Reading Eleven:

Inflation Arbitrage

Extraordinary Problems Turning Into Exceptional Opportunities

Let’s sum up the situation:

- We have extraordinary risks to the dollar in the near term, and a long-term where government promises make annihilation of the value of the dollar as we know it appear to be highly likely.

- Those risks are not incorporated into current investment market pricing, and current interest rates have indeed been artificially manipulated to be at low levels, to aid in the achievement of other economic objectives for the United States and other nations.

- We have a long-term, readily available and tax-advantaged “short” on the dollar that is available today under some of the most advantageous terms in history.

Rephrased – a convergence of factors has produced the potential arbitrage opportunity of a lifetime. Which brings us back to this course, and what we have been covered in the readings to date:

- We saw how inflation redistributes wealth, and can be used to directly take net worth from corporations and other individuals (“Inflation Pickpocket”).

- We learned to see through the illusion of nominal dollars, and uncover the opportunities that high rates of inflation open up to us.

- We boxed with inflation, and found out how a powerful, debt-based left hook can work in combination with a tangible asset right jab, to vault up an individual’s real wealth relative to both conventional investors and tangible asset investors who don’t use debt.

- We carefully reviewed history, saw that real estate by itself was not the source of wealth during our last major inflationary bout, but that it was the “left hook” of the right kind of borrowing that enriched millions of households – at the expense of the effective destruction of the Savings & Loan industry.

- We saw that a powerful left hook could be worth $300,000 to an average household if the 70s were to repeat.

- We learned how inflation could effectively make much of our debt payments for us, as the real cost of making the payments plummets along with the value of a dollar.

- We added in tax payments – and learned how we could turn a 8.7% rate of inflation into the net worth benefits of an investment yielding 22%.

- We delved deeper into how the intertwining of principal, interest and tax benefits worked during our last major bout of inflation, and found that the hidden tax benefits of the tax code being blind to inflation effectively tripled our economic benefits.

- We learned to reverse the Inflation Task, as we discovered how to turn a real tax on illusory income into illusory taxes on (economic) real income.

Putting A Number To The Opportunity

How great is this opportunity?

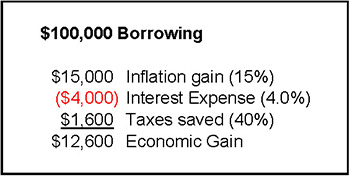

In a world where the Federal Reserve is creating money out of the nothingness to finance record government deficits, even as Social Security and Medicare crises draw nearer, and energy and commodities prices soar around the world - using historical inflation rates is a very conservative assumption indeed. What lies ahead may be far, far worse than what was experienced between 1972 and 1982. As an illustration (rather than a prediction), what happens if we combine the 15% inflation rate, with a mortgage rate of 4.0%, using the methodology from readings developed in Readings 9? For the mortgage side, we get the equation below:

[-4.0% X (100% – 40%)] + 15% = 12.6%

Using the same methodology from Reading Nine: we experienced a real $15,000 gain through inflation destroying the principal value of the mortgage debt we owe. The government does not see this for tax purposes, so that income is tax-free for us.

We paid a substantively negative interest rate of an effective 11.0%, with that representing the difference between the 4.0% interest rate we were paying and the 15% inflation rate. The government’s nominal dollar “vision” does not see the negative interest rate in real dollars, so we are able to deduct the full amount of nominal interest. In effect, we are deducting an imaginary expense (from an economic perspective), and that produces a further $1,600 cash savings for us (rounded and assuming a combined 40% marginal tax bracket).

When we take the $15,000 in tax-free purchasing power gains, add the $1,600 in tax savings from deducting (economically) imaginary interest expenses, and then subtract the $4,000 in cash interest payments, then in one year we have improved our ending after-inflation and after-tax net worth by $12,600, or 12.6%. This has been accomplished not by investing, but by borrowing in the right form, during a time of substantial inflation. More basically, we accomplish this by looking ahead to the dangers of the dollar, looking at the current very low level of interest rates from a historical perspective, and saying “this does not add up”. At its essence, that is what arbitrage is all about – positioning yourself to personally profit when things do not add up.

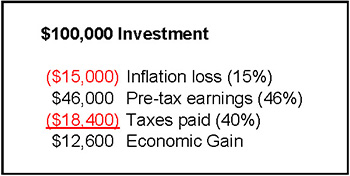

How well would we have to do with conventional investments to earn the same after-tax and after-inflation return of being short an average mortgage during a time of 15% annual inflation? Plugging the numbers in leads to the equation below:

[46% X (100% - 40%)] – 15% = 12.6%

We lost 15% of the purchasing power of our investment to inflation each year. Government tax policy does not recognize this loss, so we are not able to take a deduction, and must bear the full $15,000 loss in purchasing power terms.

We found a superlative investment, and earned $46,000, an annual return of 46% on the money invested. The real after-inflation earnings were only $31,000 ($46,000 - $15,000), but government tax policy does not recognize this. Therefore, we had to pay 40% taxes on the full $46,000, for a cash expense of $18,400. When we take our real after-inflation earnings of $31,000, and subtract $18,400 in taxes (an effective tax rate of 59%), we are left with an $12,600 improvement in our net worth.

