Per Household Annual Deficit Exceeds US Income Per Household

By Daniel R. Amerman, CFA

Overview

The official story is that total US government debt has nearly reached the Gross Domestic Product of the United States. However, it's worth noting that this total is based upon governmental accounting, the use of which would quickly put an ordinary citizen into jail for fraud if they tried to use such a standard for private business purposes.

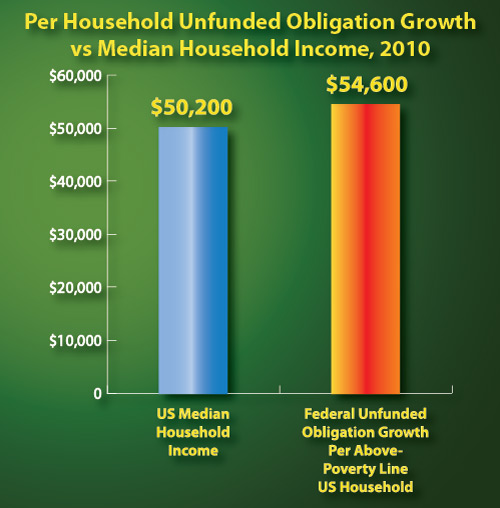

As we will explore in this article, a more accurate and full accounting for 2010 shows that in one year, total unfunded government obligations rose by about $54,600 per (above poverty line) US household. Given that the median US income is about $50,200 per household, this means that new debts and obligations taken on in 2010 by the US government, when allocated on a per "solvent" household basis, reached 109% of the total income of the median family.

This may sound wildly pessimistic, but as we will cover later in the article, the 109% figure is derived from government and media projections that are themselves based upon some quite optimistic assumptions about the future. If one assumes the US Government is not about to radically change its behavior to act more responsibly, and that the economy is not on the verge of a major rebound, then the situation becomes much, much worse.

The USA Today Report

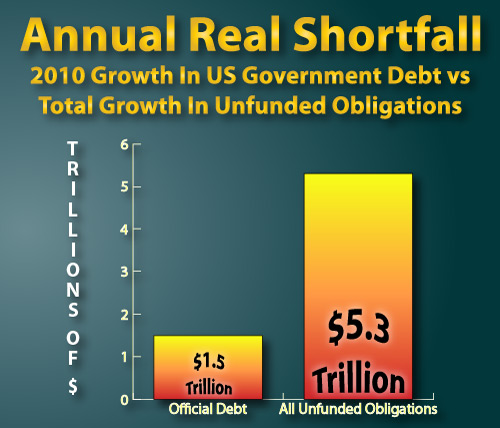

Using official government statistics, the US federal deficit grew by $1.5 trillion in 2010, and total US Treasury bonds outstanding reached $14.5 trillion, meaning the size of the US government's total debt was nearing the size of the total US annual economy. Naturally, this is considered a major red flag, and is the reason why both Standard & Poor's and Moody's have (quite belatedly) been threatening to drop the credit rating of the United States. (The $14.5 trillion includes bonds held for federal purposes, such as the Social Security trust fund and federal employee retirement accounts. The amount owed to external creditors is $9.7 trillion.)

As bad as these numbers are, however, they only represent a small part of the picture, because of the peculiarities of government accounting. Specifically, when it comes to financial obligations, the US government only reports what it has explicitly promised to bondholders.

Bonds are not, however, the only financial obligations of the US government. The government has promised many more dollars to many people, and has incurred financial obligations to future retirees for both Social Security payments and (more importantly) Medicare payments. If the US government were a private corporation, to report only selective obligations would be considered a matter of investor fraud.

What the USA Today newspaper has been doing on an ongoing basis is taking a look at the books of the United States government and asking basic questions, such as: what is the total amount of unfunded obligations outstanding, and by how much did those unfunded obligations grow in the last year? The "unfunded" aspect is crucial - the study was not of total obligations, but obligations where even after economic growth assumptions, there still wouldn't be enough taxes under the current structure to make the promised payments. In their study of 2010 which was released earlier this month, USA Today concluded that total US government unfunded obligations grew not by $1.5 trillion in 2010, but by $5.3 trillion, as shown in the graph below.

