Means Testing For Social Security Seems Likely At Some Point - How Could That Impact Your IRA, 401(k) or Roth IRA?

By Daniel R. Amerman, CFA, MBA, BSBA

TweetOverview

Current projections are that the Social Security Trust Funds will run out sometime between the mid 2020s and the mid 2030s, which under current law could trigger major cuts in benefits. Because such a reduction in benefits would push many millions of retirees with no other savings or other sources of income deep into poverty, there are likely to be major changes to the Social Security program in the decades ahead.

Many people expect that means tests will be instituted at some point, where Social Security benefits are either reduced or eliminated for those who are judged to have the means to pay, so that more money will be available for those who have no savings.

The long term funding issues for Social Security and Medicare have been known for many years, and are a major part of the reason why many people have been building their own private savings through the use of tax-advantaged retirement accounts such as IRAs, 401(k)s and Roth IRAs.

Unfortunately, the norm with retirement planning is to treat retirement accounts as if they existed in an entirely different world from the troubled Social Security and Medicare systems. Financial planning for retirement accounts can be purely financial projections, with a compounding of historic rates of return and the assumption of a stable tax code for the rest of our lives.

Yet, what we are actually investing for is a future where we know right now there are likely to be major changes to the tax code, and if we fail to take this into account, then we could face some major and potentially unpleasant surprises.

In this analysis we will take a holistic look at the financial implications for IRAs, 401(k)s and Roth IRAs of existing in a world where Social Security and Medicare are facing deep financial challenges, the tax code is changing, and means testing has been implemented.

We will look at the future in terms of the coming financial challenges, and the past when it comes to the government's history of breaking tax promises in times of financial need.

We will demonstrate how means testing in combination with ordinary taxes can create confiscatory effective tax rates that are 100% or higher for the owners of 401(k)s and traditional Individual Retirement Accounts – without ever openly raising tax rates.

We will examine the particular vulnerability of Roth IRAs when it comes to means testing and tax code changes – even if distributions do remain tax free – as well as the potential for what could be an effective triple taxation.

We will then look at the changes that have already taken place or been attempted, and what that could tell us about the future.

The Future Shortfalls

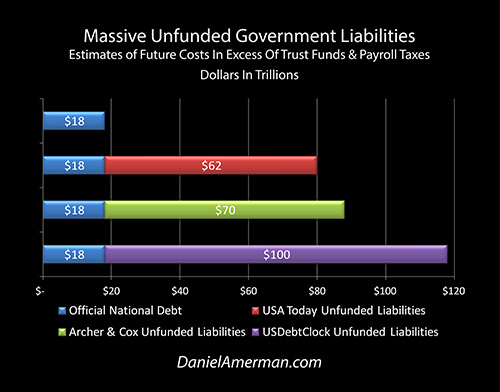

In 2012, the newspaper USA Today calculated that unfunded Social Security obligations alone were over $22 trillion – an amount well in excess of the official national debt of $18 trillion. Add in other unfunded obligations – primarily Medicare – and in a 2011 article USA Today found that the total came to about $62 trillion of "off-balance sheet debt". That is, the federal government uses a very special accounting that is not legally available to corporations or individuals, precisely so that it can report lower debt totals – and lower annual deficits – than any other sort of entity would be able to do.

Add this to the official national debt of $18 trillion, and the total then came to an astonishing $80 trillion (although it has grown in the last 3-4 years since the report was done).

As reported in the Wall Street Journal in December of 2012, when Archer and Cox (former chairman of the House Ways & Means committee and former SEC chairman respectively) took a look at the true level of national debt, they found – primarily based on the figures from the Social Security and Medicare trustee reports – that the true national debt was $87 trillion, consisting of $17 trillion in (then outstanding) official debt, and $70 trillion in unfunded obligations, most of which were payments to future retirees.

And for those who are familiar with the well-known usdebtclock.org website, which keeps running real time totals of estimated US national debts and assets, as of December of 2015 they showed that the total unfunded obligations of the US government were about $100 trillion under GAAP (Generally Accepted Accounting Principles), which when added to the official debt in 2015, brings the total to $118 trillion.

To put the issue in more personal terms, if we take the average of the various estimates of unfunded government promises, add in the official national debt, and divide by the number of above-poverty line households in the United States, then the average cost per household is a little over $900,000.

