Reading Ten:

Reversing The Inflation Tax

In previous readings we went back through history and found out what happened to historical borrowing costs when we adjust for inflation and taxes. We found some remarkable and surprising results, including:

For homeowners who entered into a mortgage in the early 70s, inflation dropped their real cost of borrowing over 30 years down to a mere 1%.

When we add the effect of taxes and the benefits of the mortgage interest deduction, the full 30-year cost of borrowing dropped to a negative 1%.

When we look at the results of just the decade of peak inflation from 1972 to 1982, we found that even though average inflation rates were only 1.3% greater than initial mortgage rates, the inflation “tax shelter” more than tripled the benefits, producing after-inflation and after-tax returns of 4.3% annually.

We then found that an investor in a 40% (combined state & federal) tax bracket would have had to earn an extraordinary 22% annual rate of return in order to realize the same after-inflation and after-tax financial benefits that were being realized by an average homeowner in an average mortgage (albeit both accidentally and unknowingly).

In today’s reading we will move from interest payments in the past to capital gains in the future, as we further explore how to turn the “inflation tax” upside down. We will set up a simple illustration, and examine it from three different perspectives. We will reconcile nominal dollars, real dollars, tax dollars and net purchasing power benefits, and come to understand the underlying sources of our wealth benefits, as we learn to turn the government’s inflation blindness to our personal benefit.

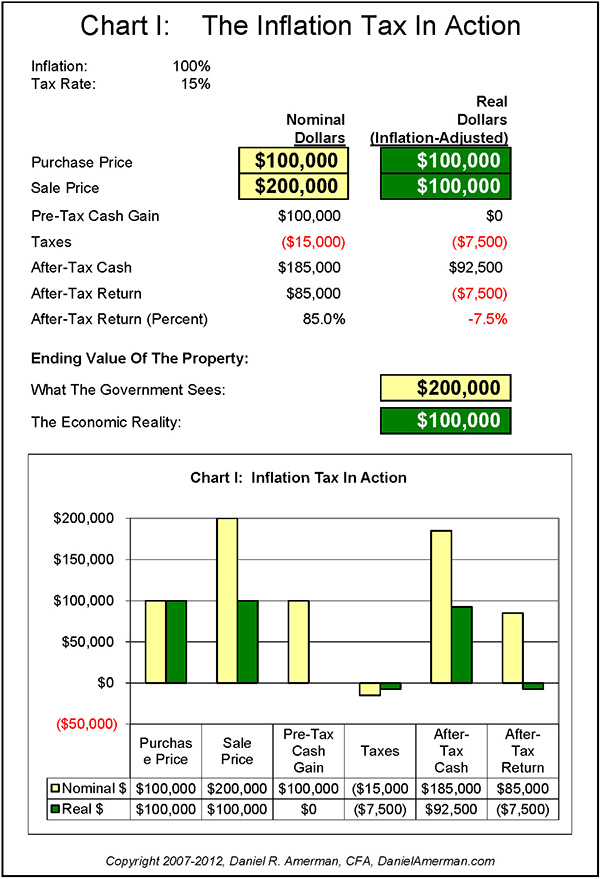

The chart below illustrates the inflation tax in action. We start with an asset, and it could be almost anything. Land, gold, stocks, or comic books. We buy it for $100,000 as shown in the “Purchase Price”. We hold the asset long enough for the tax treatment to become capital gains rather than ordinary income, and then sell it.

During this time, we experience a 100% inflationary rise in prices. It now takes two dollars to buy what one dollar used to. Another way of phrasing this is that the purchasing power of a “new” dollar has dropped to fifty cents in old dollars, which makes the conversion from future nominal dollars (the left column) to real dollars (the right column) quite easy, we merely divide by two.

Our key assumption is that our asset price keeps up with inflation (many investments won’t), but that it doesn’t exceed the rate of inflation. The price doubles, but the dollar is only worth half what it used to be, so in real terms, the asset is worth the same as it was before the inflation occurred. In real terms, in terms of purchasing power, in terms of what we can buy if we sell the asset, nothing has changed, and this is represented by the dark green boxes on the chart, as well as the green bars on the graph.

