a sharp reduction of 10.5%. So 1.8 million teens were dropped from the labor force by definition, so they no longer existed for unemployment statistics purposes, and what every one of those teens had in common was that they didn't have jobs.

The next biggest percentage change was among 20-24 year olds, who had an abrupt decline of 4.6% in their workforce participation. For some reason known only to the government, one million 20-24 years olds just lost all interest in work, and could be removed from the unemployment calculations.

In the largest age bracket, those 25-54 year olds in their prime working years, there was another mysterious participation rate decline of 1.5%. While much smaller than the percentage declines with the younger workers, for the simple reason that there are so many 25-54 year olds (124 million), the greatest number of jobless people went missing - 1.9 million - from the unemployment calculations in what is usually the very heart of the labor force.

The 55+ age group actually saw minor increases in their workforce participation rates, with 55-64 year olds experiencing a 0.1% rise, and those 65 and up seeing a full 2.0% rise. This change in behavior can be relatively easily explained by what has happened to retirement account values, as well as the currently very low level of interest rates, which slashes retirement income levels for many potential retirees who have followed the conventional retirement planning advice.

A generation that can't afford to retire, doesn't retire, and the government statistics reflect this with a very small increase in workforce participation rates among those 55 and older. Frankly, given the state of retirement accounts and retirement income, it is curious and even remarkable that the increase in workforce participation is reported to have been so low in these age categories. If, say, 10% more of the people turning 65 were actually wanting to stay in the work force in 2012 when compared to 2007, but couldn't find jobs, then the size of the labor force - and therefore unemployment rates - would be significantly higher.

(Interestingly, 55+ is the very best place to "game" the workforce participation rates, precisely because it is the hardest to get "caught" there, and there are statistical reasons to believe that is exactly what is happening. If true, then the degree of participation rate manipulation, and the millions of jobless people inappropriately removed from unemployment calculations, could be much larger than what is shown herein. However, to keep this article from becoming book-length, that needs to be another topic for another day.)

Real Unemployment Rates Among The Young & Middle-Aged

When we earlier looked at round number illustrations of a hypothetical government creating false unemployment statistics through manipulating participation rates, the examples of 2.0% and 3.0% manipulations turning 10.0% real unemployment into 7.2% and 5.8% reported unemployment, might have seemed a bit "over the top".

In this instance, however, all we need is the federal government's own very dry and obscure tables of data, and an understanding of what it means, which this article seeks to provide. When we use this data - we see a degree of blatant manipulation in the real world, that actually puts our round number illustration to shame.

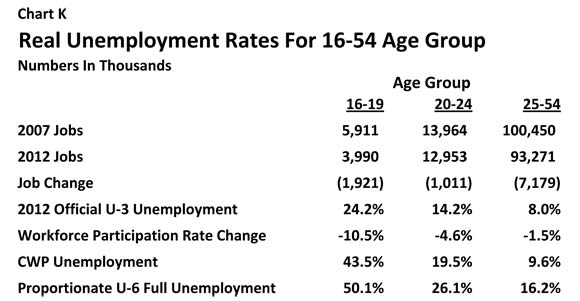

There were about six million employed teens in 2007, and by 2012 this number had plunged to four million, meaning that one in three teen jobs have disappeared. Yet, the official youth unemployment rate is stated to be only 24.2%. This deception was accomplished by simply dropping a 1.8 million teens (10.5%) from the labor force, thereby hiding what would have been a 43.5% unemployment rate with a constant teen workforce participation rate . (There are 17.1 million 16-19 year olds (rounded), and with 2007's participation rate, 7.1 million of them would be in the labor force, and with 4 million actual jobs, that means 3.1 million unemployed, which works out to our 43.5% unemployment rate).

Overall levels are even higher when we take into account that this is just the headline U-3 unemployment rate. The government does not breakout the U-6 data for all age groups, however we can do an even adjustment of all age groups for both involuntary part time workers, and "normal" discouraged workers, which works out 6.6% for the nation. Adding that average adjustment to the teen data produces a 50.1% unemployment rate.

