Student Loans & The Redistribution Of Wealth

By Daniel R. Amerman, CFA

Overview

With more than $1 trillion outstanding and growing at a rate of over $100 billion a year, student loans have leaped past the credit card and auto loan markets in size. The students will not be the only ones paying, however, for the exploding volume of student loans may contribute to a reduction in the future standard of living for tens of millions of retirees and retirement investors.

On a fundamental level, the student loan crisis is about two major redistributions of wealth - one of which is occurring now, with the other taking place over the decades to come. And each redistribution of wealth could not occur in a free market, but is dependent upon federal government intervention.

When we look at the root causes - the real story involves people in positions of power using the government to cut themselves a bigger slice of the pie, which directly leads to decades of smaller pie pieces not only for a generation of students, but also for the Boomers who are relying upon investments and pensions to support their future standard of living in retirement.

Student Lending & The Redistribution Of Wealth Today

The explosive growth in student lending is a side effect of the real problem. To find that problem requires asking the question: "where is the money going?". Not to the students, obviously, as they are borrowing to pay somebody else.

The underlying source for the exploding volume of student loans is colleges and universities increasing their cost structures at a rate well above the general rate of inflation, year after year. According to a Moody's Analytics report titled "Student Lending's Failing Grade":

- The cost of tuition and fees has doubled since 2000;

- College expenses have risen at a higher rate than housing costs every single year since 1990 - including the very height of the real estate bubble;

- College expenses have risen by twice as much as the increases in energy costs and healthcare costs over the last 20 years; and

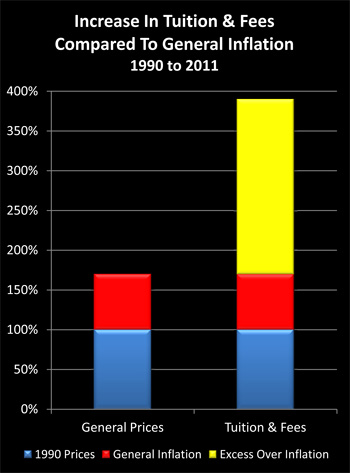

- Since 1990, tuition and fees have risen almost four times higher than they would have if they had been restricted to the general rate of inflation (Chart 7 in Moody's Analytics report, based on Bureau of Labor Statistics price data).

The Moody's Analytics report is linked here.

Four times higher is an amazing number. Let's consider the implications:

While general price levels have risen by roughly 70% since 1990, college tuition and fees have risen by about 290% (using rounded numbers).

Total prices are original costs plus the percentage increase. So for the economy in general, it is 100% + 70% = 170%, meaning the average product costs about 170% of its price in 1990. When it comes to college tuition and fees it is 100% + 290%, meaning a college education now costs about 390% of its 1990 price.

Dividing 170% into 390% is 44%, which means that only 44% of the current cost of college can be explained by historical college costs, adjusted for normal inflation.

In other words, 56% - or more than half - of the current cost of a college education is the result of universities raising their fees at a rate in excess of the general (official) rate of inflation over about a twenty year period.

This then begs the question of how much of student loan debt is attributable to college revenues climbing at a rate well above the rate of inflation?

According to the OECD and National Science Foundation, the percentage of the US economy consumed by tertiary education (college & graduate school) rose from 2.3% in 1995, to 2.7% in 2000, and 3.1% in 2007. The numbers appear to be updated infrequently, so we'll use the 2007 number (knowing 2012 is higher), and multiply times a $15 trillion GDP to come up with $465 billion per year being consumed by colleges and universities.

Going back to 1990, if colleges and universities had been forced to restrain their fees per student to the general rate of inflation, then they would be at only 44% of current levels. Multiplying $465 billion in college and university costs by 44% shows that total expenditures would be $205 billion if increases in per student costs had been held at the CPI rate of inflation (there is more to total education costs than tuition and fees, but the goal is to get in the ballpark).

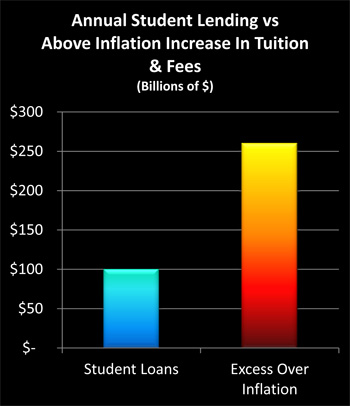

If $205 billion is historical costs plus normal inflation, that means that $260 billion is attributable to college costs rising at an extraordinary annual rate, that not only far surpassed the rest of the economy, but also such high inflation areas as health care and energy.

