Is “Mainstream” vs “Doom & Gloom” A False Dichotomy – And Could Our Financial Future Be Neither?

by Daniel R. Amerman, CFA

Perhaps the single greatest danger facing investors over the long term is to be investing for the wrong paradigm. That may sound a little theoretical, but we have a very clear and quite dangerous real-world example going on in front of us right now, which is the false dichotomy between the "Mainstream" and the "Gloom & Doomers".

The way it is too-often presented is that most people in the investment community fall into one of two groups. There is group (A), for those who are for the most part secure in the comfortable Mainstream. They understand that the financial world has some real issues and that there may be some bumps in the road, but believe that investments over the long-term future will perform pretty much the way they did in the latter half of the 20th century. And because there is a high degree of confidence among the mainstream that this will be the case, the assertion is that people can safely invest their life savings based on this assumption.

For those who disagree with this, the conventional narrative automatically moves them all the way over to group (B), the "Gloom & Doom" camp. This group is typically presented as being comprised of marginalized, eternal pessimists who are always convinced an economic doomsday is nigh.

So, as the narrative goes, either you (A) buy into the status quo, or (B) you reject it, and prepare for the inevitable collapse of the status quo.

As with all false dichotomies – which are incidentally a quite effective way to control the perceptions and thus the behavior of tens of millions of people – there is an elementary error in logic in assuming it must be either (A) or (B).

What if the current economic and investment reality aligns with neither (A) the continuation of the status quo from the long-gone latter half of the 20th century, nor (B) the collapse of the status quo, but instead (C), the ongoing transition to a new status quo for the first half of the 21st century, which is that of a dysfunctional economy that is increasingly dominated by governmental interventions, with an ever-smaller share of that economy coming from free enterprise and the private sector?

Making Calls About The Future

When you come right down to it, much of investment performance is usually dependent upon the ability to make a call about the general financial and economic future. A call is made, the investment strategy is entered into, and if the call is correct you do well – and if the call is dead wrong because the future turned out to be quite different than anticipated, then the results can be disastrous.

Perhaps the best example of an entire society making a deeply flawed "call" is long-term investment strategies being based upon the purported "equity premium". For decades now we've all been assured by nearly the entire Mainstream investment industry – along with most of academic finance and economics, and with near universal agreement of the financial media – that stocks have this almost magical property over the long term. That is, if one holds them long enough, then one is practically guaranteed higher returns than should be possible, and with relatively little risk.

Simply buy, diversify, and hold – and with the passage of enough time the risk should reliably drop out, even as the return should reliably remain.

Now as I have been professionally pointing out for 20 years now, this was never in fact certain knowledge, nor is it robust. Instead it's been based upon a series of assumptions about stocks that have turned out to be not true. That is, "the call" was mistaken.

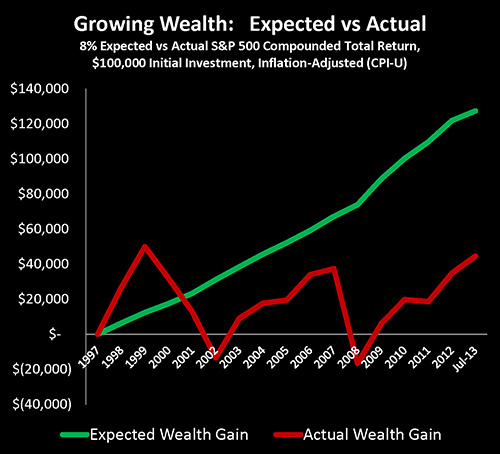

As covered in some of my recent articles here and here, even if we look at things in pre-tax and pre-expense terms with reinvested dividends, the markets have brought in only about a third of the increase in wealth that we were told they'd reliably bring in for society, for pension funds, and for investors. The Mainstream has thus been dead wrong, and the recent, belated surge in stock prices in no way makes up for 15 years of purportedly reliable wealth compounding that failed to materialize.

On the flip side, there are those in the Gloom & Doom camp who for a number of years now have been continuing to call for the inevitable collapse of the monetary system of the United States as well as much of the global financial system.

Month after month, year after year, the call is made that there is no direction but straight up for precious metals investments, with the profits resulting from the purportedly inevitable meltdown of the financial system.

