Gold / Housing Ratio Falls To Historic Low

By Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Market Sentiment & Generational Buying Opportunities

If you had polled market participants and professional commentators in early 1980: the great majority would have said that only a complete fool would move out of gold and into real estate.

Just as, in 2001, likely the overwhelming sentiment of the market would have been that only a lunatic would get out of a powerful and rising real estate market to buy that ludicrous dog of an investment of precious metals.

From an old school contrarian's perspective, having the great majority of the market agree that buying a particular asset category is a completely boneheaded move, is in fact by itself: a big, bold and flashing "BUY" signal.

By definition - this has to be true. It is the general consensus that "only an idiot would do it" that creates the gross distortion of the relationships among long-term asset values, and which in turn creates the once-in-a-generation buying opportunity.

Indeed, following this strategy of moving directly against the overwhelming investor consensus in 1980 and 2001 would have meant dodging both market collapses, and instead owning the best investment for the 10-20 years ahead, acquired under the cheapest relative terms available over the previous 10-20 years. Which is a pretty good way of building wealth safely over the long term.

But when we're talking about potentially major commitments and our own hard-earned personal wealth being at risk - we want more than that. We want some outside assurances.

This is particularly true, because - AS IS ALWAYS THE CASE - there are some really good reasons for why most investors feel the way they do. There is the issue of the "shadow inventory" of homes which banks are not foreclosing upon, and what will happen to real estate prices when these homes do come on the market. There is the question of what would happen to real estate valuations if interest rates spike upwards even as unemployment rises, and what that could do to real estate prices.

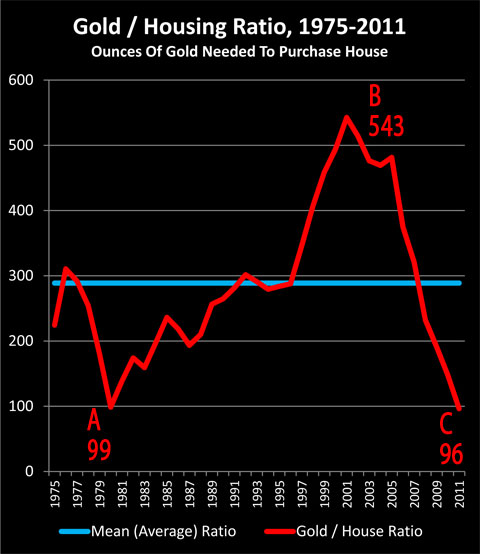

It is in helping to get a handle on whether a genuine buying opportunity exists that the Gold / Housing ratio becomes useful.

The last time this situation existed, with very similar market sentiments and psychological conditions, we know that gold would later plunge for 20 years while real estate entered an extraordinarily valuable bull market.

When we compare the current situation to the last time the Gold / Housing ratio trends reversed, we can actually buy a single-family home in gold terms for only 18% of what it was available for in 2001, before the real estate bubble even began.

That 18% is an amazing, breathtaking number. As further covered in the Solutions Companion (for subscribers), we are indeed at a extraordinary point when it comes to relative valuations in the two largest contrarian asset markets.

There is little comfort in this long-term relationship when it comes to relative price movements in the next year; real estate has huge problems, and gold investment performance could still easily crush real estate in the short term.

The value comes when we define ourselves as long-term investors, and say we are not all that interested in speculating, in flipping, or risking our retirement capital on the premise that we will be able to successfully move in and out of investment categories on a frequent basis to adroitly outperform the averages.

The value of viewing things from a long-term perspective comes when we say we would rather not spend our retirement years hunched over a computer watching markets, or facing sleepless nights as we wrestle with a long series of individual short term decisions that will cumulatively determine whether our retirement lifestyle is one of prosperity or impoverishment.

When we move our focus beyond just 2012 and 2013, and say that 2017 is much more important, and that 2022 and beyond is what really matters, and we lift our vision up above the constant short term turmoil - that is when the opportunity becomes remarkable. When we look at the average relationship between gold and housing since gold was legalized in the United States on December 31, 1974, in gold terms we can now buy housing for about 33% of the long-term average.

That 33% is a remarkably cheap relative valuation. All we have to do is say that over the long term, two tangible investments end up trending back towards their average values in inflation-adjusted terms - just like they have done before, decade after decade over the centuries - and we have set up an extraordinary return advantage in relative terms.

A Powerful Case For Gold

There is another way of viewing contrarian investing, and that is not so much to buy low and sell high while moving against the common market sentiment, but rather finding fundamentally different alternatives to conventional investment strategies in the forms of stocks, bonds and paper currencies.

The other face of gold – and the most attractive face at this time – is as a crisis investment in the event of monetary and financial system collapse.

I've written extensively on the subject for a number of years now, and won't repeat it here, but with massive government deficits without end, there is a strong chance that the gold run could still just be getting started.

Soaring entitlements and a long term unemployment crisis combine to create still more pressures on a dollar, and these problems are exacerbated by the short term fix of trying to smooth things over by creating trillions of dollars out of the nothingness, while refusing to tackle the underlying issues.

And we certainly can't forget the still strong potential for a euro collapse at some point, as well as the fundamentally different global economic environment from 1980, most particularly with the powerful rise of Asia.

Reconciling The Opportunities

In my opinion, the best way to reconcile these two sides of contrarian investing - to bring together the need to buy low and sell high, while also meeting the need for liquid safety - is to say "both".

Gold and other precious metals have powerful advantages. There are some things they do that are better than any other investment alternative in the event of a currency or financial collapse. Having a significant holding of precious metals in a currency meltdown environment is simply irreplaceable.

Gold is not absolutely bound by 1980, and if the situation in 2012-2014 is far worse than the situation in the early 1980s, then we could see gold traveling an entirely different short term path, and it may still just be getting started compared to where it will go.

However, when we remove our gaze from the short-term, and we assume a return to history as we've seen over previous decades and centuries, then what the Gold / Housing ratio shows us is that gold is valued at an extremely high level, and real estate is remarkably cheap in comparison. To choose gold long-term while avoiding real estate long-term is to fight not only the averages but history itself - which by definition, has never worked.

So our solution is to not choose between the two assets but to purchase both kinds of contrarian assets with different objectives.

We choose precious metals to the extent that we are concerned about currency and financial system meltdown (although real estate has some powerful advantages as a precious metals complement in this situation as well).

If there isn't a currency meltdown - for someone attempting to build long-term value, then buying real estate at current prices is likely to be a far better source of long-term returns than gold, and likely to act as a much better inflation hedge.

The relative amount of assets devoted to each of these contrarian investments then depends on the individual investor's personal assessment of the likelihood of actual financial meltdown.