Reading Twelve:

Accelerating Inflation Dramatically

Heightens Both Risk & Return

A 46% Equivalent Yield

In Reading Eleven, “Inflation Arbitrage”, we put together what we have been learning in the previous readings, and found how a conventional fixed-rate mortgage would perform in creating wealth in an environment of long-term 15% inflation. We found that, that being short the dollar in the form of a mortgage could produce economic returns equivalent to a conventional investment with an annual yield of 46%, on an inflation-adjusted and tax-adjusted basis! We discussed how this illustrative yield was both robust and fragile – robust in that high yields were earned with any substantial inflation scenario, and fragile in that this opportunity was based upon the continued availability of low long-term interest rates.

In this last reading within the main sequence of the “Turning Inflation Into Wealth” mini-course, we will explore an intriguing set of questions. We will begin by exploring an intriguing 80% “coincidence”. We will look at why an increased rate of inflation rearranges the importance of various investment factors, as well as how it increases the risks of using debt. We will then look at the need to find a balance point, where we can safely use debt to redistribute wealth to us.

Eighty Percent Coincidence?

One. Real estate investment is often cited as the number one source of substantial wealth in the United States, with somewhere around seventy to eighty percent (depending on the source) of all millionaires owing their financial status primarily to real estate. Please note this is not about the short term flipping associated with the real estate bubble, but rather the long term accumulation of wealth.

Two. According to government inflation statistics ( ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt ), the dollar lost eighty percent of its value between September of 1972 and September of 2007.

Looking at the eighty percent figures in One and Two above – do you think it is possible that there is a relationship between them?

As we’ve reviewed, while there can be significant exceptions in particular times and locations, on a national basis over the decades, real estate by itself tends to keep up with inflation, rather than being a wealth creator in inflation-adjusted terms. However, the inflation-driven destruction of mortgages on real estate does quite directly create major amounts of personal wealth that is quite real on an inflation and tax-adjusted basis. Could it be that when we look at the source of around 70-80% of a nation’s millionaires during a time that has seen the destruction of 80% of the value of the dollar – that it is not a coincidence?

While widely quoted, the statistical source of the 70-80% number is a bit hard to trace, though it is broadly in line when we include primary residences. When we go to the 2004 Federal Reserve’s Survey of Consumer Finances (well before the peak of the real estate bubble) we find that the median assets of the top 11 million (10%) of households by net worth were $1.6 million, and that 58% ($0.9 million) of those assets were non-financial assets – primarily homes, commercial property equity and privately held business equity. So, in actual practice, when we look at the composition of real wealth for the median of the 11 million wealthiest households in the US, it is not mainly about stocks, bonds or mutual funds at all – however unlikely that may appear when looking at financial industry advertising, particularly before 2008.

Could it be that the explanation for this widespread source of achieved real world wealth is not the illusion of the nominal, not the real estate by itself, but the cumulative effects of millions of 1-2 combinations of debt “left hooks” working with real estate “right jabs”? With most of the real wealth creation power coming gradually over time, from the “left hook” in long-term financial environment where the dollar has lost 80% of its value? Could it be that millions of not just households – but commercial property investors – have already benefited from what we have reviewed in this course? Even if few have fully understood all of the sources of their wealth?

The issue is one of vision – which is why vision was something we returned to time and again in the early readings. Going back to our Inflation Pickpocket and Inflation Vision Readings – Peter never really understood what happened to his real wealth when his pocket was “picked”, and he couldn’t so long as he was looking only at nominal dollars. As we saw in our readings on Boxing With Inflation in theory and practice, it wasn’t buying real estate that made money historically, however obvious that case looks in nominal dollar terms.

Yes, real estate is being battered. But while real estate investing was the greatest source of individual wealth in practice, the real estate itself was never was the source of that wealth. So we have a market where the prices of the assets have been growing more and more attractive, even while massive government interventions have greatly increased the arbitrage opportunity with the true source of where the historical wealth really was created. Work with your perspective here, think it through and much of what was discussed in the previous reading about making money even assuming the price of real estate continues to fall – may start to come together.)

When we add recent US history up, we have literally millions of people who have created tremendous sums of real wealth through investing in real estate – that doesn’t usually produce real wealth gains by itself. When you step back and look at real estate from those terms – how does that add up? Where did all that real wealth come from?

