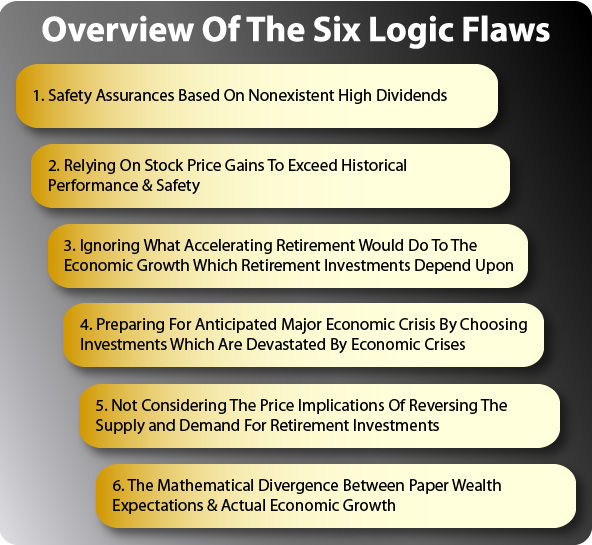

Six Fundamental Logic Flaws In The Heart Of Conventional Financial Planning

Across the nation and around the world, people are finding that their retirement portfolios have been woefully underperforming. Despite decades of deferring gratification, saving money, and following the best advice that conventional financial planning has had to offer - the results aren't what people were told they could anticipate. Tens of millions of current and future retirees do not have the assets to pay for the comfortable retirement lifestyle they were promised, and they are understandably fearful they may never have those retirement assets.

Moreover, many state and local governments face major financial issues because their pension funds followed similar investment theories, leading the governments to make binding promises to current and future retirees based upon what they believed to be almost guaranteed long-term investment returns - but which have failed to materialize in practice.

Financial author and Chartered Financial Analyst Daniel Amerman used to structure some of the most complex securities in the world as an institutional investment banker in the 1980s. In the early 1990s he began applying those same skills to take a fresh mathematical look at the almost universally accepted principles and assumptions upon which conventional financial planning is based.

What Amerman's research uncovered, which was published in his first book in 1993, were the first two in a series of dangerous logic flaws in the financial models driving conventional retirement investment strategies. These fundamental flaws, described 20 years ago and individually explained in the following sections, meant that millions of investors were taking much larger risks with their retirement investments than they believed, and that long-term returns were likely to be substantially lower than what was commonly assumed in the financial planning projections.

If the principles underlying conventional financial planning were fatally flawed - what did await retirement investors? Daniel Amerman spent a number of years seeking answers to this essential question, trying to logically anticipate the forces that would be at play in the future, and what would happen in the cash-out phase for tens of millions of Boomers in the 2010s, 2020s and beyond. What he discovered were four more fundamental flaws at the very core of conventional financial planning and pension investing. These additional flaws were explained in detail in his 2006 book on retirement finance, "Contracts With Our Children", and summaries are provided in the sections that follow.

Between the contents of his 1993 and 2006 books, Amerman put together a radically different but logically consistent view of retirement investing - which also anticipated the world of the 2010s for retirement investors with unparalleled accuracy. Understand all six fatal flaws as described below in their original language - and many of the negative "surprises" which have been repeatedly assailing retirement investors in the last decade, turn out not be surprises at all.

While history matters, what is much more important is the future. Generally speaking (and there are many individual exceptions), the voice of Financial Authority that has dominated retirement investing over the last several decades has proven to be dead wrong. There has been a failure to deliver results, and tens of millions of innocent individual investors are paying the price. Yet, the same established voices of Authority still largely dominate the flow of information to retirement investors. Will they be right this time, or wrong again? And if they are wrong (again), where are the real alternatives?

In the sections that follow, you will find extensive discussions of retirement investing that were radically different from the voice of Financial Authority at the time they were first published, and remain quite different today. As you read them, think back to what you were being told ten years ago and twenty years ago. Ask yourself: which perspective turned out to be wrong, and which was repeatedly proven right on multiple levels? Your answer to that question just may affect how you make the difficult choices today that will help determine your standard of living over the next twenty years and beyond.

(Please note that the intent herein is not to place blame on financial planners as individuals. Rather, the culprit is the flawed theories that have driven much of financial planning for many years, and have wreaked havoc on too many innocent people as a result. There is and always has been a diversity of viewpoints in the financial community, not all follow the conventional wisdom, and many of those who do are highly intelligent people who sincerely believe in what they are teaching and practicing.)

