Making 9 Million Jobless "Vanish": How The Government Manipulates Unemployment Statistics

When we look at broad measures of jobs and population, then the beginning of 2012 was one of the worst months in US history, with a total of 2.3 million people losing jobs or leaving the workforce in a single month. Yet, the official unemployment rate showed a decline from 8.5% to 8.3% in January - and was such cheering news that it set off a stock rally.

How can there be such a stark contrast between the cheerful surface and an underlying reality that is getting worse?

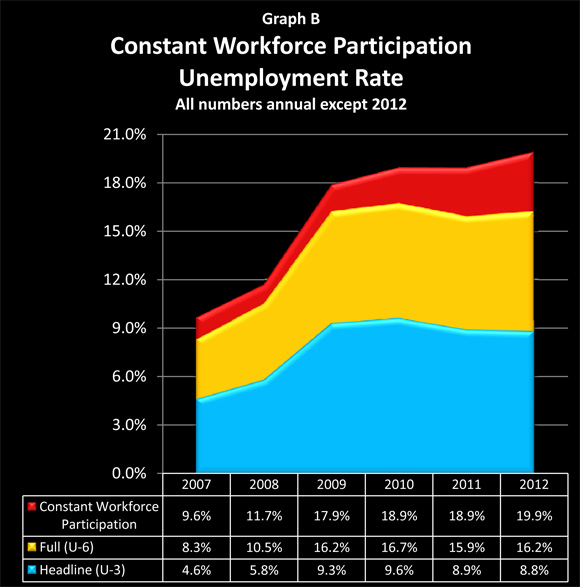

As we will explore herein, a detailed look at the government's own data base shows that about 9 million people without jobs have been removed from the labor force simply by the government defining them as not being in the labor force anymore. Indeed - effectively all of the decreases in unemployment rate percentages since 2009 have come not from new jobs, but through reducing the workforce participation rate so that millions of jobless people are removed from the labor force by definition.

Hiding A Depression: How The US Government Does It

(This article is from 2011 and precedes the article above. It examines another way in which unemployment is covered up.)

The real US unemployment rate is between 25% and 30%. That is a depression level of job losses - so why doesn't it look like a depression for many people? How can so large of a statistical discrepancy exist, and how is it that holiday shopping malls are so crowded in a depression?

The true devastation is hidden by essentially placing the job losses inside three different "boxes": the official unemployment box, the true full unemployment box, and most importantly, the staggering and persistent private sector job loss box that has been temporarily covered over by a fantastic level of governmental deficit spending. The "recovering and out of the recession" cover story is only plausible when nobody connects the dots and adds all the boxes together.

We will add together the three boxes herein - using US government statistics for all three - and convincingly show that the US economy is in far worse condition than what is presented by the government or by the mainstream media. No, we have not emerged from "recession" and there will be no "double dip" - because the first "dip" was straight down to a depression-level economy in 2008/2009, and we haven't come back up.

Leaked IMF Report Shows Dangers For US Economy

A confidential internal International Monetary Fund report was recently leaked to the Wall Street Journal, with the contents later being made public by the IMF. The contents of this report have major implications for Europe, but even greater implications for the United States.

Briefly, the International Monetary Fund and European Union did not force balanced budgets upon Greece, but only a reduction in the level of deficits.

The IMF's economists estimated that this reduction in deficits would lead to a 5.5% reduction in the size of the Greek economy. But they were horrified to discover that in practice they were dead wrong, as it instead resulted in a 17% contraction in the Greek economy, or just over three times the damage that they were estimating.

They were also badly mistaken, as they belatedly came to realize, when it came to the impact of these deficit cuts on the official unemployment rate.

That is, the IMF had expected unemployment to rise to 15%, which was unpleasant, but a necessary part of the belt-tightening associated with austerity and reducing the levels of government deficit. In practice, however, unemployment jumped to 25%, a level grossly in excess of IMF estimates, and which also placed the entire economic theory underlying the austerity approach in jeopardy.

The issue is what economists refer to as the fiscal multiplier– and this is what the IMF so badly underestimated. What they failed to fully take into account is that when all those beneficiaries of government spending lost their income - whether they be government employees, private contractors or transfer beneficiaries - they would stop spending their income.

So when the corporations, and municipalities, and waiters, and cooks, and convenience store employees whose jobs were dependent on that spending saw a contraction in their own revenues, they spent less as well. Which led to reduced employment, and a further reduced economy that spiraled down in a multiplier effect, causing the Greek economy to contract three times more than expected, even as unemployment levels grew to a level that was almost twice as high as expected.

Greece is not the only nation that has what could be called an "artificial" economy, if we define an artificial economy as being one where both economic output and employment levels are each materially dependent on the government borrowing money that it can't possibly pay back under normal circumstances.

And arguably the globe's largest "artificial" economy is also the globe's largest economy – which is that of the United States of America.