20 Global Implications Of French Presidential Election

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

7. German Windfall Profits & Rapid Redistribution Of Wealth Within Europe

If the Euro collapses, it may create an enormous financial windfall for millions of individual Germans as well as German companies, not to mention the German government. While leaving the monetary union is still far from certain, as Germany also has strong economic and political incentives to stay in the EMU, the analysis linked below says “what if” and explores some of the startling benefits - as well as the many perils - for nations and individuals that can result from quickly exiting a failing monetary union.

The implications go far beyond Germans and Germany (although there are very important implications for arbitrage opportunities with German companies). That is, in this world of financial crisis and sovereign debt crisis, there are powerful related wealth and financial security implications for individuals in every country.

European Redistribution Of Wealth

8. US Dollar, Short Term

If the one former major competitor to the dollar as reserve currency – the euro – were to effectively implode, then the US dollar's value as the world's reserve currency is likely to be substantially strengthened in the short term, as a panic-stricken globe seeks refuge from the euro collapse.

The short term effect of being the world's sole remaining reserve currency in a time of crisis might be a flood of foreign funds being sent into US dollar-denominated investments in general, and US Treasuries in particular. This could involve not only the rapid pulling out of funds from Europe, but many other investors may reduce exposures to their own currencies and make a move to the dollar as well, in an unprecedented flight to perceived safety. The buying power of the US dollar may surge in this global rush for safety.

9. Consumer Prices

The rapidly rising value of the US dollar would have the immediate effect of making almost all imports cheaper to buy, and so a trip down the aisles of Wal-mart may, for a brief period, become less expensive for the American consumer. The price decreases could be exacerbated by exporters from around the world engaging in vicious price competition within the US market, trying to keep their factories going and to offset the loss in consumption in Europe.

10. Unemployment

If this political divide brings down the Euro and Eurozone economies - then the latest poor jobs report in the US becomes inconsequential trivia, as a crisis greater than the Great Depression of the 1930s slams into a weak and structurally unsound US economy and continues on into Asia.

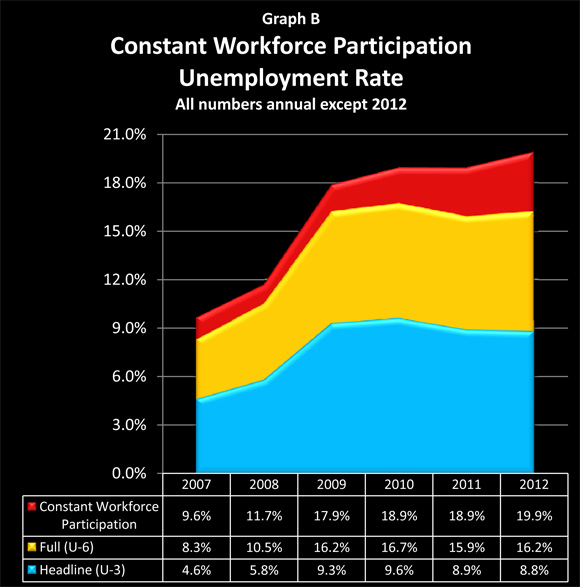

The US economy is already in the worst shape that it has been since the 1930s, with real unemployment in the 20% range. The headline unemployment rate is kept below 10% only through statistical manipulation, as covered in detail in my analysis, "Making 9 Million Jobless 'Vanish': How The US Government Manipulates Unemployment Statistics", linked below.

Making 9 Million Jobless Americans Vanish

Because of the combination of the surge in the value of the US dollar and the reduction in the size of the European economy, US workers may face devastating job losses in two major categories: exports to other nations, and goods consumed in America.

American workers in export-driven industries will lose jobs because dollar-priced US goods will be more expensive for the rest of the world to buy. This decreasing competitiveness will be compounded by a drop in consumption in the huge European markets, resulting in less US exports. There is also the third danger of a drop in overall global consumption, due to increasing unemployment in exporting nations.

In a global scramble to maintain employment even as consumption falls, the last thing workers want is to be handcuffed by having their products priced in the world's "reserve currency" - and that is the exact situation that American workers will be in.

The second major category of job losses will be found among the producers of goods consumed in the US. Because the dollar is more expensive, American workers will be undercut by other workers around the world, as imports grow cheaper and more difficult to compete with. These lower-cost goods mean that there may be a brief "Indian Summer" of lower prices for American consumers.