Logic Flaw #1: Safety Assurances Based On Nonexistent High Dividends

What happened to our security blanket? The collective best financial minds in the country assured us that while there would be short term fluctuations, if we did what was recommended and we followed a disciplined strategy over the long-term, then everything would end up working out with our retirement investments. Except that it didn't work out that way. Why not?

After all, the essence of financial education for most non-professionals has been to understand and accept that rigorous academic studies have been done, and that over the long term, investing in a well-balanced portfolio of stocks is not only a lucratively profitable strategy, but history has proven it to be a safe strategy. There was near universal agreement among academics, the media, and financial professionals when it came to this "Truth" that we could all count on the safe delivery of strongly positive compounded stock returns over the long-term. Even today, most people are still being told to make their retirement investments based upon the expected return of the historically-proven "Truth".

On the other hand, if you had read Daniel Amerman's work of 20 years ago, you would have known then that the supposedly rock-solid math proving the "Truth" was (and is) dead wrong, and indeed, as he characterized it, "patently absurd". Amerman wrote a book titled "Mortgage Securities" that was published in 1993, in which he took a fresh look at stock performance during the 20th century up to that point. He came to the following conclusion:

"Looking at the impressive 406 to 1 total return that could have been achieved by purchasing a market portfolio in 1925 and selling it in 1988, we find that 95% of this ending wealth is based upon dividends and reinvested dividends. We also find that between 1930 and 1950, stock dividend yields averaged approximately twice the rate paid by Treasury bonds, that long-term bond yields did not exceed average dividend yields until 1959, and that the two yield types remained reasonably close throughout the 1960s.

Given the paramount importance of reinvested dividends and interest payments in determining ending wealth, and given that modern dividend levels are consistently between one third and one half of long-term bond interest levels, it is patently absurd to use reinvested dividend models that incorporate data from prior to the 1970s in order to judge the likely future performance of stock portfolios"

In other words, what truly drove stock returns over the long term was people's fear of stocks as being risky investments. This fear led to low prices, which in turn meant dividend payments were relatively high compared to prices. When these high cash dividend payments were reinvested and exponentially compounded for enough years inside academic models of hypothetical investor behavior, the dividends quite reliably created substantial wealth on a consistent basis.

However, once academics, professionals and the media mutually agreed that stocks were nearly guaranteed to be both high-yielding and safe investments over the long term, then fear was replaced by (excessive) confidence, and stock prices climbed while dividend ratios fell. This meant the crucial core source of the overwhelming majority of the wealth in the academic models - the compounding of cash dividends - was drastically weakened. Ironically, the very act of enough people believing in the superiority of stock investments destroyed the underlying source of reliable long-term stock returns and safety. Thus both conventional retirement planning and pension investments have been based on this fatally flawed assumption the entire time.

The security blanket that everyone was (and still are) told they could rely upon has in fact been gone for decades, and unfortunately, this logic flaw invalidated one of the most crucial assumptions upon which much of conventional financial planning was and is based. What carried market returns through the 1990s and most of the 2000s was not the historical compounding of dividends, but increases in share prices, which then dropped dividend levels as a percentage of stock prices to historic lows, putting further holes in the security blanket.

While Amerman's 1993 book was advertised as an "Institutional Bestseller" by its publisher for a year afterwards, and led to a couple of years of speaking to audiences of (institutional) financial professionals on a nationwide basis, it was not widely read in the individual investor world. This is unfortunate, because the book was written in an attempt to alert the general public (and their advisers) that the "Truth" was far from true, and thereby potentially help many millions of people avoid decades of investment mistakes that would ultimately leave them without the retirement income or safety net they thought would be awaiting them.

Logic Flaw #2: Relying On Stock Price Gains To Exceed Historical Performance & Safety

Simply put, there are two ways of making money with a share of stock: getting paid cash dividends and/or selling the stock for more cash than one paid for it, i.e. share price growth. It may be helpful to consider this in metaphorical terms, with the value of the retirement portfolio being a boat depending for power upon the twin outboard engines of dividends and stock price gains (or more generically, current income and capital gains).

As revealed in Amerman's 1993 work, for their retirement safety and income - and without realizing it - the tens of millions of investors who were following the recommendations of conventional financial planning were relying upon historical data in which 95% of the yield and safety came from high dividend yields - that no longer existed.

(The fewer high dividend stocks in recent history are far weaker than the common high dividend & high quality stocks of many years ago, and therefore not comparable. Also, dividends were by no means 20 times greater than capital gains on an annual basis, but the long-term exponential compounding of assumed reinvested dividends plus capital gains led to a result 20 times greater than capital gains alone.)