Over those same years, total annual student loans have been surging upwards and have recently reached the extraordinary level of $100 billion per year, according to the newspaper USA Today, which cites Federal Reserve and U.S. Department of Education statistics.

It is quite clear, when we compare the extraordinary $260 billion increase in annual education expenses above the rate of inflation, to the unprecedented $100 billion a year being borrowed by students, that the student loan crisis is based on the fantastic growth in college spending. The process above is "ballpark" estimation, but the numbers are so large that we can be firm in our conclusion that the student loan crisis is the product of out-of-control increases in college costs.

Using Students To Circumvent Financial Reality

In ordinary circumstances, the colleges and universities simply couldn't do this, because the money isn't there. With public institutions, the state legislatures wouldn't provide the funding, and students and parents don't have the money to cover the gap. With private institutions, the gap is even more clear - a university can't charge more than the average student can pay, unless there is a very large endowment fund which overrules market considerations.

Like any other part of society, colleges and universities would have just had to learn to live within their means - if they didn't have government-sponsored student loans to turn to.

When you come right down to it, the extraordinary growth in student loans isn't about the students at all, they are merely the means to an end. Colleges and universities have been spared the discipline of staying within financial reality, by the federal government not directly paying for increasing college costs, but instead radically increasing the loans made to students.

What these guaranteed student loans do is open up a loophole in which the students can now borrow much more than they used to be able to borrow, and the schools are free to raise their expense structure at whatever level suits the administrators within the university system.

So the college administrators and staff (as opposed to underpaid instructors, teaching assistants and the decreasing number of tenured professors) get ever better pay packages as their numbers proliferate, and nobody is in charge to stop them. The state governments let them do it, because so long as it is covered by loans, this is outside of the budget pressure being applied on direct funding. For private institutions, there is no effective state oversight to worry about.

Enabling the entire process is the Federal government, which provides most of the loans directly these days. There is a powerful redistribution of wealth to a favored special interest group, which is the administrators who run the nation's universities and colleges. And it is effectively free for the politicians.

However, it is not the slightest bit free for the students. The average student loan debt upon graduation is now up to over $25,000 per student, and this is not ordinary debt. It can't be discharged in bankruptcy, but stays with the student for life, or until paid down. The private market would be unlikely to fund these debt levels, particularly for normal loans that could be discharged in bankruptcy.

Therefore the redistribution of wealth today is dependent on a complicit federal government, which does not give to students - but sets up for a lifetime of taking from them down the road, which in turn could have powerfully negative consequences for all of the rest of society.

Redistributing The Wealth Of The Future: Federalizing More Income

With the end of the Federal Family Education Loan Program, the government has cut out the middlemen. The government lends directly to the students, and the government gets paid back directly from the students.

The economic effects of this have been little examined, but there are major implications for society and markets. What this means is that part of the future income stream for each student (on average) has become effectively federalized. The money earned by the former students and used to pay back the principal and interest on their debts to the government won't be available for either consumption or savings, but must go into the federal budget instead.

This will have profound effects. Young professionals, who tend to be one of the freest spending segments of society, won't have as much money to spend on consumption. And given that most of the value of the stock market today is based on assumed growth in consumer spending in the future, as more money is diverted from private spending to repaying loans to the federal government, there may be a fundamental downward pressure on stock prices, that can't be captured by the usual approach to stock market analysis.

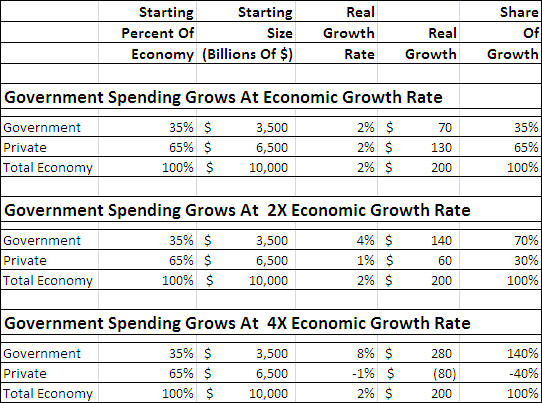

The chart below is excerpted from my article, "Soaring Government Spending 'Crowds Out' Private Investment Returns" (linked below), and it shows why blindly applying such historic metrics as P/E ratios to current stock prices is a dangerous practice, indeed. When government spending rises at a rate substantively faster than the overall rate of economic growth, it must by definition take growth from the private sector. Because private sector growth is the foundation of stock market valuation, the government taking an ever larger share of the economy necessarily undercuts the very basis of current stock market values.

http://danielamerman.com/articles/Crowding.htm

The growing volume of student loans which must be repaid directly to the government is economically almost indistinguishable from raising the federal tax rate on former college students, even if there is a technical difference between repaying a loan and being taxed. Either way - the money is earned, and then sent to the government as a matter of law, rather than being spent in the private sector, and thus the government's share of economic growth is increased. This not only reduces the standard of living of the former student, but comes directly out of potential corporate revenues over the decades to come.

