Reading Seven:

Being Paid To Borrow Money

What About Those Payments?

Over the last four readings we have focused exclusively on changes in asset and borrowing values. Which has likely left quite a few readers saying: “But … what about the payments? After all, the monthly relationship we all have with our mortgages is the payments we make. How can we look at changes in asset value while ignoring the cash we pay out each month?”

In today’s reading we will find some surprising answers to questions about payments, and how they work with inflation over time. Once again, we will find that it all comes down to a matter of vision. When we look at the world only through nominal dollar eyes, where a dollar in 1972 has the same value as a dollar in 2002 – then we see fixed mortgage payments as slashing the value of our “left hook” strategy for Boxing with Inflation.

However, when we use the inflation vision we have been developing over the past readings, we see something quite different. We see that fixed mortgage payments don’t actually exist. Yes, the dollar amounts of the mortgage payments are fixed. However, the value of the dollars themselves change every year and every month. The value of paper currency has never been fixed during our lifetimes. Therefore, if we look at the cost of our “fixed” mortgage payments in purchasing power terms, relative to income, expenses and what a dollar will buy for us in any year, then we see that the real cost of our mortgage payments is constantly changing.

Today, we will return to history and find something remarkable: millions of people being effectively paid to borrow money on an after-inflation and after-tax basis, over the full 30-year terms of their borrowing. This may sound absurd, but as you will see in the pages to follow – that is exactly what happened. An excerpt from Chapter Three of “The Secret Power Within Your Mortgage” begins below.

Book Excerpt

In the previous chapter, we took a look at the major wealth benefits gained by many millions of American households as inflation was effectively destroying their debt balances, even while the value of their homes was keeping up with inflation. Those people who sold their homes after five years, ten years or more did very well with the amount of equity which they were able pull out of their homes. As we will discover in the pages ahead – those people who didn't sell their homes, did better still.

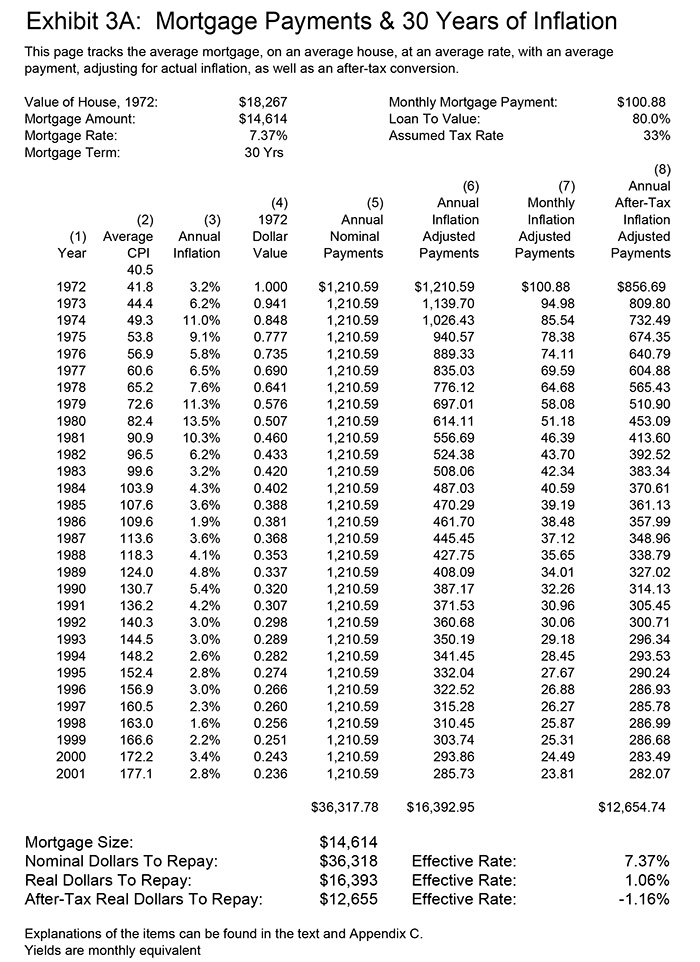

To explore the underlying economics of what happened during this time period of the 1970s and 80s and beyond, we will return to Jim, our “everyman” from 1972. Jim is our everyman of course, because Jim owns a precisely average house with a precisely average mortgage, and makes precisely average payments on that mortgage. At the top of Exhibit 3A (next page) we can see that the average payment for a homeowner who bought a house under average terms in 1972 was $101 per month. As we can see in column (5), mortgage payments in nominal (non inflation-adjusted) dollars worked out to $1,211 per year, for a total of $36,318 over the life of the mortgage.