That's right. The largest financial obligations that the US taxpayer has are not in fact to bondholders, but to future retirees and medical care. And when we take the growth of those unfunded promises into account, the annual shortfall grew from $1.5 trillion to an estimated $5.3 trillion during 2010. As shown in the graph above, this means that the real US government deficit - as it would be calculated for a corporation or for an individual - was about 3.5 times greater than what was officially reported based upon governmental accounting. The link to the USA today article is below:

http://www.usatoday.com/news/washington/2011-06-06-us-owes-62-trillion-in-debt_n.htm

The Impact On Average Families

The official $1.5 trillion annual deficit is fantastically bad. Obviously, the real federal deficit being $5.3 trillion is even more fantastically bad. But, when the numbers are already so large that they become difficult to comprehend, how much worse is a $5.3 trillion annual deficit?

As an illustration, consider two families. The first family has an income of $50,000 per year, and has built up $54,000 in credit card debts over the last 20 years. They try to budget, but simply can't afford to meet their expenses, let alone the interest charges on their credit cards. So their credit card total rises each year.

The second family talks the talk about bringing their spending into line with their income, safely down the road in a few years - but when it comes to actual spending decisions today, they buy everything they want to. Their income is also $50,000 per year, but because of their reckless spending habits - they ran up $54,000 in new debts in 2010 alone. In one year, what they owed climbed by more than what they made.

Which family is in worse trouble? Which family's financial world is likely to fall apart faster?

To see the personal applicability of this illustration, let's examine the federal deficit in terms of the number of above poverty-line households in the United States. There are approximately 113 million households according to the US Census Bureau, about 14.3% of the population is below the poverty line, and that means that about 97 million households are above the poverty line.

It's clear that the below poverty-line households are not going to be able to make financial contributions to pay retirement promises for Social Security and Medicare. On average, these households are a drain on the federal government rather than a source of revenues, which means that when we look at who's really going to pay, we consider only the above poverty-line households. So if we take a $5.3 trillion true annual deficit, and we divide that by the 97 million households who have an ability to make financial contributions towards paying for these federal government promises, then the total comes out to about $54,600 per household. Your household share is $54,600 for 2010 by itself, my family share is $54,600, and the same is true for each of our neighbors and family members.

How does that compare to our household incomes?

As shown in the graph above, when we compare the real annual federal deficit per above poverty line household, with median annual household income (about $50,200), the United States is in the situation that was described for family number two in our illustration. The amount by which each of our shares of the federal deficit went up in 2010 exceeded our median income, and it was in fact 109% of our income.

The example of the first family running up $54,000 in credit card debts may have seemed dire, but the situation of the second family running up $54,000 in credit card debts might have seemed downright fantastic to the point of straining believability. Could a family truly be so irresponsible and short-sighted that in a single year they would take on more new credit card debts than their entire annual income? It does seem fantastic, but verifying the numbers only takes a matter of minutes, and this is our collective reality, because the United States is family number two and the situation is much worse than what most people believe.

Not The Entire Picture

When the average family's share of the annual increase in government unfunded obligations exceeds median family income for that year, this is obviously an extraordinarily serious red flag. This shows a level of government spending and promise-making that is completely and catastrophically out of control. It is not, however, the entire picture, and there is both good and bad news there.

First, while this comparison is a valuable illustration, there is more to the US economy to consider than average families. Indeed, the entire US gross domestic product is about $15 trillion. So if we do a very simple comparison there, then we could say that the annual real deficit in 2010 was "only" a third of the size of the annual national economy (rather than the official 10% figure).

That's the "looking on the bright side" perspective, and if one can say that the US running an annual real deficit "only" equal to a third of the national economy is the positive spin on things, that is perhaps the most damning statement of all in terms of how much trouble this nation is in.