Are you good for your $900,000 share? Are your children and your neighbor's children good for their $900,000 shares (on top of making their student loan payments)?

(Technically, as explored here, the government doesn't haven't to make Social Security or Medicare payments except to the extent that it has cash available, so some argue that the unfunded liabilities aren't real. However, if we accept that, then we also have to accept that the retirees will therefore have to get by with $60 to $100 trillion less than they thought had been promised to them, with huge lifestyle and political consequences. That situation is likely untenable, which then gets us right back to the probability of extraordinary future changes in the rules.)

Given that it is impossible to pay these promises in full with the current tax code, we can expect with a great deal of confidence there will be major changes to the tax code at some point.

The Historical Trustworthiness Of The United States Government

But would the government actually break its word?

Let's briefly consider the history of the income tax in America.

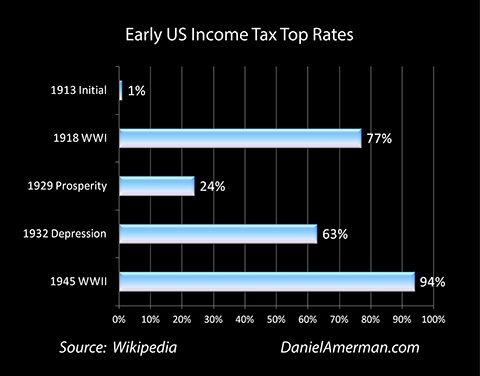

Income taxes in the United States were enabled by the passage of the 16th Amendment in 1913, and initially they were intended to be relatively small and applicable only to the wealthy. The initial tax rate was 1%, and was only applied to incomes above $3,000. Because the dollar was worth so much more at the time – and the nation was generally poorer – that meant ordinary workers did not have to pay.

This was how the income tax was sold to the American people: it would be a small percentage, it would be imposed only on the wealthy, and the majority of the population would never pay it.

That's not how things turned out, however. A mere five years later, the top income tax rate was at 77%. The rate slowly dropped to 24% by 1929. Then it soared back upwards to 63% by 1932. And by 1945 the top marginal tax rate had reached 94%.

So we have the promise made by the federal government and their representatives that the majority of the population would never be subject to income taxes – and yet here we are. And it only took five years to make a complete mockery of what the public had been told in order to enable passage of the constitutional amendment.

What brought on such a drastic change in the tax code?

Simply put, the government needed the money.

In 1918 the government needed the money to pay for World War I. In 1932 the government again needed the money because of the Depression. And then in 1945 the government needed the money to pay for World War II.

So as it turns out, no promises about taxes are binding if the government ends up really needing the money at a later point in time.

With that in mind, are there any reasons to suspect that the government could "really need the money" at some point in the future?

There may be close to one hundred trillion reasons to suspect just that. Making promises today about the future – that will be paid for by future governments and taxpayers – is one of the most common things that politicians do. Voters love it, and it doesn't have to be paid for out of the current budget – so this a very cost-effective way of winning elections.

Taxes That Aren't "Taxes"

On the one hand we have a government that historically has broken its promises about taxes and tax shelters every time administrations and congresses have felt there was a financial need to do so, and on the other we have some of the greatest financial needs in the history of the nation that will be building over the next several decades.

But – politicians wouldn't dare break such a clear cut promise and change the rules about retirement accounts, because of the fear of voter outrage. Or would they?

What is also worth considering is that with a little sleight-of-hand, so to speak, there are other ways of effectively taking money from savers than just explicit "taxes". One such method of closing the gap between revenues and expenditures is the concept of "means testing", which has been discussed with regard to Social Security for some years now, and is already being applied to Medicare premiums.

As shown in "Unfunded Liabilities" graph above, over the years to come we will have an increasingly bankrupt Social Security and medical system in which solemn promises simply can't all be paid. Even if income and payroll taxes rise sharply – the time will come when the shortfalls will just be too great, and benefits will have to be cut.

For the many millions of people who have no savings, absent government support they may risk living in increasingly abject poverty. On the Medicare side – which is the source of the great majority of the shortfall over the coming decades – there is likely to eventually be rationing, and people may be dying of preventable medical causes because of a simple lack of available funds.