But, that’s not how the government sees it. Even though the government is often the source of inflation through its fiscal and monetary policy, the government is blind to inflation with its tax policy. As far as the government is concerned, a dollar is a dollar. So what the government sees (as illustrated by the pale yellow boxes and bars) is that you bought an asset for $100,000, you sold it for $200,000, and that you just made a $100,000 profit (the “pre-tax gain” line). And the government wants its share of your profits, in the form of an assumed 15% capital gains tax, which means $15,000 in taxes.

Now, as long as we ignore inflation, that’s not so bad. We still have $85,000 in “profits”. Indeed, that 85% after-tax return on investment may look pretty sweet.

The problem is when we adjust our 85% after-tax return for the technicality of a dollar only buying what fifty cents used to. When we look at our real wealth in terms of the goods and services we can buy with the proceeds of selling our asset.

When we go down the real dollar column on the right, and look with our dark green economic “eyes”, then we see that we bought for $100,000, we sold for $100,000, and in terms of real wealth – our pre-tax gain is zero. But, we still have to pay taxes. When we discount those future taxes to bring them back to current dollars, at least it drops the real cost in half, down to $7,500. Unfortunately, once we pay those taxes – in purchasing power terms, we only have $92,500 left.

Meaning that instead of making $85,000 – we lost $7,500 out of our $100,000 investment in real terms. When we adjust for inflation and look at what a dollar will buy – our sweet 85% return vanishes, and what we are left with is a 7.5% loss on our investment.

We just met the “Inflation Tax” – and it ran over us.

Let’s review what just happened here. Through its fiscal and monetary policies, the government created inflation that cut the value of our dollars in half. Meaning that everything that we owned in dollar terms, such as bank accounts and bonds, just had half the value taken away from us. However, we were smart enough not to put our $100,000 into a dollar denominated investment. We put it into another type of asset, one that kept up with inflation. We didn’t actually make any real money, we just protected the purchasing power of our assets against the effects of unwise government policies.

So how does the government react? By stripping us of part of the wealth we did preserve, on the grounds of illusionary profits. With the illusion that created the pretext for seizing our assets having been created by the government in the first place.

That’s completely unfair. In fact, the inflation tax is totally outrageous. But that is also the way the United States federal government operates, and there is not much you or I can personally do about. Except turn the government’s inflation blindness to our advantage. If the government’s tax policy is blind to economic reality – are there ways to turn this relationship to our advantage? So that instead of paying real taxes on illusory income, we are paying illusory taxes on real income?

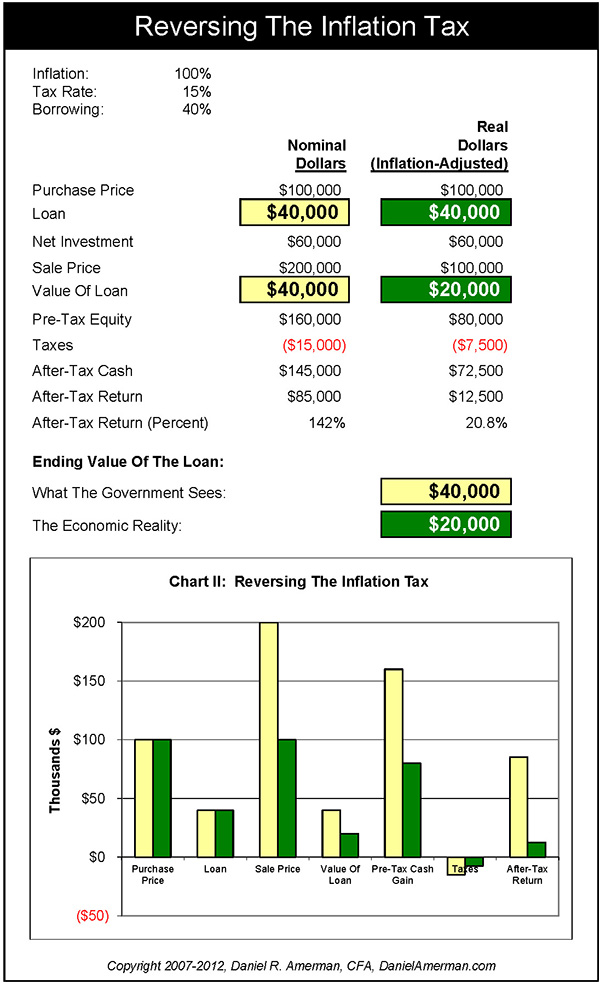

There are indeed ways to accomplish just that, and “Chart II: Reversing The Inflation Tax” (below) is a simple example of one such method. Much of this example is identical to the previous example, in terms of buying a $100,000 asset, experiencing 100% inflation, selling the asset for $200,000, and paying a 15% capital gains tax on any nominal dollar “profits”.