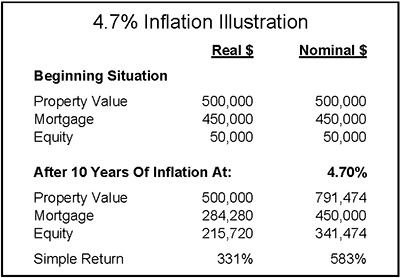

The answer could be as simple as the illustration below:

The chart above is based upon a 4.7% inflation rate – which just happens to be the average US inflation rate over the last 35 years. If you take historical inflation over ten years, a $500,000 tangible asset that keeps up with inflation will become an almost $800,000 asset – yet you won’t really make a dollar, in purchasing power terms. Add a “left hook” to the mix however – and your net worth climbs by 331% in real terms, and 583% in nominal terms. Yes, much of the detail we covered in past readings has been left out, but the core is there and plain to see.

An Accelerating Current

Going with the natural, downstream current of an 80% destruction of the value of the dollar over the last 35 years may have created more millionaires than any other financial force. Yet, as we have also discussed, there are good reasons to believe that this was only a taste of the wealth redistributions that will come in the years ahead. As an example, if there is anything even close to a 95% destruction of the value of a dollar over the next 20 years – then the redistribution of wealth will occur on a scale that far exceeds what we in the US have seen in our lifetimes to date. Fortunes will be made in relatively short periods of time, even as many other fortunes are lost just as quickly.

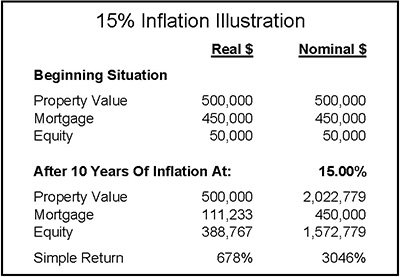

In our previous reading, we talked about earning the equivalent of a 46% after-tax and after-inflation return in an environment of 15% inflation, when compared to a conventional investment. Sounds highly attractive, but what does that mean in dollars? Consider the simple example below, which is our historical 4.7% inflation illustration from the previous page, modified to reflect an assumption of an average 15% inflation rate over a ten year investment horizon.

As we saw with our historical 4.7% rate of inflation, $50 thousand grew into a nominal $341 thousand. Take a rate of inflation that makes Boomer retirement promises affordable (with “managed” inflation indexes), and our nominal net worth jumps from $50,000 to $1.6 million in ten years! A result that is achieved merely by finding a tangible asset that does no more than maintain its value in inflation-adjusted terms, and then letting inflation wash away the real value of the debt. That is what happens when inflation accelerates from a swift current to a raging torrent – our $291 thousand profit jumps up into a $1.5 million dollar profit. Allowing for the destruction of the purchasing power of the dollar does (of course) slash our benefits, but we are still achieving a 678% return in that illustration, even on an inflation-adjusted basis.

Whether we view it the same way everyone around us will – turning $50 thousand into $1.6 million – or we use our vision to see the lower but still highly attractive real dollar figure, we need to keep the source in mind. As we started this course by explaining in “Inflation Pickpocket” – our new wealth isn’t “free money” nor does it come from the creation of new goods and services. Our increased real wealth, our increased rights to goods and services, is a redistribution of wealth that used to belong to corporations and other people.

Now, there is nothing wrong or immoral about this, any more than the business decisions involved with the sale or purchase of any investment or asset. If a schoolmate came to when you were 12 years old and offered to sell you a baseball card for fifty cents, and it is worth $50 thousand three decades later – you didn’t take $50 thousand from him. You made the opposite business decisions, and one of you made a wise one, and one made a poor one, each for your own good reasons. If you have the intelligence to spend the time seeking new financial knowledge and come across this course, and that means that you financially benefit from the same inflation which is wreaking widespread financial devastation on those around you, it just means you are being rewarded for your taking the time to make better decisions.

However, before your plans get too advanced for how you will spend your newfound real wealth in our likely inflationary future, it is worth spending a little time talking about those three key words, “widespread financial devastation”…

Rapids Ahead!

As experienced canoeists and kayakers know, when you are heading down a river and the current suddenly speeds up – that often means there are rapids just around the bend. As the water accelerates, a formerly smooth river can quick turn to whitewater, filled with rocks, ledges, and powerful currents trying to pull you straight into those hazards. Something else happens too – the Sunday afternoon boaters whose skills had been fine for smooth water conditions, usually flip over fairly quickly, and end up going down the rapids without the protection of their boats, with their former possessions on the bottom or floating away. Unfortunately, these same problems are all too applicable to accelerating financial currents as well.

High rates of inflation can rapidly redistribute wealth, and this can be true both domestically and internationally. If the dollar were to plunge then acquiring oil and other energy assets would become much more expensive for the United States as a whole, meaning there is substantively less money to be spent on other consumer spending – with a stock market whose value is predicated upon unending growth in consumer spending. When interest rates shoot up with inflation, it means that credit card and adjustable rate mortgages will take ever more cash, leading to still less money available for discretionary consumer spending. Leading to a burst of unemployment, that pushes consumer confidence lower, which pushes consumer spending lower, and then leads to another round of unemployment as the recession deepens.