On the other hand – as it may be expertly positioned by the media commentators, pundits and the politicians themselves – during this coming time when there will be an acute shortage of funds, there will also be the many "haves" of the world who can in fact afford to contribute to paying for their own standard of living as well as contribute towards their own medical care.

Now because reducing the amount of future cuts to Social Security and Medicare could have life changing implications for future retirees, it could become the single most important determinant of their vote. It is also worth noting that future retirees without significant savings will vastly outnumber those with significant assets held in retirement accounts.

Hence there is a very reasonable and realistic possibility that some form of means testing will be implemented in order to qualify for Social Security payments as well as Medicare benefits in the future.

A Visual Guide To The Impact Of Means Testing

What means testing comes down to is that if you have the assets, or you have the income – potentially including retirement account assets or distributions – then in fact you're not entitled to the payments that everyone else is. You have the means to pay, so you don't need the public assistance.

So if it is asset-based means testing someone who has over $500,000 – or perhaps even $100,000 – in assets may not be entitled to full Social Security or Medicare payments, or perhaps not even any Social Security or Medicare payments.

Or, means testing could be income based. There could be a dollar for dollar reduction in Social Security and Medicare payments, for distributions above a certain level from retirement accounts or other sources of income.

And what does that really mean?

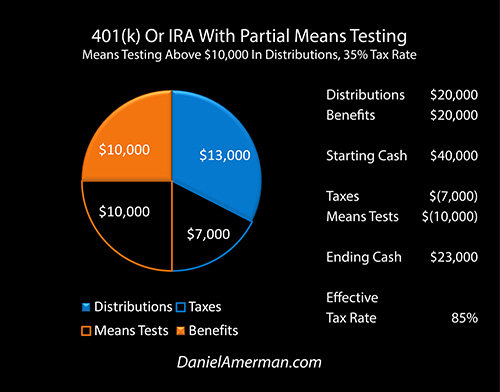

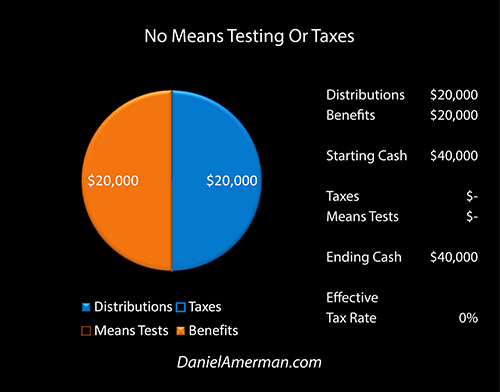

In the graphic above, the orange area represents $20,000 in annual benefits from Social Security and the blue area represents $20,000 in annual distributions from a retirement account, which could be a 401(k), IRA or Roth IRA. When the two are added together in the column on the right, there is a total of $40,000 in "Starting Cash" available per year to support our lifestyle in retirement.

In this first step there are neither taxes nor means testing. This means that our "Ending Cash" of $40,000 is the same as our Starting Cash, and as can be seen at the bottom of the right column, our effective tax rate on distributions from our retirement account is 0%.

While the specific dollar amounts may vary greatly with individual situations, this situation is the core to retirement planning for many people. We look to our Social Security benefits for our base, and to the extent we are able to save, we can then improve our standard of living in retirement by drawing down those savings over time.

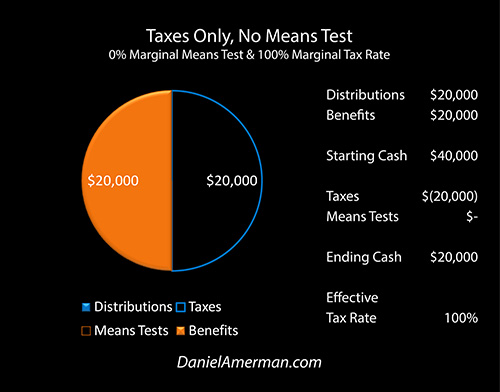

The graphic above illustrates the effects of a 100% income tax on distributions from a retirement account. The solid orange area of retirement benefits remains, but the formerly solid blue area of distributions from our 401(k), IRA or Roth IRA is now gone. Instead, there is a blank area inside the blue line which represents distributions that have been lost to taxes.

Half of the circle is now blank, and half of our spending power is gone.