When we look at 20-24 year olds, then the reported unemployment rate of 14.2% was actually created by the government dropping the labor force participation rate by 4.5%, which concealed what would otherwise be a headline (U-3) unemployment rate of 19.5%. When we hold participation constant, and adjust for the full (U-6) number of jobless - thereby including all three "boxes" - the true unemployment rate for 20-24 year olds becomes 26.1%.

(As covered in my article, "Hiding A Depression: How The Government Does It", there is actually a 4th box as well, which is the "artificially employed": those whose jobs depend on the government spending money which it doesn't have and can't realistically repay. When we add the number of jobs dependent on maintaining an impossible level of government spending, then the total unemployment rate for the nation rises to near 30% for the nation as a whole, and about 35% for 20-24 year olds.)

It is reasonably well known that there is a serious unemployment crisis among the young in America. What is not understood is that the situation is worse than what is shown in the official statistics. Indeed, the government is taking extreme (statistical) measures to make sure that the public remains uninformed about the full extent of the youth unemployment crisis.

The problem also extends to the center of America's workforce, those aged 25-54. There were 7.2 million fewer employed people in their prime working years in 2012 than there were in 2007, and there is just no getting around the 7.2 million people adversely affected. There was a manipulation here as well: for no logical reason, the workforce participation rate was dropped by 1.5%, which reduced the headline unemployment rate from a real 9.6% to a reported 8.0%. Adjust for full U-6 unemployment, and with all three boxes our total is a 16.2% unemployment rate for those in their prime working years.

(As an aside for mathematically oriented readers: some of the variations in the impact of participation rate changes may intuitively seem a bit "off", but that is because the degree to which a given participation rate change affects an age group is dependent on the starting labor force participation ratio for that particular group.)

An Aging Population & Shifting Age Buckets

One way of thinking about workforces and participation rates is as a series of buckets based on age. As a year-class (say those who graduated from high school in 1970) ages, they pass through this series of buckets, and their participation in the labor force changes depending on which age bucket they are in at the time.

Historically and with a normal economy, the participation rate sharply rises between ages 16-24 as people steadily move from the schools to the workforce, and the full adult participation rate of around 83% is reached by about the mid 20s. This peak rate stays in a fairly narrow range for about 30 years, and then as people reach the latter half of their 50s, a significant decline in participation begins that accelerates through the 60s until only 10% of the population is still in the workforce at age 75 and beyond.

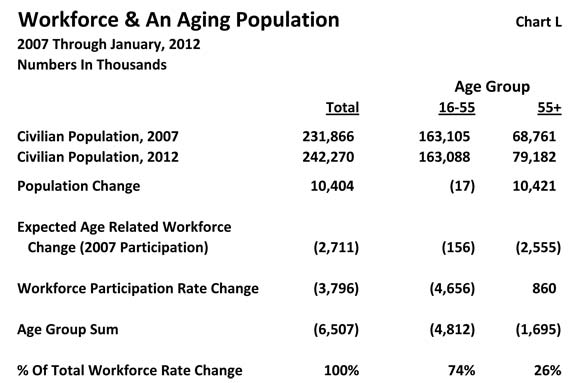

As shown in the table above, between 2007 and January of 2012, the number of people over the age of 55 grew by 10.4 million, and the number of people aged 16-54 shrank by 17,000. Because we now have 10.4 million people who have moved along to older age "buckets" where we normally have falling participation in the workforce - the average participation rate should be falling, all else being equal (the adverse developments with retirement investment accounts and interest income, however, mean that not all else is equal).

To find out how much changing ages should have changed participation, we pour into each age "bucket" the appropriate number of people for early 2012, and find out what would have happened if the government had held the participation rate for each bucket constant at 2007 levels.

When we do this, we get what is shown in the line "Expected Age Related Workforce Change". When we compare 2007 to 2012, then in a normal economy we would have expected a reduction in workforce participation of about 2.7 million people, with the aging Boomers and their parents removing about 2.5 million people from the workforce, and the changing age composition of the younger than 55 population should have removed another 150 thousand people (the prime 25-54 age group actually shrank by 1.3 million, and were replaced by less likely to be employed 16-24 year olds).

However, the government didn't remove 2.7 million people from the workforce - it removed 6.5 million people. Everyone else was removed via the method previously described, that of changing the workforce participation rates for each age "bucket", primarily among those 54 and younger. The "Workforce Participation Rate Change" line is from Chart J above, and it is found by multiplying the participation rate definition change by the number of people in each bucket.

