High Government Deficits "Crowd Out"

Stock Market Returns

Overview

“Crowding out” is an obscure term if you're not an economist – but this replacement of the private sector economy with government spending may end up being one of the largest determinants of your standard of living during retirement. The investment problem is that the past, present and likely future of the US economy is one of rapidly growing government spending. Because the investment models that drive conventional financial planning assume a rapidly growing private sector, this sets up a fundamental competition between government growth and private sector growth for their shares of a single economy, and may lead to a collapse of stock market values and conventionally invested retirement portfolios.

One of the sharpest economic changes in our lifetimes occurred between 2007 and 2009, as the private sector share of the United States economy collapsed to a depression level. About 75% of the collapse in the private sector was (and is) hidden by an explosive increase in government spending, which could not be paid for by taxes, but has instead created a "new normal" of fantastic annual government deficits without end.

The current trillion dollar plus annual deficits which are used to cover up the continuing "hole" in the economy are not stable, however, but merely serve to "bridge" the gap between the private sector collapse and the rapidly accelerating future deficits that will be required to pay for Boomer social security and Medicare promises, as well as the increasing amount of the economy devoted to government transfer payments.

On the most fundamental of levels, stock market valuations and traditional long-term investing are based upon a dependably growing private economy. However, when government spending is surging at rates sufficiently far in excess of overall economic growth, this means that the private economy is necessarily barely growing - or even shrinking. Therefore, the current situation creates a long-term and highly bearish scenario for stock valuations.

The ripple effects of the government competing with the private sector for the limited real resources of the future may potentially collapse most pension funds – and their government and corporate sponsors – across not only the US, but the rest of the developed world.

The Plunge Of 2007-2009

The United States government has always been a voracious spender, but the percentage of the economy consumed by the government began soaring when the financial crisis hit in 2008.

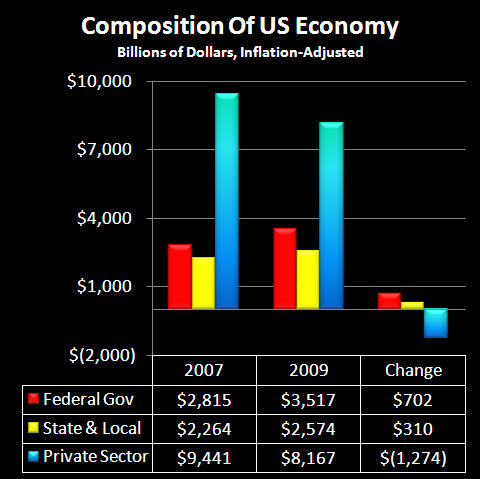

As shown with the blue bars and the chart below the graph, the size of the US private sector economy plunged by $1.3 trillion between 2007 and 2009 - and it hasn't come back.

Yet, we don't see the full extent of this plunge around us on the streets or in the headlines. Indeed, despite this ongoing, gaping hole in the US economy, the official story is that the US isn't even in a recession. How can this be?

The answers can be found in the red and yellow bars above, representing Federal government spending and state and local government spending. Federal spending rose by $700 billion, and state and local government spending rose by $300 billion. (As the state and local spending increases were generally being funded by Federal government transfers that have been netted out, it was really almost all growth in Federal spending.)

So, the private economy plummeted by $1.3 trillion while the government economy soared by $1 trillion, and we were left with what looks like a much more manageable $300 billion shrinkage. In other words, a little over 75% of the collapse in the private economy was (and is) being covered by increased government spending.

(Inflation adjustments are based upon the official GDP deflator as of 7/1/07 and 7/1/09, which I and many others believe to understate inflation. With a higher and more realistic rate of inflation, the shrinkage in the real economy is significantly greater.)

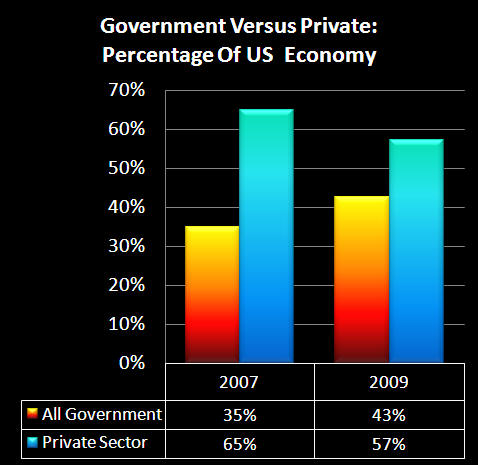

As shown in the graph above, there has been a radical shift in the composition of the US economy, with the government share of the economy leaping from 35% to 43%. The $1 trillion "hole in the economy" from 2008-2009 is still there, and is still being covered by the (not at all coincidental) abrupt increase in federal deficits by about $1 trillion per year. If federal spending and deficits were to suddenly drop to pre-crisis levels, then the cover-up would end, and the true post-2008 economy would become plain to see - as a yet-to-be-cured depression.