However, we make one essential change – we borrow part of the money to buy the asset. When this strategy is executed properly it creates a means to redistribute wealth from corporations and other investors into our pockets during times of substantial inflation. Even a small amount of borrowing can also act as vitally important shield against the Inflation Tax, and a moderate amount of borrowing can reverse the tax altogether.

In our example, we borrow $40,000 and put up $60,000 in cash for the remainder of the purchase price of our asset. When the inflation occurs, the value of the investment doubles – but the value of our borrowing does not. Indeed, when we look at the loan with our dark green “economic” eyes, we see something fascinating – in real dollar terms, the value of the loan we have to pay back dropped in half. Yes, we still have to pay back $40,000, but because our purchasing power has been cut in half, the dollars we pay the loan back with are only worth 50 cents each.

This means that the inflation-adjusted value of the loan is only $20,000. We own an asset that is still worth $100,000 in real terms ($200,000 in nominal terms). Our equity is equal to the value of the asset less the loan, so our equity in real dollar terms has climbed to $80,000. Meaning we have realized a genuine $20,000 profit on our investment in real dollar terms. We have gone from making no real economic profit to making a very real and substantial economic profit, on the very same asset – bought and sold at the same price.

Now this is where things get very interesting and very important. The government doesn’t see this real profit. Because government tax policy is blind to inflation. As shown with the pale yellow boxes and bars, all the government sees with are nominal dollar eyes, where a dollar is equal to a dollar and never changes in value. As shown in the yellow boxes, all the government sees is that we borrowed $40,000 – and we paid back $40,000. This lack of profit or loss means that the loan is pretty much a non-event from a tax standpoint.

So what the government sees is that we bought a property for $100,000, we sold it for $200,000, we had a loan that was a non-event, and we made a $100,000 profit, so we owe them $15,000 for their share. We pay the government in full, and they are fine – with what they officially see.

What the government doesn’t see is what happened with real dollars. Looking with nominal dollar eyes, it did not see us earning (taking) $20,000 of real value from the lender, through paying them back in full with dollars that are worth less than the dollars we borrowed from them. Because the government did not officially see the gain, we were able to take it on a tax-free basis. We take our tax-free real gain, subtract the $7,500 inflation tax that we owe the government because of our illusory gain – and we have a real gain of $12,500, after adjusting for both inflation and taxes. This is illustrated in the chart below:

In nominal terms we turn $60,000 into $145,000, which is an after-tax return of $85,000, which represents a 142% return on investment. Even after we discount for inflation, and the government seizing a share of nominal asset appreciation that doesn’t exist in real terms – our $12,500 real gain is almost a 21% return on our $60,000 investment.

So same asset purchase price. Same sale price. Same taxes legally paid in full to the government. But instead of losing 7.5% of the purchasing power of our investment – we increased it by almost 21%. That is how to reverse the Inflation Tax!

Once Again

While the relationships demonstrated above are entirely real, and how well you utilize the lessons contained may very well make a major difference in your future standard of living – you may not have followed every nuance in our first run through. Even using a very simple example with nice, rounded numbers – combining tax accounting and constant dollar economics is going to be difficult to follow for many readers. So let’s try it again, quickly, from a somewhat different perspective, and see if that helps. Let’s close out each of our strategies with just plain dollars.

With Chart I we buy an asset for $100,000, we sell it for $200,000, we have a pre-tax profit of $100,000, we pay 15% capital gains tax in full of $15,000 and we walk away with $85,000 more than we initially invested.

With Chart II, we buy an asset for $100,000, we sell it for $200,000, we have a pre-tax profit of $100,000, we pay 15% capital gains taxes in full of $15,000 and we walk away with $85,000 more than we initially invested. Identical to Chart I.