When we add both categories together, that of people moving into different age buckets, and that of changing government definitions for what percentage of each age bucket is in the workforce, then we get our 6.5 million total change.

Of the total, only 1.7 million, or 26%, were aged 55 and older (net of the 860 thousand jobs added by slightly increased workforce participation). Conversely, 74% of the removal of the jobless occurred among those aged 16-54, as the government has blatantly and rapidly changed labor force definitions for the young in a manner that has twisted a rising 20.0% unemployment rate into a publicly reported falling 8.8% unemployment rate.

The truth about unemployment is not what the press releases say it is, and it is the U.S. government's own numbers that prove this in damning detail.

It is worth noting again that perhaps the most questionable aspect of the government's numbers is what is happening to those above age 55 when it comes to retirement choices, retirement account values and retirement income. In an environment where retirement account values are falling woefully short of financial planning projections from years ago, and interest rates are not much above zero percent, is it really true that only a mere 0.1% of potential retirees who are in the key discretionary retirement age range of 55-64 have changed their behavior between 2007 and 2012?

Based on who you know, do you believe that among 55-64 year olds, the number choosing to delay retirement and stay in the workforce has climbed only from 63.8% to 63.9%?

If more than one in a thousand potential retirees aged 55-64 is changing their individual behavior because of what has happened with the economy and investments, and they are attempting to defer retirement but they don't have a job, then the true total of jobless being hidden since 2007 could be significantly higher than 6.5 million, and the real unemployment rate could be higher than 20%.

The Bigger Picture

The heart of the long-term problem with employment in America can be seen in Chart G above, when we compare the population for 2000 and 2012, and those fully employed in each year. The "working age" civilian population rose almost 30 million - from 212.6 million to 242.3 million - while the number of fully employed people fell 1 million, from 133.7 million to 132.7 million.

Our long term labor force participation rate is about 66%-67%, or two-thirds. So to maintain constant employment rates, if there are 30 million more people over 16, there need to be 20 million more people in the labor force, and roughly 19 million more jobs (allowing for normal unemployment). Instead, when we look at the fully employed (employed workers less involuntary part-time workers), there are one million fewer jobs now than in the year 2000.

Thirty million more people over the age of 16 and one million fewer people being fully employed is a shortfall of 20 million jobs, and this by itself creates Great Depression range unemployment levels. Fundamentally, this is not even remotely consistent with a reported unemployment rate in the 8% range.

The government is attempting "information management" (aka manipulating statistics in a manner specifically intended to deceive) when it comes to how the public perceives this situation. The method used is to split the catastrophe into three boxes: putting 13.5 million jobless people into the first box of official unemployment for press release purposes; segmenting another 11.8 million jobless into the second box that is hidden in the U-6 footnotes, and making another 7.2 million jobless disappear completely by using the third box of changing the workforce participation rates (outside of U-6 since 2000).

Those three boxes add up to 32.5 million jobless, and the 12.5 million jobless over and above the 20 million missing jobs is in the ballpark for what would be "normal" (5.2%) full unemployment for a population of 242 million people aged 16 and above.

Everything adds up, and the big picture of those 20 million missing jobs reconciles with current improving official unemployment statistics when we dive deep into the heart of the workforce participation deception, and discover that the worst of the damage is among those younger than 55. That is the opposite of the cover story for the decline in labor force participation rates to date. But intuitively, this is a good fit with the big picture of 30 million more people in the working age civilian population, and 1 million fewer jobs.

We might expect that those who have good jobs would (mostly) pull those jobs forward in time along with them, but that those who enter the labor force behind their employed elders find that the door is shut, at least when it comes to the most desirable jobs. And it gets a little worse every year, as teens enter their 20s, go through their 20s, and then enter their early 30s, without ever landing the kind of solid and reliable middle class job that can support a family in a house (or pay enough in taxes to support a retiree and pay for their health care).

And when we pierce through the statistical manipulations - that is exactly what is happening. Employment has been devastated among the young. Which is precisely why there has been such a blatant manipulation of workforce participation statistics among the young in particular. With nothing in those statistical manipulations changing the bigger picture of twenty million missing jobs, and a total that continues to grow annually.

