Economists Can't Account For 98% Of Rising Inflation

By Daniel R. Amerman, CFA

TweetEconomists no longer understand how inflation works.

That is the conclusion of a fascinating - and deeply worrying - article, "On Inflation, Economics Has Some Explaining to Do", that appeared on page 2 of the June 17th Wall Street Journal.

According to the article and the prominent economists interviewed, the leading inflation prediction methodology used by economists completely failed, leaving the Federal Reserve, White House & European Central Bank stunned and blindsided by the highest rates of inflation in 40 years. By one estimate, the main inflation model used by economists can explain only 0.1% of the 6.6% increase in inflation above its 2% target. As for the remaining 98% of the actual inflation we've gotten? Well, that's quite the mystery, as far as the current state of the art in economic theory goes.

Now, ordinarily, theoreticians having modeling problems with their theories would not be a concern for the average person. However, we are currently in an extremely difficult situation, with high rates of inflation, fast-rising interest rates, crashing markets, and strong near-term chances for a global recession. It is the decisions of the government and Federal Reserve that ultimately created this situation.

If the highly credentialed decision-makers don't even understand how they created this terrible situation, then that means their chances of resolving this problem without major hardships for the entire nation may be very low indeed. This could have extraordinary implications for all of us when it comes to our financial security, the value of our savings, and even our day to day future quality of life.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

“Economists do not have a satisfactory theory of inflation at this point”

Greg Ip was the author of the article, and I have been reading his work for a number of years. I would characterize him as being the top economics writer at the Wall Street Journal, and like the newspaper itself, he seems to have a mixed role that goes beyond being an ordinary reporter. The Wall Street Journal is both a newspaper and the mouthpiece for the heart of the financial establishment. It is where Wall Street, the government and the Fed sometimes talk amongst themselves, and present what they want to be communicated to the corporate and financial industry. So too, with Mr. Ip. For those who have a subscription, his article is linked below.

https://www.wsj.com/articles/on-inflation-economics-has-some-explaining-to-do-11655294432

The beginning of the article is startling.

"Having failed to anticipate the steepest inflation in 40 years, you would think the economics discipline would be knee-deep in postmortems.

Not yet. Outside of a handful of individuals, economists have thus far devoted remarkably little attention to how their theories and models got inflation so wrong."

"Economists at both the Federal Reserve and the White House were blindsided. The European Central Bank recently reported that the accuracy of its inflation forecasts 'declined significantly during theCovid-19 crisis.'"

The theoretical failure is explained as follows.

"Nowadays, working economists try to predict inflation by comparing the demand for goods and services and their supply as represented by the “output gap”—the difference between actual gross domestic product and potential GDP based on available capital and labor—and by the Phillips curve, according to which wages and prices accelerate when unemployment falls below some natural, sustainable level."

"These models worked reasonably well over the roughly 40 years before the Covid-19 pandemic, but not since. “Economists do not have a satisfactory theory of inflation at this point,” said Harvard University’s Larry Summers"

Larry Summers is, of course, much more than just a Harvard University professor. He was Secretary of the Treasury for Clinton, and Director of the National Economic Council for Obama. He was also chief economist for the World Bank, and was president of Harvard as well. Mr. Summers remains highly influential, and for someone with his stature and establishment credentials to make the flat statement that “Economists do not have a satisfactory theory of inflation at this point" is extraordinary. This is particularly true in our current circumstances of raging inflation.

This helps to place in perspective current Fed Chair Powell's frequent assertions that the Federal Reserve has the tools to control inflation. Keep in mind that Powell has no choice but to make that assertion, for if the Fed were to admit that it couldn't control inflation, that could by itself trigger a crisis.

The problem is that if the Fed doesn't have a theory to accurately explain the current inflation, if its models are all wrong - then it necessarily doesn't know if it has the tools to control inflation. If they don't know what is currently causing far higher rates of inflation than they anticipated, then they don't know what will stop that inflation. I would characterize Summers as being much more of an intellectual heavyweight in the economics area than Powell or Yellen, and if Summers says they don't understand what's happening, then the Fed and Treasury are flying blind, whether they will publicly admit it or not.

