Can Theory & Jargon Destroy Your Net Worth?

Daniel R. Amerman, CFA, DanielAmerman.com

Overview

Could how you define inflation have a major affect on your financial security in these times of financial crisis?

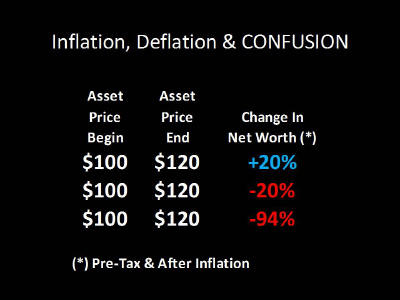

What if one definition of inflation could show you whether your net worth went up 20%, or down 20%, or whether it plunged 94%?

How about if the other definition takes those same three circumstances, but is incapable of distinguishing whether your net worth goes up or goes down?

Which definition would you prefer? That one which can tell you the difference between making money and losing everything you have? Or the definition that’s oblivious?

I recently debated well known blogger Mish Shedlock, and he had difficulty understanding the practical difference between these different ways of looking at inflation and deflation. The difference is essential, so I decided to prepare this educational article and video as a way of helping many other people understand the crucial, real world implications. Because let me suggest that what inflation does to your net worth is anything but theoretical, and you can’t afford endless internet debates that do nothing but create confusion.

Theoretical Economics Perspective

Let’s start with Mr. Shedlock’s views, and we’ll call them the norm. As taught in Economics 101, the definitions of inflation and deflation are fairly straightforward.

Inflation is an increase in the money supply.

Deflation is a decrease in the money supply.

Unfortunately, that's where the straightforward part ends. Just what does “money supply” mean anyway? Is it M1? Is it M2? Is it M3? What about credit? What about the value of real estate and other assets? (And for the average person - what do those Ms mean anyway?)

Once we have (somehow) picked a definition for “money supply”, what are the practical implications for you and your savings? Unfortunately, that's another problem with these theoretically correct definitions of inflation and deflation. Any linkage between our definition of inflation, and actual price levels is, well, highly theoretical. Some economists write papers saying one thing, then others write papers disagreeing with them - it’s the perfect subject for endless debates, because it’s unsolvable.

Finance & Applied Wealth Management Perspective

Now let's move from theoretical economics to investment decisions in the real world. Speaking as a CFA, MBA, financial author and former investment banker who has worked with dollars by the billions in the real world -- one of the core principles that permeates professional finance is that a dollar isn't a dollar, not at different points in time.

To make real-world investment decisions, we use rates to compare dollars at those different points in time.

We usually incorporate inflation into our discount or compounding rates - at least implicitly.

The most common number that we use to represent inflation is the change in price levels. The cost of groceries is a real world example. To capture a broad spectrum of price level changes, the consumer price index (CPI) is often used.

So from a Finance perspective, the perspective of applied wealth management for the most sophisticated investors in the world – I think it's fair to say that the norm is using price inflation rather than some theoretical money supply change that's too ambiguous to ever pin down. What’s the difference for you between these two definitions? And why should you care?

The Price Of Blindness

We’ll start with the Econ 101 perspective. The money supply, however we define that, went up. More money sloshing around the economy means prices rise. Our asset was worth $100, now it’s worth $120, so that’s inflation by definition. And that’s pretty much all we know.

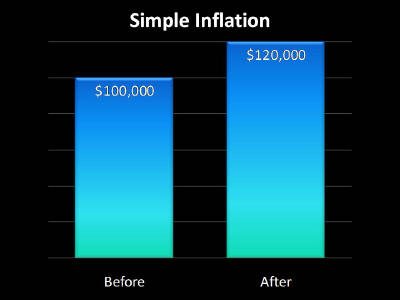

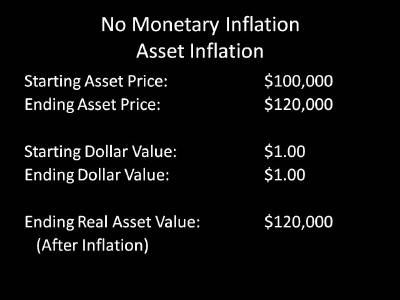

Now, let’s come in from a practical finance perspective. We started with a $100,000 asset, and we end up with a $120,000 asset. This asset could be a house, stocks, comic books, whatever you want it to be.

In this example, the dollar doesn’t change in value.

Since a dollar started out being worth a dollar, and ended up being worth a dollar , we end up with an asset worth $120,000

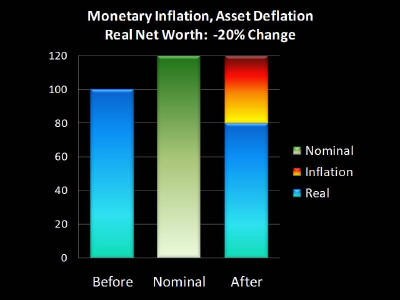

That means our net worth went up 20%, as shown on this graph. That’s great!

