Reading Nine:

Creating Wealth With An

Inflation “Tax Shelter”

Please note the “Tax Shelter” described is not a statutory tax shelter, or tax shelter in the usual sense of the word. There are no esoteric write-offs, there is no extraordinary sheltering of current statutory nominal dollar income – there is just the potential enjoyment of substantially increased purchasing power over many years on a likely tax-advantaged basis.

The bad news is that the United States government does not recognize the existence of inflation for tax purposes, which creates profoundly unfair results for many people, as we covered in two of our previous readings.

The good news is that the United States government does not recognize the existence of inflation for tax purposes, which creates lucrative opportunities for many people.

In today’s reading we will pull together what we’ve been learning in our previous readings, and then talk about some personal implications for you. We will go beyond the economic analysis of the early readings, show the tax implications, and demonstrate just how different real wealth creation worked during 1970s than homeowners realized at the time.

Most people thought it was the houses that produced their increased real wealth, but as we learned early in this course, their houses were on average losing money on an inflation-adjusted basis. The more financially sophisticated may have known the mortgage had a lot to do with it. Yet, if we look just at the difference between inflation and the mortgage rate – that is not sufficient to explain the surge in wealth experienced by millions of households. It was the tax shelter created by the interaction between mortgage, tax policy and inflation that multiplied the value of the wealth.

The Investment Challenge Of Breaking Even

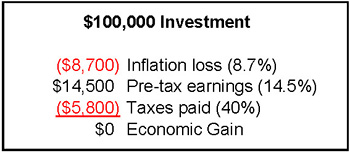

Let's start by looking at a historical challenge - and then test a historical solution. Between June of 1972 and June of 1982 the average annual rate of inflation was 8.7%. Just to maintain our after-tax net worth, how much would have to earn with that kind of inflation?

8.7% / (100% – 40%) = 14.5%

The equation calculates the investment return we have to earn in order to merely stay even with inflation on an after-tax basis. Not really make any money, just run in place and keep our wealth worth the same in inflation-adjusted terms. The simplest way to view this return is to say that if the value of our money declines 8.7% each year because of inflation, then we must earn 8.7% per year just to keep up. Unfortunately, in today’s investment environment there are no widely available ways to earn anything close to a 8.7% truly risk-free yield.

The full situation is much worse. Because the relationship between inflation and taxation is one of the more unfair aspects of life. Government policies create inflation. That inflation creates the illusion of income. The illusion of income is then fully taxed by the government. These taxes apply to investment assets as covered in the previous reading, however, they also apply to interest payments, dividends, capital appreciation, rental payments, or other income sources.

So our illusory 8.7% yield, that is really just keeping pace with inflation, is taxed by the government with most forms of investments. If our combined state and federal marginal tax bracket is 40%, then we lose 3.5% of our yield, meaning our after-tax yield is only 5.2%. Therefore, even an investment yielding 8.7%, in this environment of 8.7% inflation, would have only locked in a 3.5% annual loss in real purchasing power terms.

This brings us back to our equation above. To stay even with 8.7% inflation, we have to earn an after-tax yield of 8.7 percent. So we divide inflation by one minus our marginal tax rate, and find that it takes a 14.5% rate of return to stay even with 8.7% inflation. As an example, if we invest $100,000, then we lose $8,700 (which is 8.7%) of the real value of the principal amount of our investment to inflation the first year. We must earn $14,500 in income, which is taxed at a rate of 40%, meaning taxes take $5,800 of our earning. Eight thousand seven hundred dollars of lost purchasing power, plus $14,500 in nominal income, less $5,800 in taxes all add up to zero, meaning we truly do have earn almost 15% to just tread water and maintain the purchasing power of our savings!

Reversing Inflation Taxes

In a previous reading when we found the historical after-tax and after-inflation “cost” of borrowing of a negative 1.16%, it is worth remembering that this was a 30-year cost. Which included ten years of substantial inflation between 1972 and 1982, and twenty years of reasonably moderate inflation between 1982 and 2002. What happens if we look just at the inflationary period? For that is, after all, the purpose of this course, to concentrate on how we can turn inflation to our financial advantage during times of future substantial inflation.

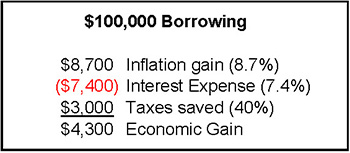

As just covered in our investment example, historical inflation averaged 8.7% per year between June of 1972 and June of 1982. The average 30-year conventional mortgage rate in June of 1972 was about 7.4%. Adapting the investment equation from above for a borrowing leads to:

[-7.4% X (100% – 40%)] + 8.7% = 4.3%

Let’s quickly review what those numbers mean, using an example $100,000 mortgage – which was high for that time (and low for this time), but allows for some nice rounded numbers that are easy to follow. We borrowed $100,000 at a 7.4% interest rate, meaning we pay $7,400 in interest payments for the year. However, 8.7% inflation has reduced the principal value of what we owe from $100,000 down to $91,300 in real dollars, meaning in purchasing power terms we experienced a $8,700 gain over that year. Subtract the $7,400 we paid in interest from the $8,700 of economic gain, and we are ahead $1,300.

