High Government Deficits "Crowd Out"

Stock Market Returns

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

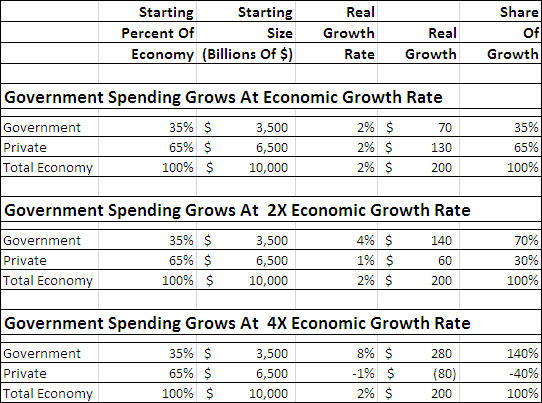

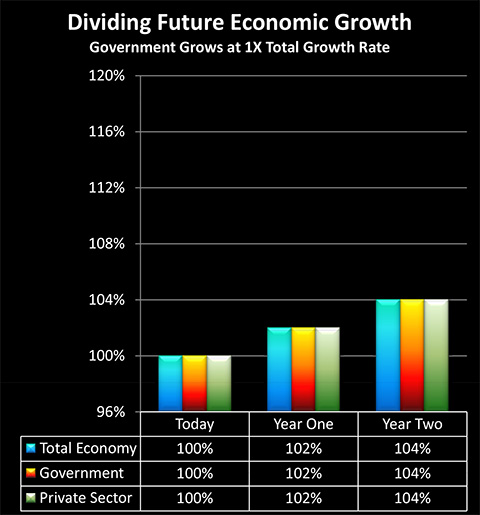

The chart above illustrates how rapid growth in government spending can effectively destroy private investment market returns. For simplicity’s sake, we’re using round numbers and saying that the starting size of the economy is $10 trillion, and it is experiencing real growth (inflation-adjusted) of 2% per year. Two percent growth in a $10 trillion economy means $200 billion in real annual economic growth.

We will assume that the private sector constitutes 65% of the economy and the government share constitutes 35% (the same split as the US economy in 2007). If the private sector and the government each maintain their same shares of the overall economy, that would mean that each of those sectors grow by 2% in real (inflation-adjusted) terms when the overall economy is growing by 2%. So the private sector would account for 65% of the $200 billion in growth, meaning the private sector grows by $130 billion.

With that same scenario, the government gets 35% of the $200 billion in total economic growth, and government spending rises by $70 billion. There is only one economy, the economy is made up of the government and private sectors, and the two must add up. Naturally, when we add the $70 billion in government growth (i.e., government spending) to the $130 billion in private sector growth, we come up with the $200 billion growth for the overall economy.

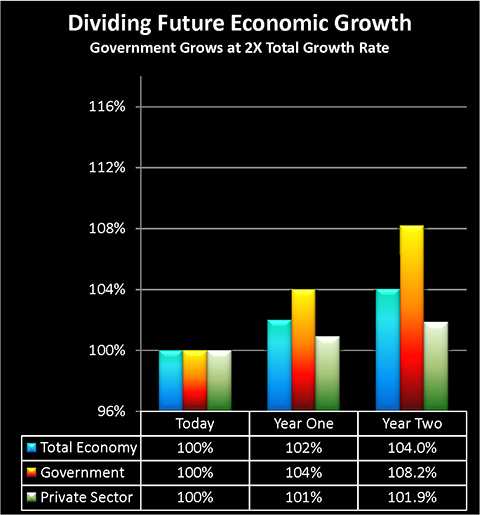

Government Spending At 2X Economic Growth Rate

Now let's change our assumption and say that government spending in real terms is rising at 4% per year. This means that the growth in real government spending is $140 billion, rather than $70 billion. To find private sector growth, we need to take our $200 billion in total growth, subtract $140 billion in government growth, and we’re left with $60 billion in private sector growth, a reduction of 54% from our number with 2% government growth.

In other words, if government spending is rising at a faster rate than total economic growth, that means the government is taking more than its share of the growth, which means that the private economy has to be growing at a slower rate than total economic growth. There is simply no other way for the numbers to add up. For the size of the government to grow 4% while the overall economy grows 2%, then the private sector can only grow 0.9%.

