Three Converging Factors May Slash Economic Growth By 71%

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Adjusting For Population Growth

According to the Census Bureau, the population of the United States was 179 million in 1960, and had risen to 309 million by 2010. This means that the US population has grown at an average annual rate of 1.1% per year over the last 50 years. Therefore, if we:

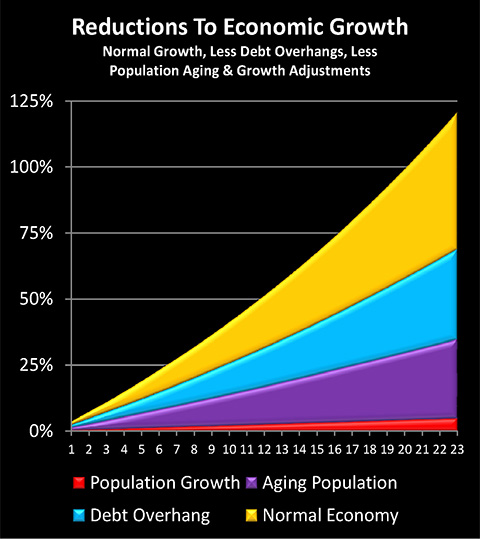

1) Start with the long-term average growth rate of 3.5% over the last couple of centuries, across multiple developed nations;

2) Subtract 1.2% for the average long-term loss in economic growth historically associated with having a national debt exceeding 90% of the national economy;

3) Subtract 1% per year for the effects of a rapidly aging population where there is a steady fall in the percentage of the population that consists of adults in their normal working years; and

4) Subtract 1.1% per year to move growth from total growth to growth per person; then

5) On a per capita basis, the convergence of these three deeply fundamental, long-term factors would seem to indicate that per capita real economic growth for the next 20+ years should drop to about 0.2% per year, or just barely above zero.

What truly matters is not the size of the economy - but what the economy does for the citizens of a nation. If an economy is just barely growing fast enough to keep up with the growth in population, then the nation is not growing wealthier - it is barely staying even.

This third area of adjusting for population growth is a little different from the debt overhang and aging population adjustments. The models for Social Security and Medicare do include a shifting and growing population, albeit not the economic effects of an aging population.

When it comes to tens of millions of retirement investors and pension plan beneficiaries, then, everyone is being told that they can grow wealthy together. I've written about this at much greater length elsewhere, but in very short form - the average person can't be wealthier than the average person. When it comes to resources for a nation as a whole, real wealth is always about the actual economy, rather than compounded paper wealth.

And if, on average, there is no gain in real wealth per person over the coming decades - then stock market valuation (in inflation-adjusted terms), retirement account values and the solvency of pension plans all implode together. Because they are all based upon a (deeply mistaken) belief that substantially positive economic growth is not only the most likely path but the only path ahead.

Financial Geology & The Future

We've all been trained that the essence of financial knowledge is to follow what is happening in New York, London and Tokyo this very minute, with tens of thousands of financial commentators competing to offer their jargon-filled interpretations and complex graphs, in the effort to anticipate the future.

This analysis is quite different and could perhaps best be described as "Financial Geology", for it is not about the myriad crises and headlines of today, but rather the economic bedrock underlying everything else. And the bedrock over the next couple of decades is looking very different from the economic bedrock of 1950-2000 that so many investors and investment analysts seem to believe is the natural and perpetually fixed financial order of things.

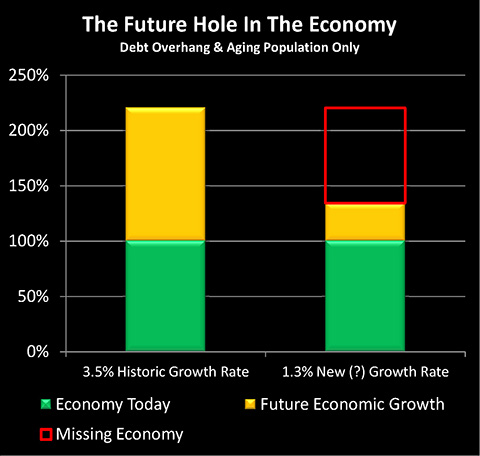

The graph above is the applicable Financial Geology for future deficits and for the solvency of Social Security and Medicare. When we blindly project forward the past, then we get the bar on the left - which still leaves a $62 trillion shortfall over the coming decades, using independent projections from sources such USA Today.