In other words, the main engine that the overwhelming majority of long term stock returns relied upon, that of compounded high dividends, was starved for fuel, and could only put out power at a fraction of its previous level. So, if the retirement portfolio "boat" were to reach its destination of being able to provide a comfortable retirement income for decades, then the other engine, that of stock price capital gains, had to make up the difference.

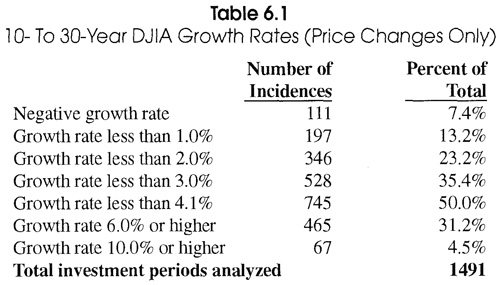

There are major problems with shifting engines. The long-term capital gains engine by itself historically only put out a fraction of the power necessary to meet financial planning expectations. And the ability of the price gain engine to deliver at all was unreliable, even over the long term. Part of Amerman's research analyzed returns from price changes only, for all 1,491 possible long-term holding periods between the years 1900 and 1990 (with holding periods being defined as 10 to 30 years, in one year increments, beginning each January). The table and text excerpt below are from the results as presented in the 1993 book:

"About one-eighth of the time investors received less than a 1% long-term annual return from price gains on their investments, and they realized less than a 2% growth rate almost one-fourth of the time. Investors received less than a 4.1% long-term annual return from price gains half the time, and a greater than 4.1% return the other half of the time. The chances of sustaining a 6% or greater annual growth rate over the long-term were less than 1 out of 3. Historically investors were 64% more likely (7.4% versus 4.5%) to achieve a long-term negative rate of return based on price changes than they were to realize a 10% or greater growth rate."

For the Boomers to reach the performance levels that their retirement investment strategies were based upon, and which they mistakenly believed were more or less historically assured, then the second engine of stock price gains would have to perform with much more power and far less volatility than could be justified by its actual historical performance. This was upside down from what was being told to investors, which was that history proved both yield and safety. For without the help of high dividend levels, the data from 1900 to 1990 was quite clear in showing that stock price gains did not by themselves provide sufficient growth or stability.

This misguided reliance by many millions of investors - as well as by pension funds and their sponsors - upon stock price gains to deliver performance well in excess of actual history is the second fatal logic flaw at the very heart of conventional financial planning, and again it has been there for a long time.

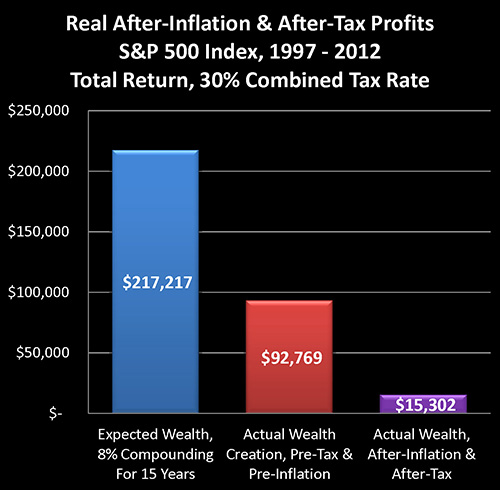

As explained here, and illustrated above, when we look at the fifteen crucial years from the end of 1997 to the end of 2012, tens of millions of retirement investors thought they were more or less assured of getting the blue bar on the left. What they got in practice - including the compounding of dividends at modern low levels - was the purple bar on the right.

Unfortunately, the math of wealth creation in practice worked as anticipated in 1993 - the dividends weren't large enough to reliably create the wealth as they had been through much of the 20th century. Without the protection of compounded dividends, stock price gains by themselves were neither reliable nor large enough to deliver the anticipated wealth creation on their own. And while there has been a surge in paper wealth in the stock market in 2013 and 2014, this has only recovered a minority of the longer term damage.