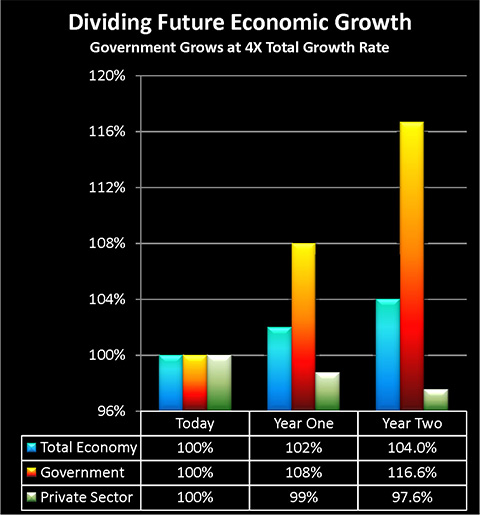

Government Spending At 4X Economic Growth Rate

Where things really get serious, however, is when the growth in government spending rises to 8% in real terms, which means $280 billion in dollar terms. Meanwhile, total economic growth was only $200 billion. Obviously, the only way government spending can rise by $280 billion when the overall economy only increased by $200 billion is for the remaining $80 billion to come out of the private sector economy. So when government spending rises too rapidly, it completely wipes out growth in private sector wealth, and in fact turns it negative for the nation as a whole.

Now, let’s go back to our illustration of the Magic Money Machine. Not only retirement planning, but the very fundamentals of stock valuation are based on the exponential mathematics of endlessly compounding growth. While many people don’t realize it, from a financial mathematics perspective most of the value of the stock market is generally based not on today’s earnings, but expectations about increases in future earnings. With no growth, or even negative growth, it’s not just that future stock price increases don’t occur – but most of the value of the stock market today implodes. Taking everyone’s IRAs, Keoghs and pension plans with it.

The Government, Pension & Stock Feedback Loop

Long-term, we have the huge shortfall resulting from Social Security, Medicare and other transfer payments. Long-term, we still have the current state and corporate pension fund crises to be concerned with. What we need to note here is that there is a powerful feedback loop that is likely to be at work, particularly when we have a government that is inclined towards bailouts. That is, an increasing government share of the economy means there is decreasing real economic growth, which increases pension fund insolvencies, which further increases the government share of the economy when the pension funds are bailed out, which then leads to still more pension fund insolvencies, which means the government is taking an ever greater share of the economy to pay for the next round of insolvent pension fund bailouts. Repeat. And repeat.

When we put this all together, we have two behemoths, each of which have laid claim to the wealth of the future. One behemoth is government retirement and health care promises. The other behemoth is pensions and individual retirement plans. Each behemoth not only needs but demands growth rates in future wealth that are far in excess of the ability of historical real economic growth to deliver.

This is where things get a bit ironic. As I've been writing about for many years, the irony with regard to retirement investors is that millions of well read investors, particularly younger boomers such as myself, are acutely aware that the government can't afford to pay its retirement promises. So, to ensure financial security, we've all been told to invest in the private sector, where we've been told we can expect to reliably compound our wealth together so we don't have to worry about the government breaking its retirement promises.

Unfortunately this theory is based on the mistaken premise that we have two economies: one economy for broken government retirement promises, and a separate, beautiful economy that can be reliably expected to generate fantastic wealth for private investors. When we meld the two economies together into one real economy, what happens is that a government reaching out for ever more resources in fact collapses the private sector retirement dreams for an entire nation. The central reality of cashing out retirement investments in the coming decades is that this will occur in a world of two vast sets of impossible promises – that have been promised in full – foundering upon the rocks of a limited underlying economy that must pay for everything.

The Implications For Investors

We have an entire society that has been making trillions of dollars of long-term pension and retirement investments based on this notion that there will be a separate investment economy that is immune from government problems, and where wealth will reliably compound at rates well in excess of real economic growth. We've been told (effectively) that the essence of being financially literate is to understand that this is more or less preordained, and the smart thing to do is invest more or less blindly every month into a market basket of index funds, while ignoring little technicalities like the economy, national problems and the prices we pay for securities relative to their value. Just do this simple task consistently for several decades, we are told, and a prosperous future is assured for all of us. It is so assured that in fact every state and municipal government in the country as well as major corporations can all safely bet their solvency upon it.

Things haven't quite worked out that way.

The consistent application of this (deeply) flawed investment theory does have some interesting side effects, however. Besides leading to enormous real wealth in annual profits for the investment industry, it also creates tremendous paper wealth for the entire nation. The logical result of tens of millions of people blindly buying investments without regard to price or expectations about the future, with buyers outnumbering sellers for decades, is that the prices go up, up and up.

So the prices go up, until the time comes for tens of millions of Boomers to cash out those investments and try to turn wealth expectations into the real wealth of goods and services.

