Hiding A $500 Billion Tax On Savings: How The Government Deceives Millions

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Comparison To Other Taxes

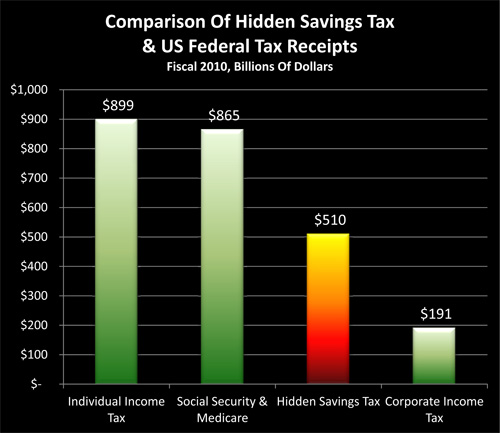

The graph below illustrates just how large this hidden tax is in comparison to some well known overt taxes (from the White House OMB for fiscal year 2010, the most recent year which is not estimate based).

The hidden tax on savings is more than half the size of total individual income taxes for fiscal year 2010.

It is almost sixty percent of the size of total Social Insurance and Retirement taxes (primarily Social Security, Medicare and Medicaid).

Savers paid almost three times as much in hidden taxes as the total federal incomes taxes paid by all corporations.

Much Higher Cost Than $510 Billion

In the interest of effective communication about this vital issue, a highly simplified approach has been taken here and many complexities have been left out. One complication is that the US government does not borrow exclusively in the short term, and it does pay higher interest rates on medium and long-term borrowing.

However, these other interest rates have also been the subject of extraordinary levels of manipulation, and on a historical basis, medium and long term interest rates have been forced down to record lows relative to the current "official" rate of inflation. They are even farther below the real (as opposed to "official") rate of inflation that we pay at the grocery store and elsewhere, and are also remarkably low for a downgraded government that is openly "printing" money by the trillions.

Of even greater importance is that the US government has distorted interest rates for all borrowers and lenders. Banks, corporations, and mortgage borrowers are therefore able to obtain funding at well under market interest rates for their own private purposes, and savers have little choice but to provide the funding. This massive government manipulation of interest rates, that serves the government's interests as the nation's largest borrower, distorts the relationships between all savers and all borrowers in the economy.

If we take into account all debt and not just federal government debt, and we also use a rate of inflation that is truly reflective of such things as grocery bills, utility bills, clothing, and the soaring cost of medical insurance and college tuition (rather than the official rate of inflation), then $510 billion is only a fraction of the true confiscation of net worth that is victimizing tens of millions of innocent savers. Indeed, a rough estimate of the true total damage could run in the range of 2 to 4 times the annual $510 billion estimate developed herein.

Savers, Retirees & The Redistribution Of Wealth

Not all citizens pay the tax equally; instead the hidden savings tax acts to redistribute wealth between different segments within society. There is a powerful generational aspect, as the young typically don't have substantial savings. The poor and lower middle class usually have little savings, while the truly wealthy have the funds and advisors to pursue quite different strategies.

The maximum damage is inflicted on the middle class, and it is particularly the older segment of the middle class who are disproportionately victimized by this hidden tax. They are typically the ones with the substantial savings held in interest-bearing investments. The purpose of these savings is most often to build financial security for future or current retirement. In other words, it is retirement savings that are being confiscated in order to hold down government interest costs.

Anyone who is retired or saving for retirement and has accumulated significant savings has a personal knowledge of just how extraordinarily frustrating the current interest rate environment is. Tens of millions of the most productive members of society labored for years, got financially educated, and deferred gratification, all in pursuit of what the media and their advisors assured them would be a relatively sure thing when it comes to enjoying financial security in retirement.

Looking at the financial turmoil that is consuming the world, the need for financial security has never been higher, but these responsible and hard working people see their savings strategies collapsing - because the yields simply aren't there. There is no way to stay ahead of inflation on an after-tax basis through following conventional strategies, without taking risks that may far exceed what investors had in mind for this stage of their lives.

This situation is the direct result of entirely deliberate government policies, and the fact that an entire generation of conventional retirement investors is losing massive sums of wealth every year at the exact same time that the US government is spending extraordinary sums of money every year - is no mere coincidence.

Financial Repression & The Destruction Of Financial Planning

Among professional economists, there is a term for what the US government is currently doing, and it has a long history. "Financial Repression" is the strategy the US government (along with many other nations in the developed world) used to pay down the massive government debts outstanding after World War II. My article linked below, "Financial Repression: A Sheep Shearing Instruction Manual", contains essential information about how and why the US government is again using this strategy on a massive scale.

It isn't just interest rates that are failing to keep up with inflation. As anyone who is receiving Social Security or has an inflation-indexed salary knows well: the cost of living adjustments aren't keeping up with the rate at which actual prices are increasing. Why that is, and why it is highly likely to continue are explained in my article, "The 2nd Edge Of Modern Financial Repression: Manipulating Inflation Indexes To Steal From Retirees & Public Workers", linked below.

Financial Repression is outside of the assumptions used in conventional financial planning, even as it dooms conventional retirement investment strategies. Indeed, that is more or less the point: the government creates a financial playing field which is designed to systematically take wealth from savers - while sealing the exits - so the wealth can then be redistributed by the government. There is simply no way to beat the government, so long as you play the way the government wants you to.

Take a quite different and unconventional approach - and Financial Repression creates a target rich environment to build wealth. But to avoid victim status and instead see these opportunities, requires seeing with clarity exactly what is really going on. This article is designed to help deliver that vision, and I hope that you have found it to be of use.