This is perhaps the most rapid and greatest change in the fundamental nature of the US economy since World War II - yet there has been remarkably little discussion of the full consequences for long-term investors.

The "New Normal" Of Massive Deficits

Total US federal government spending is now up to around $3.5 trillion, including about a $1.3 trillion budget deficit. (This is the official figure based on governmental accounting standards – the use of which standards could lead to fraud charges if a private business attempted it, but we’ll use it as a conservative estimate.) Net of government transfers, state and local government spending totals about another $2.5 trillion, for total government expenditures of over $6 trillion per year.

In order to maintain total government spending at its "new normal" of a little over 40% of the total economy, then absent major tax increases, annual federal budget deficits are required to be in the extraordinary range of 8%-9% of the size of the total economy on an ongoing basis. The approximately $1 trillion dollar increase in the size of the average annual deficit means that the cumulative federal debt is rising at a much faster level, and now exceeds 100% of the size of the national economy of about $15 trillion per year.

Soaring Future Deficits

Federal debt equalling 100% of the gross domestic product is an astonishing enough number by itself - but it appears that we are still just getting started. We need to take into account – which government accounting does not – the rapidly approaching $62+ trillion crisis with Social Security and Medicare, that dwarfs the current financial crisis. We need to include the costs of paying for health-care and other transfer payments as well. We also need to take into account the costs of likely bailing out the state governments (such as California and Illinois) on their fiscal and pension liabilities, and eventually many municipalities as well.

When we add it all up, what we clearly have is a rate of government spending that is leapfrogging ahead of the growth in the real economy, as the government consumes more and more of the resources – as well as an ever greater share of the investment capital – available within the US economy.

It is important to note that while I am using the example of the United States, the US is far from the only nation with these issues. All across the world we have developed nations that are in the midst of monetary crisis, and these nations have their own looming retirement and health care problems with their aging populations. The private investment effects of government spending rising more rapidly than total economic growth is a global issue.

Exponential Retirement Investment Expectations

Now, let's explore how this rapidly growing government spending directly affects pension funds, as well as the many millions of individual retirement investors whose portfolios aren’t worth anywhere near as much as they had been told that they could expect. To understand the interrelationship, we need to understand the financial models that drive these retirement investments, and why the retirement investment system is in such crisis at this time.

The fundamental issue is that conventional retirement planning is not really about stocks or bonds at all – but exponential mathematics. Retirement investing is not based on earnings today. Retirement and other long-term investing is based on assumed future investment earnings that must occur. These earnings must not only occur, but they must grow every year and most importantly, they must exponentially compound.

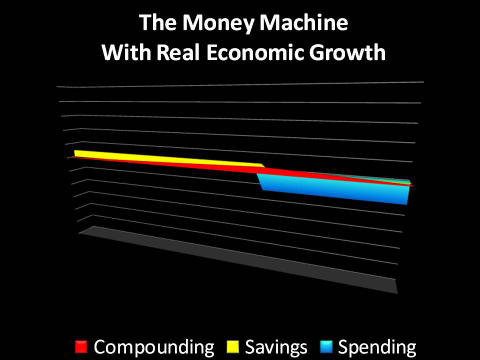

The core of conventional retirement investing is illustrated in the graph above from my video/text article, “The Retirement Magic Money Machine". The thin yellow line represents actual savings, or pension fund contributions. The fat and growing red area is assumed exponentially compounded investment earnings, where the assumption of earnings upon earnings and then earnings upon earnings upon earnings dwarf the actual savings contributions. Which leads to the beautiful blue bar of a prosperous retirement for all. For this particular illustration we assume an 8% earnings and exponential compounding rate, which has long been considered fairly reasonable for long term retirement planning.