However, the $7,400 interest expense is deductible against current income, which at a marginal combined rate of 40%, is equal to a $3,000 (rounded) reduction in taxes paid. So, we start with a $8,700 economic gain from inflation reducing the real principal value of our debt, subtract $7,400 in interest payment expense, add $3,000 in tax savings, and we are ahead by $4,300.

Let’s stop and slowly go through what is happening once more, because this review of actual historic numbers is so important for each of our financial futures:

We experienced a real $8,700 gain through inflation destroying the principal value of the mortgage debt we owe. The government does not see this for tax purposes, so that income is tax-free for us.

We paid a negative interest rate, because the 7.4% rate we were paying was less than the 8.7% inflation rate. The government also does not see the negative interest rate, so we are able to deduct the full amount of interest. In effect, we are deducting an imaginary expense (from an economic perspective), and that produces a further $3,000 cash savings for us.

When we take the $8,700 in tax-free purchasing power gains, add the $3,000 in tax savings from deducting (economically) imaginary interest expense, and then subtract the $7,400 in cash interest payments, then we have improved our ending after-inflation and after-tax net worth by $4,300, or 4.3%. When we compare the after-tax benefits of 4.3% to the starting spread of 1.3% between 7.4% mortgage and 8.7% inflation rates – our tax shelter has more than tripled our benefits. All of this has been accomplished not by investing, but by borrowing in the right form, during a time of substantial inflation.

(We are, of course, ignoring the small monthly principal payments that occur, as they don’t affect things that much, and would make the example much harder to follow.)

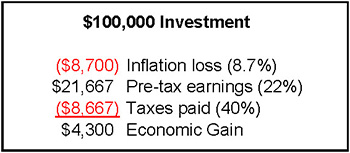

Now, a return of 4.3% may not sound that impressive, if you are used to looking at the world through nominal dollar eyes. Keep in mind, however, that the 4.3% is double net – net of inflation and net of taxes. It is the bottom line “real thing” in terms of growth in purchasing power. How much would someone have needed to earn with a conventional investment that generated ordinary and fully taxable income, to realize this same historical double-net benefit, this same real increase of 4.3% in purchasing power? Let's plug the numbers in:

[21.7% X (100% - 40%)] – 8.7% = 4.3%

In order to earn $4,300 in real terms, we would have needed to earn $21,667 in nominal terms. That is, we invest $100,000, inflation costs us $8,700 of the value of our investment, we earn $21,667, we subtract 40% taxes of $8,667, and we end up with a real gain of $4,300.

Because this is so important, let’s go through the investment in the same detail that we did with the borrowing:

Using historical inflation from 1972-1982, we lost 8.7% of the purchasing power of our investment to inflation each year. Government tax policy does not recognize this loss, so we are not able to take a deduction, and must bear the full $8,700 loss.

We found a superlative investment, and earned $21,667, an annual return of almost 22% on the money invested. The real after-inflation earnings were only $12,967 ($21,667 - $8,700), but government tax policy does not recognize this. Therefore, we had to pay 40% taxes on the full $21,667, for a cash expense of $8,667.

When we take our real after-inflation earnings of 12,967, and subtract $8,667 in taxes (an effective tax rate of 67%), we are left with a $4,300 improvement in our net worth.

That is remarkable – but true. When we take taxes into account, having an average mortgage from 1972 to 1982, with a rate that was 1.3% below the historical inflation rate, was throwing off economic benefits equivalent to a conventional investment earning almost 22% per year. The huge gap between the two was due to the tax code being blind to inflation – and to the difference between swimming against the current and going with the current.

Swimming Against The Current Versus Floating Downstream

Making money with investments the conventional way is hard, hard work during a time of substantial inflation. Because you are swimming against the current, trying to make dollars at a greater speed than they are losing value. Making the situation worse is that you are swimming not only against the inflation current, but the tax current as well. The tax code keeps you from recognizing your real losses, even as imaginary profits are taxed. Therefore, you would have had to swim like an Olympic gold medalist, in a furious and never ending surge, to maintain a 22% per year return in order to recognize real gains of a modest 4.3% per year. Compounding the difficulty is that you would have had to earn those returns by swimming not only against the inflation and tax currents, but against the investment markets current as well. For that is the same decade in which the Dow lost 62% of its value on an inflation-adjusted basis.

