Political Economy Collapses False Dichotomy Of Mainstream vs Doomers

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Reality Check List

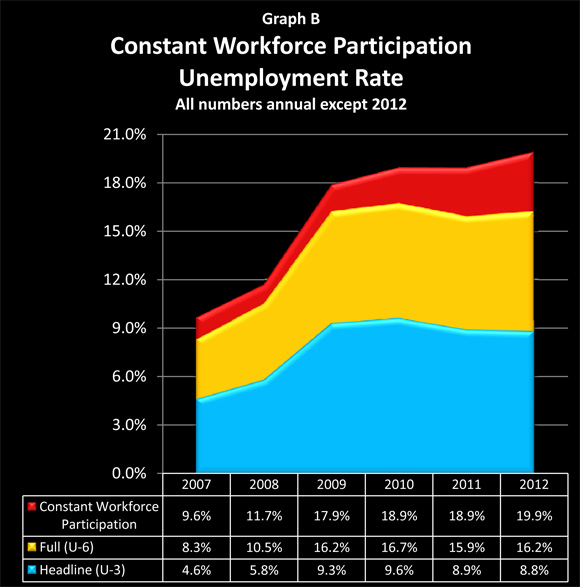

Reality is that total unemployment is much higher than what we see in the headlines. Indeed, if we take the headline rate (U–3), the full unemployment rate (U–6), and the 9 million jobless Americans who have been removed from the unemployment statistics via the little understood changes in workforce participation rates, then we have close to a 20% true unemployment rate.

http://danielamerman.com/articles/2012/WorkC.html

The reality is that the fundamentals of the US economy have radically changed since the year 2008, with there now being 28% less private dollars to support every dollar of government spending than there was before. This is the true source of the "Fiscal Cliff", and why the changing tax rates - and the laws governing investments in general - will be a process that occurs again and again, instead of only a one-time event.

http://danielamerman.com/articles/2012/FiscalC.html

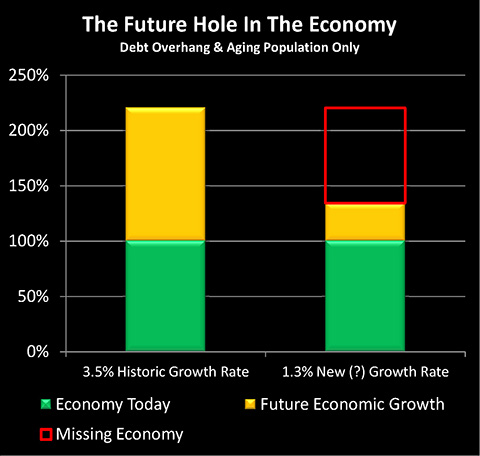

The reality is that we have two centuries of historical information about what happens with economic growth rates when countries get too deeply in debt: they decline. And when we combine this with a lower growth rate for an aging population, then we understand that economic growth is likely to be far slower for the years ahead than it has been in the past.

http://danielamerman.com/articles/2012/OverC.html

Reality is that the economy of the late 20th century already collapsed in the years 2008 and 2009, and it was only extraordinary government interventions -- ones that persist to this day -- that create the illusion of economic health. If more cash had not been created out of thin air by the Federal Reserve in the fall of 2008 than the total physical cash that was in circulation in the United States after 200 years - $819 billion from the nothingness in a move that changed the very nature of the dollar - then the global banking system would have failed in October of 2008.

Reality is that it is only the extraordinary amount of deficit spending at the new normal of over $1 trillion a year that has kept the economy in a "Great Recession" since 2008, instead of an overt depression with true unemployment levels above 25%.

The reality is that when it comes to true deficits, the United States isn't "only" $16 trillion in debt, but rather $87 trillion in debt when we take into account the present value of unfunded obligations. This is according to a recent report by Cox and Archer, the former head of the Securities and Exchange Commission and the former chairman of the House Ways and Means committee, respectively. The US is impossibly in debt, and it is only governmental accounting gimmickry that allows it to be presented as a "mere" $16 trillion in debt.

And perhaps the central reality that governs everything else is that none of the above mattered when it came to the 2012 US elections. Indeed, perhaps the most important part of the election was not the results, but rather what wasn't voted on. Neither candidate even dared present to the American people a program for cutting entitlement spending or for stemming the rapid growth in entitlement spending that is necessarily coming up in the years to come. The American people won't stand for that. They want what they believe has been promised to them in full.

But the reality is that impossible promises can't be paid in full - at least not in real terms. So the promises must instead be paid in the currency of deception.

Reality is that inflation is the key to deceiving the people, because it is a means for paying promises in form, but not in substance.

Reality is far more complex than simple inflation, however, and the most dangerous tools at the government's disposal are the ones that few individual investors understand.