When we look at that blue bar – very little of it actually comes from savings. Future earnings – and then earnings upon earnings – must reliably occur, or the retirement that all these many millions of investors have been told they can expect, simply won't be there for them. Therefore, with investors who have entered into contractual obligations based on their belief in this model – that is, government and corporate traditional pension plans – their very financial survival depends on these fantastic levels of compounded earnings in the future, or they simply won't be able to pay.

A Limited Pie

Here's a simple but vital question: where does the real wealth come from to pay the pension funds and the private retirement investors (as well as all other investors) their exponentially compounded wealth in real goods and services? For in order for millions of retirees to be able to actually pay for things like housing, utilities, energy and food and so forth, we need the real economy rather than just paper wealth. If retirement wealth is not only to grow on paper, but to actually be cashed out and consumed in retirement by retirees, there must be a corresponding growth in the real economy.

A succinct summary of the economic theory underlying conventional retirement investing is as follows: long-term investors produce more real goods and services than they consume. This excess of production over consumption is economic savings, and these savings are invested in growing the real economy. The economy then generates the real wealth which enables the long term investors to enjoy a prosperous retirement when they cash out their share.

This creates a natural question about the practicality of the prevailing retirement investment theory: how much real growth does the economy actually generate?

The dramatic difference between the above graph and the previous “Magic Money Machine” graph can be found in differing earnings rate assumptions. With the first graph we took a relatively common retirement investment assumption of 8%. In this second graph we take a look at the real (after-inflation) per capita average economic growth rate of the United States over roughly the last 50 years or so, which has been about 2% per year.

The yellow bar is the exact same size in each graph, meaning that the retirement investor or the pension fund is making the same savings contributions. However when we reduce our exponential compounding rate from 8% to the 2% that corresponds to real per capita economic growth, that means that reinvestment earnings shrink from the vast red area in the previous graph down to the thin red line here. Which then means that the prosperous blue bar of retirement is a tiny fraction of what it was with the first example. When we look at real economic growth and compare it to wealth expectations, there are likely to be many millions of very disappointed people. As well as numerous effectively bankrupt pension funds.

Through conventional retirement planning and pension fund investments, society essentially agreed that the average person can become wealthier than the average person. The reality check will likely be devastating.

The above is a short summary of The Mythical Retirement Magic Money Machine, the full video and article are available at the link here.

Unfortunately however – it gets worse, because there is an implicit assumption that the retirement investors can compound their wealth at even a 2% rate. In other words, we’re assuming investors get their full share of economic growth. But the problem is that there is only one economy. There's not one economy for investors and pension funds, and another separate economy for the government to take an ever bigger share. The government is taking its bigger share of the economy out of the same limited economic pie that the retirement investors and pension funds were counting on for their own real wealth.

The Inevitable Collision: Crowding Out

“Crowding out" is a term used to describe what happens when a government competes for limited resources with the private sector. The term is generally used for government borrowing. During periods of rapidly rising deficit spending the government is issuing large quantities of bonds, each of which carry the full faith and credit of the government. Because it is the government, the government also has the ability to effectively pay whatever interest rate it needs.

Private sector bond issuers find this a very difficult one-two combination with which to compete, when trying to obtain funding from private bond investors. So when the government sells too many bonds in order to finance deficit spending, it is said to “crowd out” private-sector borrowers, who have less ability to borrow and must pay higher interest rates than they otherwise would. Because less funding is available for business growth, this means that the essential side effect of crowding out is to slow the overall economic growth rate.

This concept can also be applied to the overall economy and to investment markets in general. Indeed, this may be the most important interpretation of all when it comes to determining not only personal and pension fund investment returns, but the long term standard of living for retirees and those investing for retirement.

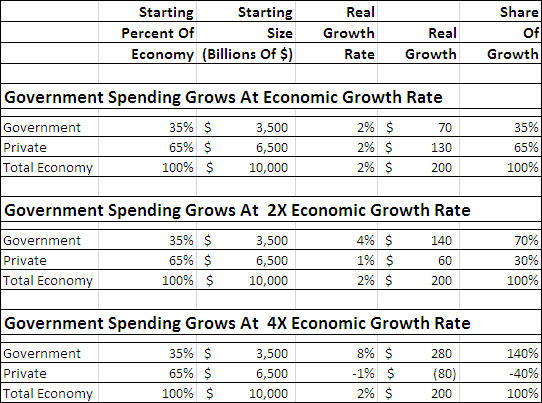

The chart above illustrates how rapid growth in government spending can effectively destroy private investment market returns. For simplicity’s sake, we’re using round numbers and saying that the starting size of the economy is $10 trillion, and it is experiencing real growth (inflation-adjusted) of 2% per year. Two percent growth in a $10 trillion economy means $200 billion in real annual economic growth.