Each of these factors then feed back to lower corporate profits, even as the “discount rate” on expected future corporate profits rises with inflation, meaning that stock prices must plunge in real terms (albeit while still possibly rising and generating taxable income in nominal terms). Bond prices will be hit even worse than stock prices, generating returns that are negative in nominal dollar as well as real dollar terms. This means that the two cornerstones underlying retiree income may very well be simultaneously plunging (much as they did through the 70s). This will of course be devastating with conventionally invested individual retirement accounts, but will be even worse for the governments and corporations who have contractually pledged their full faith and credit to meeting retiree pension obligations. Even while they are struggling in an adverse business environment, they will face enormous deficits between portfolios values and retiree promises, leading to still more economic stress – and still higher levels of unemployment.

This is not to say that we are looking at a financial doomsday scenario, not at all. People and economies are remarkably flexible, and they will adapt. Using their intelligence, creativity and high degree of motivation to act in their own self-interests, much of the population will find ways to thrive even under conditions that are quite different from what we see today. That said, there will likely be substantial economic dislocations that will occur, likely a series of them, and these dislocations will likely substantially stress the economy and employment even while they are destroying retiree wealth. Indeed, it is the retirees who are most at risk in this scenario, for their wealth loss with existing portfolios will be permanent, and many will have the least options for generating new wealth in a new economy.

(The dilemma of how retirees can withstand a potentially devastating combination of Monetary Inflation, Inflation Taxes, and Asset Deflation, even as 4 million Boomers a year flip over from buying assets to selling assets, is another of the core topics of the Turning Inflation Into Wealth Complete Video Course.)

Will the above or something like it happen? There are no guarantees (and I lack a crystal ball), but with a high chance of future substantial inflation, there is also a high chance of future economic turmoil. Therefore any long-term inflation strategy should incorporate the ability to weather prolonged and potentially severe recessions. Stagflation is a powerful economic force, as the US found during the late 1970s. As we face a future that is potentially much more inflationary than the 1970s – we need to allow for an ongoing depression that may be worse than anything seen in the US since the 1930s.

This is the point where we need to separate our Turning Inflation Into Wealth strategy from mere leverage – for depressions and recessions are typically catastrophic for the simple strategy of borrowing as much as you can, and hoping things work out for the best. This course is not about leverage – it is about inflation redistributing wealth to you. On the surface, the two concepts may look similar but they are not the same at all – you want debt that will be safely and rapidly annihilated by inflation, not debt that will destroy you in inflation-induced economic turbulence.

Striking A Balance Point

Better explaining the difference between leverage and safely Turning Inflation Into Wealth is the purpose of “Commercial Property Balance Point: Achieve Deep Protection From Economic Turmoil While Turning Inflation Into Wealth”, which is one of the components of the “Real Estate, Retirement & Inflation Readings” book.

The information and perspective contained in “Balance Point” can sometimes surprise readers, as it may appear to be the direct opposite of what we have covered in this course. “Balance Point” urges commercial property owners to consider reducing their debt to levels far below industry norms. How can that be reconciled with what we have spent the last twelve readings exploring – the numerous wealth redistribution and tax advantages of being short the dollar through using debt?

We can’t go into the 26 pages of detail in “Balance Point” here (eye-opening though they are), but one reason for the discrepancy is that high leverage is the norm for commercial property investors, while having no debt at all is often the goal for other types of investors – the starting points are quite different, in other words. Unfortunately, the prevailing commercial property model of wealth maximization through debt maximization also often leads to quite different debt choices than the debt we have described herein.

When you are trying to borrow as much money as possible, and the early year property income is limited, then you achieve your maximum borrowing amount by minimizing your initial interest costs. This means that you take on short term or adjustable rate debt, with the assumption you will be able to refinance when needed. (A similar assumption to that made by all too many subprime homeowners when they chose adjustable rates.) With this quite common approach, debt becomes a wealth destroyer when rising inflation boosts interest rates faster than rents, even as economic turmoil hits and increases vacancies.

Regardless of your choice of tangible assets, when you wish to profit from inflation during a time of economic turmoil, then you must strike a balance between opposing forces. Too much debt – and you risk being unable to make your payments, and losing the tangible asset. Too little debt – and you unnecessarily give up too much of your powerful ability to achieve extraordinary returns through aligning yourself with broad economic forces on a tax-advantaged basis. Making finding this balance more difficult, is that there is no one balance point. The balance point varies by tangible asset class, investor philosophy, and also a wide spectrum of investor circumstances, such as age, income, net worth, objectives, and so forth.