The value of those dollars was however changing each and every year, and in columns (2), (3), and (4) we track actual historical inflation in three different ways. In column (2) we look at the average consumer price index for each year. In column (3) we see the annual percentage rate of inflation experienced in each of those years, ranging from a high of 13.5% in 1980, down to a low of 1.6% in 1998. In column (4) we look at the cumulative effects of how inflation eroded the value of the dollar, by comparing the dollar in each year to what it would buy in 1972 dollars. As we can see, a 1981 dollar would only buy 46 cents in 1972 terms, by 1991 that had fallen to 31 cents, and by the time the mortgage was paid off in 2001, it was down to 24 cents (3-1).

(Please note that while we are sticking to 1972 and “Jim” for consistency's sake, 1972 was not the most dramatic example of inflation and homeowner benefits. The peak year for using a mortgage to purchase a home, then benefiting from inflationary effects over a full 30-year period was likely 1965, before the even moderate inflation of the late 1960s kicked in. People who purchased homes in the mid 60s through mid 70s enjoyed the greatest inflation-driven benefits overall.)

Historical inflation figures can be pretty dry stuff, even for economists, but when we look at columns (6) and (7), we can see something that may really start to catch your interest. Column (7) shows how Jim’s real (inflation-adjusted) monthly mortgage payment dropped every year for 30 straight years. It started at $101, it was below $95 by the second year (in real terms), about $86 by the third year, below $75 by the fifth year, below $50 by the 10th year, and down to a mere $24 by Jim's final year in the mortgage. Because of inflation, every year that Jim was in his home, the mortgage payments just got easier and easier to make.

(Only principal and interest are included in the mortgage payment in the discussion in this book. Property taxes and insurance are on top of that, but are irrelevant to the discussion as they are owed so long as you own the property, and are not part of the mortgage decision.)

Column (6) has the annual total for our monthly payments, and when we add them up for all of the years, we find something dramatic. When we look to the bottom of the page, we can see that Jim borrowed $14,614. In exchange for being loaned that money, he promised to pay back $36,318 over 30 years, at an effective rate on the mortgage of 7.37%. However, when we look at what happened with the inflation that was historically experienced and the real dollars that Jim paid on his unusually average mortgage – he only paid $16,393. That means that Jim only paid $1,779 more than he borrowed over the 30 years, instead of the $21,704 he had contracted for. In real dollar terms then, Jim only paid 8% (1,779 / 21,704) of the interest that he had agreed to. Another way of phrasing this is that the effective rate on Jim’s mortgage was only 1.06% after accounting for inflation instead of the 7.37% he had signed up for!

What this illustrates is an interesting principle about mortgages. If over the time that the mortgage is outstanding, the inflation rate is equal to the mortgage rate, then in real dollar terms, you are effectively receiving an interest-free loan. Inflation is effectively subsidizing you in this case, making your interest payments for you (you are still repaying principal, of course).

If the inflation rate is higher than the mortgage rate, then you are paying back less dollars then you borrowed in real terms, giving you an effective negative interest rate, meaning you were being paid to borrow money. Historically, this worked out to be true for Jim (and many millions of real homeowners) during the height of the inflationary period from 1972 through 1982 when real inflation averaged 8.73%. Inflation later dropped, but over the entire 30 years it was still sufficiently high that Jim was only paying a real interest rate of 1.06% in inflation-adjusted terms.