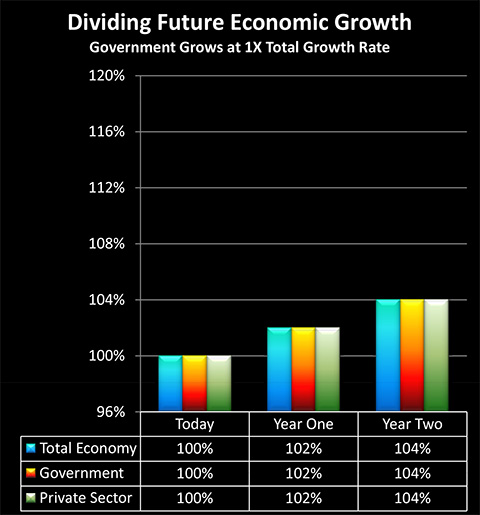

We will assume that the private sector constitutes 65% of the economy and the government share constitutes 35% (the same split as the US economy in 2007). If the private sector and the government each maintain their same shares of the overall economy, that would mean that each of those sectors grow by 2% in real (inflation-adjusted) terms when the overall economy is growing by 2%. So the private sector would account for 65% of the $200 billion in growth, meaning the private sector grows by $130 billion.

With that same scenario, the government gets 35% of the $200 billion in total economic growth, and government spending rises by $70 billion. There is only one economy, the economy is made up of the government and private sectors, and the two must add up. Naturally, when we add the $70 billion in government growth (i.e., government spending) to the $130 billion in private sector growth, we come up with the $200 billion growth for the overall economy.

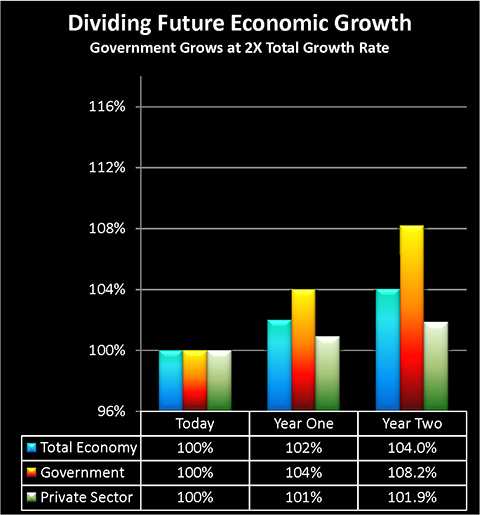

Government Spending At 2X Economic Growth Rate

Now let's change our assumption and say that government spending in real terms is rising at 4% per year. This means that the growth in real government spending is $140 billion, rather than $70 billion. To find private sector growth, we need to take our $200 billion in total growth, subtract $140 billion in government growth, and we’re left with $60 billion in private sector growth, a reduction of 54% from our number with 2% government growth.

In other words, if government spending is rising at a faster rate than total economic growth, that means the government is taking more than its share of the growth, which means that the private economy has to be growing at a slower rate than total economic growth. There is simply no other way for the numbers to add up. For the size of the government to grow 4% while the overall economy grows 2%, then the private sector can only grow 0.9%.

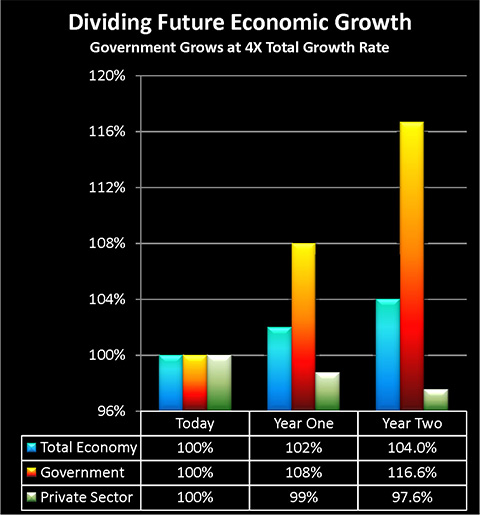

Government Spending At 4X Economic Growth Rate

Where things really get serious, however, is when the growth in government spending rises to 8% in real terms, which means $280 billion in dollar terms. Meanwhile, total economic growth was only $200 billion. Obviously, the only way government spending can rise by $280 billion when the overall economy only increased by $200 billion is for the remaining $80 billion to come out of the private sector economy. So when government spending rises too rapidly, it completely wipes out growth in private sector wealth, and in fact turns it negative for the nation as a whole.