Offsetting that, however, is the problem that the USA Today estimate is demonstrably much too conservative when it comes to the full extent of the problem. Specifically, as we are about to review, there are three major areas where the estimates fall apart.

Unrealistic Cost Savings Assumptions

The first problem with these estimates is they are based on federal government projections in which the behavior of the government in the future is assumed to be radically different from the behavior of the President and Congress today, or in the recent past. The politicians always claim they are going to fundamentally change their behavior, get all responsible, start acting like sober adults, and slash those deficits. Except the plan is never quite to take the necessary steps immediately, but a few years down the road, just like it has always been a few years down the road for much of our adult lives. So the ongoing charade is to take credit today for those tough, brave decisions that will really hack some people off - but only a safe few years from now - while continuing to pass the money out by the barrelful to keep as many people as possible happy for this particular election cycle.

As pointed out in the second and more detailed USA Today article below, "Government's Mountain of Debt" (which accompanied the first article), as bad as these estimates are, they are nonetheless based on some assumptions about behavioral changes by the government that, to date, show no sign of happening. As an example, the budget deficit assumptions are based on 165 cost-saving changes for health care, including cutting payments to physicians by 30% in 2012. Now that's a significant change, which is coming upon us very quickly (particularly for election year).

http://www.usatoday.com/news/washington/2011-06-06-us-debt-chart-medicare-social-security_n.htm

Where is the signed legislation for that to happen? Where is the furious political battle and national dialogue that would be necessary for such a massive reduction in payments to the medical establishment to actually happen? Where are all the brave politicians who are stepping forward and saying "this may cost me the next election and my political career, but the interests of our nation require it"?

Let's get real: there's no sign of this, because it's not going happen. As a recent example of political behavior and budget reality, consider all the sound and fury associated with the purported $38 billion deficit reduction package in the US. When the Congressional Budget Office later took a closer look, however, it found the actual savings were only $352 million. This figure represents less than 1% of the supposed savings - and under one hundredth of one percent (0.007%) of the $5.3 trillion real growth in unfunded obligations in 2010. In other words, when we compare the true reduction (per the CBO) to real growth in unfunded obligations (per USA Today), Congress only lopped 35 minutes off the full year deficit.

When we take a realistic view of what is going on with politicians and political parties actually paying the price to pursue "austerity measures" - there's no sign of that. But unless these austerity measures and cost reductions are in fact at some point actually implemented (instead of the cost increases that dominate the real world), the costs of unfunded obligation estimates are grossly in error, and the true unfunded obligations are much higher.

How much higher than $54,600 per household will they be?

Assumptions Don't Include Current Real Economy

While the USA Today article does not specify their economic assumptions, in looking at their overall estimate of about $62 trillion in unfunded obligations and comparing to other studies, it appears quite likely that they are making roughly similar assumptions to those used in most government projections. In shorthand form, these assumptions would include that the US economy actually exited the recession in June of 2009, that everything is fine for the future, and that US economic growth will return to the levels seen between 1950 and 2000 of about 3% per year in real (inflation-adjusted) terms, or a little over 2% per year on an inflation-adjusted, per capita basis.

The problem is, as has been covered by many commentators, and which I explain and analyze in my article "Hiding A Depression: How The US Government Does It" (link below), the US economy is not at all in normal condition. The private sector nearly collapsed in 2008 and 2009, and it has not recovered. As discussed in the article, the semblance of normality is only being maintained by the massive government deficits, and polls are showing that the claim of a normal economy is not convincing to most of the US population.

http://danielamerman.com/articles/Hiding.htm

The new economy of the early 21st century has been very different from the latter half of the 20th century, and if the old days do not return, we will have far less economic growth and far less tax collections (in the current tax structure) to pay for obligations. This shortfall in taxes does not affect the promised payout of those obligations.

So when we take a wounded economy that remains in deep fundamental trouble, and incorporate that into our future scenario, then we have radically higher deficits.

