What's Truly Different About This?

Much of what is contained in the DVDs and manual represents a quite new and very different approach to risk and return than what most individual investors have previously been exposed to.

Now this is not to say that variations of some of the concepts have never been used before, as they have indeed, and quite extensively.

However, they have been traditionally only been used in what could be described as a quite different investment universe, at least compared to that of individual investors.

On the one hand we have individuals buying real estate (or other investments), which has been done by a huge number of people in a wide variety of ways over a very long time.

Many fortunes have been made this way, and fortunes have also been lost this way.

For individual investors, the unique aspect of this DVD set is the explicit incorporation of principles used in asset/liability management by financial institutions and corporations.

Unless you have actually worked in this area – and likely have a degree or two in finance as well – there are things going on here that you have probably never been exposed to.

But are the underlying concepts all that radical? Is this really that far out of the range?

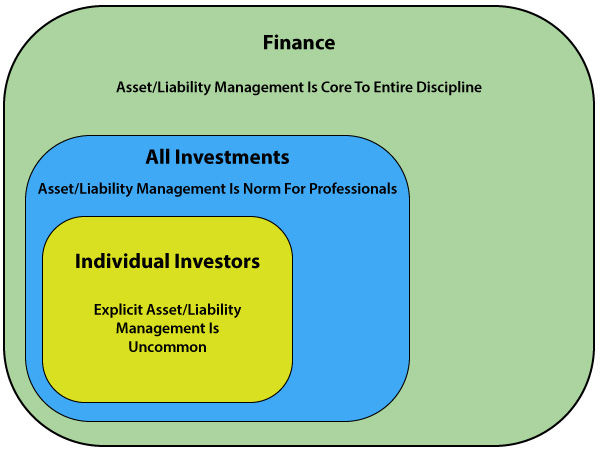

To answer that we need to keep in mind that investments for individuals are a subset of investments in general, which are a subset of the parent discipline of finance.

And for most areas of finance other than investments for individuals, asset/liability management is the unquestioned norm. Corporations engaging in asset/liability management is the routine during healthy and prosperous times because that is how they make the most money.

When we look at financial corporations such as banks and insurance companies, what are they really?

They're all professional asset/liability management organizations. So are pension funds.

When we look at ordinary major corporations, when we look at city governments, when we look at state governments, what do they all have in common?

They're all engaged in liability management as well as asset management.

When we look at a treasurer, or at a chief financial officer, what are they doing?

They're managing assets and liabilities – and the differentials between them, with regard to both cash flows and valuation – in an attempt to maximize shareholder wealth.

Asset/liability management is one of the very core components of professional finance, and there's an excellent reason for this – even when it comes to major corporations with large cash flows that should be the last organizations you'd think would ever need to have liabilities.

And that is because by adding liabilities into the mix, you can vastly expand the range of available options when it comes to ways of increasing return on equity, of managing risk and of managing taxes.

About Daniel R. Amerman

Daniel R. Amerman is a Chartered Financial Analyst, author, and speaker, with BSBA and MBA degrees in Finance, and over 30 years of professional financial experience. As an investment banking vice president in the 1980s he did groundbreaking work in the security originations and asset/liability management areas, including CMO/REMIC originations as part of portfolio restructurings for financial institutions, as well as the creation of synthetic securities for institutional clients. As an independent quantitative analyst in the 1990s and 2000s, he structured mortgage-backed bond financings and provided analytical services for real estate acquisitions by multifamily and commercial real estate owners, investment banks, and tax-exempt issuers.

Mr. Amerman is the creator of a number of DVDs and books on finance, including two books published by McGraw-Hill (and subsidiary): Mortgage Securities, and Collateralized Mortgage Obligations: Unlock The Secrets Of Mortgage Derivatives. He has been a speaker and workshop leader for sponsors including The Institute for International Research, New York University, and many banking groups.

Beginning in the early 1990s, Mr. Amerman became an outspoken critic of conventional retirement planning, arguing the accepted paradigm had multiple deep flaws that could potentially lead to a profound long-term underperformance, resulting in millions of retirement investors finding themselves with neither the retirement portfolios nor the retirement lifestyles that the traditional financial education system had led them to believe would almost assuredly be theirs.

Dissatisfied with the conventional choices for investors, Mr. Amerman has spent a number of years in researching alternatives. Drawing upon his background outside the individual investor industry, he has developed an interrelated group of non-traditional solutions – including asset/liability management strategies – for such concerns as financial crisis, inflation, inflation taxes, low economic growth rates, and pervasive low yield markets.