Logic Flaw #3: Ignoring What Accelerating Retirement Would Do To The Economic Growth Which Retirement Investments Depend Upon

For that second engine of stock price gains to have a chance to exceed its historical performance levels, it needed fuel. Lots and lots of fuel in terms of a never ending high rate of economic growth, and the corresponding growth in corporate profits. However, between "Mortgage Securities" (1993) and "Contracts With Our Children" (2006), Amerman worked out the logical links that anticipated the fuel shortages that would devastate retirement portfolios for potentially decades to come (and we are likely just getting started), with a timing that would look precisely like Murphy's Law in action. The excerpt below is from a chapter in "Contracts With Our Children", that is entirely devoted to explaining how the fuel which drives stock price growth would be predictably cut off for retirement investors, just when they need it the most.

"Only 50 million Baby Boomers have retirement savings, but all 77 million of us are consumers, and the engine that drives many investment valuations is expectations of unending, exponentially compounded growth in consumer spending. Which raises another simple question: what does happen to growth when the biggest generation of spendthrifts in world history goes on a fixed and much lower retirement budget? Particularly when there are problems with Social Security and the pension system funding even that fixed budget?"

"There is a big engine driving the economy and markets and it is called Consumption. A little more than seventy percent of the United States economy is consumer spending, a percentage that has been rising in recent years. Leaving out the international component for now, when we buy shares in corporations in general, about seventy percent of our investment is really investing in consumption by our fellow Americans.

However, the profits to corporations from providing those goods and services for consumption are not sufficient to warrant anything even close to current stock price levels. Average dividend levels on stocks are a little under 2% per year, meaning you get about a 2% cash return per year on your investment.

Nobody buys stocks with the idea of making 2% a year on their investment. The reason people buy stocks is for the growth. They want to see those dividends and company earnings rising every year. So that the value of their stock will rise every year. Just growth is not enough however. The reason people are willing to accept a current 2% yield is that they have already priced many years of future growth into the stocks, so the profits from expected growth have already been included in the price.

Indeed, most of the value of the entire stock market is in growth in consumer spending that has not yet even occurred, but is just being assumed for the future."

"...it is fair to say that something in the range of 50-80% of current stock market valuation is expectations about growth in corporate sales and profits in the future. For the stock market to leap ahead substantially in valuation and achieve greater returns than expected, then those growth expectations will have to be exceeded, all else being equal. If on the other hand those expectations for future growth are not met, then a great deal of the “wealth” that is currently in the markets just might vanish. As if it never was."

"There is no room in our collective expectations for our investment performance, for us to collectively retire. Even a moderate reduction in the growth rate in our spending slashes the value of our collective investment portfolios. If we actually cut our spending as our incomes reduce in retirement to the point where the positive growth rate is lost, at least for a year -- then the value of our retirement portfolios will be devastated."

"That is the central fallacy that underlies much of the financial planning that gets done in this country. The idea that you can in isolation take a label, take a number, and then extrapolate it forward to find what your future earnings are going to be. As in buy a portfolio of stocks, take their historical returns, and see how you will likely do in the future.

Except that everything is linked."

In other words, the very act of enough Boomers reaching retirement age would predictably slow down the overall economic growth rate and cut off the fuel to the second engine of stock price gains. And at the very time when retirement investors most needed continuing price gains, they would all start to see the fuel supply to their main remaining engine falling fast. Leaving the retirement portfolio "boat" limping into retirement (or no retirement) on two weak, sputtering engines, instead of a twin engine speed boat powering at full throttle into nearly assured prosperity, as shown in all those millions upon millions of financial plans drawn up for all those clients over the decades.

As with the first two logic flaws, this deadly third flaw of an aging population cutting off the fuel supply for their own investment portfolios has been plainly in sight for a long time, as has the cruel logic of when it would likely begin to hit hard. Plainly in sight that is, when one steps out of the conventional wisdom box, and takes a fresh and quite unconventional look.

Logic Flaw #4: Preparing For A Widely Anticipated Major Economic Crisis By Choosing Investments Which Would Be Devastated By Economic Crisis

Powerfully negative forces are at work in the markets today. The national debt is over $17 trillion, and the entitlement promises that are rapidly coming due mean that the problem is only likely to grow worse. The economic growth that used to drive the markets just hasn't been there. State and local government pension funds around the nation are in dire trouble and may devastate the economy, either through bankrupting the states with the resulting mass layoffs, or through being bailed out by the Federal government, which would force the national debt to even more catastrophic levels.

Unfortunately, these negative forces are slamming into the economy at the worst possible time for Boomer retirement investors, with negative results for those already in retirement or hoping to retire.

Now, is this just Murphy's Law in action, an impossible-to-anticipate burst of improbable bad luck hitting at just the wrong time for tens of millions of people?