While it's a call with some strong logic underlying it, as the danger of financial collapse at some future point is indeed a very real threat, it is nonetheless a call that so far has also turned out to be wrong, month after month, year after year.

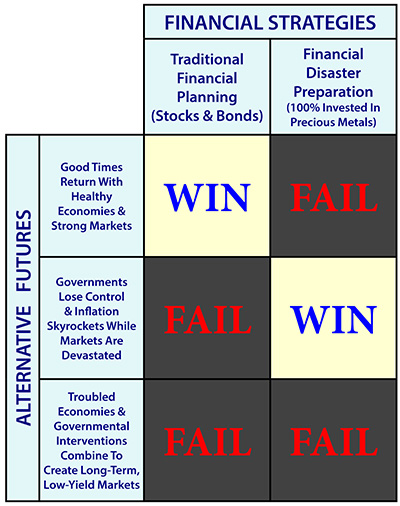

As illustrated in the above chart, when we put these starkly contrasted "call-based" strategies side by side, we see that both the Mainstream stock/bond strategies and the "Doom & Gloom" 100% precious metals strategies are effectively "Win-Lose" strategies.

That is, Mainstream stock/bond-based strategies Win if we experience (1) "normal" market conditions and economic growth over the coming decades. Essentially, conventional financial planning builds this scenario into the starting assumptions as being the only possible future – the last 6 years notwithstanding.

However, these Mainstream strategies are highly likely to Lose, perhaps even catastrophically, if we experience the future scenario which many fear of (2) severe financial crisis leading to a deep depression, accompanied by a possible currency collapse.

On the other side of the coin, a Gloom & Doom purely precious metals-based strategy can Win in a spectacular fashion (at least in pre-tax terms) if the future does work out to be (2) severe financial crisis accompanied by a possible currency collapse.

Yet a 100% precious metals weighting will likely Lose if the future instead works out to be (1), a return to "normalcy", keeping in mind that gold lost 80% of its purchasing power over a 20 year period when the dysfunctional stagflation of the 1970s was followed by the healthy economy and markets of most of the 1980s and 1990s. (Precious metals can be superb as one component of an overall strategy. It is when one believes they have certain knowledge of the future and put 100% of their investments into precious metals, where things can become problematic.)

So when it comes to the most common approaches to investing, we essentially pick our future and we take our chances. If we are right – then we Win, perhaps spectacularly. If we turn out to be wrong about the decades ahead, then we likely Lose, also perhaps spectacularly.

Considering A Third Future - The Continuation Of The Present

There is a third potential future to consider, which I believe to be the most compelling – even if generally not taken into consideration by either Mainstream or Gloom & Doom investment strategies. And that is the continuation of the path we've been on these last six years.

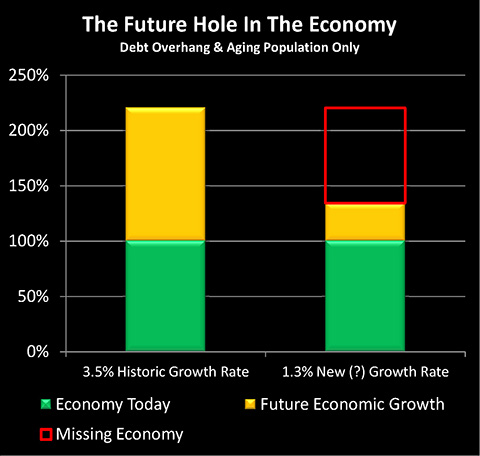

With this future, the economy doesn't collapse – but neither does it return to the healthy growth of past decades. Instead the economy experiences low growth or no growth (as explained here).

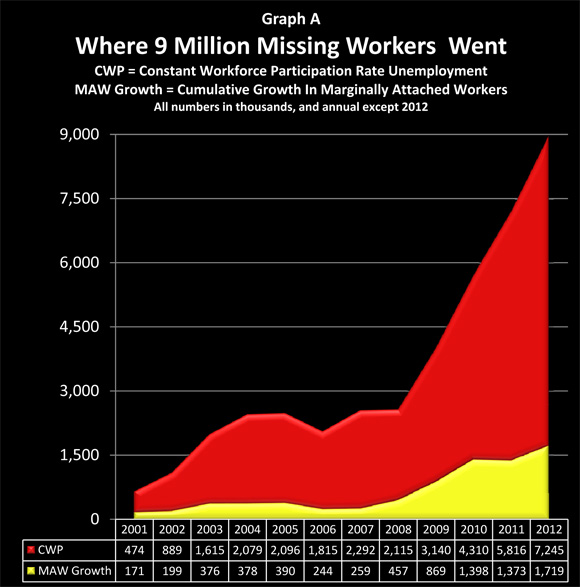

In such a low growth economy, many millions of the long-time unemployed may never find new good jobs. They may instead be defined out of the workforce by government statistical methodologies, and they could vanish from the headline unemployment statistics altogether, just like nine million already have (as explained here).

