Six Reasons Why The Government Is Destroying The Dollar

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

The Long Term

Let's add our six powerful motivations together and see how they interrelate. The truly big picture for both the United States and most other major developed nations is that population growth has been shrinking, while long-term promises to current and future retirees will be enormously expensive to fund, and for the most fundamental of demographic and economic reasons, the nations simply can't afford to pay for those promises.

On a global basis, governments are left with a choice between breaking promises openly – reneging on their legal commitments on a massive scale, possibly having to actually declare bankruptcy in many cases (effectively) – or they can follow the time-honored route that almost every nation which has found itself in the situation and has had the ability do so has done: they can pay their promises in form, but not in substance. They can inflate away the value of their national currency, and pay everything in full, but that currency will only be worth a fraction of what it is right now.

So the larger the future shortfall, the more overwhelming the motivation to destroy the value of the currency, and the greater the degree of destruction of the currency that is necessary in order to turn impossible promises into possible promises.

This is particularly the case when inflation not only reduces the real expenses (in after-inflation terms), but also increases the real income. The higher the real rate of inflation (which is not the same thing as the official rate), then not only the lower the real size of the required payments to beneficiaries, but the higher the collection of hidden taxes in the forms of both Financial Repression and inflation taxes. Thus, the gap is closed from both directions.

The Short Term

Let's look at the short term in the United States. As previously discussed, there is currently a gaping hole in the US economy that is equal to about 5% of its size if we look to official deficits, and about 8% if we include the hidden $500 billion tax on savings. This economic hole in the private sector is being covered over by overt deficit spending and hidden taxation, which in combination account for about one in every twelve dollars spent in the nation this year. If this 1-2 combination of deficits and hidden taxation were to cease abruptly, and taking into account the millions of unemployed who are being effectively hidden by changes in workforce participation rates, then the US risks going straight to a Great Depression-level of unemployment.

So, if you're in the political establishment and you don't want outright political revolution, then you have enormous incentives to try to keep an appearance of normalcy in the economy through spending vast sums of money that can't be paid for by taxes, and running up endless deficits to keep the facade of a healthy economy, no matter how much damage you need to do to the long-term value of your nation's currency.

Tying Together Long Term & Short Term

Short term interests are served by recklessly risking the long-term value of the nation's currency, thereby providing the funding to cover over the hole in the economy. Long-term interests, in terms of impossible government promises that must be inflated away, are served by the destruction of the value of the nation's currency. The more severe this destruction, the less the cost of repaying impossible promises. Arguably then, the more risk that is taken in "papering" over the hole in the current economy, and the more severe the long-term consequences, the better off the government will be in the future when it comes to its ability to cheaply repay debts that are otherwise unpayable.

The Medium-Term & The Real Economy

Now, let's go to the medium term and consider the real world factor that bridges the current economic crisis and the long-term economic crisis. That bridge is ultimately all that really matters, and it is the real economy. Without a powerful and rapidly growing real economy, there is no way out of the hidden depression in which the United States currently finds itself. American workers must be competitive if they are to regain both domestic and international market share (a situation many other nations are in as well).

Mixing Medium & Long Term

Nobody knows the true extent of the trouble the US economy faces over the next ten, twenty and thirty years as Boomer retirement promises come due in full. But we do know that:

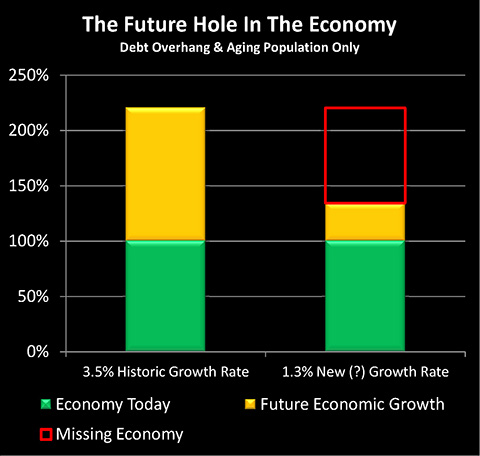

1) It would take a historically unprecedented rate of economic growth to meet the promises in current dollars without bankrupting the nation; and

2) The financial devastation could be far, far worse than most estimates if the US economy does not perform like it has historically, but instead continues the downward spiral of a wounded empire that is losing prominence and economic power on the world stage.