There is of course the usual investment decision default of just continuing with what has worked in the past. Look at history, pick what would have worked best over the last 35 years, and then go with that choice. However, while our Turning Inflation Into Wealth strategy worked quite well in the inflationary past, we are anticipating a strong possibility of much stronger inflation in the future, and as we will see below, that just might change everything.

The Fast Current Conundrum

What a faster current means is that the importance of the various factors which determine investment success are rearranged. The slower the inflation current – the less important the destruction of your debts. With little or no inflation – then the investment results will be heavily dependent on asset results. Making good choices for the numerous factors involved in choosing a piece of property, or tangible asset class, may be more important than your liability strategy.

When inflation averages even a moderate speed, such as the 4.7% pace of the last 35 years, then the game changes. If we follow the “newspaper headline” strategy of investing where we look only at nominal dollar gains, then our apparent source of profits remains the assets, and this is where we look for wealth gains. While the financial commentators follow the gyrations of financial assets, inflation steadily eats away at the value of the debts which finance tangible assets such as real estate, and real wealth is slowly redistributed on a tax-advantaged basis in the background. It is only when we look at the real world results of decades of investor experience – see where the most people experienced the largest gains in their after-inflation net worth as the dollar lost 80% of its value – that the pervasive power of this long-term wealth redistribution force becomes plain.

When the current accelerates however, there is another rearrangement in importance between assets and liabilities in determining future net worth. This is our conundrum with a faster current:

- Record inflation will mean that the wealth gained through debt strategies will become the most important that it has ever been in US financial history. Never before will debt have had such an important role in wealth redistribution. Never before will the tax aspects of this redistribution have been so important. Never before will the “left hook” debt have so dominated the tangible asset “right jab” when we look at the after-inflation redistribution of wealth.

- Record inflation may also lead to economic turbulence that in the short term will lead to record numbers of debt defaults. With time for inflation to reduce real debt service costs this danger will fade for people who lock in at current levels, but to get to this safer long term – will require surviving a potentially turbulent near term.

A faster rate of inflation changes everything. The very fundamentals of the way wealth is achieved turn upside down. A 30 year, 6.5% bond with a par amount of $100,000, becomes worth $7,900 after ten years of 15% inflation, for a loss of 92.1%, when we look at market value in inflation-adjusted terms. As we have discussed in previous readings, the last time we had significant inflation – the Dow Jones lost 62% in ten years in inflation-adjusted terms (exclusive of dividends). With a higher rate of inflation, compounded by the systematic liquidation of millions of Boomer portfolios as they reach retirement age – a mere 62% loss in inflation-adjusted terms could look pretty good compared to what may await us.

At the very same time, the inflationary currents that are destroying millions of conventional investor dreams, will also be slashing the costs of outstanding debt. Using our 15% inflation example, this means that the purchasing power needed to repay a given debt will be falling at a rate of 15% per year. By itself, this will be producing wealth gains for debtors that are in excess of historical long-term rates of return for any conventional asset investment class. When we add in the tax benefits covered in earlier readings, and assuming that we took advantage of today’s market and locked in at some of the lowest borrowing rates of the last 35 years, then our debt strategy could be producing an after-inflation and after-tax return equivalent to a conventional investment earning 46%.

A high enough rate of inflation that remorselessly destroys the symbol that is the dollar produces an exaggerated photographic negative, where white turns into black, and what was black becomes white. The traditional investment sources of wealth become black holes, consuming the paper net worths and life savings of millions of conventional investors. The people who hunker down and hold onto their cash while minimizing their debts, watch the purchasing power of their savings blow away like sand in the wind, as the value of the symbols that are dollars are blown away. As the value of the debts are also blown away, leaving the fortunate ones who used debts to buy tangible assets with full ownership of their much larger portfolios of real assets.

For those whose debt choices were such that they survived the maelstrom, that is. And maelstrom it will be for the stability of the economy is to a large extent based upon accepting that a symbol is not only real but concrete. When the concrete becomes vapor, the impact is to throw the economy into turmoil. And in an economy that is in turmoil – debt destroys households even more easily than it creates wealth. It will only be carefully selected types of debts that will most effectively turn inflation into wealth, entered into with the most careful of consideration. For the overextended who can barely cover their debts, when powerful inflation causes their variable interest rates to jump upwards even as their layoff notice arrives – debt will most assuredly not be their friend.