Keep in mind that the government does not tax us on percentage return on investment, we are taxed on nominal dollar profits, which are identical under the two structures. For instance, if we realize a capital gain of $1,000,000, then we owe $150,000 – regardless of whether we invested $100,000,000 (a 1% return) or $1,000 (a 100,000% return).

The difference to our personal bottom line comes from our having invested $100,000 of our own money with Chart I, and only $60,000 with Chart II. If we invest $100,000, then we need to earn $100,000 in after-tax terms, if we are to keep the full purchasing power of our investment during a time of 100% inflation. Because the government took $15,000, that means we only made $85,000, and we came up $15,000 short in nominal dollars. That is a $7,500 loss in terms of what our money will buy for us, and we walk away having $92,500 in (pre-inflation) purchasing power. We lost 7.5% of the real value of our assets to the government’s tax on inflation.

With Chart II, we invested $60,000, and we needed $60,000 in after-tax profits to stay even with inflation. We earned the same $100,000, the government took the same $15,000, so we made the same $85,000. However, an $85,000 profit on a $60,000 investment is more than enough to keep up with inflation. We came out with $25,000 more in nominal dollars, than we needed to stay even. Adjusting for inflation means we came away with $12,500 more than we needed to stay even, and when we divide that $12,500 by our initial $60,000 investment, we find we walked away with entirely real 21% after-tax and after-inflation return on investment.

So we paid government taxes of $15,000 in their full legal amount as we close out – there is no shady or questionable tax-shelter going on here. We walk away with $145,000 in after-tax cash, which is an $85,000 nominal profit on our $60,000 investment. We increased our real purchasing power by $12,500, which is a 21% after-tax and after-inflation gain on our original investment. Flipping the inflation tax on its head was entirely real in our example. As it can be entirely real for you in an inflationary future.

Pay 7.5% when you really make nothing. Or, turn the combination of government fiscal and tax policy into a 21% return – when on the underlying asset itself, you really made nothing at all in inflation-adjusted terms. Your choice.

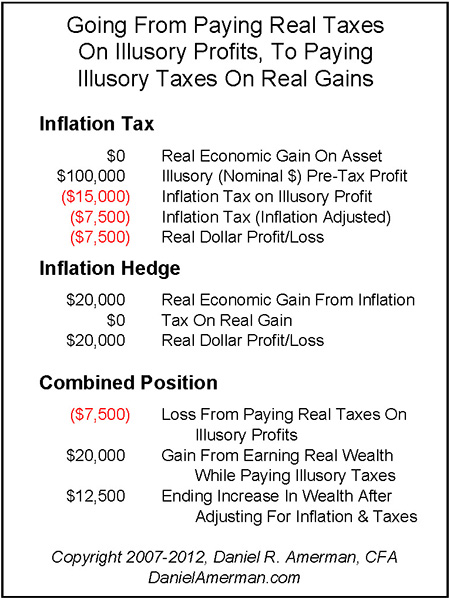

The Source Of Our Gains

Now, we’re going to take it one level further. We did indeed successfully reverse the inflation tax in terms of our own bottom line of real wealth, but we didn’t actually take any money from the government –which is why the government tolerates this, and it isn’t a tax shelter in the usual sense. To see where the money really came from, we need to return to the first paragraph of “Inflation Pickpocket”, the slightly twisted morality tale that constituted the first reading in this series:

“Inflation is not an even game, it is not a fair game, and we are not all in this boat together. For inflation is not about destroying everyone’s wealth – it is about redistributing that wealth, and if you don’t understand this, then it will likely be your wealth that will be getting redistributed.”

What today’s reading shows is not just how inflation redistributes wealth – but how it redistributes tax benefits.

Where we made our money was in taking $20,000 in real wealth from the corporation or bank that lent us the $40,000 in the first place, through paying them back in full with dollars that were only worth half what they were when we took out the loan. We took $20,000 in purchasing power from them, we paid $7,500 in real dollar taxes, and we walked away with $12,500 more in real wealth than we started with.

The lender took a $20,000 loss in real terms – but couldn’t deduct it, because government tax policy only sees through nominal dollar eyes. Effectively, we took their tax deduction and used it to make our own real income tax-free, and that was more than sufficient to pay our inflation tax on our illusory income, and still come out substantively ahead.

