| Daniel Amerman & The Turning Inflation Into Wealth Mini-Course | |||

| Home | Inflation & Wealth | Author Info | Crisis, Books & DVDs |

| Bailout Lies | Deflation & Inflation | Inflation Supply Shock | Retirement Reality |

By Daniel R. Amerman, CFA

Let's start with two quick questions

for gold investors. We're going to assume, as will be illustrated in detail later

in this article, that 10 to 15 years from now a dollar is worth a nickel, that after

a tremendous bull market gold has returned to more or less its long-term

average value in inflation-adjusted terms (meaning a far higher dollar price

for gold than today), and that as governments struggle financially around the

world, the future average marginal tax rate on gold profits is 50%.

Question

One. If the future dollar is worth five

cents, and gold is trading around its long-term historical real (inflation-adjusted) value, which would

be $9,000 an ounce in future dollars, did you:

A) Make a killer investment that's

really multiplied your net worth? Or,

B) Lose more than 80% of your net

worth, with much of that going to the government?

Question

Two For Extra Credit.

Let's say that gold eventually returns to something close to its long-term

historic average value, and we'll call that $450 an ounce. Which of the

following scenarios gives you a higher after-inflation and after-tax net worth?

A)

Gold is nominally at $9,000 an ounce but in inflation-adjusted terms is only

worth $450 an ounce.

B) Gold goes straight from $1,350 an

ounce down to $450 an ounce with no significant inflation.

The correct answers are B and B. If the dollar becomes

worth five cents and gold eventually returns to its long term average value in

real (inflation-adjusted) terms, then you lose over 80% of your net worth on an

after-tax basis. Also, if gold is going to return to its long term inflation-adjusted

value, you are almost three times better off if gold is selling for $450 an

ounce, than if it was selling for a nominal $9,000 an ounce.

How did you score?

You may doubt the answers right now,

but will come to understand them as we

cover these questions in step by step, irrefutable detail. If you missed either correct answer, or if

anything at all came as a surprise, let me suggest that it is very much in your

long term financial interest to read this complete article, and then learn some

of the professional grade tools that you will need to get ahead in real terms (after-inflation and after-tax). If you are a long-time reader, please also

note that what is quite different in this article from my previous articles on

gold, is that it addresses how gold asset

deflation in purchasing power terms affects investors when they buy into a

precious metals bull market that is followed by substantial monetary inflation.

Gold and silver can be superb

investments for the current times, and when you use a professional level

strategy – then a heavy precious metals weighting can be a key component in not

only surviving the destruction of the value of currencies, but potentially

building multigenerational wealth even

after adjusting for the corrosive effects of inflation and taxes. Also please note that the principles

illustrated herein are not dependent on the specific example of gold regressing

to a long term valuation mean, but are even more important in a spectacular

bull market where gold could hit the highest real valuations of our lifetimes. But whether we are looking at long term

declining valuations or short term soaring valuations, to understand the

difference between the gold investors who will be highly successful, and the

gold investors who will lose most of what they have, we need to look at the

difference between examining gold using professional level methodologies versus

the alluring but deceptive surface level used by so many gold investors.

For this reasonable illustration,

let's start with you. We'll assume that you've been a gold investor for some

time, because you've been looking at the irresponsible financial and monetary

decisions of your government for many years, and you have concluded that the

destruction of the dollar was the most likely result. Unfortunately for us all - you are turning

out to be exactly right. Now you're seeing the madness that has officially

consumed the Federal Reserve with QE2 and the creation of new money in an amount

equal to 9% of the US economy. In other

words, a thousand dollars per household per month, is being created directly

out of the nothingness by the Federal Reserve and then used to purchase

treasury bonds. You believe that the end of the dollar as we know it is indeed

approaching, and you buy still more gold at the current market price of

approximately $1,350 per ounce.