Or is there a logical relationship that has been plainly visible for many years now when one steps outside of the conventional paradigm? A relationship that would lead one not only to anticipate that these exact kinds of events were on the way, but that they would take place precisely at the time when they would hurt retirement investors the most? Consider the excerpts below from "Contracts With Our Children" by Daniel Amerman, published in 2006:

"Lumping the primary focus of this book, investments, in with things like social security, the national debt and other people’s pensions may also seem an unusual choice. For the whole point in buying investments is financial independence. So we are not dependent on other people. We own something of value that we worked hard to acquire, precisely so we can be well paid for it when we are ready to sell.

From “our” perspective these rights and expectations seem more than reasonable. The little technical problem is, however, that we won’t be the ones paying for them. The people paying for the Contracts will be the generations after the Baby Boom, including Carl the cashier and his peers. If we want to find out how much Carl is going to pay us for our investments and the other Contracts, we should probably take a very close look at things from his perspective, and not ours."

"There won’t be one future for the stock market that is insulated from another future for the economy. Or one future for the financial markets, and another future for manufacturers and retailers. Or one future for taxpayers and a different future for Social Security and Medicare. The buyers of our investments will be living in one world, as will we."

"The Baby Boom have laid heavy burdens on the following generations in the form of Social Security, Medicare and pensions. Burdens that are so heavy that we are concerned about whether there is any way that they can be met. So, tens of millions of us are attempting to protect ourselves. By purchasing investments, that we expect the next generation to buy from us at extremely high prices, with the tens of trillions of dollars they have left over after they haven’t been able to pay for Social Security and Medicare."

Arguing that stocks as a long term retirement investment had to be evaluated within the framework of the very negative impacts of upcoming crises in "social security, national debt and other people's pensions" was indeed highly unusual in 2006 - even as these exact issues dominate the investment headlines and failed retirement strategies in the 2010s.

It's also sadly ironic that many millions of Boomers, particularly younger Boomers, have been encouraged to follow the exact path above, which was to avoid the clearly oncoming economic problems by purchasing stocks, without considering what those economic problems would do to the prices of those very stocks.

This fourth fatal logic flaw at the heart of conventional financial planning is a doozy. And as Amerman explained in detail and in advance, it is a thoroughly predictable doozy that had little to do with Murphy's Law.

To return to the retirement investment-as-boating metaphor, the absolute key (mistaken) assumption was wide open waters up to and through retirement, which would allow both of our engines with their abundant and never ending fuel supply to be running full blast and straight ahead through our golden years. Because there were no rocks in our path, we knew that if we followed the best advice, then we would indeed all be rewarded with an income that would carry us through many years of comfortable retirement.

However, anybody who was reasonably well read in economics and finance saw the oncoming problems. Indeed, that was more or less the entire point for many investors - to invest privately in order to avoid the massive rocks on the horizon that the federal budget and the public retirement entitlement system were expected to founder upon. So the rocks and reefs have not only already been marked on the charts, but there have been big flashing lights warning us all of the severe economic perils.

Given the looming rocks ahead with their flashing lights, there was only one way to make sense of the conventional financial planning investment approach. While it was of course never quite phrased this way - and it never likely occurred to the professionals and academics that this was what they were doing - the essence of it was that the future had to be split into two different economies, or even two alternate universes. In one future economy, there were likely really bad things going on: Social Security and Medicare were in the process of bankrupting the federal government, even with entitlements being slashed, and this could lead to a catastrophic decline in the economy.

Now, by definition, this couldn't be the same future economy that financial professionals were urging millions of clients to prepare for by making stock investments. Let's go back and look at a key excerpt from 2006 that was included in the previous section:

"If on the other hand those expectations for future growth are not met, then a great deal of the “wealth” that is currently in the markets just might vanish. As if it never was."

This relationship is one of the fundamentals of stock valuation. If the value of a stock market is based primarily on future growth expectations (which is still the case), and the market later accepts that growth won't happen, then the market doesn't slow down or go flat - instead the market shatters. Most of the paper value of the stock market should, per the fundamental basics of financial theory, necessarily implode almost instantaneously - and not bounce back until the economic situation fundamentally changes, which could take decades.

So, even if it was never phrased that way - the 4th fatal flaw at the very heart of conventional financial planning has been and continues to be this absolute need for a separate economy / universe for retirement investors.

A place where the economy and corporate earnings were completely unaffected by changes in spending by an aging generation of spendthrifts running out of money and borrowing capacity - and eventually health and working capacity.

A place where fantastic government deficits - and the government taking an ever increasing share of the economy - never slowed down private sector growth rates.