It is the little-understood Inflation Taxes that the government uses to take wealth on a wholesale basis from the private sector in an inflationary environment. Because investors generally don't understand how they work, Inflation Taxes are effectively a form of deception, and one that is highly effective when it comes to confiscating the wealth of unknowing investors, including precious metals investors.

http://danielamerman.com/articles/GoldTaxes1.htm

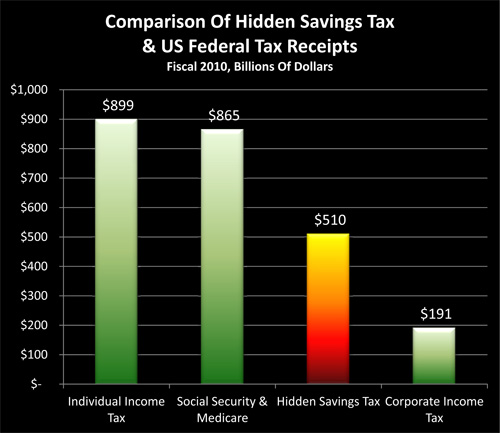

Reality is that the dominant financial force of our day is Financial Repression, where among other repressive measures, the government forces interest rates down to near zero in using a method that again very few understand, but which enables it to effectively confiscate wealth on a wholesale basis from retirement investors, savers and pension beneficiaries. Because Financial Repression also operates at a level of sophistication a notch higher than the way most investors view the world, it too could be called inherently deceptive, even as it serves as a method for the government to effectively raise taxes by many hundreds of billions of dollars per year without paying the political cost for doing so.

http://danielamerman.com/articles/2011/SaveTaxC.html

The reality is that when we put all this together, an entirely different approach to investing is called for than what most people are pursuing.

Now when we look at this reality check list, the first decision is whether we accept it as being reality, or whether we reject it out of hand. If we accept even two or three of the points, then one thing we know is that the status quo from the second half of the 20th century is no more. Which means that the real difference between (A) the respectable Mainstream and (B) the Doomers, is that the Mainstream is based on keeping one's eyes tightly closed to the reality which is all around us, and instead investing on the basis of blindly extrapolating numbers forward from an economy that is long gone.

Avoiding The Trap Of The False Dichotomy

The Doomers are absolutely correct, in my opinion, that there is a significant ongoing chance in the next year and the coming years of what could be called a financial meltdown event. It could take the form of a governmental default, it could be major inflation, it could be hyperinflation, or it could be all of the above accompanied by an overt and sustained depression. It is entirely prudent to be well prepared for this.

However, the Doomers fall into the trap of the false dichotomy if they invest on the assumption that financial collapse is inevitable, because there is nothing inevitable about a financial meltdown. If it were inevitable, it would have already happened. It should have happened in 2008. If by some fluke, some short term emergency measures only delayed the inevitable, then the meltdown should have happened in 2009. Or 2010, or 2011. For sure, by 2012, the meltdown really should have occurred if it were actually inevitable.

Indeed, the number of contrarian commentators insisting the system must collapse by no later than the autumn of 2012 seemed to reach a short term peak in the first half of 2012 - but autumn came and went, and still no collapse.

Let me suggest that (B) collapse didn't happen, even though (A) the old status quo stopped working long ago, because it has been (C) the new status quo of an increasingly politicized economy, with a radically different monetary system and ever increasing government control of markets that has been with us the whole time since 2008.

Now, this new status quo doesn't change any of the core realities - far from it. Pure politics can't create real wealth, nor can printing dollars or manipulating statistics and markets. Real wealth isn't the size of the government check or the nominal level of a stock market index, but rather it is the real goods and services of the economy that determine the standard of living for a nation.

Given that a politically-controlled economy with suppressed markets and an ever growing public sector has a lower growth rate in the real wealth of real goods and services - if there is any growth at all - it is therefore a sick and dysfunctional economy, when compared to a healthy free market economy in which decision makers have accurate information to work with.

So, ironically, the very act of a majority of voters insisting on the payment in full of the government checks they have been promised and are entitled to - regardless of the size of the economy - has the bottom line effect of a smaller real economy, and a lower average standard of living, than if the promises had never been made.

That great irony is sad but arguably irrelevant for personal decision-making purposes, because reality is what it is, and not what we want it to be.

And it appears all too likely that reality not only is but will continue to be (C), a politically-controlled economy, where there is a gradual impoverishment of both investors and entitlement beneficiaries, that is mainly achieved through deceptive measures that will never be understood by the average voter, and where the rules are quite deliberately changed over time to take ever more wealth from the private sector for redistribution. This world of (C), a political economy is a dystopia for both (A) Mainstream and (B) Doomer investment strategies.

It also has the potential to become a quite stable dystopia, even in an environment where collapse might seem inevitable when viewed from the perspective of how the US economy worked in the last century. That's what governments tend to do when they accrue ever more power - they deploy that power first and foremost to make sure they continue to rule.

If we accept that even most of the above is in fact reality, then the next question becomes a personal one: what are we doing about this in practice?

This can be a very difficult issue, because investing for a government-dominated, dysfunctional economy that is beset with inflation, inflation taxes and political risk is not something for which most people are prepared. It's not what we've been educated about, and is entirely incompatible with the conventional financial planning models of previous decades.

But if we truly accept reality, then we are faced with a most important decision. Do we do nothing about it, perhaps because we have no idea what to do?

Or do we take personal responsibility for ourselves and our families, roll up our sleeves and get down to learning about how to do something about it?