While we're making assumptions, we

will assume that what I have been writing about for many years comes true, and in

addition to the above, the government uses massive inflation (such as that so

conveniently eventually caused by QE2, QE3 and QE4) to effectively meet the

Social Security, Medicare and pension promises that would otherwise be

impossible. For a nice round number

we'll take the example developed in the article linked below, "Bailout

Lies Threaten Your Savings", and assume that the bottom line is correct

and the dollar becomes worth a nickel.

http://danielamerman.com/Video/BBL1B.htm

Now if gold is currently selling for

$1,350 an ounce, and gold were to entirely keep up with inflation, (which it is

likely to do and even exceed in the next few years), then gold would rise to 20

times its current value, which would be $27,000 an ounce. Which sounds spectacular, but keep in mind

that when we adjust for inflation, the real (inflation-adjusted) value of our

investment is merely constant at $1,350 an ounce in today's dollars.

However, for our example we are not

assuming peak valuation (i.e. selling near the top) but rather a long term

buy-and-hold strategy for an investor who truly believes in the wealth

retention power of gold. So the peak of the crisis came and went some years

ago, we're a more impoverished nation than we were, and this relative

impoverishment is concentrated among the retirees and boomers whose savings,

retirement accounts and investments were shredded in the Great Collapse. We'll assume that a new and poorer financial "normalcy"

has returned, as some form of "normalcy" almost always does

eventually, Zimbabwe notwithstanding. So

we're looking 10 or 15 years out and saying that gold has returned to its

long-term historic average value. Like

it eventually did after the last great gold bull market of 30 years ago that

accompanied the stagflation of the 70s and early 1980s.

The graph below tracks the long-term

inflation-adjusted value of gold, using New York market prices from 1791

through 2009. There are difficulties

involved with the calculation of long term inflation rates, and the numbers

need to be taken as a ballpark range rather than being precise values. Therefore the average shown of $458 an ounce

is likely more indicative of a valuation between, say, $433 an ounce and $483 an

ounce. By coincidence, $450 an ounce, which

is near the middle of the range, is precisely one third of today's price of

about $1,350 an ounce, which makes illustration calculations easy to follow.

So let's take what the value of gold

would be if it precisely kept up with inflation, $27,000 an ounce, and say that

long after the crisis has passed, gold has "regressed to the mean"

and returned to its average value in real terms over the last couple of

centuries, and that's an inflation-adjusted $450 an ounce, which is one third

of $1,350. So we take our $27,000 and we divide by three, which gives us a

value of $9,000 an ounce. (We then check

by multiplying by 5%, and it is indeed an inflation-adjusted value of $450 an

ounce.)

While not quite as exciting as

$27,000 an ounce, $9,000 an ounce sure does look a whole better than $1,350 an

ounce, and indeed, when we divide $9,000

by $1,350, we come up with 667% of our starting investment value.

That is all well and good, except

that there's a slight complication. When

you eventually sell the gold to fund your lifestyle or redeploy the assets, the

government compares the $9,000 sale price of gold versus the $1,350 you bought

it for and sees a $7,650 profit. And the government says that we're in very

difficult times (thanks to the mess it created years before) and we all need to

pay our share, which is now 50%. (The idea the tax rate will "only"

be 50% being a decidedly optimistic one perhaps.) So we take our $9,000, we pay

the government the half it demands of the $7,650 book profit, which is $3,825,

and we're left with $5,175. That's still not too bad as it is almost four times

what we originally bought the gold for.

Except there's this second

complication of our needing to adjust for a dollar only being worth a

nickel. $5,175 times 5% is equal to

$259. That's right, if we buy gold at $1,350 an ounce, and we sell at the long

term average inflation-adjusted price for gold (about $9,000) when the dollar

becomes worth a nickel, and we pay 50% in taxes on our "profits",

then we're left with $259 an ounce in

gold purchasing power after adjusting for both inflation and taxes. If we

compare that $259 with the $1,350 we started with, we have only 19% percent of

our net worth remaining on an after-inflation and after-tax basis. When we

compare the 667% (or $9,000), which is the glittering surface that many

investors would look to, to the 19% (or $259) in real purchasing power that

investment professionals would see as being the end result, the difference is 3475%

($9,000/$259 = 3475%).