Promising to pay 7% but effectively and legally only paying 1% is a sweet deal. However, what makes it even better is when you can deduct the full 7% from your taxes! The homeowner mortgage interest deduction allows you to do exactly that and the beneficial effect of this tax write-off is shown in column (8) of Exhibit 3A (next page). This column assumes that our effective tax rate is 33% (combined marginal federal and state income tax rates), and that therefore our interest payments are effectively reduced by 33%.

Looking at the bottom of Exhibit 3A, we can see that on an after-tax, after-inflation basis, Jim only paid back $12,655 in real terms. Because he borrowed $14,614, and he paid back almost $2,000 less, this means that his effective interest rate was a negative 1.16%! In real terms, even without getting access to that large run up in homeowner equity, Jim was still effectively being paid to borrow money during a time of significant inflation. This windfall worked for many millions of households for a number of years in the not too distant past (even if many of them did not fully understand what was happening at that time), and this is something that can work for all of us if inflationary times are in our own futures.

(End of book excerpt)

Vision And Our Past

What you have just seen is the power of vision. Millions of households who had home mortgages during the mid 1960s through early 1970s were in real terms, being paid to borrow money. Simply through taking out a normal mortgage, and making their payments for 10, 20 or 30 years, they realized the benefits of a negative rate of interest. For the most part – while they may not have seen the numbers behind the negative interest rate, they fully benefited from it, every month. The specifics of how they realized the full benefits (the same type benefits you may be able to realize in the future) is the subject of the rest of Chapter Three, and we won’t be covering that in this Mini-Course, as the course now goes a different direction from the book.

A short summary would be that many of the readers in this course have already personally enjoyed substantial benefits from past zero and near zero real interest rates. The benefits took the form of making monthly payments of $50, $100 or $200 for decades, even while payments for your neighbors were climbing to $500, $1,000, $1,500 or more, to live in an equivalent house. Every bit of those monthly dollar savings were used, in one form or another. Whether it was your parents sending you and your siblings to summer camp and college – or you sending your children – having a negative interest rate in real terms may have been what paid for it. Whether it was color TVs, riding lawn mowers, or a better grade of red wine at the restaurant, the lifestyle enjoyed by much of the middle class during the 1970s, 1980s and 1990s was based on a hidden foundation of large sums of extra cash available each and every month – because inflation had eaten their once formidable payments.

The reason that we so closely examine the past in this section of the course is to show that the fundamental principles of Turning Inflation Into Wealth are no theoretical abstraction, or theory about what might happen in the future. These principles are the past, and many millions have benefited in the most concrete terms. People benefited with an improved lifestyle, month after month, year after year, even though the beneficiaries may not have had the slightest idea of the difference between nominal and real dollars, or understood anything of the tax implications. However, that does not mean that the benefits realized from accidentally applying Inflation Into Wealth strategies are going to be equivalent to the benefits of deliberately and intelligently applying such strategies, nor does it mean that the general population will benefit to the same extent that it did during the 1970s and 1980s.

For the past does not always repeat itself. Indeed, coming into what may be the greatest inflationary dangers we have seen in our lifetimes, the current intention of much of the American middle class is to do everything they can to keep from benefiting from the lessons of the past. One large group of homeowners is trying to minimize currently monthly expenses through maximizing their exposure to inflation dangers, by choosing adjustable rate mortgages. Another large group believes the best way to prepare for inflation is have as little debt as possible and as many paper assets as possible.

If A Friend Sent You This Link

If you found this reading because of a friend’s recommendation, then you should know that it is part of a free book on Turning Inflation Into Wealth. Sign-up below if you would like your own copy of this valuable educational resource, delivered via e-mail.

If there is something in this reading that you think a friend or colleague would find helpful, you are encouraged to send them a link to this webpage.

Please DO NOT use the form above to sign up friends without their permission. The book is intended only for people who want it, and have given their permission by signing up for it.

All readings in the book are the exclusive property of Daniel R. Amerman, CFA. Subscribers are allowed to print a single copy for their own usage. Any other copying of materials from these readings and reposting or reprinting elsewhere is strictly prohibited and constitutes a violation of international copyright law. If you would like to share these educational materials with others - please use a link to this website.