But what if we define inflation not in terms of money supply, but well, changes in what a dollar will buy for us. Isn’t that the part of inflation that most people care about? What it costs to, well, buy things?

Changing The Value Of A Dollar

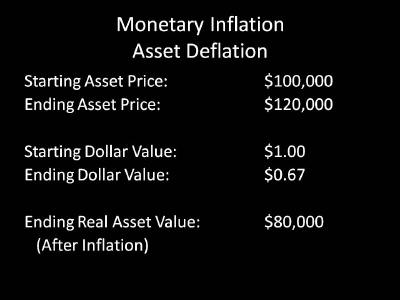

OK, we have exactly the same situation, from an Econ 101 perspective. We start with an asset price of $100,000, and end with an asset price of $120,000. Indistinguishable from our previous example.

Only this time we have inflation in the sense that most people mean it. A dollar becomes worth only 67 cents, in purchasing power terms. So, if we can sell our asset for $120,000, but each of those dollars in the future will only buy what 67 cents will today, what’s the real value of our asset? I would say that it is obviously $80,000.

So when we look at our graph, we start with the bar on the left, which is $100,000, on the surface it looks like we go to the bar in the middle, which is $120,000, but when we account for dollars being worth less than they were before, the real value of our asset is only $80,000. The difference between the $80,000 and $120,000 is the fire of inflation. (We’re taking this fast to keep the article short, but if you would like to walk through these vital concepts in expanded form, there are extensive supplemental materials available at http://danielamerman.com/)

So when we use the the Econ 101 definition of inflation, we’re unable to tell the difference between a 20% gain and a 20% loss. Interesting, and a bit troubling. And this becomes even more troubling if a dollar becomes worth a lot less than 67 cents. With the bailout and stimulus packages, the Fed creating trillions of dollars out of thin air, and the dollar in trouble overseas, many people are quite rightly worried about a much more dangerous degree of inflation.

High Rates Of Simultaneous Inflation & Deflation

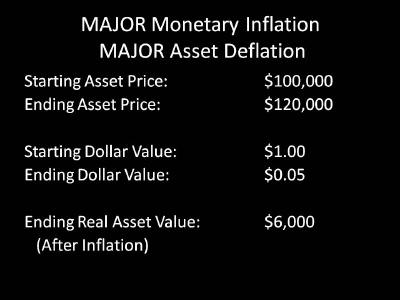

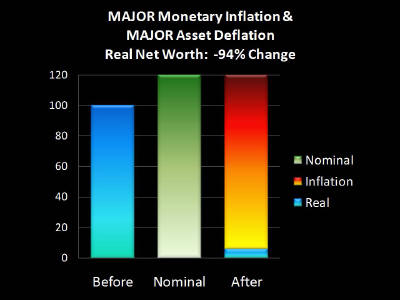

OK, exact same situation, from an Econ 101 perspective. Starting asset price of $100,000, ending asset price of $120,000.

Only this time, a dollar ends up being worth only five cents.

If we can sell our asset for $120,000, but each dollar is only worth five cents, what happens to the real value of our asset, it’s purchasing power, what it will buy for us? It dropped all the way down to $6,000.

Our left and middle bars are just the same, but look at our right bar. That $120,000 is almost all inflation, because we lost 94% of our net worth! We lost 94% of the value of our asset, which is asset deflation in purchasing power terms, but it was entirely hidden by the 95% destruction of the value of the dollar.

Three scenarios. In every case, we start with the same price, we end with the same price, but we have three radically different outcomes in our net worth. Now, if you take what some people consider to be the smart route of using a theoretical economics definition of changes in money supply – those outcomes will be impossible to tell apart. However, if we use a methodology created specifically for practical, real world investment decisions - these differences become boldly obvious.

So does this mean that only finance people have a clear vision for what's happening, and that the economists have no idea? Of course not, that would be absurd. Because here's the other thing you’ve got to keep in mind about our Econ 101 definition of inflation as being changes in the money supply. Economists don't use it either, not once something concrete and tangible needs to be done. Such as calculating the growth of the national economy, or changes in productivity. For these type of practical calculations, ambiguous theory doesn't hack it, and economists also use changes in price levels, much like the finance people.

Unfortunately, many millions of people are paying a very real penalty for this clash of definitions and jargon.

Real World Theory & Jargon Price 1: Blindness

The first price is that if you or your advisor can’t see the difference between gaining 20% and losing 94% because of the definition you choose – then you are investing blind. If you can’t even see what is happening, then your only hope for success is pure luck.

