Hiding A $500 Billion Tax On Savings: How The Government Deceives Millions

There is a hidden and deeply unfair "tax" that is costing US savers in excess of $500 billion per year. Through forcing interest rates far below the rate of inflation, the government has effectively created a tax on savings that not only takes all real interest income, but quite deliberately confiscates wealth from tens of millions of savers every year - for the direct benefit of the government.

As will be demonstrated with step by step, simple illustrations, the government is imposing the economic equivalent of a 90% income tax on savers. The amount taken annually from savers is equal to more than half of all individual income taxes, and is nearly three times as large as total corporate income taxes.

The tax is not uniformly imposed, but instead targets older middle class savers in particular. The effects include invalidating decades of financial planning, and potentially impoverishing millions of current and future retirees.

Bullets In The Back: How Boomers & Retirees Will Become Bailout, Stimulus & Currency War Casualties

Currency wars have their victims, much like military wars. What differs is who the victims are and what the casualty rate is. In a military war, the casualties are usually under age 25. Even in a deadly campaign, most soldiers are not victims because they are in support capacities.

The age of the casualties in a currency war is upside down compared to military war, because the worst of the damage is inflicted on those above age 50. Moreover, it is not just a few, but almost everyone who is on the front lines, and thus almost all become a casualty.

The latest financial headlines may seem arcane, with a vocabulary that is difficult to grasp, but the bottom line is unavoidable – the United States government and the Federal Reserve, in a belated defense of the fundamentals of the US economy, have effectively declared their intention to destroy the life savings of older Americans and devastate their future standard of living. It is the necessary "collateral damage" and all.

Soaring Government Spending “Crowds Out” Private Investment Returns

This resource goes to the heart of what drives stock valuation, and why the future may be very different indeed from the past. There is no long term rate of return in the market that can be expected to indefinitely repeat in a vacuum, independent of the economy and rest of the world.

Rather, market returns are based on growth in the private sector. One of the greatest changes in the US economy in the modern era took place in 2008/2009 - although it has received surprisingly little notice, and there has been comparatively little discussion of the profound implications for investors. The private sector plunged to an extent far greater than what is shown in the overall GDP numbers - and was replaced by the public sector in a sharp and enduring, deficit-financed substitution that changed the fundamental composition of the economy.

Because the investment models that drive conventional financial planning assume a rapidly growing private sector, this fundamental competition between the government and private investors for the limited annual growth in real resources may lead to a collapse of stock market values and conventionally invested retirement portfolios.

The ripple effects may potentially collapse most pension funds – and their government and corporate sponsors – across not only the US, but the rest of the developed world.

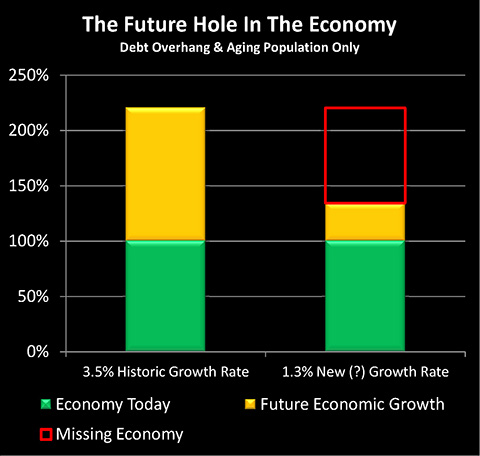

Three Converging Factors May Slash Economic Growth By 71%

Everything from the ability to pay for Social Security, to projected federal deficits, to retirement planning and stock market valuations is based upon assumptions that the United States and other nations will emerge from crisis and return to "normal" long-term growth rates.

What happens if we don't return to those growth rates?

When we step far back from the crisis in Europe, the US fiscal cliff, the Federal Reserve's "twists" and "easings", and other day to day headlines, and we instead go down deep to the very bedrock factors that help determine economic growth - then we can see that some major changes have taken place. Indeed, when we combine three of these deep and fundamental factors, there are strong historical reasons to believe that the United States growth rate could drop from a long-term historical rate of 3.5%, to an annual rate of 1.3% - and a per capita rate of 0.2% - in the coming decades.