Retirement Accounts & The Coming Tax Code Revolution

By Daniel R. Amerman, CFA

Overview

Let's say that you live in a capital city under siege, that is surrounded by revolutionary armies. While you don't know the timing, you do believe that the overthrow of the current regime is close to a 100 percent certainty. So you take your life savings and enter into a series of binding contracts with the current regime, under advantageous terms for you. The revolutionary armies enter the capital city, the current regime is overthrown, the new regime repudiates the contracts of the previous regime – and you are left penniless.

Is your impoverishment a matter of pure bad luck – or is it just possible you could have made some better decisions along the way?

The situation described above is a metaphor for the most common retirement planning mistake being made today in the United States. We know the US financial system is broken and hurtling out of control, with extraordinary deficits continuing to mount at a fantastic rate, and that there will be a necessary resetting of the financial and tax system at some point. Since the current system cannot continue indefinitely, we know a financial "revolution" is close to inevitable at some point.

Yet, one of the most common approaches to the upcoming "revolution" is to invest our assets with the governing guide being the current tax system. By doing so, we are in effect making contracts with the current regime, in the attempt to seek protection from its overthrow.

Almost by definition, one aspect of a financial revolution is that the previous tax shelters are going to be in a highly precarious position. There will be a lot of assets in retirement accounts, the nation will be in crisis mode, and everyone will be called on to make sacrifices. Tax deferred retirement accounts and other tax breaks will have a prominent and very public "bulls-eye" on them, and may very well be one of the first victims of the financial revolution.

Does that future sound reasonable? How prepared are you? Could it be there is a better path?

The 2013 "Surprise"

Investment News bills itself as the leading news source for financial advisers, and the following quotes are from a recent article, "Tax breaks for the wealthy are likely to be cut off":

"tax incentives for retirement savings are no longer safe from cuts"

"income tax rates on higher earners will likely rise in 2013, and the capital gains rate is unlikely to remain at its current level."

"the real action will take place in 2013"

This information was generated by experts at their Retirement Income Summit, but it really shouldn't be any great surprise for anyone who follows US politics.

It is arguable in the 21st century whether a first term US President really ever completely leaves campaign mode. There are, however, degrees of campaigning, and the US political cycle has already advanced to the point where the 2012 presidential election is dominating the actions of incumbent politicians, their challengers and campaign staffs. Any serious attempt to solve the current budget crisis is likely to be hugely unpopular with a major block of voters, whether the solution is slashing spending, raising taxes, or a combination of both in large doses. Whatever the approach, there is simply no way of solving it in 2011 or 2012 without manifesting a major degree of political courage. In other words, while there is a lot of posturing going on, when it comes to substantive real changes, they are most unlikely to be seen before the election.

No voters will know for sure what the attempted fix will be until after the election, when a quite predictable "surprise" is likely to occur. The US will enter that very brief window of about one hundred days to six months after a presidential inauguration, the opening that occurs once every four years, where both the next congressional and presidential campaigns are judged far enough away for the politicians to risk making major changes to the laws - which may or may not have even been mentioned in the campaign.

Regardless of the party platforms, realism dictates that taxes are likely to rise and benefits are likely to fall. The mix and degree will vary with who wins, but it is in early 2013 that retirement accounts and other tax breaks are most likely to come under attack, that income and capital gains tax rates may rise, and that Social Security and Medicare benefits are most likely to be cut. It will all just be part of the usual cycle.

However, the times are anything but usual, and the future for tax breaks and tax rates is likely much worse than what would be expected from "politics as usual" over the last several decades. Let me suggest that what the Investment News Retirement Income Summit failed to consider is that the old days are over, and the United States is in a full blown economic and financial crisis that is far worse than what can be solved by the typical political cycle.

Much Worse Is On The Way: The Bigger Picture

There is a case to be made that the US financial system may not even make it to the early part of 2013 in its current form. The US dollar, the US fiscal situation and the US economy are already all in crisis mode. The dollar has lost much of its value against most other currencies in the world, and its reserve currency status continues to slip. The US is racking up debt at a fantastic rate with no end in sight. The official deficit already stands at $1.5 trillion dollars per year, meaning that about 10% of the total US economy has been financed recently through money manufactured out of thin air by the Federal Reserve.

When looking at future entitlement spending and current promises, the most current estimates are that promised expenditures exceed estimated tax receipts by about $62 trillion, or in excess of a half million dollars per US household.