Real World Theory & Jargon Price 2: Confusion

The second price is confusion, and this one is nailing many millions of people right now, as well as confusing the heck out of many commentators who are using simplistic definitions. People think that because housing prices and stock prices have plunged, that the value of their checking account is protected from inflation.

This belief is dead wrong and profoundly dangerous for investors. When a nation gets into economic trouble, and it has a symbolic currency like the current US dollar, then simultaneous monetary inflation and asset deflation are the norm, as I explain in my other writings.

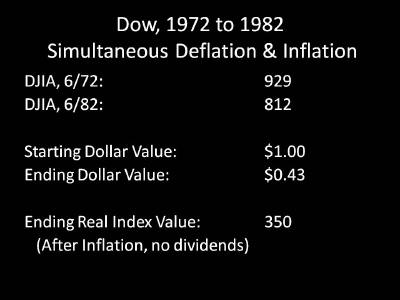

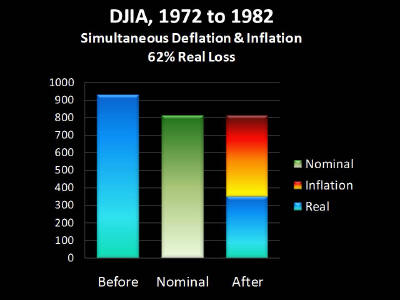

To very briefly illustrate, let’s consider what happened with the last huge move downwards in the stock market. The Dow Jones Industrial Average stood at 929 in June of 1972 – and was 812 by June of 1982, ten years later. Now, as you may recall, this ten period was also the greatest bout of inflation that the US experienced in the 20th Century. The dollar fell in value by 57% in the space of ten years. When we take our ending DJIA number of 812, and adjust for a dollar only being worth 43 cents – the real value of the index was only 350. In purchasing power terms, what our investments will buy for us, the Dow had fallen by almost two thirds.

Let me rephrase: the single largest bout of paper wealth asset deflation in the US since the Great Depression, occurred SIMULTANEOUSLY with the single largest destruction of the value of the US dollar in modern history. Asset values fell 62% in real terms, even as money was simultaneously losing 57% of its value.

However, if all you use is the Econ 101 definition of inflation – you will never see this. All you will see is a case of quite mild asset deflation. Which means you will be completely confused. You will think, as even most commentators do, that it is EITHER inflation OR deflation, and quite mistakenly believe that falling asset prices provide at least temporary protection for your money. This common theoretical mistake could be deadly for the real world value of their savings for many millions of people, as well as their real world standard of living over the coming decades.

(Those who believe that the Great Depression proves the opposite case, that asset deflation leads to monetary deflation, are strongly encouraged to read my article “Puncturing Deflation Myths, Part I”, for a jargon free look at what really happened, and the elementary apples and oranges confusion that has misled too many commentators.)

Real World Theory & Jargon Price 3: Missed Solutions

The third real world price for theory and jargon is the worst of the bunch. There are a whole set of innovative, practical solutions which are out there, but people can’t act on them, because they can’t see the real problem. If you can’t see what’s going because you’re blind and confused, then you have no chance of protecting yourself, and that’s a tragedy!

A tragedy that does not have to happen to you.

As an example, John Paulson saw the crisis that was coming in subprime mortgages, researched and educated himself on this area (which had not been his field of expertise), and he turned the crisis into a $3-$4 billion personal payday in 2007. If he had taken the orientation of Econ 101 and looked to the effects on the money supply – he wouldn’t have made a dime.

Instead, Mr. Paulson started from the perspective of a highly skilled financial practitioner. Even with a background as a hedge fund manager – he didn’t start with the answers on how to turn mortgage market disaster into personal wealth. But using the skill set and orientation of sophisticated, applied wealth management, he searched for uncommon ways to flip disaster into opportunity until he found a series of solutions that worked. Methods that weren’t in the introductory economics textbooks.

When you improve your vision, and learn to see clearly - you will also find that you have more tools than you may think, some of which may surprise you. Tools which can give you the opportunity to turn financial disaster into personal net worth. There are ways you can use those tools to turn the destruction of the currency into perhaps the greatest real wealth-building opportunity of your life, on a long-term and tax-advantaged basis. Even if asset prices continue to fall in real terms.

But, if you want this to happen --you will need to start with learning. You are going to have to educate yourself, and work to not just understand, but to master some of the financial forces and methods in play here. You will have to learn how to turn the destruction of paper wealth into real wealth. With Turning Inflation Into Wealth being the first key step. My best wishes to you for turning this challenge into an extraordinary personal opportunity.