Going to the numbers column, our Starting Cash is still $40,000, but we now lose $20,000 to taxes, so our Ending Cash is only $20,000. The distributions were $20,000, the reduction in Ending Cash was $20,000, so we had an effective tax rate of 100% on retirement account distributions.

What is illustrated above is something that is easily understandable by all voters. And if there were to be an openly stated tax rate of 100% on retirement account distributions that would outrage many voters, with major consequences for politicians in power.

However, there is a back door method for the government to accomplish the exact same thing, with much less political damage.

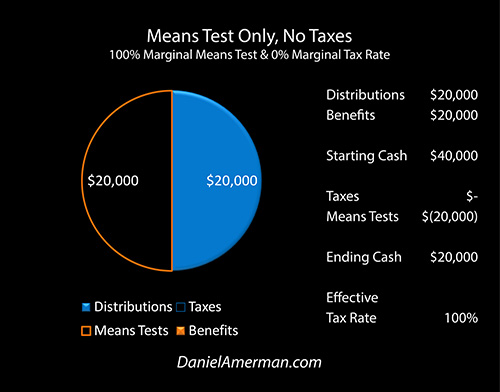

The graphic above represents a means test with no taxes. What is illustrated is means testing for Social Security and Medicare payments, with a dollar for dollar reduction in benefits for each dollar distributed from the retirement account.

Visually, the results are identical to a 100% tax, but the sides of the circle have flipped. The solid blue of retirement account distributions is now entirely available for our spending because there are no taxes. And it is now the left side of the circle that has gone missing, with the solid orange area of benefits being paid having been replaced by the loss of benefits caused by means testing.

Half of the circle is again blank, and half of our spending power in retirement is again gone.

Going to the numbers column, our Starting Cash is still $40,000, but we now lose $20,000 to foregone benefits, so our Ending Cash is only $20,000. The distributions were $20,000, the reduction in Ending Cash was $20,000, so we had an effective tax rate of 100% on retirement account distributions (given that the reduction in benefits was triggered by means testing of those distributions).

Economically then, the result is identical with this example between means testing and a 100% income tax – we started with $40,000 between income and benefits, and are still left with only $20,000 to spend either way. If we scroll back and forth between the two graphics, the circle is only half full, either way.

Also either way, the government comes out $20,000 ahead, because it either took in an additional $20,000 in taxes, or it saved $20,000 in benefits not paid.

So either way, we lose $20,000, and our loss goes directly to the benefit of the government, which gains $20,000.

When it comes to the dollar bottom line for both retirement account owners and the government, means testing may look like a tax. It may smell like a tax. It may bark like a tax.

But literally and legally, means testing is not a tax, because the government isn't actually taking any money – it is just withholding money that would have otherwise been paid. And if means testing of this kind comes to be, I think we can count on some pundits and politicians waxing quite indignant at the suggestion that this is some kind of tax.

Which is why the government can do things with means testing that it might not dare to do directly with tax rates.

How Means Testing Can Create Confiscatory Effective Tax Rates That Can Exceed 100%

Outside of a Roth IRA, if we are considering the impact on a conventional IRA or a 401(k) or 403(b) or the like, then means testing creates the possibility of a marginal tax rate of over 100% on retirement distributions. This is because those distributions are fully taxable, and there is no particular reason to believe that a means testing based reduction in benefits would create some sort of tax deduction.

Let's say there is future means testing, perhaps 10-20 years from now, such that retirement account distributions above $20,000 per year reduce Social Security benefits on a dollar for dollar basis, and the retiree is also subject to a combined federal, state and local income tax rate of 35%.

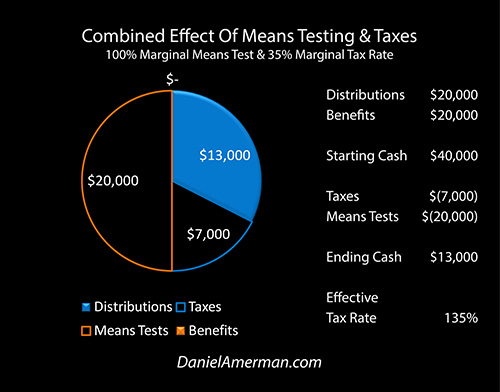

The graphic below is on the margin, meaning we are looking only at the distributions that are above the threshold for means testing. It ignores the first $20,000 in distributions (we'll get back to that below), and looks only at benefits, and the second $20,000 in distributions that is subject to means testing.