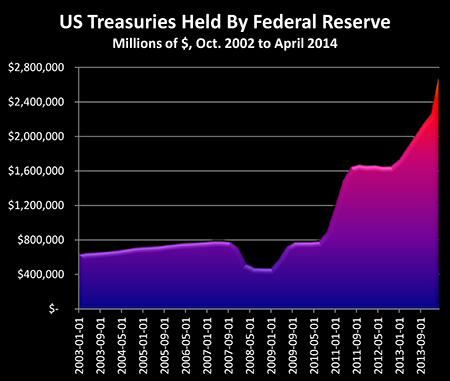

The names and specifics may change, but massive periodic interventions in the markets occur as needed, with the Federal Reserve creating trillions of dollars out of the nothingness to keep interest rates forced down and asset values at least somewhat propped up (as explained here).

The laws continue to change as needed to force stability, and tax rates continue to rise as needed to help pay for expensive government promises.

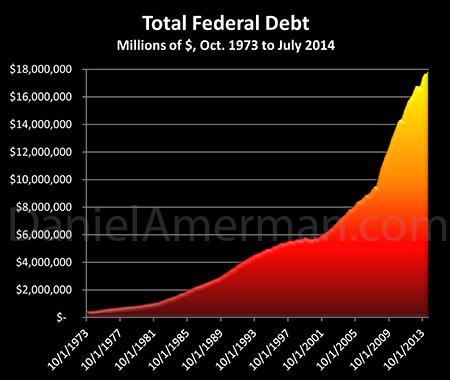

Bond yields never return to historical averages – because a government $17 trillion in debt can't afford for that to happen (as explained here).

Stock values don't collapse, but neither do they deliver the compounded wealth that is built into traditional financial planning assumptions. And given that stock returns are ultimately dependent on the real economy over long periods of time, if sufficient real wealth is not being created by the economy, then the real wealth just isn't there to deliver to tens of millions of retirees – whether they individually own their investments or are depending on pension fund investments.

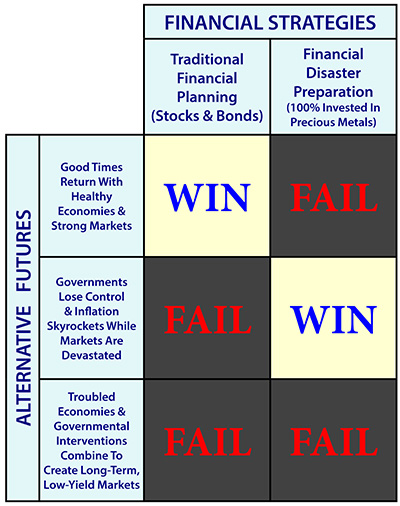

When we consider the possibility of this third category of future, then both Mainstream stock & bond-based strategies – as well as Gloom & Doom purely precious metals-based strategies – become Lose-Lose-Win propositions.

Mainstream strategies likely steadily Lose over time if we see (3) a continuation of low or no economic growth, high unemployment, steady but moderate monetary inflation covering over asset deflation (as explained here), low interest rates, rising tax rates and confiscatory inflation taxes – all of which are being held together by governmental interventions which dominate the markets and economy.

Gloom & Doom purely precious metals-based strategies may also continue to incur steady ongoing losses in after-inflation and after-tax terms in the event of (3) a continuation of the past few years, with the government continuing to "change the rules" over and over again in order to avert collapse, leading to deeply dysfunctional results for investments, the economy, and standards of living.

Indeed, the deliberate suppression of precious metals investors through a variety of means is historically a core component of Financial Repression, and one only need look at the United States between 1933 and 1974 for a very good example of this process.