However, this will sadly likely be accompanied by a fundamental weakening of the US economy as unemployment surges, and fewer people can afford to make the purchases at all. Which then further reduces overall global consumption, intensifying the competition among exporters.

There may also then be increased "outsourcing" as American corporations seek to lower production costs by moving employment out of the US.

11. Gasoline & Energy

As a result of a likely depressed global economy leading to reduced energy usage, most nations are likely to see a declining cost of energy imports (with the exception of Europe, depending on how devastating the currency damage turns out to be). Because the US will benefit in this regard from the 1-2 combination of a higher valued currency and decreased global demand, the decline in the cost of energy may be particularly sharp in the United States. This cheaper energy will be an offsetting factor when it comes to global competitiveness for US firms, but likely not nearly enough to overcome the dollar's strength.

12. US Financial Institutions

Up to this point, the markets have been focusing on the US financial institutions which have the greatest direct exposure to Europe and European banks. However, in the months following a potential Eurozone collapse, the secondary or ripple effects are likely to dwarf the first round of primary effects – and few major banks will be positioned to withstand it. After all, the US economy is still reeling from the last financial crisis, and there has been no real recovery to date.

A new second round of depression slamming into the global and US markets means a potentially massive increase in unemployment, with delinquencies soaring in all categories of consumer credit along with bankruptcies. There will also be dire financial implications for firms relying on exports or US consumer sales - and those two categories cover most of the private economy. This could all lead to a rapid increase in corporate loan losses. Most important of all could be the extraordinary effects upon the derivatives markets (see "Derivatives" below).

Over time, and as the interrelated negative effects compound upon each other, the direct and indirect effects of a Eurozone collapse are likely to be a "doomsday" event for the major US banks, absent another likely round of massive government interventions (see "US Deficit & Credit Rating" below).

13. Derivatives

A potential euro collapse threatens the possible near term annihilation of the financial system through both credit derivatives and interest rate derivatives losses. The near criminal insanity of investment bankers writing themselves massive bonus checks for effectively standing in a circle and making promises to each other that none of them have ever had the capital to back up (in the event of genuine systemic crisis), will be brought to the fore.

Absent massive government interventions, we may have a bankrupt financial system where none of the highly leveraged big players have any real capital remaining because their loan and investment portfolios went bad, but they still owe massive amounts of money to each other as counterparties on the hundreds of trillions of dollars in derivatives contracts.

The nominal sum of derivatives contracts outstanding is about $700 trillion, while the global GDP is estimated to be about $63 trillion. If the governments assume and honor the derivatives contracts, then they could be on the line for a cumulative bailout that exceeds the size of the global economy (though this would be reduced by the netting out of offsetting contracts). As a more likely alternative, there would be attempts at a legal "fix" of some sort, where governments use their lawmaking, regulatory and monetization powers to maintain a functional banking system, but would effectively set aside the rule of law (in one way or another) when it comes to derivatives contracts.

14. US Deficit & Credit Rating

If the Eurozone economy collapses, then the US government is likely to face a situation of soaring unemployment, a failing economy, and a bankrupt financial system. Given the political realities and the track record, the reaction of the US government is all too predictable:

1) Spend federal money like there is no tomorrow in an attempt to boost employment levels;

2) Run federal deficit spending up to all new levels as the money is spent but taxes aren't increased;

3) Massively bailout the US financial industry;

4) Bailout other US major corporations as needed; and

5) Create trillions more dollars out of thin air to finance the above (see "Federal Reserve & Monetization" implications below).

This radical increase in the federal deficit accompanied by "printing" ever more money should "downgrade" both the US dollar and the entire US financial system as well as the US government.

15. Federal Reserve & Monetization

The Federal Reserve's responses to the events of late 2008 and beyond may serve as a guide to some of the strategies that could be deployed in a new crisis. There are likely to be multiple key stages in a developing crisis, where the Fed will use its unique powers to create and give out trillions of dollars - with little public attention - either in asset purchases (at non-market prices), or in actual and contingent lines of credit, or in dollar swaps, or in hidden bailouts that are only limited by the imagination of the Federal Reserve.