The entire left side of the circle is now empty, because the distributions have triggered means testing that have wiped out the government retirement benefits. There are also taxes equal to 35% of the 401(k) or IRA distributions, which equals $7,000 on $20,000 on distributions. This cuts another slice out of the pie, with $7,000 being lost to taxes, leaving only $13,000 of cash available to spend.

Visually, the pie is now 65% empty, and 65% of our lifestyle in retirement (on the margin) disappeared along with the pie.

Going to the numbers column, our Starting Cash is still $40,000, but we now lose $20,000 in foregone benefits and then another $7,000 to taxes, so our Ending Cash is only $13,000. The distributions were $20,000, the reduction in Ending Cash was $27,000, so we had an effective tax rate of 135% on retirement account distributions (given that the reduction in benefits was triggered by means testing of those distributions).

Means testing in combination with taxes can indeed quite easily create effective marginal tax rates that are in excess of 100%. Where for each $1.00 in additional distributions that we take from our 401(k) or IRA, we lose $1.35 in spending power in retirement.

They just wouldn't be called "taxes", but rather letting those who can pay for their own retirement expenses in a time of financial emergency do so, while the government only helps the genuinely needy.

Different Types Of Means Testing

There are several different ways in which these effective rates of over 100% can be created. There can be a dollar for dollar reduction above a threshold amount, such as above $50,000 per year, or $20,000 per year, or $10,000 per year.

There can be the asset form of means testing, where for instance, having more than $1 million in retirement accounts could mean no government retirement benefits. Or it could be having more than $500,000 in assets, or more than $200,000, and the government may look beyond retirement accounts at some stage as well.

There can also be "hard cutoffs", where once a threshold is passed, all benefits are lost. For instance, anyone with more than $100,000 in annual taxable income and retirement account distributions might lose all of their Social Security benefits and most of their Medicare benefits. Indeed, if we look at the current situation with means testing for Medicaid and food stamps (as explored later in this analysis), this may be the most likely scenario, and it can create marginal effective tax rates that are well above 100%.

Or, it could be a mixture of distribution and asset based means tests, that start high in each case, and then once the door is opened and as the government's financial situation with regard to retirement benefits continues to worsen, moves down over time.

So (as an example), $1 million in asset-based means testing and $60,000 in distributions-based means testing are introduced in a hypothetical Tax Reform Act of 2021. This is made politically possible by selling the means testing as something that applies only to the wealthy, with 95%+ of retirement account holders being exempt, and 99% of the overall population being unaffected.

Then, as we know right now, the financial situation of Social Security and Medicare grows much worse each year, as the number of Boomers eligible for benefits continues to rapidly build and near its peak, even as the Trust Funds deplete, and even as the ratio of younger workers available to support each retiree continues to fall. This brings forward the time when the tens of millions of retiree voters who have no significant savings face potentially catastrophic reductions in standards of living and health care, unless something is done.

At this point, most of the potential savings from means testing would be exempt, because so few people have $1 million in retirement account assets, or are drawing down $60,000 or more in annual distributions. So there would be an enormous pressure to move the threshold down over time, and to increase the savings from means testing by making it applicable to far more people.

It could very well be that by 2031 the means testing is down to having $150,000 in retirement account assets and/or taking distributions of more than $10,000 per year.

The specific numbers and dates above are an illustration, but what matters is the needs and the process. We know the pressures will be powerfully building in the future. And we also know how governments have behaved in the past.

A Particularly Attractive – And Vulnerable – Tax Shelter

Roth Individual Retirement Accounts are presented as being an uncommonly attractive and powerful method of creating wealth for retirement when viewed from the usual financial perspective. What sets them apart is that contributions are made with after-tax dollars, but withdrawals are made on a tax-free basis – which is the reverse of most other retirement accounts.

This is among the reasons why Roth IRAs are enormously popular with many millions of retirement investors in the United States and why they are so widely recommended by financial planners, CPAs and many other financial professionals.

They are also perhaps the single most vulnerable type of retirement tax shelter when it comes to changes in the tax code. The reason is that unlike other retirement accounts, with a Roth IRA there are no immediate advantages when making contributions. Rather the advantages are deferred until retirement and the time that withdrawals are being made – which means that in practice they are entirely dependent on what tax laws are in effect at that time.