When we have high asset prices today because we've all been promised we can be wealthy together, and we expect that when we do look at the future with our eyes wide open that those prices will likely be falling, then what we are expecting is asset deflation. This prospect of falling and even plunging asset values across the entire investment landscape is a nightmare for the conventional financial "wisdom". Effectively the only solution that is offered by conventional financial planning is to more or less exclude asset deflation by definition, and say that the hallmark of financially literate people is to understand that this situation can't happen (with shutting one's eyes to what happened in Japan the last couple of decades being an essential part of this “solution”.)

Something else happens when we have enormous government deficits, while having future retirement promises that are well beyond the capacity of the federal government to pay. Not only do we have crowding out, but we have a high probability of potentially very high future rates of inflation. We can expect that monetary inflation may be devastating the value of the dollar, even while asset deflation is devastating the value of investments.

Unfortunately those who think the future will be either inflation or deflation are likely to be sadly mistaken. For the reasons discussed in this article (as well as my extensive writings on this elsewhere), the future is all too likely to be one of simultaneous asset deflation and monetary inflation.

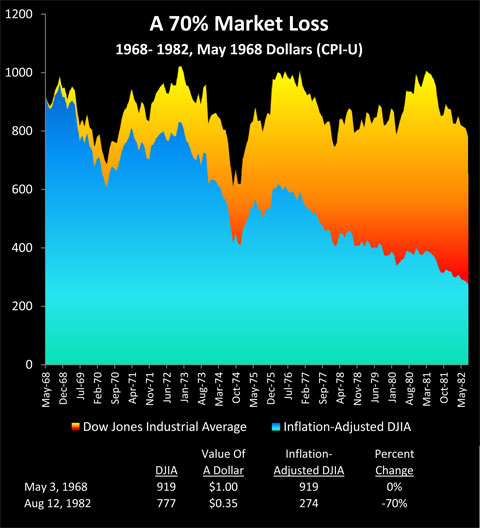

A historical example of simultaneous monetary inflation and asset deflation is the Dow Jones losing 70% of its inflation-adjusted value between 1968 and 1982, with the great majority of the destruction of the value of investments being hidden by the destruction of the purchasing power of the dollar.

The chart above is from my article "Deadly Dow 36,000 & The Secret History Of A 70% Market Loss" (linked below), and it shows this toxic relationship that can destroy investor net worth, even as the stock markets appear to go from record high to record high. As explained in that article, Dow 36,000 may be far deadlier for tens of millions of equity investors than the Dow 6,000 that some fear.

http://danielamerman.com/articles/2012/Dow36C.html

Finding Solutions

On a societal basis, there is much to be done, and the sooner it starts – the better. Each year that we ignore the evidence that abounds all around us, and blindly pour billions of dollars of investor and pension fund savings into a badly mistaken financial model, we are just compounding the future damage. We compound the fiscal crisis of states and nations, and the personal pain for tens of millions of responsible men and women around the world, whose only mistake was to believe the voice of investment authority.

Unfortunately, on a societal level, we can't suddenly convert the impossible into the possible. We can't make the “Magic Money Machine” work. The level of retirement wealth that an entire nation has been led to believe is their right likely won't be there for them to the degree that they believe it should be. This is a sad situation, but the fundamental reality is that the economic growth rate never has been there to pay for all the` promises the Boomers (and their equivalents in other nations) have made to themselves.

There are practical ways for individuals to use inflation to redistribute wealth to themselves, rather than away from them. So that the higher the rate of inflation and the more the value of the currency that is destroyed – the greater the resulting after-inflation and after-tax net worth of the investor.

Asset deflation is a much tougher nut to crack than monetary inflation – but it can be done for individuals, and the rewards can be even greater. Indeed the heart of some of my recent work has been educating people about the practical methods for turning asset deflation into greater wealth opportunities than those that can be found through reversing monetary inflation. For understanding simultaneous asset deflation and monetary inflation is the essential key to unlocking the most profitable precious metals investment strategies.

Crowding out will be a terrible problem for the many. For those who see the full implications, however, it also has the potential to become one of the greatest wealth creation opportunities of our lifetimes.

The solutions to monetary inflation, asset deflation, inflation taxes and crowding out are distinct but intertwined. But they all start with the same first step: education.

To get out of step with your generation, and have wealth redistributed to you even as your peer group is being devastated by this extraordinary destruction of wealth, you need to start with education. You need to gain the knowledge you will need to turn adversity into opportunity. Ultimately, you will need to look at the simultaneous destruction of the value of assets and the value of money – and see a once in several generation personal wealth creation opportunity. An opportunity that can be accessed through a multi-component strategy that anticipates the stages of monetary crisis and then moves with the stages, with a relentless focus on systematically protecting and building after-tax and after-inflation net worth.