Now, let’s go back to our illustration of the Magic Money Machine. Not only retirement planning, but the very fundamentals of stock valuation are based on the exponential mathematics of endlessly compounding growth. While many people don’t realize it, from a financial mathematics perspective most of the value of the stock market is generally based not on today’s earnings, but expectations about increases in future earnings. With no growth, or even negative growth, it’s not just that future stock price increases don’t occur – but most of the value of the stock market today implodes. Taking everyone’s IRAs, Keoghs and pension plans with it.

The Government, Pension & Stock Feedback Loop

Long-term, we have the huge shortfall resulting from Social Security, Medicare and other transfer payments. Long-term, we still have the current state and corporate pension fund crises to be concerned with. What we need to note here is that there is a powerful feedback loop that is likely to be at work, particularly when we have a government that is inclined towards bailouts. That is, an increasing government share of the economy means there is decreasing real economic growth, which increases pension fund insolvencies, which further increases the government share of the economy when the pension funds are bailed out, which then leads to still more pension fund insolvencies, which means the government is taking an ever greater share of the economy to pay for the next round of insolvent pension fund bailouts. Repeat. And repeat.

When we put this all together, we have two behemoths, each of which have laid claim to the wealth of the future. One behemoth is government retirement and health care promises. The other behemoth is pensions and individual retirement plans. Each behemoth not only needs but demands growth rates in future wealth that are far in excess of the ability of historical real economic growth to deliver.

This is where things get a bit ironic. As I've been writing about for many years, the irony with regard to retirement investors is that millions of well read investors, particularly younger boomers such as myself, are acutely aware that the government can't afford to pay its retirement promises. So, to ensure financial security, we've all been told to invest in the private sector, where we've been told we can expect to reliably compound our wealth together so we don't have to worry about the government breaking its retirement promises.

Unfortunately this theory is based on the mistaken premise that we have two economies: one economy for broken government retirement promises, and a separate, beautiful economy that can be reliably expected to generate fantastic wealth for private investors. When we meld the two economies together into one real economy, what happens is that a government reaching out for ever more resources in fact collapses the private sector retirement dreams for an entire nation. The central reality of cashing out retirement investments in the coming decades is that this will occur in a world of two vast sets of impossible promises – that have been promised in full – foundering upon the rocks of a limited underlying economy that must pay for everything.

The Implications For Investors

We have an entire society that has been making trillions of dollars of long-term pension and retirement investments based on this notion that there will be a separate investment economy that is immune from government problems, and where wealth will reliably compound at rates well in excess of real economic growth. We've been told (effectively) that the essence of being financially literate is to understand that this is more or less preordained, and the smart thing to do is invest more or less blindly every month into a market basket of index funds, while ignoring little technicalities like the economy, national problems and the prices we pay for securities relative to their value. Just do this simple task consistently for several decades, we are told, and a prosperous future is assured for all of us. It is so assured that in fact every state and municipal government in the country as well as major corporations can all safely bet their solvency upon it.

Things haven't quite worked out that way.

The consistent application of this (deeply) flawed investment theory does have some interesting side effects, however. Besides leading to enormous real wealth in annual profits for the investment industry, it also creates tremendous paper wealth for the entire nation. The logical result of tens of millions of people blindly buying investments without regard to price or expectations about the future, with buyers outnumbering sellers for decades, is that the prices go up, up and up.

So the prices go up, until the time comes for tens of millions of Boomers to cash out those investments and try to turn wealth expectations into the real wealth of goods and services.

When we have high asset prices today because we've all been promised we can be wealthy together, and we expect that when we do look at the future with our eyes wide open that those prices will likely be falling, then what we are expecting is asset deflation. This prospect of falling and even plunging asset values across the entire investment landscape is a nightmare for the conventional financial "wisdom". Effectively the only solution that is offered by conventional financial planning is to more or less exclude asset deflation by definition, and say that the hallmark of financially literate people is to understand that this situation can't happen (with shutting one's eyes to what happened in Japan the last couple of decades being an essential part of this “solution”.)

Something else happens when we have enormous government deficits, while having future retirement promises that are well beyond the capacity of the federal government to pay. Not only do we have crowding out, but we have a high probability of potentially very high future rates of inflation. We can expect that monetary inflation may be devastating the value of the dollar, even while asset deflation is devastating the value of investments.