About The Financial Analyses & Teaching Methodology

The Creating Win-Win-Win Solutions Using Real Estate-Based Asset/Liability Management Strategies DVD set is a focused educational resource designed to teach you essential information in a matter of hours that might otherwise require multiple semesters of academic work, followed by years of applied work experience.

This is accomplished through using an intensive "hands on" approach. Rather than conceptual review, with theory and jargon, the DVDs primarily consist of a series of over 100 financial analyses and schedules on the screen (this is not a "talking head" video), with the same or sometimes expanded versions of those schedules available in the manual to review and take notes on.

Now a major challenge when it comes to doing real estate analysis for a wide and diverse audience is that real estate is the supremely local investment. And this is particularly true when you look across multiple nations.

Therefore what is contained in the DVDs, what forms the great majority of these materials, is best characterized as a "reasonable example".

We use a reasonable "capitalization rate" for most markets (net operating income divided by purchase price).

Now properties generating that much cash flow as a percentage of purchase price probably won't be available at all in high-value markets such as Vancouver, Sydney and many cities in California where rents haven't kept up with rapidly rising property values.

On the other hand, capitalization rates in excess of what we show are available in many secondary markets.

We use a reasonable expense ratio – depending on the particular metropolitan area and the type of property. It is possible to do better, and it is possible to do worse.

The available mortgage rates are round numbers that are based upon the US market with Fannie/Freddie 1 to 4 unit mortgage loans.

All of these factors change on a frequent basis, in addition to being local.

Indeed, it is the nature of real estate that even in the same city and nation, two different properties that are ten blocks apart and with six months separating the acquisitions, could generate quite different cash flows and yields.

It thus needs to be clearly understood that the exact path of the future is highly unlikely to precisely correspond to the smoothed path shown in any set of financial analyses. And when we add in other local and national factors, whatever the opportunity that is available, it is highly unlikely that actual results will precisely correspond to the exact cash flows and yields that are explored in the DVDs.

Instead, the purpose of this DVD set is to serve a different and very important need indeed – which is financial education.

By going directly to a hands-on immersion in the many pages of cash flows and financial schedules – in understandable layman's terms – the goal is to in a relatively short period of time offer a clear and even intuitive explanation of what are quite different sources of wealth creation than what most individual investors have been previously exposed to.

So that, in a future financial environment of prosperity, you will clearly understand how to potentially create yields far in excess of what is ordinarily realized by stock and bond investors, using the same type of asset/liability management methodology that has created many real estate fortunes around the world.

Upon completing this review, you will have an uncommon understanding of how to use asset/liability management strategies to directly profit from major financial crises.

After walking step-by-step through these cash flows, you will learn how to take this maddening low growth and low yield environment that so many investors are having difficulty in dealing with, and you will understand how to do what many corporations and financial institutions are currently doing – which is to use asset/liability management strategies to flip this environment to your advantage.

And most importantly, because you will have a hands-on understanding of these multiple sources of wealth, you have a much better idea of how to apply these elements to your own personal situation.

Purchase the DVDs

Satisfaction guaranteed or your money back.

(30 day return period, see DVD purchase page for more information.)

Value Packages

These DVDs are currently available as part of value packages along with other DVD sets, click here to learn more.

DVD Contents & Topic Outlines

Wealth Creation During Normal Times (DVD #1 Topic Outline)

Wealth Creation From Prosperity (DVD #2 Topic Outline)

Wealth Creation From Financial Crisis (DVD #3 Topic Outline)

Wealth Creation From Economic Stagnation (DVD #4 Topic Outline)

Robust Wealth Creation, Part I (DVD #5 Topic Outline)

Robust Wealth Creation, Part II (DVD #6 Topic Outline)

More About The Educational Course

Disclaimers

Please note that the DVDs and companion manual are of a strictly educational nature, rather than the rendering of professional advice. The future is uncertain, and there are no guarantees or promises of success or particular outcomes. As with any financial decisions, there is a risk that things will not work out as planned, and with hindsight, another decision would have been better.

The DVD set and printed manual will not include specific investment, legal or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the specific results of the application of the general educational principles contained in the DVDs and the written materials, either directly or indirectly, are expressly disclaimed by Daniel Amerman.