The Fed will again want to move quickly and without Congressional approval, and will particularly seek to avoid openly including the bailouts in the federal budget. Beneficiaries are likely to include US banks, foreign banks, and major US and foreign corporations.

There may also be massive monetary-creation events for the dual purposes of funding radically increased US deficit borrowing, while still keeping borrowing rates below the rate of inflation.

Rather than another TARP-type program for troubled assets that have not actually defaulted, look for the Federal Reserve to take to all new levels its program of directly creating money and using that to purchase investments from banks at non-market prices. This is likely to contribute to the "hollowing out" of financial institutions on a global basis, as performing economic assets are increasingly replaced by central bank reserve balances which have no inherent economic value.

Primer On Monetary Creation & Hollowing Out Banks

16. US Dollar, Long Term

After the immediate crisis and panic-induced global dash for safety is over, then the United States will be in a highly unstable and precarious position, with an effectively artificial economy that is not putting out the goods needed to pay for what it consumes. There will be massive paper money creation as the US engages in currency warfare to bring down the value of the dollar, even as artificially-funded jobs are created all across the country. Something will have to give - as historically, it always eventually does.

From one source or another there will be a push. That push could have a domestic origin, or more likely an international origin. Either way, because the underlying fundamentals will have already collapsed, and all that will be holding up the value of the dollar is a collective belief system, then once the fall of the US dollar gets going and the rest of the globe heads for the exits, it could be very rapid and near impossible to stop.

We could see a whipsaw in import costs if this scenario occurs. There will be a soaring cost of energy and gasoline as the dollar implodes and oil-exporting countries no longer want US dollars that are plunging in value. We could see a sudden spike in the cost of virtually all the imports that are consumed by the US, with that external supply shock inflation rapidly becoming internalized, and domestically produced goods and services soaring in price as well.

This very high rate of inflation would be economically devastating, and ultimately the only way to stop the damage will be to stop the monetary creation and stop the stimulus spending. Which means that more millions of people would become unemployed as the economic damage that was done to the corporations, banks, and state and local governments must finally be recognized.

17. State & Local Governments

State and local governments in the United States are likely to face a deadly combination of soaring unemployment which increases expenditures, even while income and sales tax revenues are falling with employment and consumption. This may be compounded by highly adverse results in pension investment portfolios, thereby pushing highly stressed states and cities into insolvency across the nation. What is more likely than this scenario of nationwide state and local government bankruptcies, however, is a massive Federal government bailout, that would likely be financed through the Federal Reserve creating still more money out of thin air.

18. Long-Term Investment

Even a partial Eurozone currency and economic collapse would have serious negative implications in multiple categories for US investments. Corporate earnings growth rates could turn negative on a global basis as a result of the new global depression, thereby slashing stock market values.

As discussed previously, the likely US response of trying to cover over negative short-term economic developments by simply creating more money, has highly negative implications for the long-term value of the US dollar. Quite simply, the more money that is created in the attempt to prop up an artificial economy, the greater the long-term damage to the US dollar, and the higher the likely future rate of inflation.

This would mean that both bonds and stocks - the two cornerstones of conventional long-term investment strategies - could face devastating and sustained losses, which might never be recovered.

As discussed in the analysis linked below, the eventual US response to a new unemployment crisis is likely to effectively be currency warfare, which may have particularly unfortunate consequences for retirees and retirement investors.

19. Inflation, Unemployment, Stocks & Inflation Taxes

There was one more political signal sent out of Paris that went around the world. Francoise Hollande was elected on a promise to tax the wealthy at a 75% tax rate.

In this extraordinary economic and political environment, the voter appeal of promising to increase benefits while raising taxes on the wealthy has just been proven in the most concrete of terms.

This sets up what could be called a worst case scenario for stock investors on a global basis. While little appreciated, the three way combination of high unemployment, high inflation and high taxes could effectively confiscate most of global stock investor wealth on a real basis - while appearing to generate a powerful bull market on the surface.