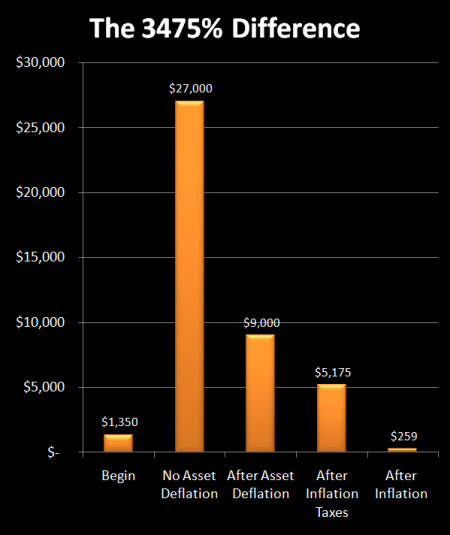

Let's quickly review the five

columns:

We

start with $1,350 an ounce gold;

A

dollar becomes worth a nickel (monetary

inflation), and gold exactly keeping up with inflation would mean $27,000 an ounce;

However,

gold at $1,350 an ounce is roughly 3 times the long-term historic average, and

if gold eventually returns to its long-term average real value in

inflation-adjusted terms after 10-15 years, that would be about $9,000 an ounce (asset deflation in purchasing power terms);

The

government taxes us heavily on the decline in purchasing power on our

investment, because the tax code doesn't (usually) recognize inflation (inflation taxes), leaving us with $5,175 an ounce; and

When

we finally multiply by 5% to account for a future dollar only being worth 5

cents in purchasing power compared to today, we are left with the tiny column

on the far right, which is $259 an ounce

in after-tax and after-inflation terms.

It is the ultimate, spendable reality:

what we can purchase after paying taxes.

As illustrated in this reasonable

example, when we compare the $9,000 an ounce value in the "surface"

column, and the $259 "real" value in the spending power column, let

me suggest that there is a 3475% difference between looking at gold performance

using professional analysis tools, and performance when measured with the

simple surface approach.

The sources behind our going from an

apparent huge gain to losing 81% of our real net worth are that (1) the value

of money was destroyed (aka monetary or

price inflation); (2) that gold eventually fell in real terms in a

regression to the mean to its long term average value (aka asset deflation in purchasing power terms), and (3) that even

partially keeping up with monetary inflation created a false income that was

taxed by the government (aka inflation

taxes). When all three parts work together, we take what on the surface looks

to be the best investment decision of our life and we instead lose most of our

net worth.

When (1) the Federal Reserve and

European Central Bank are creating new money out of the nothingness on a

massive basis; when (2) you are buying at the highest gold prices in real terms

in almost 30 years; and when (3) your government is effectively bankrupt and

highly likely to be raising tax rates in the future, let me suggest that what

we just illustrated are three of the most important factors in your life when

it comes to determining what your future standard of living will be for both

yourself and your family.

We do not have to be helpless

victims, however. Right now and the years coming up may indeed be some of the

most advantageous times of our lifetimes to create wealth through purchasing

gold and silver – but we've got to get there using a little different path than

the simplest and most popular strategies.

Gold investors are well aware that

gold is trading at high prices relative to where it has been for most of the

last 30 years, and that while we may have strong opinions about where

investments are likely to go, we rarely have guarantees. Serious investors know that there is a risk in

buying gold at current levels, that gold may return to previous levels, and that

they could lose a good deal of money if that does happen.

Now, I happen to agree with the

assessment that $1,350 an ounce is not bad at all given what the government is

currently doing, in combination with the long term fiscal situation of the US

government. It could even be called

bargain basement when we consider that the US government is massively

monetizing for the first time since the Civil War. And while I don't think $450 an ounce in

nominal dollars is at all likely - the possibility can't be dismissed

altogether, and indeed, explicitly considering the possibility that an

investment will return to a long term average valuation should be one of the

scenarios considered as a part of any responsible investment evaluation

process. (Taking a good, long look at

inflation-adjusted gold prices over the last couple of centuries as shown in

the 1791-2009 graph can be quite compelling, when we consider the potential

inflation-adjusted price of gold in the long-term future.)

