Reading Four:

A Right Jab & A Left Hook

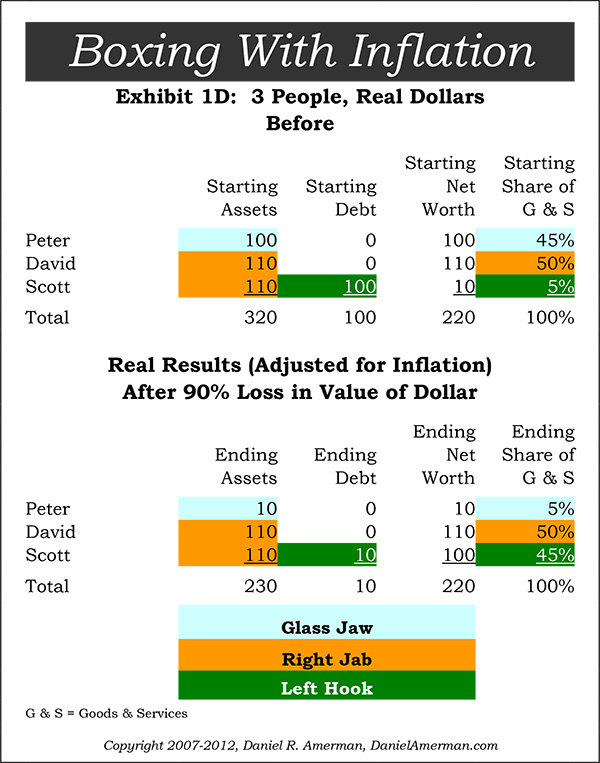

Tonight’s feature is a three part boxing exhibition, where Inflation will take on three investors in a row. His first opponent will be the honorable and fair-haired Peter followed a dollar-denominated investment strategy. Inflation’s second opponent will be a newcomer, David, aka “the Rock”, an all-tangible asset investor known for his steady strength. The final match of the night will feature a title bout between Inflation and his tricky nemesis, Scott, aka “the Pickpocket”.

The boxing matches are identical to our last reading, except for the addition of David. Peter takes his $100, and invests it all in a loan to Scott. David believes in “neither a borrower nor a lender be”, so he invests his entire $110 in a tangible asset. Scott is our initial lightweight with beginning savings of only $10, which he uses in combination with Peter’s loan to purchase a $110 tangible asset.

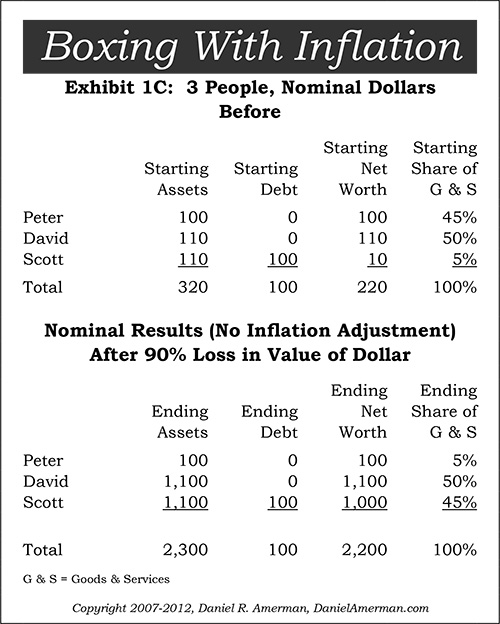

The results of the three fights are presented below in nominal dollars.

Careful review of the chart above on a line by line basis with real dollar vision should telegraph all the punch lines in today’s readings, but just in case a nuance or two has been missed, we will go through a fight by fight description.

The Glass Jaw

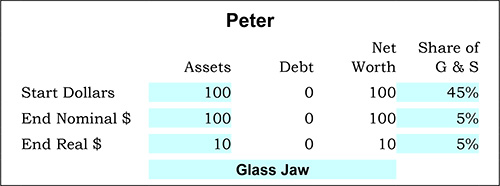

Peter invested without regard to inflation. Using our boxing simile, this is like standing in the ring with your eyes shut, leaning forward a bit, with jaw extended and hands down by your side. Because you don’t realize that you have an opponent. One punch from Inflation was all that it took, and Peter was down for the count. The worst of the damage was done before Peter even realized he was in fight.

Peter could have tried to get back up and preserve more of what was left of his assets – but even flat on his back, he didn’t understand he was in a boxing match. He thought he was a victim of the economy. He was encouraged in this belief because there were so many tens of millions of people like Peter, that inflation had knocked flat on their backs. So, he just stayed on his back until his $100 is only worth $10, and 90% of his real wealth is gone. He only has 10% of the purchasing power he was planning on from his investments during retirement, and his purchasing power, his relative ability to outbid David and Scott for goods and services, has fallen from 45% of real wealth down to only 5%.

Peter is most people, and an inflation “Glass Jaw” is how most people (and most pension plans) are investing for the long-term and retirement. This is usually true even when inflation is included in the assumptions. A financial strategy based on a 3% inflation assumption is an assertion that we already know the results of the match: inflation will remains weak and under control for the rest of our lives. It says that we know the future, and that none of the powerful threats to dollar that we see today or looming with the retirement of the Baby Boom – ever materialize. And we are so sure of this – we are betting everything we have on it – without even thinking about the alternatives all that much.

Right Jab

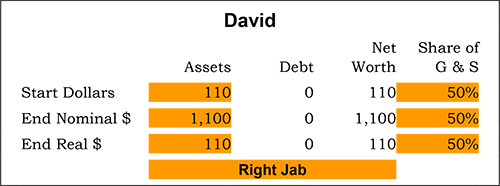

Inflation came after David, but could never land a solid punch or take him down. That is because “the Rock” had a steady right jab going, which kept Inflation from getting close enough to inflict real damage. The right jab consisted of a 100% tangible asset portfolio, whose value was not related to the dollar. Inflation’s power was based on changes in the value of the dollar, and separating his portfolio from the dollar was the key to David’s defense of the purchasing power of his assets.