A place of sunshine and light, to which prepared investors could turn and reliably pull a comfortable standard of living from, even while their less fortunate and less prepared peers endured a dark and bleak world with rapidly falling standards of living amid the wreckage of failing government programs, rising tax rates, and an economy that was plunging downwards.

In contrast, consider Daniel Amerman's warning words from his 2006 book, "Contracts With Our Children":

"We have choices, and our financial futures may come down to a choice of what faith we choose to rely upon. Faith may seem an odd choice of words for a secular work of financial futurism, and it is not intended in any religious sense. However, if we define faith as a strong belief that can’t be proven -- then is not the essence of long term investing all about faith?"

"One choice is a blind faith that certain carefully selected mathematical relationships will endlessly replicate themselves into the future. We can believe that history properly interpreted guarantees exponentially compounded wealth to all of us. We can have faith that such details as the number of us planning on splitting this wealth or the size of the national economy are irrelevant. That the automobiles, condominiums and steak dinners we want and need will spontaneously arise out of the earth by the millions if need be, because the ironclad laws of financial history will require them to do so.

We can believe that the investment world exists in a state of splendid isolation from the rest of the world. We can have faith that no matter how onerous the future Social Security and Medicare tax burden, the cash coming into the markets will only increase, because an isolated extrapolation of the past requires it to do so. We can believe that tens of millions of real people systematically cashing out of the markets will not even slow down the endless exponential compounding of investment prices. We can have faith that such things as the plummeting ratio of investment buyers to investment sellers will not affect investment prices, for such variables are not included in the sacred equations.

Most importantly, we can believe that our collective children and grandchildren will exist solely to serve us. We can have faith that they will have limitless capacity, and after funding our first three Contracts of paying Social Security, Medicare and the Trust Fund, they will be capable of and eager to buy all of our investments at the prices we want. We can believe that they will lie awake nights trying to figure out how they can possibly create more real wealth to pass straight on to the old people, so that they can better meet our expectations. We can trust that there will be no shirking or evasions, no attempts to keep too much of the wealth they are creating for themselves, and that their own self-interests and those of their families will always be subordinated to the greater goal of supporting the white hairs in style.

This blind faith is the currently most popular retirement investing choice, even if it is not generally described in those precise terms.

Or, we can choose a different faith, in something perhaps more powerful than exponential mathematics. We can choose to believe an intertwined world of cause and effect where wealth is produced anew each year by rational people collectively acting in their individual self-interests."

Logic Flaw #5: Not Considering The Price Implications Of Reversing The Supply and Demand For Retirement Investments

The modern financial theories that drive the conventional approach to retirement investing are in some ways a rather odd child of Mother Economics. One of the foundation principles of economics is supply and demand. There is perhaps no arena where supply and demand is more important - and can be more easily watched on a daily basis - than the investment markets. Every day the markets are dominated by the shifting forces of buyers versus sellers, with rising prices on days that those wanting to buy exceed those wanting to sell, and falling prices when those wanting to sell exceed those wanting to buy.

Yet, for the overwhelming majority of the population, when it comes to the single most important component of financial theory - the governing assumption is that supply and demand don't exist. Conventional retirement planning does not allow for this foundation principle of economics to impact the prices which tens of millions of investors pay for their investments - or more significantly, the prices that tens of millions of investors will receive when selling their investment portfolios. Because if supply and demand are allowed to influence retirement investments, then conventional financial planning falls apart in a world that is dominated by the "bulge in the python" of Boomer investors, because everyone buys too high, and sells too low, slashing long-term returns.

Now, consider the series of excerpts below from Daniel Amerman's 2006 book, "Contracts With Our Children":

"Because the Baby Boom is so large with so many people investing for retirement, the very act of their attempting to cash out their portfolios will also necessarily transform the investment markets and the returns we all realize from our investments –whether we ourselves are Baby Boomers investing for retirement or not."

"Becoming the biggest generation of investors was more than just the total number of people however, it was the percentage of people who were buying investments. New tax-advantaged savings plans came out: IRAs, 401(k)s, and an alphabet soup of other plans. The goal of these plans was to take investing from just the wealthy and upper middle class, and spread the benefits to all of the middle class. Each plan used the tax code to encourage regular monthly and annual purchases of investments by tens of millions of people – but not their sale.

