| Daniel Amerman & The Turning Inflation Into Wealth Mini-Course | |||

| Home | Inflation & Wealth | Author Info | Crisis, Books & DVDs |

| Bailout Lies | Deflation & Inflation | Inflation Supply Shock | Retirement Reality |

By Daniel R. Amerman, CFA

(The

video below takes just under two minutes to view, the transcript can be read in

about a minute.)

Let's talk about your retirement. You

responsibly save for decades, your investments help the real economy of this

country grow, and as a reward, you eventually reap the benefits of that

economic growth in the form of a prosperous retirement.

Wonderful theory.

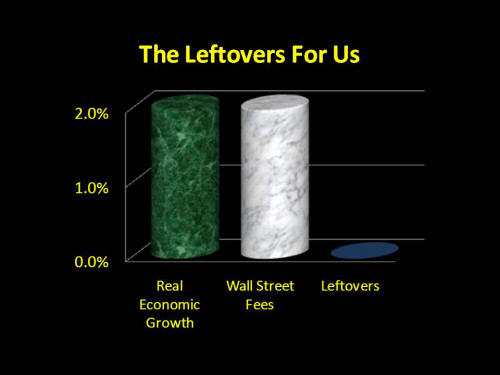

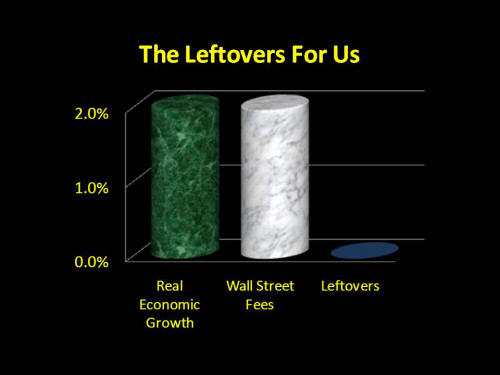

When we look not at paper wealth, and not at

stock or real estate bubbles, but the real US economy, then over the last 50

years economic growth has averaged about 2% per year per person, after

adjusting for inflation.

Now here's a fascinating coincidence. The rule of thumb figure is that total financial

industry revenues average about 2% of assets under management. So for every $100 in an investment account,

about two dollars will end up sticking to the fingers of the investment

industry over the course of the year.

What a coincidence! We responsibly save to

be rewarded with our share of economic growth, but the annual financial fees

exactly cancel out the annual growth and we’re left with… what?

Meanwhile, in exchange for managing let's say

$10 trillion in retirement account investments, Wall Street pulls out $200

billion every year. That's $200 billion

they get whether the economy is growing or shrinking.

Now logically, this would lead to a

situation where tens of millions of retirement investors wait patiently for the

wealth that has been promised to them but never quite arrives, while in the

meantime every year a relatively small group of people enjoy extraordinarily

good incomes on Wall Street.

It sure is a good thing this is just some

silly coincidence, isn’t it?

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will

redistribute real wealth to you, and the higher the rate of inflation – the

more your after-inflation net worth grows?

Do you know how to achieve these gains on a long-term and tax-advantaged

basis? Do you know how to potentially

triple your after-tax and after-inflation returns through Reversing The

Inflation Tax? So that instead

of paying real taxes on illusionary income, you are paying illusionary taxes on

real increases in net worth? These are

among the many topics covered in the free “Turning Inflation Into

Wealth” Mini-Course. Starting simple,

this course delivers a series of 10-15 minute readings, with each

reading building on the knowledge and information contained in previous

readings. More information on the course

is available at DanielAmerman.com or InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

This article contains the ideas and

opinions of the author. It is a conceptual exploration of financial

and general economic principles. As with any financial

discussion of the future, there cannot be any absolute certainty. What

this article does not contain is specific investment, legal, tax or any other

form of professional advice. If specific advice is

needed, it should be sought from an appropriate professional. Any

liability, responsibility or warranty for the results of the application of

principles contained in the article, website, readings, videos, DVDs, books and

related materials, either directly or indirectly, are expressly disclaimed

by the author.

Copyright 2010 by Daniel Amerman