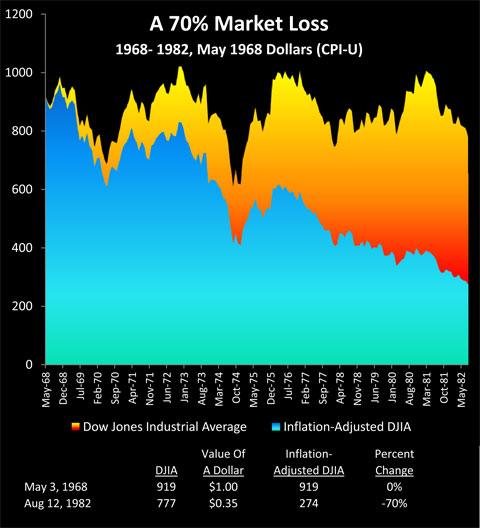

The Secret History Of A 70% Market Loss

As explored in the detailed analysis linked above, the last time we had sustained high inflation, high unemployment and higher tax rates than today, US stock investors lost on average 70% of their portfolio value in after-inflation and after-tax terms - even though most of their losses were hidden by inflation destroying the value of the dollar.

We face the potential toxic combination of higher unemployment than the 1970s, higher future inflation than the 1970s, and a return to higher tax rates. If this should occur, then real losses in after-tax and after-inflation terms may be substantively greater than the historical experience of a 70% long-term loss, particularly when compounded by a growing wave of boomer stock sellers who are liquidating into the smaller and increasingly unemployed group of investors behind them.

20. The Destruction Of The Conventional Investment Paradigm

The election of Francois Hollande as President of France may be setting into motion not only the end of a financial era, but also the end of a financial paradigm when it comes to the conventional wisdom about investing.

There could be a near term collapse of the Euro and European economy that could send the world plunging into depression and currency chaos. Or, order could be established - which would most likely set in motion a long-term process of inflation and punishing inflation taxes on investors. Either way - the results are deadly for those pursuing conventional investment strategies. Indeed, either way, the end results are likely to be the annihilation of the purchasing power of retirement savings and other long-term investment assets.

I do believe that there is one investment asset category that will outperform all others in the months and years ahead, and that investment is knowledge.

When I say "knowledge", I don't mean the study of the conventional wisdom about finance and investing, because that hasn't been working out too well. Instead, we need to aggressively challenge the conventional wisdom - and for most of us, that means leaving our personal comfort zone.

It is hard to change a lifetime of looking at things in the way that we have been educated to believe is the correct way. If we look at an average investor in their 50s, who has spent 30 years building their knowledge of how investments work - most people won't be able to do that. And the consequences are likely to be unfortunate.

For those who are willing to take the challenge, and to be flexible and rethink what they know, then the following are three questions to think about:

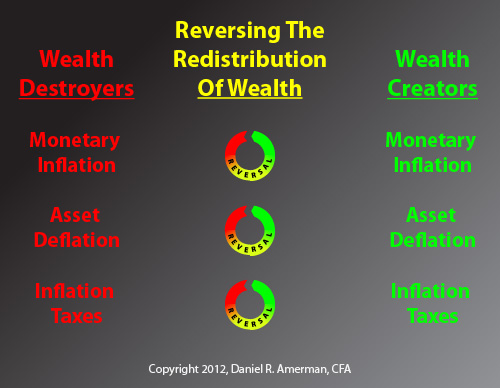

How can I personally and realistically change my financial profile and strategy so that monetary inflation redistributes wealth to me? And the higher the rate of inflation, the higher my real wealth grows?

How can I change my strategy so that asset deflation becomes a profit opportunity rather than a wealth destroyer?

How can I take advantage of the government's blindness to inflation and reverse inflation taxes, so that instead of paying real taxes on imaginary income, I am (perfectly legally) paying imaginary taxes on real income?

These are not the usual questions.

But they are the essential questions.

Because when we successfully answer all three questions, and reverse all three wealth destroyers, then we have three wealth creators instead. These wealth creators can then build upon each other, and transform our personal finances in a time when paper wealth is being destroyed all around us.

We all need to get deeply uncomfortable with everything that we think we know about long-term investing. We need to seek out genuinely different ways of looking at things, perspectives that challenge what we may have accepted as being the truth for decades now.

We need this, because if sustained high monetary inflation, severe asset deflation and inflation taxes do return - or if the Eurozone does collapse and global depression is the result - then those who do nothing to change their "normal" financial profiles will face year after year of pervasive and sustained financial pain, with declining wealth and potentially declining standards of living. Change is coming upon us all, and we either adapt or we pay the consequences.