There was another twist to the tax laws and the way they changed investor behavior that was new for the markets as well. The profits, dividends and interest on investments could not be taken out before retirement age, but had to be reinvested in the markets as well. So that all profits were to go straight back into buying more investments, instead of consumption. After someone had been saving for a number of years, these reinvestment purchases would grow even larger than the annual contributions from their working incomes.

Even those employees who never saved a dime in such self-directed plans, still became investors on a massive scale as their private and governmental employers promised them pensions – and invested in the markets on their behalf. With the earnings on those investments that were associated with their pensions also then being entirely reinvested into the markets.

During this time, a revolution was reaching fruition in the field of finance, as academic studies over the previous couple of decades became widely known and accepted. Long term studies of the stock market were showing that there did appear to be free lunch after all. That is, if you bought a diversified portfolio of those notoriously risky assets, stocks, and held them long enough, then it looked like the risks disappeared. While the high returns remained, higher than pretty much any other kind of investment.

At the same time, another new investment theory was becoming well known. It was called the Efficient Market Hypothesis, and at its core, it said that small investors didn’t have to worry about individual stock prices. The existence of a group of super-rational professional investors was hypothesized, who in the interests of profit would collectively make sure that all securities were fairly priced at all times, based upon the information then available.

(Interestingly enough, however, there was and is little questioning how in a world of super-rational investors, stocks could consistently offer both higher returns and lower risks, as “free lunches” should be impossible in “Efficient Markets” – but the 1-2 combination was good for selling investments while reassuring investors, and why worry about technicalities?)

What a combination, and from professors at some of the most respectable universities in the country, no less! So, with the double barrel protection of investment history and investment theory, dartboard investing was born. This promise from the most respectable sources of high returns and low risks if you just buy, diversify and hold was the magic formula to convince the Baby Boomers to become the biggest stock investors of all time."

"The biggest generation. The highest participation rate in buying investments, both directly and through pensions. Tax laws that encouraged tens of millions to pour their money in the markets every year and to then keep reinvesting every dime of their earnings and profits in those markets for decades – with corresponding strong penalties on taking any cash out prematurely. The wealthiest generation in the history of a nation during the years that it was becoming the wealthiest and most powerful nation in all of world history. With academics, journalists and an entire investment industry coming together to preach the new gospel that long term investing in assets that had formerly been considered risky was now not only safe and lucrative, but that your financial future depended upon it.

Every factor came together to push cash, cash and more cash into the financial markets for year after year."

"This greatest of bull markets needs to be properly labeled: it is the Baby Boom Bull Market. After all, what determines the value of any investment that you own? The value is the price that someone else is willing to pay to buy it from you on that day. If there is more cash coming into the market than going out, if there are more buyers than sellers, if the demand for investments exceeds the supply, then the price of those investments goes up. On the other hand, if there are more sellers than there are buyers, if people want to pull cash outside of the markets, if the supply exceeds the demand -- then the price goes down.

Could it be as simple as that? Could it be that the laws of supply and demand apply to finance like they do the rest of economics? That the number one determinant of investment value is not its dividend ratio, or earnings growth, or sales per share, but what the supply of buyers is compared to the number of sellers? How much cash is coming in versus going out? This is nothing more than common sense, and is the underlying core to pretty much all investment theories, even if it is usually unspoken. Where things get interesting, and so many financial careers are made, are then theorizing or predicting whether there will be more buyers or sellers, and the reasons why. A multitude of theories, which include dividend ratio, earnings growth and sales per share, with the popularity of the particular theories regularly changing along with the markets.

When we put all of these factors together and look back at the past, the results have been awesome. However, when we look to the future, we have to consider a simple but disturbing question: what happens when everyone sells? Not only sells, but takes their money out instead of reinvesting?

What happens to prices and returns when tens of millions of Baby Boomers and their pension funds are simultaneously selling their investments? That is after all, the whole idea of investing for retirement. Eventually selling your investments, cashing out, and enjoying the proceeds.

What happens when this massive sales pressure takes place not for a month, but a year? Then five years, and ten years. With no end in sight for decades? With up to 50 million Boomers attempting to cash out trillions of dollars of investments each year?"

"What happens when the tax laws reverse what they encourage now, and force sales instead of buying? When Boomers in their 70s and 80s have to be spending down their portfolios instead of adding to them?

What happens to prices as the cash coming in slows down, and the profits are taken out instead of being reinvested? When instead of cash, cash and more cash pouring into the markets – it is cash, cash and more cash being pulled out of the markets?"