Viewed from that perspective, a Roth IRA is an act of pure faith in the trustworthiness of all future federal governments.

So Roth IRA investors do face the possibility of what is effectively a most cruel and onerous double taxation – where they are fully taxed on their original income at the time they make their contribution.

And then later, even if they are technically never taxed on their future IRA distributions, means testing can effectively become a second round of taxation.

There are many possible forms of means testing, but let's return to our prior example of a dollar for dollar loss of benefits for each dollar of distributions above $20,000 per year. The example also works with an alternative form of means testing which is asset based, such as those with more than $250,000 in assets not being eligible for Social Security benefits, or having much higher premiums or deductibles for Medicare.

Let's say someone paid a 40% marginal rate (federal, state and local income taxes as well as payroll taxes) on the original income at the time they earned it, leaving them with 60% to invest. Then when that original money is returned to them in retirement, they lose benefits that they would have otherwise received. The 40% initial tax, and a loss of benefits equal to the 60% that was their after-tax contribution are equal to a combined effective 100% tax on their original income.

Now, they do (hopefully) earn substantial income on their Roth IRA in the meantime, although once we take inflation into account in our current low-yield environment it may not be nearly as much as they had hoped for. There is then a reduction or elimination of government-funded retirement benefits on a dollar for dollar basis as they pull those earnings out of their Roth IRA.

This means they are also paying an effective 100% income tax on all earnings in the Roth IRA over the years that they are investing. Which is the direct opposite of how Roth IRAs are supposed to work, they are supposed to deliver a 0% tax rate on earnings, and this is why people choose a Roth even with the lack of up-front tax benefits that an ordinary IRA or 401(k) would deliver.

The key word here is the "effective" tax rate. Because both literally and legally, there are no taxes. It is just a reduction in benefits, so that the government provides money to those who genuinely need it, rather than those who can afford to pay.

Now, economically there is an effective 100% income tax. When it comes to future lifestyle there is an effective 100% income tax. When it comes to future financial security there could end up being an effective 100% income tax.

But it is not actually a tax, or at least politically that is likely the case that will be made.

Of course there are many possible variations for how this could work. Let's say that someone withdraws $40,000 a year from their Roth IRA in retirement, and the means testing for Social Security and/or Medicare starts at $20,000 a year in distributions.

In that case they would have an effective tax rate of 0% on their first $20,000 in distributions, and an effective tax rate of 100% on their second $20,000 in distributions. This would then be an effective 50% average tax rate on both the return of their original contribution as well as all earnings in the Roth IRA. It just wouldn't be called a tax, and there would not be any actual payments made to the Internal Revenue Service.

So a 100% effective tax could be called a ceiling, with actual tax rates for most people hopefully being less than that.

However, it is also important to understand that the possibility of an explicit future tax on Roth IRA distributions is a separate risk, and is not mutually exclusive when it comes to the risk of means testing – both could happen together. This would then effectively create three levels of taxation: 1) taxes on initial earnings before the contribution is made; 2) taxes on Roth IRA distributions; and 3) means testing on asset amounts and/or distributions leading to a reduction in retirement entitlements. This would also mean an effective tax rate that could be well above 100%.

Based on the history of the tax code in the United States, the most likely scenario for a potential triple taxation of Roth IRA owners would be a combination of a more aggressive Alternative Minimum Tax (AMT), along with means testing. As we saw in the Tax Reform Act of 1986, the use of AMTs allowed the government to retroactively change the rules for passive income and depreciation, and thereby impose taxes on what was supposed to be tax-free income under the previous tax code.

The political advantage of an AMT is that at least initially, only the wealthy are supposed to pay, although in practice the damage can be worse for the upper middle class, aka the professional class, rather than the truly wealthy. Also, there would still be no taxes on Roth IRAs specifically, but rather reductions in benefits for those who have the means to pay, along with simply not having an exemption from the catch-all Alternative Minimum Tax that is supposed to keep those who can pay from excessively benefiting from tax shelters. In other words, such an approach would be a perfect fit with much of the current public dialogue about tax policy.

Means Testing Of Government Benefits Is Already The Norm

If we take a slightly broader perspective, then using means testing for government benefits is already the unquestioned norm. Income-based means testing is used to determine who qualifies for food "stamps" (actually electronic cards these days), as in those with incomes above a certain threshold are not eligible for any benefits, while those below the threshold get free food.