(For regular readers, as previously mentioned, the output gap is the fourth component for the full Taylor Rule equation. Inflation, natural interest rates, and differences between potential and actual GDP are theoretically assumed to be tightly intertwined, and are the sources of the equation for determining the interest rates needed to bring down inflation.)

A Staggering Miss

The two paragraphs below help to show just how far off current economic theory is when it comes to explaining our current very high rates of inflation.

"While all of these critics got the direction of inflation right, their analyses can’t explain, at least using pre pandemic relationships, the magnitude, i.e., how inflation suddenly shot from around 2% before the pandemic to 8.6% now—6% excluding food and energy."

"Alan Detmeister, an economist at UBS and formerly the Fed, ran a statistical exercise earlier this year that found that the output gap, derived from actual GDP and Congressional Budget Office estimates of potential GDP—both adjusted, and unadjusted, for inflation—can explain at most 0.1 percentage point of the rise in inflation since the middle of last year, and the unemployment rate can’t explain any."

Per current theory, prices are supposed to be up by 0.1%. If we look at year on year inflation, prices are actually up by 6.6% above the 2% target. This means that the best mainstream economic theory for inflation can only explain about 2% of the current rate of inflation (0.1% / 6.6% = 1.52%), leaving 98% as a mystery.

So, we're not off just a little bit. This isn't some sort of adjustment that's needed. This is a total model failure.

Supply Side Simplifying Assumptions

What is the source of this complete model failure - which can also be stated as the people who are supposed to be bringing inflation under control having no idea what is going on?

As regular readers know, I've been explaining our current inflation in supply-side terms from the beginning. I did call the non-transitory and major increase in inflation - and accurately identified the source - within one week of the release of the April 2021 Consumer Price Index, as explored in the analysis "The Current & Future Supply Side Inflation Shocks", linked here.

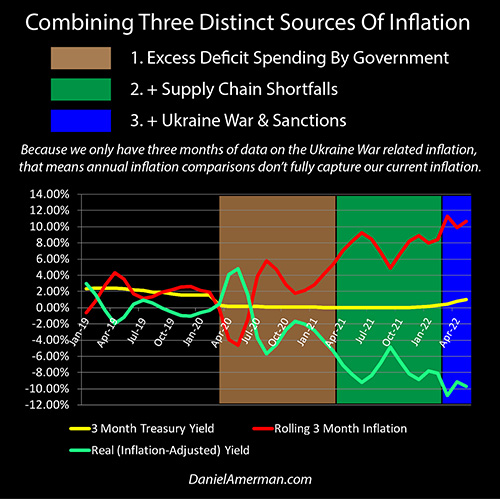

The culprit was initially excessive deficit spending, as shown in the brown background area above, and as explained in my analysis "Combining Three Distinct Sources Of Inflation", linked here. In an economic experiment - that was not part of longstanding economic theory - the stimulus checks flooded the economy, giving consumers lots of money to spend.

At the same time, the U.S. & other governments shut down much of the global economy in another novel experiment - which would come to create major supply chain difficulties. Apparently, what none of the experts at the Fed or Treasury thought through was how the two novel experiments would combine.

What the stimulus checks and pandemic shutdowns created in combination was too many dollars chasing too few goods - which as I identified and explained in my May of 2021 analysis, was the economic equivalent of writing out a prescription for high rates of inflation that would be ongoing. This combination of those two sources of inflation is shown in the green background area above, and it increased inflation to a level that was almost five times what it had been between 2009 and 2019.

These difficulties were greatly exacerbated by the global supply issues caused by the Ukraine War and the related sanctions, as shown in the blue area above. Even with just the first three months of inflation data since the Russian invasion, the average rolling three month rate of inflation for the U.S. is now up to over 10% - meaning that mainstream economic theory expectation of a 0.1% increase in inflation is only explaining about 1% of what we are seeing.

How could that be? For an answer, let's return to Mr. Ip:

"Economists have treated the supply side—autos, housing, restaurants, energy, healthcare, finance—as homogenous and elastic: When demand for nursing home beds or cars rise, so does their supply, and prices rise only a little, if at all.