Let's go back to the 2nd quiz

question. On the one hand we have gold at $9,000 an ounce, which on an

inflation-adjusted basis is equal to $450 an ounce. On the other hand we buy

gold at $1,350 an ounce, and we could say that it works out that to everyone's

great surprise - Bernanke really is the greatest economic genius in history.

The economy does fully recover. The dollar maintains full value. Social security and Medicare pay in full

without the value of the dollar falling, just like the politicians have

promised us. (Again this is an illustration, not a prediction.) In this

scenario, if we purchase gold at $1,350 an ounce and we sell it at $450, we

would take a $900 per ounce loss. And let's assume that we generate a tax loss

that is usable for us at the current collectibles rate of 30%.

Our $900 loss allows us to reduce

our tax payments by $270 ($900 X 30%). If we take the $450 we got in sales

proceeds and add the $270 tax loss benefit, we've got $720. This equals 53% of

the $1,350 that we originally spent, meaning we took an after-tax and

after-inflation loss of 47%.

We previously calculated that with a

dollar being worth a nickel and gold going to $9,000 an ounce (which also

returns us to the long term average inflation-adjusted value of $450), that we

end up with $259 in after-tax and after-inflation terms. Which represented 19%

of our original investment. If we compare ending up after-tax and after-inflation

with 53% of our net worth intact, to having only 19% of our net worth intact,

we see that selling gold at $450 an ounce can indeed leave us with almost 3

times the after-tax and after-inflation net worth that we would have if we sold

gold at $9,000 an ounce under the assumptions shown. (Raising the tax rate from

30% to 50% to make the examples uniform would just increase the advantage to

$450 gold).

This may seem to be highly counterintuitive,

but it all comes back to what I have been educating investors about for years

now, and that is about how simultaneous monetary

inflation and asset deflation can

work together in an environment of inflation

taxes. When you have asset deflation

(in purchasing power terms) in a time of overwhelming monetary inflation, no

tax losses are generated, and instead you're paying substantial taxes on

illusory income. Remove monetary inflation, and the same exact level of asset

deflation leads to deductible losses you can (hopefully) use, with this tax write-off materially reducing the "hit" from

the loss. This explains how you can do almost 3 times as well through selling

gold at $450 an ounce and taking a $900 pretax loss, versus selling gold at $9,000

an ounce and taking a $7,650 profit - so long as the true (inflation-adjusted) value

for gold is the same.

Rephrased, when real asset deflation

is masked by monetary inflation, it is inflation taxes that can destroy nearly

2/3 of your real wealth, as opposed to a fully tax-deductible asset deflation

loss with no monetary inflation.

Last year, I was one of the six

experts who participated in Jim Puplava's Great 'Flation Debate (along with

Marc Faber, Peter Schiff, Robert Prechter, Harry Dent and Mish Shedlock), and

in the aftermath of the debate I prepared the simple ten minute video tutorial

"Can Theory & Jargon Destroy Your Net Worth?" (linked below). What the video teaches is just how radical

the difference is between seeing the world in simplistic terms (inflation or

deflation), versus using the tools of professional wealth management to see

what was illustrated herein:

simultaneous monetary inflation and asset deflation in an environment of

inflation taxes.

http://danielamerman.com/Video/Jargon.htm

Avoiding mistakes, such as

accidentally losing 80% of one's net worth in real terms, is a very good reason

to learn and understand these concepts.

Monetary inflation, asset deflation and inflation taxes are three

powerhouse wealth destroyers - and the investor who is unaware of how these

fundamental forces work is the investor who is most vulnerable to their

destructive onslaught. Conversely, if one

learns not only of their existence, but studies how these destructive forces

work in close detail (the financial application of "hold your friends close and your enemies closer"), then you

can do something quite fascinating: turn each one of them to your advantage.

Extraordinary peril can be turned

into extraordinary opportunity when we understand that each one of these

powerful forces are in fact not

universal wealth destroyers, but rather each acts to redistribute wealth

between individuals. Monetary inflation redistributes wealth from some people

to other people. The ending implications of asset deflation powerfully

redistribute wealth from some people to other people. Inflation taxes

powerfully redistribute wealth from unknowing investors to government.