There is also a loop going on, as the GDP itself is based on this extraordinary level of deficit spending, and over 40% of the GDP results from government workers and contractors, meaning that they're not making an independent financial contribution to pay for the state, but rather are being funded by the state. So when we compare the size of the economy to the deficit, but the economy itself is to some degree dependent on the deficit-funded employment of public workers and private contractors for government projects, then the real situation is worse than it is officially made to look.

When we include the true condition of the wounded US economy, and discount for the portion of the economy that is based upon deficit spending - how bad does it get?

Keep in mind as well that future expenses and future economic growth are each exponential series, as each are growth rates that compound over time. If expenses are rising at a higher rate than the assumptions in the $5.3 annual unfunded obligation growth figure, then the compounding rate will be higher, and expenses will exponentially accelerate away from current official estimates. If economic growth is rising at a lower rate than expected, the compounding rate will be lower, and future economic growth (and tax collections) will fall short of current estimates by a shortfall amount that is itself exponentially accelerating over time.

Unfunded obligations are the divergence between future expenses and future revenues, and in this situation where government behavior fails to change even while the economy fails to return to historical norms, the shortfall becomes a double exponential function, and the differential between revenues and expenses (i.e. unfunded obligations) may radically accelerate over time, with a per household result that is far, far worse than $54,600 per year.

Federal Reserve Spending Not Included

Finally, the real deficit estimates are fatally flawed because they do not take into account massive deficit spending by the Federal Reserve Board. Part of the fraud that is governmental accounting is that if the Treasury department spends $1 trillion to bail out some banks, this is treated as government spending, but if the Federal Reserve Board creates the US dollars out of thin air and effectively does the same thing – this is not treated as being spending at all.

Which is why most of the true bailout in the past, present and future of financial institutions has never reached the US budget estimates or Congress at all. Rather it has been done on a quite secretive basis by the bankers of the Federal Reserve, for the benefit of the "Too Big To Fail" banks of the world.

So when on a realistic basis: 1) we strip out the purported future austerity measures that show no sign of happening; 2) we consider the shape the economy is genuinely in (which is a very different place than the period from 1950-2000); and 3) we include the massive off-balance-sheet expenditures by the Federal Reserve, then there is a case to be made that the estimated $5.3 trillion real deficit figure is in fact understated in a major way, or perhaps even in a radical way. And the real comparison is far worse than the 109% shown, when comparing unfunded government obligation increases in 2010 to annual "solvent" household income.

Protecting Yourself

The simple solution is to pull all you can out of paper investments and symbolic currencies, put them into gold and/or silver, and hunker down to survive the still coming crisis.

Unfortunately, however, we live in a complex and deeply unfair world, that makes mincemeat of emotional reactions and simple solutions. As illustrated in step-by-step, easy to understand – but irrefutable – detail in the article "Hidden Gold Taxes: The Secret Weapon Of Bankrupt Governments" linked below, a simple solution of just buying gold leaves you handing a good chunk or perhaps most of your starting net worth over to the government by the time all is said and done. The way the government – under existing laws – effectively confiscates the wealth of gold investors in a highly inflationary environment is little understood by most gold investors, but should form the central point for their investment strategies.

http://danielamerman.com/va/GoldTaxes.html

These inflation taxes on gold are one of the multiple aspects of the modern form of Financial Repression. For those not familiar with the term, "Financial Repression" is the academic description for an economic strategy that is currently being widely discussed by global economists and policymakers, because it offers a historically proven third way out for massively indebted governments, a strategy that avoids default or hyperinflation. Gaining familiarity with the components of "Financial Repression" should be a high priority for investors, because governments using back-door methods to deliberately confiscate the value of your savings is the whole purpose of the strategy as explored in the article linked below.

http://danielamerman.com/va/Repression.html

Let me suggest an alternative, which is to study, learn and reposition. Almost all financial and economic articles that you see today are really about the upcoming re-distribution of wealth, whether those words are used in the article or not. To have a chance, you must learn not just how wealth will redistribute, but how unfair government tax policies (that can be relied upon to increase in unfairness) will cripple most simple methods of attempting to survive inflation.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.