Income-based means testing is used to determine who is eligible for Medicaid, with those who fall below the threshold getting free medical care, while a family of four above that threshold must sometimes pay $1,500 a month or more for health insurance policies that may have deductibles for each person of $3,000 or more.

This creates a very real world situation which can potentially affect many millions of people right now, where means testing can become an effective marginal income tax rate that is well in excess of 100%. If someone is just below the means test threshold, and they get a $1 an hour raise which raises them just above the threshold – it could cost them $18,000 a year in free health insurance. With that (quite simplified) example, the effective marginal tax rate on their $2,080 in additional income is about 865%, when we take into account the loss of $18,000 in benefits.

While the economic effect is identical to an 865% marginal tax rate for both the worker and the government, it just isn't called "taxes", and the loss is in benefits withheld rather than taxes paid.

What is also important to note is that when we look at existing government benefit programs, it is completely politically acceptable to set the means test at a very low level. So that those above the poverty line (or lower middle class) get nothing, while those below that line get full benefits.

As discussed below, some of the current or proposed means testing for retirement benefits and retirement accounts is set at a fairly high levels. However, because of the widespread acceptance of means testing at far lower levels today, that would seem to indicate that there is a great deal of room for those thresholds to move down over time.

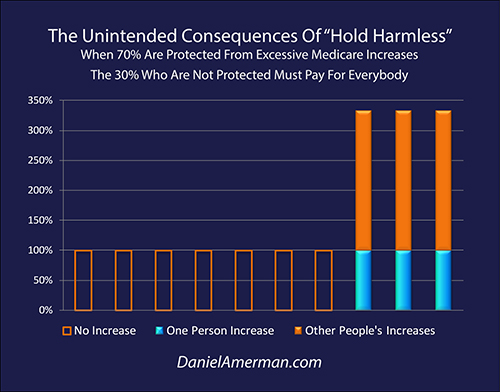

There Is Already Means Testing For Medicare

There is already quite explicit means testing for retirement benefits when it comes to premiums for the Medicare Part B program. The "hold harmless" provision of Social Security means that Medicare premiums cannot increase at a rate that that would lead to a reduction in Social Security payments for the majority of retirees (who are having their Medicare premiums deducted from their Social Security benefits).

There are several exclusions, and one of them is a means test. Individuals earning over $85,001 per year, or couples making over $170,001 per year, are not eligible for "hold harmless" protections, meaning there is no cap on how much their Medicare premiums can increase in any year.

What makes the situation much worse is that those above the means test line have to pick up the cost of excessive Medicare premium increases for those beneath the means test threshold.

About 30% of current Medicare beneficiaries just barely dodged this bullet in late 2015 when a last minute budget fix averted what would have otherwise been up to a 52% increase in Medicare Part B premiums that was scheduled to take place on January 1, 2016. Not all of the 30% were vulnerable because of means testing, but many were.

As explored in my analysis of Social Security claiming decisions (linked here), the linkage between Social Security decisions and Medicare premiums is far more important than most people realize, and can entirely change the decision about what age to start collecting Social Security benefits.

What matters for the discussion here is that the price of 70% of Social Security beneficiaries being shielded from excessive Medicare premium risk is a focusing of that risk onto other retirees, and this is being done on the basis of means testing. An expansion of Medicare means testing to include retirement account distributions would be a relatively small step.

Again, this is current law, and there is an effective tax that is not called a tax, but rather a differential allocation of benefits for retirees depending on income levels.

Asset-Based Taxes On Roth IRAs, IRAs & 401(k)s Have Already Been Proposed

In April of 2013 the Obama administration proposed placing a $3 million cap on total tax-advantaged retirement accounts for any one individual, including Roth IRAs, 401(k)s and traditional Individual Retirement Accounts, with taxation of accounts above that threshold. Because of resistance by Republicans in Congress the details were never fleshed out, but the projections by the administration were that this asset-based means test for taxing retirement accounts would raise $9 billion over the next ten years.

The first key takeaway is that the government breaking the compact with all types of retirement accounts including 401(k)s is not just theory, but has already been attempted. And as the retirement of the Boomers continues over the coming years, the financial pressures are likely to increase each year, which is likely to bring repeated attempts.