As an investor, what is described above is the worst possible approach to long-term investing. The disproportionately large generation that buys, buys, buys together - pays too much. The disproportionately large generation that sells, sells, sells together - gets paid too little. The net result is tens of millions of retirement investors who collectively "buy high" and "sell low", turning the usual goal for investing upside down.

Unfortunately, as explained well in advance by Amerman in his 2006 book, the problem is that this pricing issue compounds the fundamental performance issues explained in Logical Flaws #3 & #4. The negative fundamental effects of slowing growth that are hitting - even as the ratio of sellers to buyers is rising - multiplies the damage. The negative "sovereign debt" issues associated with the effects of rising entitlement spending on private sector growth are multiplied by the fundamental change of an increasing supply of sellers relative to a decreasing demand by buyers. Everything interrelates.

Logic Flaw #6: The Mathematical Divergence Between Paper Wealth Expectations & Actual Economic Growth

There is another theme that has emerged in the 2010s and began bubbling up into public policy discussions of what had gone wrong and why things weren't getting better. Politicians and pundits are finally beginning to wake up to the fact that what matters when it comes to paying for retirement promises isn't politically convenient long-term projections of trust funds, taxes and compounded paper wealth. Instead, they are belatedly realizing that what governs everything else is the real economy, and the real jobs that create real taxes and generate the real resources that can be redistributed to retirees, whether through Social Security, pensions, or the cashing out of private portfolios.

What is finally being discussed are the results of the divergence between projections of bountiful paper wealth for investors and society, and the much smaller rate of real economic growth. For almost 20 years, one of Daniel Amerman's core themes has been that this divergence between paper wealth and real wealth would necessarily be forced into convergence when too many retirement promises begin to come due, particularly in a real economy that was being dragged down by the governmental and market dysfunctions associated with that mandatory convergence. As part of his 1993 book, "Mortgage Securities", Amerman wrote in bold, large type:

"Stock performance comes from the economy, not numerology."

This may sound like common sense when presented in this manner, but what most people don't understand is that the heart of conventional financial planning - and much of modern portfolio theory (aka, the "Truth") - is based on the effective numerology of using wealth compounding rates that are higher than economic growth rates. When a convergence between paper wealth and real wealth is forced, then the retirement portfolios are predictably devastated, the state and local government pension funds predictably face possible bankruptcy, and this has always been coming like a freight train. The only question being when it arrives.

After years of working on more effective ways to explain to the general public why the near universally accepted wisdom was logically absurd at its foundation, Daniel Amerman wrote the summary excerpted below in his 2007 article "Apple Pie, Economic Growth and Fatal Stock Market Flaws" (which is also core to the 2006 book):

"If the economy is made up of the corporations, governments and individuals, and the corporations, governments and individuals are all attempting to compound their wealth because they all can’t afford to pay for the Baby Boom retirement promises and expectations, then who, precisely is it that cashes them out? If all the components of the economy can’t afford to pay for something from current revenues, then how do they all get bailed out? Who is the Santa Claus who steps in and bridges our example 18 to 1 gap between wealth growth expectations and the growth in real wealth?

Who bails out the economy itself? Is it the new generation of investors who will be coming into the markets? That smaller generation of investors behind the Boomers? With the money they have left over after being unable to pay for Social Security and Medicare? Those are questions of capacity, but perhaps the biggest question is one of motivation. Even if they could, would the Boomer’s collective children and grandchildren really work night and day for the privilege of voluntarily buying out the Boomer’s portfolios at the highest prices in history? Or might they do something else, like trying to hold on to as much of the goods and services they are creating as they possibly can for their own benefit?

We could say that the “who” will be the corporations that will appear and thrive between now and when the bill comes due. All the new Googles and so forth. Except, there aren’t really that many Googles, and the one we have is miniscule compared to the size of the problem. The idea behind founding new companies is generally to try keep as much of the money as you possibly can for yourself, instead of passing it along to the passive investors in legacy companies. Can we really count on an entirely new economy appearing, with a growth rate far in excess of historical standards, that will be happy to step forward and bail out the old economy?

Some others might say that the “who” will be the other nations of the world. Their economies will bail us out! Except, well, maybe as a starting point, we should be buying their economies right now, instead of selling them ours, as we are doing with our massive trade and budget deficits. There is also the issue that other nations have their own demographic issues, much of Europe has problems that are worse than those of the US. Which doesn’t likely leave much left over to bail out the US. As for the booming economies of Asia – sure it is convenient now for them to support the US economy while they grow their own productive base, but do we really expect them to continue to subsidize our standards of living at the expense of their own for decades to come?"