When we strip away the standard assumption by the government when making budget projections of endlessly compounded 3% real economic growth, and say that we are either losing economic growth or just breaking even, then the future shortfalls grow even more staggering. Indeed, when we include the academic evidence of the growth-slowing effects of large government deficits, and then add in the reduction in consumption expected for an aging population, then we may already be in an effectively zero per capita growth mode, as covered in my article linked below, title.

Bridging Medium, Long & Short Term

What the short term and long term both have in common is that the only true solution is ultimately to grow the real economy. The real economy has been hampered since the mid-1990s by a short-sighted "strong dollar" policy that has enormously benefited major international corporations and major banks, while creating a debt-driven illusion of personal prosperity for many of the citizens of the United States. It's a standard of living that could never be paid for, but rather was reliant on other nations lending the US the money to fund that lifestyle, so long as we agreed to keep the dollar "strong". The effective terms were that certain other nations lent us the money to live it up without our being able to pay for the goods that delivered our subsidized standard of living, and in exchange we let them take our industries and jobs.

To re-grow the real economy and regain economic competitiveness, the US must remove the handcuffs on American workers, which requires driving down the value of the US dollar. This has to be done in a competitive world, where other nations want to defend their own market share by driving down the value of their own currencies. So for the US to be "successful", it has chosen a strategy of taking more radical actions – in the threat to destroy the value of its currency – than other nations dare counter.

In other words, the other nations aren't as willing to recklessly and rapidly wipe out the value of their citizen's savings as the United States is, which gives the US a temporary "advantage" in currency brinksmanship against most of the world (other than Japan, who has taken the competitive currency devaluation lead for now with Abenomics).

Most conveniently, the otherwise-impossible cost of covering over the gaping hole in the US economy can be paid for through open monetization on deliberate, prominent display for the whole world to see. The strategy is to simply manufacture the money out of nothingness, which then lets the rest of the world know that the US dollar is in grave peril of swiftly diving in value. This then drives down the value of the dollar, and reboots the real economy and real American competitiveness, even as the hole in the economy is temporarily covered over.

Perhaps most important of all, this begins the rapid destruction of the value of the dollar as necessary to avert formal US bankruptcy when it comes to paying the enormous retirement and health care obligations that are coming due over the next ten, twenty and thirty years. Even as this higher rate of inflation increases tax collections year after year on a massive basis through using the two distinct types of hidden taxes, which history shows that average voters don't understand. The equations are simple: 1) no inflation means no hidden tax revenues from Financial Repression and investment inflation taxes; and 2) the higher the rate of inflation, the higher the receipts from hidden taxes which don't have to be defended in elections.

To understand the true extent of the danger to your savings requires understanding how all three of these levels work together: hiding the depression in the short term, rebooting the real economy in the medium term, and the long-term destruction of the value of the dollar so that tax revenues rise, even while impossible promises are paid in form but not in substance. All three levels effectively require the destruction of the value of the savings of older Americans and retirees in particular. It is your future lifestyle that must be sacrificed for all of these goals to happen together.

Adding In Short-Term Political Benefits

And finally, perhaps not quite as fundamental as the other factors but still significant, there are enormous political rewards for those currently in power when it comes to pursuing this approach. As covered in my article, "Hiding A Depression", the government's share of the US economy swiftly went (with amazingly little commentary) from 35% of the total economy to 43% of the total economy. In the real world of politics, this growth translated to increased discretionary spending, that (usually) rare commodity that is the currency of pure power. In normal circumstances, between government transfer payments, the military, and the established bureaucracy, there isn't all that much discretionary money for politicians to channel for their partisan desires. That has turned upside down. Indeed, discretionary money was created so fast that Congress and the Administration initially had trouble figuring out how to spend it.