The other crucial change in the economic behavior of former students is likely to be the deferment and reduction of both future savings and future investment purchases. The federal government has stepped to the front of the line and must be repaid first, before money becomes available for significant savings or investment. Former students first pay off their loans (with interest), and then maybe finally enjoy a few years of enhanced standard of living, and are only then likely to start buying investments.

In the meantime, there are about fifty million Boomer retirement investors who will be trying to sell their retirement investments (held either in retirement accounts or on their behalf in pension fund portfolios). Fundamentally, because private sector growth is working out to be less than expected, the stocks are already under downward price pressure. This is compounded as more and more Boomers start selling to the less numerous generations behind them, until by the year 2027 there are only two people under age 65 in the workforce for each person of retirement age.

Now, the downstream effects of the current explosion in student lending will be that the college educated professionals, who are the prime purchasers for Boomer investments, will have less money to invest, and it won't be available until later in their careers. This takes an already bad situation - and makes it that much worse.

Too Many Interests Trying To Grab A Piece Of The Future

For 20 years, I have been a vocal critic of a number of fatal flaws within the conventional retirement planning model, and the still developing debacle with student lending is only one part of one of the biggest of the flaws. Everyone wants a piece of the future - and they are using federal law to carve it up right now.

The future, in this case, isn't the impersonal compounding of trends and numbers - but very real individual people. The generations behind the Boomers have been targeted and legally obligated to pay for Social Security, Medicare and now student loans, on top of a rapidly growing network of transfer payments that are increasingly built into the law. With the money they have left over, if they have a job at all, they are supposed to raise consumption to maintain stock market values, as well as come up with the tens of trillions of dollars to buy out the Boomer investments at the highest prices in history.

Those expectations don't add up, not even remotely. The attempt is being made to take more from the wealth creators of the future - the Boomers' collective children and grandchildren - than they will have available to them. Ethics and generational abuse aside - you can't take what it isn't there.

Yet, those expectations of being able to essentially take infinite wealth from the finite wealth creators of the future is built into the very heart of conventional financial and retirement planning even today. The factors discussed in this article simply aren't considered.

Price Of Student Loans Will Be Asset Deflation

Along with the students who are the primary victims, retirees and other investors in the future will be paying a steep price for the Federal government-enabled redistribution of wealth to college and university administrations today.

It is a fairly basic relationship. The lower standard of living for millions of students in the future means simultaneously lower consumer spending, and fewer investors with less money available to purchase investments. That is a toxic combination for stock prices over the long term, meaning prices are likely to be driven down in real terms, which translates to asset deflation. Investment portfolios don't reliably compound in value each year like they do in the computer models, but instead buy less and less with each year.

However, this does not necessarily mean that stock prices won't be rising. The most dangerous combination of all is shares prices rising because of monetary inflation, while purchasing power is driven down because of asset deflation. We've been there before, in the 1970s, and asset deflation can indeed be masked by monetary inflation and fool a nation, as discussed in my article "Deadly Dow 36,000 & The Secret History Of A 70% Market Loss", linked below.

http://danielamerman.com/articles/2012/Dow36C.html

We Are All In This Together

Ethics and common decency are reason enough, but there are other powerful reasons for older Americans to try to help college students today, and do what they can to stop runaway spending and runaway student loans. Throw all the elaborate numbers and models out the window: what retirement really comes down to is people.

Retirees who have stopped working are reliant for their standard of living upon people who are still working, whether the transfer of wealth occurs through the government or private investment. Simply put - the lower the wealth for the generations behind the Boomers, then the lower the standard of living for the Boomers in retirement. We truly are all in this together, and it doesn't get any more basic - or inescapable - than that.

When wealth is taken from our collective children for decades to come - it is taken from all of us for decades to come. When a politically powerful special interest group enriches itself by taking from college students - it is also grabbing a big slice of the financial pie of the future, which then comes out of the future standard of living of us all.