Finishing The Mini-Course & The Readings Ahead

With this reading, you have now completed the main segment of the Turning Inflation Into Wealth mini-course. The mini-course will continue at a slower pace, and you have much more to read if you choose to stay subscribed. For some people, the most interesting readings are still to come.

I’m proud of the content of these readings, and I have stacks of e-mails from people telling me how valuable they have found the remaining readings to be. That said, there are a couple of inherent limitations:

- They explore problems rather than providing solutions

- Many “start from scratch” and assume you haven’t read any of the other materials – so they don’t build on each other

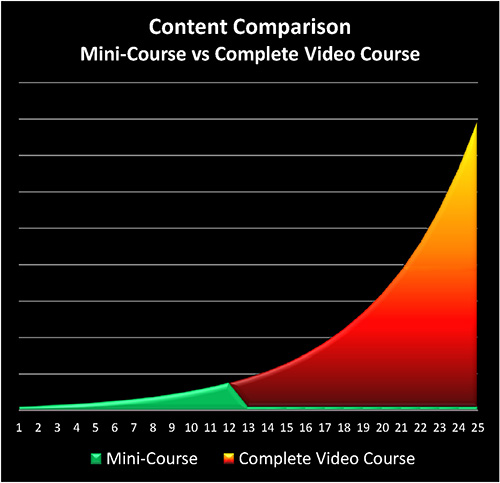

This doesn’t mean that that they are second rate materials – no, each is a substantive 15-25 page piece of work, with thought-provoking and sometimes unique perspectives which may be of keen interest to you. But they are quite different from what we have been doing here, and what is ahead in the Complete Video Course. The graph below is the best way I can clearly explain the difference.

The 12 part mini-course was not a newsletter – it’s not about what is happening this week. The mini-course has been about education and paradigm change. About teaching things that can’t be effectively taught in one article, or one three part series. That means that it built knowledge step by step in a carefully designed sequence. To continue the education and take it where it is designed to go – means moving on to the complete course. The building upon the foundation developed only continues in the main course. It is that building, which is what you need the most, and where the solutions are developed.

I didn’t actually start off to be an inflation writer at all, let alone an inflation tax writer. What I saw over the last twenty years was:

- Fifty million Boomer investors in the US using their life savings to pursue a mathematical impossibility, within a dominant investment paradigm that created a veneer of sophistication – but was based upon what could be easily demonstrated to be a series of simplistic absurdities;

- A real estate industry that held unique potential for weathering the storm ahead – but would lead to the financial destruction of many or most real estate investors, because of the flawed dominant paradigm in that market, of maximum leverage that could not withstand severe economic turmoil and asset deflation;

- A stacking of impossible promises for Boomer retirees to such a degree that the breaking of those promises was the only possible outcome; and

- A building derivatives house of cards that created huge risks that were not only possible but near inevitable – given enough time and the assuming the economic cycle had not been repealed (unlike Wall Street’s implicit assumptions).

When you put all four of the above together – you get:

- Pervasive monetary inflation, i.e. the destruction of the value of money;

- Pervasive asset deflation, i.e. the destruction of the value of investments; and

- An unequal destruction in which wealth is redistributed, and retirees, retirement investors and other long-term investors face the worst damage.

The conventional investment wisdom can’t handle the above. They are outside of the assumptions so to speak. Yet, that is the environment we are currently in, with plunging asset values even as pressures rapidly build that could lead to swift and catastrophic inflation.

To not deal with this situation – is to be a passive victim. To continue to take the same abysmally bad advice from the most respected of financial authorities who have failed us all so badly at least three times in the last twelve years, and hope things turn out differently this time – well, it’s a choice. In my opinion, the better choice is to proactively change your financial strategy, while rejecting a conventional wisdom that has been proven to be badly flawed.

Which means going new places – and using strategies that may appear to be profoundly counterintuitive, when viewed from the perspective of the (deeply wounded, but still quite active) dominant financial paradigm.

http://danielamerman.com/aFour.htm

If A Friend Sent You This Link

If you found this reading because of a friend’s recommendation, then you should know that it is part of a free book on Turning Inflation Into Wealth. Sign-up below if you would like your own copy of this valuable educational resource, delivered via e-mail.

If there is something in this reading that you think a friend or colleague would find helpful, you are encouraged to send them a link to this webpage.

Please DO NOT use the form above to sign up friends without their permission. The book is intended only for people who want it, and have given their permission by signing up for it.

All readings in the book are the exclusive property of Daniel R. Amerman, CFA. Subscribers are allowed to print a single copy for their own usage. Any other copying of materials from these readings and reposting or reprinting elsewhere is strictly prohibited and constitutes a violation of international copyright law. If you would like to share these educational materials with others - please use a link to this website.