As a redistribution - each one of

these can be reversed! That is, an

individual through his or her actions has the ability to change their personal

financial profile so that all three wealth destroyers act to redistribute

wealth to them, rather than slashing their wealth.

As an example, some of the

strategies illustrated in detail in my Gold

Out Of The Box DVDs start with a potentially heavy precious metals

weighting, but there are more components than just metals, and the strategies

are designed from Day One to allow one to shift in the four stages of

crisis: the ramp up to crisis, the peak

of the crisis, the immediate aftermath, and the longer-term aftermath. Having multiple components that are designed

from the very beginning to potentially shift over time may seem a bit complex -

but there is a professional grade reason for that: the opportunities and perils with monetary

inflation and asset inflation/deflation shift at each stage.

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

Unfortunately, it is not quite as "easy" as merely shifting investments for changing monetary inflation

and asset deflation points of opportunity over the four stages. The problem is that selling assets typically

causes a taxation event, and in an environment of high inflation the

"haircuts" associated with paying multiple rounds of confiscatory inflation

taxes each time assets are redeployed, can cripple an otherwise brilliantly

executed investment strategy. Even

partially reversing inflation taxes is not an easy challenge, and if you wait

until you are ready to sell an asset that is carrying a fat inflation-based

"profit" - it is probably too late.

If you are going to redeploy assets in multiple stages, or pull monetary

inflation and/or asset deflation profits out during stages three or four when

you need that money to support your future standard of living - without handing

everything you have over to the government - you had better have your eyes wide

open and be carefully planning for these redeployments and cashing out events

from Day One.

The difference between

"accidentally" losing 80% of your net worth, and turning three perils

into three profit opportunities as you potentially multiply your real net worth,

comes down to a matter of vision. It comes

down to seeing with perfect clarity the 3475% difference in vision illustrated

in this article. It means seeing the

problems so well that you can also see the opportunities within each problem.

To gain that vision there is a first

step and it isn't something anyone else can do for you. The first step is education.

1. This article, "Hidden Gold Taxes: The Secret Weapon Of Bankrupt

Governments", removes the complexity of asset deflation, and provides a

simpler, step by step overview of gold, inflation and inflation taxes.

http://danielamerman.com/articles/GoldTaxes1.htm

2. This two minute video,

"Deadly Danger Of Dow 50,000", takes a very quick look at how

simultaneous monetary inflation, asset deflation and inflation taxes could

devastate stock investors in the same inflation/tax environment shown herein.

http://danielamerman.com/articles/DeadlyDow.htm

3. A free book, the "Turning

Inflation Into Wealth Mini-Course" can be received in installments via

e-mail subscription through the website below.

It covers the essentials of developing your inflation vision, analyzes a

historically successful inflation fighting strategy, and illustrates an

inflation tax reversal strategy in detail.

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will

redistribute real wealth to you, and the higher the rate of inflation – the

more your after-inflation net worth grows?

Do you know how to achieve these gains on a long-term and tax-advantaged

basis? Do you know how to potentially

triple your after-tax and after-inflation returns through Reversing The

Inflation Tax? So that instead

of paying real taxes on illusionary income, you are paying illusionary taxes on

real increases in net worth? These are

among the many topics covered in the free “Turning Inflation Into

Wealth” Mini-Course. Starting simple,

this course delivers a series of 10-15 minute readings, with each

reading building on the knowledge and information contained in previous

readings. More information on the course

is available at DanielAmerman.com or InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

This article contains the ideas and

opinions of the author. It is a conceptual exploration of financial

and general economic principles. As with any financial

discussion of the future, there cannot be any absolute certainty. What

this article does not contain is specific investment, legal, tax or any other

form of professional advice. If specific advice is

needed, it should be sought from an appropriate professional. Any

liability, responsibility or warranty for the results of the application of

principles contained in the article, website, readings, videos, DVDs, books and

related materials, either directly or indirectly, are expressly disclaimed

by the author.

Copyright 2010 by Daniel Amerman