If we allow for an aging population and two centuries of experience with debt overhangs, then we get the bar on the right - and the gaping hole in the future. Nothing works. The situation gets much worse than projected - and it happens must faster than what is projected. This is because the projections are based on the simplistic extrapolations of historic growth rates, and we have bedrock reasons to believe that growth rates will be much lower.

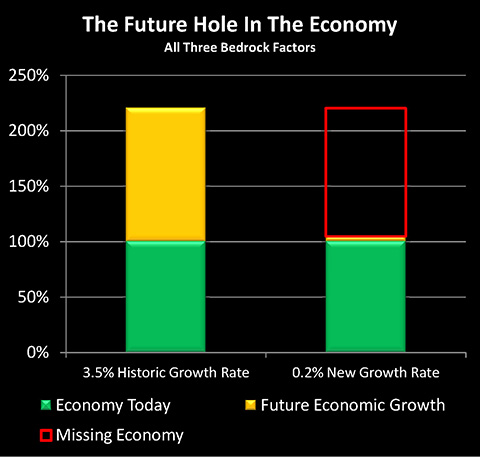

When we look at Financial Geology of wealth for individuals, then the number of people splitting the wealth in the future becomes highly applicable. As shown above, when we adjust for per capita growth rates as well as the other two factors - then there may be no real growth on a per person basis.

Most of the value of the stock market today is based upon the assumption that we know the future, and it is one of unending, exponentially compounded growth. However, our limitation is that the average person can't be wealthier than the average person, and this means that if growth in wealth per person goes flat - the hole shown above consumes most of the value of the market. Not in a short term bear market as part of a longer term cycle, but a total redefinition of stock market returns on a generational time scale, that may last until the bedrock fundamentals change again.

The New Baseline Scenario

Of course, it would be folly to say that we know the future with certainty.

There are many possible paths to higher future growth rates, many revolving around potential technological breakthroughs. As examples, nanotechnology, robotics, and making fuel from algae all have the potential to radically increase the wealth and economic growth rate of the entire planet.

Or, they might not.

There are also at least as many routes to a much bleaker future than merely near flat growth. Global economic depression, hyperinflation, and the many variants of war in modern times such as nuclear warfare, biological warfare and cyber-warfare all have the potential to catastrophically collapse wealth and economic growth.

Or, they might not.

The point is that while the future is inherently unknowable, we still need a baseline scenario from which to work in order to make the financial decisions that must be made for our families. The baseline financial planning scenario used by almost all of us today is effectively an indefinite projection of selected elements from the past into the future.

Now, when we know that fundamental, bedrock factors are changing historical growth rates, then logically, simply projecting past economic growth rates from recent decades forward becomes not the center but an outlier. That is, in order for the future to deliver the results upon which government and conventional financial planning projections are built, we must have a major acceleration of economic growth from... somewhere... on a sustained basis, in order to overcome the three bedrock reductions in per capita economic growth discussed herein.

It could happen. After all, 3 nations in two centuries (out of 26 with debt overhangs) did just that, they were statistical outliers that did succeed at keeping their growth rates at normal levels.

But are you willing to bet your entire financial future on this emergence of powerful economic growth factors from some unknown source that will offset - or more than offset - the known factors which indicate a decline in growth rates? Because if we are following the conventional financial wisdom for long-term and retirement planning, that is precisely what we are doing.

On the other hand, if we accept that the economic bedrock has changed, and that the new baseline scenario is one of much slower or even flat growth, then continuing to follow conventional investment strategies which entirely depend upon high growth rates, means that we are more or less intentionally throwing the value of our savings away. Because we are investing for a high growth future through buying investments that will collapse in value absent such growth - even when we know better today.

Following that logic to the next level, it then becomes an urgent personal priority for each one of us to find alternative investment strategies which are not based upon historical growth rates. We need not attempt to outguess a volatile market week by week or month by month, but to instead find and enter into fundamental, long-term strategies that are based on a new baseline scenario of low growth, high government debts, and an aging population where the ratio of investment sellers to investment buyers is steadily rising.