Unfortunately those who think the future will be either inflation or deflation are likely to be sadly mistaken. For the reasons discussed in this article (as well as my extensive writings on this elsewhere), the future is all too likely to be one of simultaneous asset deflation and monetary inflation.

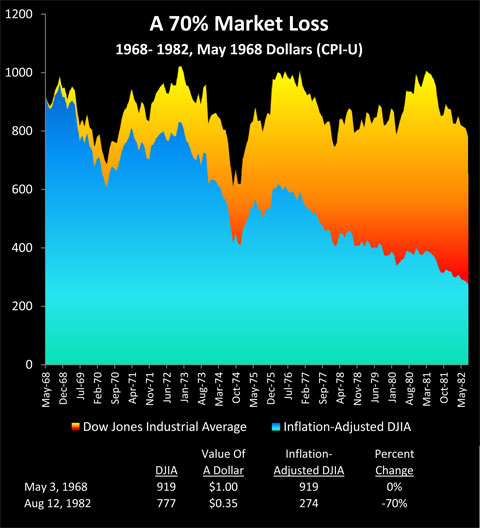

A historical example of simultaneous monetary inflation and asset deflation is the Dow Jones losing 70% of its inflation-adjusted value between 1968 and 1982, with the great majority of the destruction of the value of investments being hidden by the destruction of the purchasing power of the dollar.

The chart above is from my article "Deadly Dow 36,000 & The Secret History Of A 70% Market Loss" (linked here), and it shows this toxic relationship that can destroy investor net worth, even as the stock markets appear to go from record high to record high. As explained in that article, Dow 36,000 may be far deadlier for tens of millions of equity investors than the Dow 6,000 that some fear.

Finding Solutions

On a societal basis, there is much to be done, and the sooner it starts – the better. Each year that we ignore the evidence that abounds all around us, and blindly pour billions of dollars of investor and pension fund savings into a badly mistaken financial model, we are just compounding the future damage. We compound the fiscal crisis of states and nations, and the personal pain for tens of millions of responsible men and women around the world, whose only mistake was to believe the voice of investment authority.

Unfortunately, on a societal level, we can't suddenly convert the impossible into the possible. We can't make the “Magic Money Machine” work. The level of retirement wealth that an entire nation has been led to believe is their right likely won't be there for them to the degree that they believe it should be. This is a sad situation, but the fundamental reality is that the economic growth rate never has been there to pay for all the` promises the Boomers (and their equivalents in other nations) have made to themselves.

There are practical ways for individuals to use inflation to redistribute wealth to themselves, rather than away from them. So that the higher the rate of inflation and the more the value of the currency that is destroyed – the greater the resulting after-inflation and after-tax net worth of the investor.

Asset deflation is a much tougher nut to crack than monetary inflation – but it can be done for individuals, and the rewards can be even greater. Indeed the heart of some of my recent work has been educating people about the practical methods for turning asset deflation into greater wealth opportunities than those that can be found through reversing monetary inflation. For understanding simultaneous asset deflation and monetary inflation is the essential key to unlocking the most profitable precious metals investment strategies.

Crowding out will be a terrible problem for the many. For those who see the full implications, however, it also has the potential to become one of the greatest wealth creation opportunities of our lifetimes.

The solutions to monetary inflation, asset deflation, inflation taxes and crowding out are distinct but intertwined. But they all start with the same first step: education.

To get out of step with your generation, and have wealth redistributed to you even as your peer group is being devastated by this extraordinary destruction of wealth, you need to start with education. You need to gain the knowledge you will need to turn adversity into opportunity. Ultimately, you will need to look at the simultaneous destruction of the value of assets and the value of money – and see a once in several generation personal wealth creation opportunity. An opportunity that can be accessed through a multi-component strategy that anticipates the stages of monetary crisis and then moves with the stages, with a relentless focus on systematically protecting and building after-tax and after-inflation net worth.

What you have just read is an "eye-opener" about just one of the ways in which a rapidly shifting world is removing the foundations beneath conventional investing - even while most investors continue to follow the traditional strategies, unware of just how much the financial playing field has changed.

What you have just read is an "eye-opener" about just one of the ways in which a rapidly shifting world is removing the foundations beneath conventional investing - even while most investors continue to follow the traditional strategies, unware of just how much the financial playing field has changed.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.