Taking a series of quite reasonable steps has led us to a most remarkable conclusion: if even a 15% annual rate of inflation does occur, then for an investor in a combined 40% federal and state marginal tax bracket, it would take a conventional investment yielding almost 46% to provide the same after-inflation and after-tax financial benefits of merely accepting the average terms of today’s mortgage lenders.

An Opportunity That Is Both Robust & Fragile

There are a long series of “ifs” leading to figures like 15.0% inflation, or a 46% conventional investment equivalent. There is also an artificial precision to percentage points and tenths of percentage points that is not appropriate for even the next year, let alone the next 20 years. Which is why we are careful to use the words “illustration”, rather than “prediction”. That said, so long as we make two basic assumptions, then the ability to achieve extraordinary inflation arbitrage profits is quite robust in general terms, even if the specifics vary quite a bit. Those crucial assumptions are substantial future inflation levels AND the ability to borrow long-term at some of the lowest rates in history.

So long as both assumptions hold true, then the fundamentals of the strategy should deliver strong benefits for you – because you are floating downstream rather than swimming against the current. To use the metaphor from Reading Nine, the combination of high inflation and low fixed interest rates means the current of inflation will steadily wash away the value of your debts. The current of a tax policy that is blind to inflation will shield your economic profits from taxes even as it sends you money each year through allowing you to deduct your (economically) illusory interest payments in full, thereby increasing your downstream speed. Instead of fighting the direction of the investments markets, you will be floating downstream in synch with the broadest of economic forces, the basic economic force of inflation redistributing wealth from creditors to debtors.

The rewards of this strategy will be to naturally accumulate wealth during a future time of major market downturns for conventional investments, at a rate faster than most investors are able to accumulate wealth during bull markets. The “naturally” part means that it works very well whether the future inflation rate is 15% -- or 8.5%, or 25%. Which brings us to one of the best parts of this strategy – while the returns are all desirable, they are not constant. Rather, the higher the inflation rate, the more spectacular the after-tax and after-inflation benefits produced. The very nature of this strategy (properly applied) then is to function as a long-term wealth hedge, where the higher the inflation rate, the more damage is inflicted on other assets in the form of savings, portfolios and pensions – and the more this strategy delivers to help offset the losses. (This relationship is developed and explored in more detail in the middle chapters of “The Secret Power Within Your Mortgage”).

While substantial inflation is the current in our river metaphor, there is a second source for the remarkable returns shown here, and the ongoing availability of that source is quite fragile and undependable. Our extraordinary returns are based the one-two combination of very low current interest rates and high individual inflationary expectations. If the general markets start to price substantial future inflation into required returns, and current interest rates move sharply upwards – then the biggest part of our arbitrage would disappear, for those who have not yet acted. There will likely still be substantive value to the strategy when the tax implications are fully considered, however, the “easy money” aspect would be long gone.

(What happens if the reverse risk occurs, and we keep low interest rates while the expected future inflation never materializes is the subject of “What If Rates Fall Instead?”, which is Chapter Nine of “The Secret Power Within Your Mortgage”. As explained in the chapter, while not desirable for the strategy, there is a strong skew to potential returns, and with a properly crafted approach the downside risk associated with low inflation is far less than the upside potential with high inflation.)

Unfortunately, there is no way of telling how stable current long-term interest rates are, and whether they could last another two years – or be gone in two months. The many pressures on the dollar mean that the situation is inherently unstable, and of course, financial history is full of sharp moves that catch most of the market completely off guard. Financial history is however of limited use here, as the unprecedented international component means we are truly in uncharted waters. International pressures could offset domestic pressures, and vice versa, but if the two move together (which could easily happen with a downside breakout), then we could see some of the fastest interest rate moves ever seen in the United States.

In summary, we have an unusual opportunity, but no way of determining how long the opportunity will persist. Which means the only way to be sure of the opportunity – is to move quickly.

46% Is Based On A Conservative Methodology

It should be noted that the methodology used above is an illustration that gets you close, but has its limitations. Optimizing your benefits requires incorporating more factors than we include in this Mini-Course. As discussed in the book “The Secret Power Within Your Mortgage”, one difference is that as a true “short”, your gross returns are capped at an amount equal to the dollar amount of the mortgage, with higher returns being achieved through a more rapid destruction of the real value of the mortgage at higher inflation rates. On the other hand, the 46% equivalency is based upon the full mortgage amount being our “investment” – except, it is a borrowing, not a cash investment. If we take the more common approach of looking at our investment amount as not being the borrowing amount, but our equity contribution, then the equivalent annual rate of return is far higher than 46%, whether you are a homeowner, commercial property owner, or use other assets.

If there is something in this reading that you think a friend or colleague would find helpful, you are encouraged to send them a link to this webpage.

Please DO NOT use the form above to sign up friends without their permission. The book is intended only for people who want it, and have given their permission by signing up for it.

All readings in the book are the exclusive property of Daniel R. Amerman, CFA. Subscribers are allowed to print a single copy for their own usage. Any other copying of materials from these readings and reposting or reprinting elsewhere is strictly prohibited and constitutes a violation of international copyright law. If you would like to share these educational materials with others - please use a link to this website.