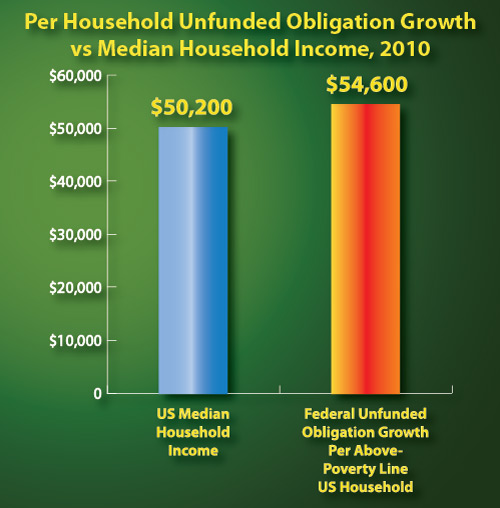

As covered in a recent article of mine, "Per Household Annual Deficit Exceeds US Income Per Household" (linked below), the situation is in fact much worse than is commonly presented, to the point of being almost difficult to believe. Using numbers from USA Today, unfunded federal obligations (such as Social Security and Medicare) grew by a fantastic $54,600 per above poverty line household in 2010, and in comparison, the median household income is only $50,200.

http://danielamerman.com/articles/2011/medianA.htm

Thus, the US is currently in this extraordinary place where the annual growth in unfunded obligations per (able to pay) family is in excess of the median family household income.

Even when the various sides discuss possible "solutions", nobody has proposed one that would actually solve the crisis. Instead there are battles over band-aids that even if implemented would barely slow the bleeding. There simply aren't any concrete plans being proposed for how to fix the budget in a manner that would be politically palatable.

The same can be said of the current talks between the President and Congress, where the end result is more likely to be political theater than the pain of true, fundamental reform as the election cycle accelerates. Oh, assuming that the results of vigorous interim public polling allows the talks to continue, both parties may work very hard at presenting the appearance of fiscal responsibility. However, when it comes to the likelihood of major real cuts angering real voters, let me suggest that the best guide may be the "$37 billion" in budget cuts from earlier this year, that when measured by the Congressional Budget Office turned out to be a mere $352 million in real savings, or less than 1% of the purported savings.

While it is generally agreed that US government spending has gone completely out-of-control, and people talk about the brakes - nobody's actually applying them. Quite the contrary, they're just pushing the accelerator down harder and harder, and there are no credible alternatives in place by either party to pull back from this disaster.

Once the US hits true emergency mode with governmental finances melting down along with the economy, everything will be on the table in terms of raising revenues and slashing expenses, as the nation desperately tries to recover, lest it plunge down to third world status. All bets will be off, and all the past promises will be meaningless when it comes to not just entitlements, but the idea that there will be tax breaks for "well-off" retirees that nobody else gets. Instead we should anticipate a reset of the tax code and tax rates, very much to the detriment of long-term savers and investors.

The Central Problem With Retirement Accounts

There are several basic problems with retirement accounts that have existed from the very beginning. One whopper of a technicality is that financially the numbers don't add up, at least not when too many people are trying to cash out their retirements at the same time for too high of an amount of assumed compounded paper wealth. This is a problem that has been exacerbated by the federal government deliberately holding investment yields far below the levels needed to maintain solvency for the nation's pension funds as well as to meet the needs and expectations of conventional private retirement investors. My previous article, "Feds Force State & Local Government Insolvency", which explains this fundamental issue, is linked below.

http://danielamerman.com/articles/2011/PensionsA.htm

Along with the financial issues, there is an equally powerful political problem with individual retirement accounts. Ironically enough, this political problem owes its existence to the sensible and prudent approach taken by many people, which is to fund individual private retirement accounts in order to survive the widely anticipated inadequacy (or even insolvency) of the public retirement entitlement system.

Over the last several decades, the government has encouraged people to save for retirement by offering carrots in the form of tax breaks when people put their money into dedicated retirement accounts. To get the tax breaks, savers have to agree to the government's terms, which are that people can put money in, but they can't take it out (without significant penalties) until they are of retirement age.

The message from the media, financial industry and government continues to be that making contributions to legally restricted retirement accounts is one of the a basic attributes of a financially educated and responsible person. When this message is combined with the carrots of the tax breaks and all those financial schedules showing the (supposedly) reliable compounding of wealth for a comfortable retirement, the result has been that tens of millions of middle-class and upper middle class people have deferred consumption and responsibly set aside significant sums of cash every year, which have been accumulating inside of legally segregated restricted retirement accounts.

So what we have are tens of millions of people with trillions of dollars of assets set aside for retirement – coming into an extraordinary financial crisis in which all tax breaks and rules are almost certain to be rewritten.

Of course, we need to keep in mind that there are more people in society than just responsible savers. There are the poor and lower middle class in their many millions, who simply don't have the financial resources to accrue any savings. Moreover, the majority of the baby boomers don't have any significant savings in personal retirement accounts. Neither do the young, nor do the early middle-aged.