Or, you could not swim at all, and simply float downstream on your back. Let the current of inflation steadily wash away the value of your debts. Let the current of a tax policy that is blind to inflation, shield your profits from taxes even as it sends you money each year through allowing you to deduct your (economically) illusory interest payments in full, thereby tripling your downstream speed. Instead of fighting the direction of the investments markets, float downstream in synch with the broadest of economic forces, the basic economic force of inflation redistributing wealth from creditors to debtors. The rewards of this strategy are to naturally accumulate wealth during a time of major market downturns, at a rate faster than most investors are able to accumulate wealth during bull markets.

There are names for this rare ability to move the exact opposite direction of the general investment markets, such as hedging or being contra-cyclical. In general, hedging is a risk-reduction strategy designed to protect the value of your portfolio against market downturns, to reduce your overall risk. Hedges are generally quite complex and difficult to execute, and effective hedges cannot usually be entered into by ordinary individuals on a cost-effective basis over long periods of time. Investments that reliably deliver contra-cyclical results – go up when the rest of the markets are going down – are uncommon and prized. When we look at your home mortgage – if it is the right mortgage for your particular circumstances – then we have a natural, long-term, low-cost and tax-advantaged hedge that has been proven to deliver powerful returns during the worst decade that the investment markets have seen in the last 60 years.

Your Third Choice: Swimming Downstream

There is a third alternative to swimming upstream or floating downstream. That alternative is to deliberately swim rather than passively float with the current – but to swim downstream, with the currents, rather than against the currents. To accomplish this – one method is to use debt to fund a contra-cyclical asset, rather than your home. Let’s say you have borrowing power in your home, which you can safely access given your overall financial situation (the importance of the word safely cannot be overstated). You make an optimal decision on how to access that borrowing power, and reinvest the money into assets that you expect to thrive in an inflationary environment. Assets that you expect to throw off their greatest returns when the stock and bond markets are plunging. By entering into this strategy – you have doubled up your ability to profit from inflation.

This is not a hedge by itself – you are making a distinct call and bet on the future – but it could function as a hedge if constructed with only a portion of your portfolio or net worth. For instance, let’s say 70% of your standard of living is exposed to market downturns, either because of your existing investments, or because the safety of your pension or even career are tied to the overall markets and economy. In this case, doubling up your contra-cyclical exposure with a self-funding combination of both liability and asset could be a powerful way of reducing your overall risk of losing savings and standard of living to future adverse economic events.

Gold and gold mining stocks would be the classic example for the asset side, and yes, funding gold purchases with a 30-year, fixed rate mortgage could have been the most profitable decision of your life, if you had done so in the early 1970s (and if gold had been legal for individual Americans to own at the time). However, there is the issue of funding your interim mortgage payments with a non cash-flow producing asset, as well as gold having some inflation tax exposure.

There is another historically proven way to swim downstream, and that is to combine a mortgage not with your home – but with an income producing property. Whether are we buying a duplex, farmland with an energy play (gas wells or windmills), a hotel, a strip shopping center, or a portfolio of apartment complexes diversified across multiple metropolitan areas, buying cash flow producing real estate offers a powerful combination of advantages:

- You don’t make the mortgage payments (if properly done), rather, your property makes the payments for you.

- You receive cash flows from your property that rise with inflation, while your debt payments do not. This means that your cash flow (if properly structured) is rising at a rate higher than the rate of inflation – and the faster inflation rises, the greater the annual increase in purchasing power benefit to you.

- Because the property is throwing off cash flow, it can reliably generate earnings you can use to subsidize your lifestyle – even while asset appreciation investment strategies (such as most common stocks) are plunging all around you.

- Real property is not an either/or choice when it comes to asset appreciation, however, as the largest part of your return may be in the widening spread between the tangible asset of the value of your property, that is rising with inflation even while the real value of your debt is being shredded by inflation.

- You receive the full tax benefits shown in this reading for the treatment of interest expenses.

- You receive the full tax benefits shown in this reading and the following one, for the treatment of capital gains.

Quite a bit more information about the benefits of using commercial and rental properties are available in the 26 page special report, “Commercial Property Balance Point: Achieve Deep Protection From Economic Turmoil While Turning Inflation Into Wealth”, which can be found beginning on page 5 of the book “Real Estate, Retirement & Inflation Readings.” Using simple examples which are illustrated by numerous graphs, the report shows how to successfully weather turbulent markets, credit crunches, soaring interest rates and a plunging dollar, even while simultaneously turning inflation into personal wealth and increased safety.

The Next Reading

So, it’s the effective use of the “tax shelters” that is perhaps the most important ingredient in turning inflation into wealth. It’s the special and very little understood tax implications associated with debt in inflationary times that take us from a 1.3% spread between the inflation rate and the mortgage rate – up to the same after-inflation and after-tax benefits as a conventional investment yielding 22% per year. We will go deeper inside the asset side of one of the inflation tax shelters in the next reading, as we reconcile nominal dollar, real dollars, tax dollars and net purchasing power benefits.