The second takeaway is that the acute vulnerability of Roth IRA account holders in particular is also not just theory, but something that has been confirmed. There are no initial tax advantages to a Roth IRA. Instead, a Roth IRA is an act of pure faith when it comes to the trustworthiness of all future governments. And we have already seen at least one administration show that there is no binding deal as far as they are concerned, and that the terms for Roth IRAs can be changed at will.

The third takeaway is how the proposal to break retirement account promises was politically sold in 2013 – as a tax on the wealthy that would only apply to 0.3% of retirement account holders. Almost exactly like how the American public was convinced to vote for income taxes in 1913, in other words. And once that door was opened, and the 16th Amendment was passed, it only took the government five years to make a complete mockery out what had been told to voters.

It's not just that the top tax rate increased by 77 times within five years, in the midst of paying for a war. But sixteen years later, in a nation that was flush with money and prosperity - the top tax was still 24 times higher than what it had started at. Once the government got used to spending the money, it never did return to the original deal, even after the emergency was long gone.

Preparing For The Fall Of The Tax Code

Suppose that you live in a capital city under siege, that is surrounded by revolutionary armies. And while you don't know the exact timing or specifics, you do believe that the eventual overthrow of the current regime is close to a 100 percent certainty. So you take your life savings and enter into a series of binding contracts with the current regime, under advantageous terms for you.

Then the day arrives that the revolutionary armies enter the capital city. On that day the current regime is ousted, the new regime repudiates the contracts of the previous regime – and you are left penniless.

Is your impoverishment a matter of pure bad luck – or is it just possible you could have made some better decisions along the way? Should you have taken the city being surrounded by revolutionary armies into account when making the decision about what to do with your retirement savings?

This hypothetical scenario is a metaphor for the most common retirement planning mistakes being made today in the United States.

We know the encircling revolutionary armies are there when it comes to the long-term financial viability of Social Security and Medicare, as well as the toxic consequences for the federal deficit and national debt. Yet, the routine advice is to completely ignore those factors when it comes to making the decisions that will determine our standard of living and financial security in retirement.

Every time you read an article about the impossible financial situation of the US government, or its irresponsible spending, or monetary creation and manipulations by the Federal Reserve or other central banks on a massive scale – what you are seeing are the campfires of the surrounding armies.

We do not yet know the specifics, but there are an extraordinary number of campfires burning out there – to the extent that we know the Capital City will fall and that the day will come that our tax code will change on a wholesale basis, it is just a question of the form and the timing.

I do strongly believe that there are solutions to this dilemma – but they are not found in the usual places. The starting point is to accept reality, and to accept that the tax code is likely to radically change at some point over the next one to two decades. The first major changes may arrive much sooner than that, and there may be several waves of major changes over time.

The farther out in time we go in our search for financial security, then the more we must take into account the possibility that the "City" (our current tax code) will have fallen by that time, and the more substantial the changes may be when it comes to (currently) tax-advantaged retirement accounts.

Granted, to begin with a starting assumption that the rules will change, and to then seek to maintain financial security nonetheless can be a much more uncomfortable process than merely staying in the middle of the herd. Because so long as we follow the very widely-accepted advice, then there is no challenge, and there's a certain sense of security in doing what everyone else is doing, even as we're given soothing assurances from every direction that the experts know what they are talking about, that this is a solved science, and that there is nothing to worry about. In other words, we have a comfortable cocoon of seeming certainty.

We just need to ignore those countless campfires surrounding our City.

Because if we don't – the moment we acknowledge that the retirement promises are eventually not just unpayable, but are not even close to being payable – then the cocoon vanishes, along with all the soothing assurances and promises.

It is when the campfires are acknowledged that the essential personal choices must be made. With the first choice being whether to do anything at all. For it is simply human nature that even if the campfires are seen, many or most people will nonetheless disregard them, if that is what everyone around them is doing.

Yet, no matter how universal the current narrative is when it comes to ignoring the surrounding army, it does not change the individual reality for each of us. For if the City does eventually fall at some point, then it is likely that every aspect of our current retirement account tax code will come "into play", along with potentially every aspect of our expected financial security.

***************************************************

Read Chapter One Of "The Homeowner Wealth Formula"

Read Chapter One Of "The Eight Levels Of Homeowner Wealth Multiplication"