Deceptions & The Problem With The Future

One of the big problems with deceptions is that they can have ripple effects.

These ripple effects can cause particular problems when it comes to our expectations about the future. If what we believe about the past and the present are both wrong - then when we project forward that false information, we get a result that is likely to be disastrously wrong.

This statistical problem is sometimes referred to as GIGO: Garbage In, Garbage Out. Unfortunately, we have a major GIGO problem when it comes to the future economy, tax revenues, deficits, Social Security, Medicare - and investment performance.

When we project forward the train wreck that has been happening with employment and workers younger than 55 - then everything that we think we know about Social Security, Medicare, and federal budget deficits shatters into little pieces. The unending trillion-dollar-plus federal budget deficits that we see discussed in newspapers - are themselves based upon ignoring what has actually been happening with employment since 2000, and instead projecting forward the healthy growth of a healthy economy, that in truth hasn't been healthy for a long time. Without that growth - taxes are much less than projected, deficits get much larger, and the crises with Social Security and Medicare get much worse, much faster.

The heart of the problem is that there are two different kinds of reductions in workforce participation rates - and they are on collision courses. One kind is the subject of this article, which is the statistical deception that is being committed to cover up the full extent of the still growing unemployment crisis among those aged 55 and younger.

The second kind of falling workforce participation is the fundamentals of demographics and what will become a dominant reality for the economy. The Boomers are aging, and by 2027, population projections are that there will only be two people in the 16-64 labor force for each person aged 65 or over. Leaving aside children, and going a level deeper than the facade of money-based projections, the true fundamental factor that governs everything is the ratio of two people producing resources for each one hopeful retiree consuming resources. (Over the long-term and for societies as a whole, money is only an easily manipulated symbol; goods and services are the reality that determine actual standards of living.)

Even with a robustly healthy economy and full employment - let me suggest that it has always been a very dicey proposition in terms of those two workers paying for their own family, the military and government infrastructure and other transfer payments, and then supporting one older person between them, while buying out massive sums of Boomer retirement account and pension investments at the highest prices in history with the money they have left over every year.

Indeed, in my opinion this has never been possible, and as I have been writing about for many years now, much of conventional retirement planning is based on a fairy tale which assumes fifty million Boomer investors can compound paper wealth together at a rate much faster than the growth in the real economy - and then somehow simultaneously cash this paper wealth out into real resources that don't exist.

But when we have a real economy that isn't experiencing healthy growth but is instead staggering, with imploding employment levels among younger workers - then there are two major implications which turn a building disaster among the young into a future disaster for the old. The first implication is that the gap between what has been promised and what is available must grow. The less real wealth that is produced by the actively working young, then the less wealth there is available for the old after retirement, whether we are talking about public transfers or private investments.

Politicians and financial firms can make all the soothing projections they want, but the fundamentals are that fewer jobs for the young mean greater eventual impoverishment for the old, and there is no getting around that.

The second implication is that the demographic financial crisis is brought forward in time. An average of four million Boomers will be reaching traditional retirement age each year. Meanwhile the job base among the young has been shrinking. The longer those two forces are occurring simultaneously, the faster the gap between expectations and reality grows, and the sooner the arrival of a crisis which could dwarf what we have seen to date.

This situation is a powerful incentive for older Americans to ramp up their savings and investment rate. Ironically however, the worst of the damage from employment statistics GIGO is not in the public sector, but can be found in the deception of private investors. Most of the value of the stock market is based upon expectations of future growth, which are being enabled by garbage statistics about what has actually been happening in the past and present. Remove the growth - and most of the current value of the markets goes with it, for when jobs implode, so do stock markets.

This can be seen very clearly by what happened to stocks the last time we had a major (albeit lesser) jobs crisis in this country. As covered in my article, "Deadly Dow 36,000 & The Secret History Of A 70% Market Loss" (link here), there are ample historical reasons to believe that the jobs crisis may create a stock market illusion, with apparent rising stock market indexes that mask investment values plunging in inflation-adjusted terms.

This is a national emergency, and what is needed more than anything else is full honesty about what is happening, and a nation pulling together to change what can be changed.