So then, the belief that the only two possible paths for the future are "Mainstream" or "Gloom and Doom"– that is, either a growing economy or outright collapse – is a false dichotomy. For what economic history shows us is something else altogether, which is that when it comes to governments in financial distress, they can avoid default and collapse by changing the rules to put the clamps down on markets and investors, enforcing an artificial stability that can last for decades.

This is why believing in a pervasive but false dichotomy may be the single most dangerous mistake an investor can make. Because if an investor erroneously believes that the future will necessarily come down to only two paths, and the future in fact turns out to be neither of those paths, but is instead a third path which is not kind to either Mainstream or Gloom & Doom strategies, then investment results could be profoundly disappointing.

This third path and new status quo is of a blended economy that shifts a little more each year from being dominated by the markets to being dominated by the State, even while laws, regulations and tax shelters repeatedly change on a wholesale basis to allow the State to pay for the extraordinarily expensive promises that are needed to win elections. This third path is not theoretical, but is all around us, and has been growing in strength ever since 2008.

If the dominant determinants of investment performance in the future are political rather than economic, then investors need to be investing for politically guided economies and political risk. Those who do not invest for such an economy risk being blindsided and financially devastated.

Avoiding The Trap Of The False Dichotomy

For most investors, however, it can be very difficult to make the mental transition and break out of the false dichotomy.

We've all been taught to invest for the most fundamental assumptions of all, which are those of a free market economy and a free market that determines investment prices. The free markets are what creates the wealth. And the market forces are what collapse irresponsible governments and their currencies.

But in an economy that is increasingly dominated by public spending, and in which there is substantial likelihood that the rules will be repeatedly rewritten to increase the control over market forces in order to force stability – even as the rules are also rewritten to increase the take that is needed from the private sector to pay for the rapidly rising costs of the promises that have been demanded by the electorate – what can we do?

The Doomers are absolutely justified, in my opinion, in their concern about a potential financial meltdown event happening, whether in the near term or further in the future. It could take the form of a governmental default, it could be major inflation, it could be hyperinflation, or it could be all of the above accompanied by an overt and sustained depression. It is thus entirely prudent to be well prepared for this.

However, the Doomers fall into the false dichotomy trap if they invest on the assumption that financial collapse is inevitable, because there is in fact nothing inevitable about it. After all, if it were inevitable – it would have already happened. It undoubtedly should have happened in 2008. Though if by some fluke some short term emergency measures had merely delayed "the inevitable", then a meltdown should have happened in 2009. Or else 2010. Or 2011. Certainly by 2012 the meltdown really should have occurred if it were actually inevitable.

Let me suggest that (B) collapse didn't happen, even though (A) the old status quo stopped working long ago, because it has been (C) the new status quo of an increasingly politicized economy, with a radically different monetary system and ever increasing government control of markets that has been with us the whole time since 2008.

Now, this new status quo doesn't change any of the core realities – far from it. Pure politics can't create real wealth, nor can printing dollars or manipulating statistics and markets. Real wealth isn't the size of the government check or the nominal level of a stock market index, but rather it is the real goods and services of the economy that determine the standard of living for a nation.

Given that a politically-controlled economy with suppressed markets and an ever growing public sector has a lower growth rate in the real wealth of real goods and services – if there is any growth at all – it is therefore a sick and dysfunctional economy when compared to a healthy free market economy in which decision makers have accurate information to work with.

It also has the potential to become a quite stable dystopia, even in an environment where collapse might seem inevitable when viewed from the perspective of how the US economy worked in the last century. That's what governments tend to do when they accrue ever more power – they deploy that power first and foremost to make sure they continue to rule.

Before any problem can be solved, the necessary first step is to recognize the existence of the problem. Which is, in this case, to recognize that our current status quo is quite different from the latter half of the 20th Century. But that doesn't mean the economy or markets must be like they used to be during those particular decades in a few Western societies – or else collapse is inevitable.

For there are myriad possible futures that don't involve either a return to the economies and markets of the past nor a collapse of those markets. Recognizing that plain and simple truth is what is missing from far too much of the investment discussion.

And unfortunately, missing that simple truth could be deadly dangerous for investors, because falling for the false dichotomy leaves them choosing between two unsatisfactory types of strategies, each of which leads to Lose-Lose-Win risk exposures in a potentially long-term, low-growth and low-yield future.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.