“Defense” is the key word here, because that is all David was able to do. That may seem an odd statement to many people, when we look at the nominal dollar section of the chart below. David started with an asset worth $110, and by the time the boxing match was over – his asset was worth $1,100. That sure looks like a $990 profit, which would represent a delectable 900% return on investment. (Unfortunately, that is the way the government views it for tax purposes, which will become a key component of later readings.)

However, when we adjust for the purchasing power of what $1,100 will buy, as shown with the real dollar numbers – our profit disappears. David can only cash out for the same $110 in goods and services that he had when he started. Which makes sense – the whole idea of the tangible asset was to preserve wealth independent of the value of the dollar, and the investment performed exactly as planned. David started with rights to 50% of the goods and services relative to Peter and Scott, and David ended with 50% of the rights. He maintained.

David’s powerful right jab did it’s job in keeping inflation at bay, it left him in much better shape than Peter -- but it didn’t make him any money in real terms either. Particularly when the Inflation Tax is taken into account.

Left Hook

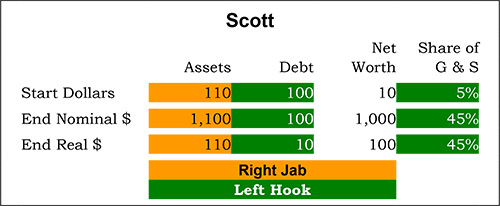

Inflation came straight after Scott as well, but couldn’t close – because Scott had a powerful right jab going. His right jab was in fact identical to the right jab of David’s, with the same $110 tangible asset that was worth $1,100 in nominal terms when Inflation had done its worst.

Scott had more going for him than just a right jab, however, for Scott also had a left hook. Every time Inflation tried to close – Scott let him have it with a left hook that momentarily knocked Inflation to the floor. Being an economic force rather than an actual person, Inflation would of course bounce right back up, but these repeated knockdowns showed the essential difference between Scott and David: Scott had a offense. Scott was not just trying to fight off inflation and preserve his assets – Scott was quite deliberately turning inflation into real wealth.

Scott’s net worth was equal to the difference between the value of his assets, and the value of his liabilities. The real value of his assets was staying even, thanks to his tangible asset right jab. The real value of Scott’s debt was plunging with inflation. The harder Inflation came at him – the faster the value of the debt dropped, and the faster that Scott’s real net worth was increasing.

By the time the bout was over, and a dollar was worth ten cents – Scott’s nominal net worth had soared from $10 to $1,000. Because he was using two punches instead of just one, even when we adjust for inflation, Scott’s real net worth had jumped from $10 to $100. Because Scott went on the offense and quite deliberately positioned himself to exploit the weakness in Inflation’s attack – Scott saw his ending rights to real goods and services climb from 5% of the total up to 45%. Meaning substantial inflation radically improved Scott’s financial place in life.

(As will be discussed in later readings, Scott’s left hook had another benefit going for him – unlike a right jab, which can carry tax disadvantages, a left hook can be used to Reverse the Inflation Tax and generate powerful tax advantages.)

The Control

In our previous reading, we talked about the need for a “control” that would help sort out the answer our dilemma: should Scott’s vaulting net worth be attributed to the readily obvious huge increase in the nominal dollar value of his asset, or was it the more obscure real dollar change in the value of his debt? The all-tangible asset investor David was of course our control, and a close examination of the color-coded real dollar chart below provides our answers.

The role of the tangible assets is, in fact, critical. It is the asset that preserves the wealth. However, when we look to real purchasing power of the assets – the nominal 900% profit truly is only an illusion. David, with tangible assets only, succeeded in maintaining the (pre-tax) purchasing power of his savings, no more and no less. With absolutely identical tangible asset results as Scott, David protected against inflation, but he did not turn it into real wealth, he started and ended with rights to 50% of the goods and services.

Scott preserved wealth through tangible assets and created wealth through understanding how inflation redistributes real wealth. “Redistribution” is the key word here, for we also need to look at Peter, and the underlying source of Scott’s “left hook”. Peter’s net worth decrease was the direct source of Scott’s net worth increase, and the neat symmetry of their real net worth reversal from 45% Peter / 5% Scott to 5% Peter / 45% Scott is no coincidence.

Dollar for dollar, every bit of real wealth that left Peter’s pocket as a lender, went straight into Scott’s pocket as a debtor – as classic economic theory indicates should happen. Peter’s “Glass Jaw” and Scott’s “Left Hook” are just two sides of the same equation, with that equation being the wealth redistribution equation. An unforgiving, unfair and impersonal equation that will destroy the life savings of tens of millions of good people if and when major inflation returns. An equation that you can flip to your advantage and use to turn inflation into wealth in a potentially low-cost and tax-advantaged manner.

If A Friend Sent You This Link

If you found this reading because of a friend’s recommendation, then you should know that it is part of a free book on Turning Inflation Into Wealth. Sign-up below if you would like your own copy of this valuable educational resource, delivered via e-mail.

If there is something in this reading that you think a friend or colleague would find helpful, you are encouraged to send them a link to this webpage.

Please DO NOT use the form above to sign up friends without their permission. The book is intended only for people who want it, and have given their permission by signing up for it.

All readings in the book are the exclusive property of Daniel R. Amerman, CFA. Subscribers are allowed to print a single copy for their own usage. Any other copying of materials from these readings and reposting or reprinting elsewhere is strictly prohibited and constitutes a violation of international copyright law. If you would like to share these educational materials with others - please use a link to this website.