We’ve left interest payments out so far to keep things simple, but they don’t necessarily hurt our position. Not if, as happened during the last major bout of inflation in the US, mortgage rates (and other long term rates) were 7% and less coming into the inflationary period, and inflation average 8.7%. Meaning that we would take their interest payments from them too, as our borrowing cost would be effectively negative, as discussed in detail in the previous readings. (We do need to be cautious not to just simply add up this and the previous readings on inflation and interest rates, however, as that would double count principal benefits).

The major tax benefits from our interest payments in a time of substantial inflation? We took those from the lender too. We are paying a negative rate of interest in real dollar terms, but all the government sees are nominal dollars. So the lender has to pay taxes in full on illusionary nominal dollar profits, even while it earns a true negative return. Even while we are being paid by the lender to borrow in real dollar terms, we are able to take tax deductions for the nominal interest payments we make, meaning that we are earning a (much) better than tax-free income, as we are effectively getting paid by the government to pay a negative interest rate.

(The other interest cost consideration is of course the earnings from whatever we did with the $40,000 we freed up by taking out the $40,000 loan.)

None of the above is fair. But, it is reality, during a time of major inflation. The wealth will be redistributed, and government tax policy will just compound the inequities. Some people will not only incur major investment losses in real dollars as a result of inflation, they have to pay substantial taxes on those losses, because of the illusion of nominal dollar income. Other people will win from inflation, but their benefits will be more or less accidental, and they won’t necessarily even understand that anything happened, other than enjoying the benefits of an increased standard of living. Still others will come into the next period of inflation prepared and with eyes wide open. They will thoughtfully position the combination of their assets and liabilities in such a manner that wealth flows to them from inflation. They will do this using a strategy with an emphasis on risk-reduction, and they will do it in such a manner that much of their real dollars earnings may even be tax-free to them – so they are indeed, paying illusory taxes on real income.

The Home Exception

There is currently an exception to the inflation tax in the United States. While the specifics are beyond the scope of this reading, the exception is that homeowners don’t have to pay capital gains taxes when they sell their primary home, so long as they reinvest in another home within a specified period. They are also allowed a once in a lifetime exemption to cash out profits from their primary home.

When we consider just a home in isolation, this would seem to lessen the need for inflation hedge. When we look at overall financial positions for individuals, however, this strongly increases the attractiveness of using a mortgage hedge for the purpose of increasing net worth during a time of inflation. The home exception means there is no longer an offset needed to pay an inflation tax, and all of the appreciation benefits of the inflation hedge can flow straight to the homeowner on a tax-free basis, even as the homeowner is realizing the other benefits discussed in prior readings.

There are many forms of inflation hedges, not all involve liabilities, and not all liability hedges involve mortgages – but mortgages do have some particular advantages for households, including households with sufficient net worth that they don’t actually need a mortgage. Indeed, for a household with substantial financial assets to protect from the inflation tax, it could be termed near folly to not take full advantage of the unique advantages of the mortgage inflation hedge, with its easy access to long-term, low fixed-rate terms, as well as the potent one-two tax-advantage combination that exploits the treatments of both interest deductions and capital gains.

Is This Just Leverage?

Any time you use both an asset and a liability, then there is a form of leverage involved. However, it is important to keep in mind that leverage is the name for a tool – not a strategy. The tool can be (and is) applied in a near infinite number of ways and strategies. Often, the term “leverage” is used with a connotation that suggests using debt to increase returns by increasing risks.

Financial professionals may be more likely to use the phrase “asset / liability management”, in recognition that we are doing is managing tools. Sometimes the strategy involving debt can mean taking speculative risks in concentrated form – but other times assets and liabilities are managed together with a focus on portfolio risk reduction, or with the idea of managing tax exposures and increasing the amount of dollars that can be realized on an after-tax basis.

What is being illustrated here is the judicious use of moderate amounts of carefully selected liabilities as part of an inflation risk management strategy, where the goal is to reduce overall risks for the long-term investor. We are strategically using a combination of economic and tax benefits with both interest payments and capital gains in order to redistribute wealth benefits and tax benefits to our personal advantage during a time of substantial inflation. To realize these benefits – we have to be able to safely cover interim loan payments. There is a trade-off between the two and we will later be discussing more about that.