The government has enormously increased its control over the day-to-day economic life of the nation – not on an altruistic basis, but in the exercise of raw political power. Politicians have the unprecedented ability, almost without limitation, to take the ~$650 per month per above-poverty line American household in money that is being created out of the void ($1,100 with the hidden savings tax), and to use it to reward their friends and hurt their enemies. And many are doing so.

The Personal Implications

These six powerful motivations all exist simultaneously, they all wrap around each other in their numerous interrelationships, and they all reinforce each other. Together they constitute an overwhelming incentive to make sure that a dollar does not remain worth a dollar.

The implications of these six powerful motivations all coming together are that there are multiple compelling reasons to believe that the value of the US dollar (and many other currencies) will be mostly or near entirely destroyed in the coming years and decades. Now, when paper wealth is wiped out for much of the population, and real wealth (goods and services) for a nation has taken a blow, but is not wiped out – then what we necessarily have is a massive redistribution of wealth. And there is very good reason to believe that the largest redistribution of wealth that has been seen in modern times is likely to be occurring over the coming years.

Inherently, the older that you are – the more likely it is that wealth will be redistributed away from you instead of towards you. A giant "Reset Button" will likely be pressed for the dollar, and with it – if you have been following the conventional wisdom for retirement investing – the value of savings and investments will likely evaporate. And if you're nearing retirement, you may not have that many working years left to recover from the damage, with jobs being difficult to come by even if you want to work.

So the older compete against the younger - not just for jobs, but for goods and services, where the younger workers have the current income in inflation-adjusted terms to buy these desirable goods – and the older don't. Thus, the older citizens become impoverished relative to the younger citizens. This is a history that has been repeated time and again across nations and across the centuries – it is the pensioners that get nailed when the currency reset button gets pressed.

Making it even more difficult is that the hidden savings tax acts as a giant anchor, making it near impossible for fixed income savers to break even on an inflation-adjusted basis, let alone compound their wealth like all the financial planning models promised. Simultaneously, the likely reduced economic growth rate associated with a heavily indebted and aging nation will likely slash further stock returns, or even turn them negative in after-inflation and after-tax terms when we consider hidden inflation taxes on investments.

Both of the pillars underlying conventional financial planning have shattered and fallen, which leaves traditional retirement investors with two negative return asset classes (in inflation-adjusted and after-tax terms) that are steadily destroying wealth over the long term rather than compounding it. Even as the slick investment firm ads featuring vibrantly healthy and wealthy retirees enjoying their active and prosperous retirements, continue to fill the airwaves and financial media.

There are personal solutions. Indeed, there are other schools of investment finance that can handle what is coming, with methodologies that are used by the most sophisticated investors in the world – but they are quite different from the simplistic strategies that dominate both the mainstream and contrarian flavors of personal finance.

The first step is to see what is coming. Once you see how all six factors work together – you will be able to do something that most people will never do, which is to take personal responsibility for your own future in a deeply unfair world. Neither the government nor Wall Street are going to bail you out of the mess they have created, and the conventional financial "wisdom" isn't going to do it either. You're on your own, and that means rolling up your sleeves and taking individual actions to protect what you and your family have.

Once you've decided to accept this personal responsibility for your future, then you have to be open to changing how you see money and your investments. To find personal solutions, you have to be open to education leading to paradigm change. When you have that education, and have changed the "lenses" through which you view money and investments – then you can also start to see the professional grade tools that can be used to handle the simultaneous destruction of the value of money, and the value of assets. Surprising tools found in places you never expected, often without even calling a broker, that can be accessed by most people, and used in a dynamic sequence for the stages of crisis – when we step outside the usual personal finance boxes.

Your financial profile can't look at all like that of an ordinary older person – or you will share the fate of most older people. To survive and even thrive in the very different financial environment of this decade and the ones to come, requires changing that profile so that inflation systematically redistributes wealth to you, rather than away from you, and the more of the value of the dollar that is destroyed - the better off you become on an after-inflation basis.