So, even though there are tens of millions of people who have worked hard and deferred gratification for many years to accumulate a great deal of retirement savings, they are still very much in the minority within the overall US population.

Rephrased, when it comes to substantial retirement account savings: the "haves" are vastly outnumbered by the "have-nots".

From the perspective of the reality of the political process, of even more concern is that the truly wealthy have put only a tiny percentage of their overall financial assets into the usual tax-advantaged retirement accounts. This is generally due to the limitations on how much can be put into a retirement account on a tax advantaged basis, with the assets of the truly wealthy greatly exceeding the limits that can be contributed.

So when we consider not the average voters, but we instead concentrate on the people who in political terms really matter - which we'll define as the kind of people who can pick up the phone and call a United States Senator, and the Senator will personally call them back – for those kinds of people, retirement account assets are often a negligible part of their net worth.

Where things start to get really dangerous, however, is the next step. If someone with few or no financial assets doesn't understand very much about tax accounting, and their only source of information is what they see on TV or read in the newspaper (if they even do that much), then they are likely to see little difference between how the tax code affects a person who has accumulated a few hundred thousand in assets over the course of a career, versus the effects on a billionaire, as both people are among the "wealthy". For people without assets or financial education, it is easy to deceive them into rallying behind a tax code that effectively loots the middle and upper middle class in the name of "fairness" and social equity, while the complexities of the same tax code protect the assets of the truly wealthy and powerful (for proof, just look at the current US tax code).

If you don't have savings, or if your job is paid for by public taxes, and you're looking at your entitlements being slashed or your job eliminated, there's likely not all that much difference between someone who has scrimped and saved to build $200,000 in retirement assets, and someone who has $200 million in inherited family wealth. Framed from the perspective of politicians and the media, both are (and will be) "haves" that could be giving more of their fair share in times of great need.

So the overall situation is that we have this huge, very tempting target in terms of wealth that is conveniently set aside into legally segregated assets, coming into a time of national fiscal emergency when "everyone must do their share". It will be an enormously popular campaign theme among the people who do not have significant retirement account savings, that the boomers and other retirees who have substantial assets going into retirement should be paying their "fair share" of the total retirement entitlement burden, as well as other entitlement spending.

I believe it to be all too likely that those who have worked productively and spent decades deferring gratification in the name of financial responsibility, will effectively have bull's-eyes on each one of their retirement accounts. For when the financial revolution arrives in full force and it comes to political posturing and media coverage, there may be little or no difference between these middle-class and upper-middle-class people who have worked hard their entire lives to fund the retirement accounts that form their life savings, when compared to the truly wealthy whose assets are invested - and protected - in an entirely different fashion.

So it becomes highly advantageous for the billionaires to throw the simple millionaires "under the bus" to appease the angry mob (so to speak), even as those with $200 million in assets are also throwing those with a $200,000 retirement account balance under the same bus.

Preparing For The Fall

Let's return to the metaphor with which this article began. We are in the capital city, and it appears that the "government" (in its current fiscal form) - and the tax code as we know it - are likely to fall. Every time you see an article about the impossible financial situation of the US government, or the irresponsible spending, or monetary creation by the Federal Reserve on a massive scale – what you are seeing is a campfire from the surrounding armies. We do not yet know the specifics, but there are an extraordinary number of campfires burning out there – and we know the capital city will fall, it is just a question of the form and the timing.

The fundamental nature of retirement investment for most people in the United States (and around the world) is to segregate their assets into highly visible "boxes", the protection of which is likely to at least partially fail - and maybe entirely fail - upon the arrival of the new regime. In some ways these boxes can be considered to each have bull's-eyes boldly painted upon them with fluorescent paint.

If you see the "surrounding armies" and you think the fall of the capital city will happen in one form or another, then to avoid the fate of the many, you must fundamentally change your financial profile as well as your goals. Accept that the tax code will change radically, don't make your decisions based on wealth maximization under the current tax code, and consider what investments make you a target – and what investments will be more or less unseen as far as the majority is concerned, when they're on the march, enraged at what has happened, and looking for targets.

Try to accrue and cash out your wealth in such a manner that the majority will not even see it, because it isn't part of the conventional personal finance paradigm.

Try to align your financial interests on a fundamental basis with the wealthiest and most powerful segments of society, so that the billionaires will effectively pay for your defenses when the vengeful "mobs" are on the hunt for assets.

This has been coming for a very long time, and there are concrete solutions for individuals. Indeed, I deeply believe that if you can just change the way you see the financial future, that a whole new world of opportunities opens up, as it often does when there's a regime change.

But to have a chance, you need to change your strategy and that requires education.