But in the last two years, supply hasn’t been homogenous. Some industries like e-commerce have hired easily, while others like nursing homes have lost workers in droves. Food sold to restaurants didn’t substitute easily for food sold in supermarkets. Supply hasn’t been elastic: Increased demand for cars and houses boosted prices, not output."

Modern economics and finance are both based upon simplifying assumptions, which are used to reduce the inherent complexity to the point where the equations become useful. In essence, the correct theory often depended on the choice of assumptions.

As a very quick overview of the current applicable theory, inflation increases in the short run are created by a change in the relationship between the dynamic aggregate demand curve (AD) and the short-run aggregate supply curve (SRAS). A central bank can act to close the gap that is creating excess inflation, by moving the dynamic aggregate demand curve. The central bank moves the curve by changing the real (inflation-adjusted) interest rate. Raise the real rate (as the Fed is attempting to do), and consumer expenditures and business investments drop, which reduces demand, and which then reduces inflation. That's the theory, anyway. (This can also be reduced to the more common sense perspective that whenever supply gets out of whack with demand, then prices change. If supply exceeds demand, then prices go down, and if demand exceeds supply, then prices go up.)

My apologies if moving AD and SRAS curves on a graph sounds a bit esoteric, but if you want to understand why your stock portfolio has taken a 20-30%+ plus hit, or why mortgage rates have jumped over 6%, or why the purchasing power of your money in the bank is falling at a 10%+ annual rate, or why millions of people could be losing their jobs in the coming months, this corner of economic theory - and its failure or success - is a critical underlying reason.

Now, we don't need to understand this theory. We don't need to agree with the theory - we may think it is rarified academic nonsense. The theory doesn't even need to be correct.

But nonetheless, the Federal Reserve has enormous power over interest rates, the economy, and the markets. The Fed is made up of economists, who are following a particular set of theories that are more or less universally believed to be true - within their profession. These policymakers have the power to take actions based on those theories, and those actions can have life-dominating effects for the population at large, regardless of whether the underlying theories about supply curves, demand curves, output gaps, and inflation are correct or not.

The recent 0.50% and 0.75% increases in interest rates - and the anticipation of the future interest rate increases - are occurring because of these economic theories. The real world implications have devastated the stock and bond markets, slashing the net worths of tens of millions of investors, even while rapidly changing the home market and the home-building industry.

Large layoffs have already begun as an increasing number of companies decide that the still to come interest rate increases called for by the theoretical model are likely to create a recession. Likely well under 1% of those who have lost or will lose their jobs have any idea that they are being sacrificed in the attempt to move the theoretical intersection of the AD and SRAS curves on a graph and thereby theoretically dampen the rate of inflation - but it doesn't matter, the real world life-changing job losses for what could become millions of people will still occur.

Massive Economic & Investment Changes Based On Erroneous Theories

Ironically, what makes this bizarre situation even worse, is that we don't have a theory that the theories are wrong - we have the fact that we know that at least some critical parts of the theories are wrong.

According to the theory - current inflation should be somewhere in the general neighborhood of 2.1%. That doesn't need to be precisely true, the 0.1% increase was the estimate of one economist. (And for those who read the WSJ article, yes, Detmeister said he could explain about half of the remaining gap (with 20/20 hindsight), but keep in mind those adjustments are not part of the standard theory.)

Nonetheless, in the real world, we have a catastrophic model failure in front of us. We know the theories about the supply curve, and the particulars of its intersection with the demand curves are wrong, and that this is producing a rate of inflation that is completely outside of what the standard theories call for. We know that the Fed, the White House, and the European Central Bank have all experienced this catastrophic model failure, even as the value of our money in the bank falls each month.

The Federal Reserve has (aided by the spending power of the money in our bank accounts) taken an unprecedented degree of control over interest rates, the economy, the markets, and our lives - and it will exercise those powers whether it really knows what it is doing or not.

We should therefore anticipate a series of market-changing actions from a Federal Reserve with unprecedented powers (from a historical perspective), that because they are based on an incorrect set of theories, will likely have different results than what the Fed thinks they will. These actions and the resulting differing results may dominate the economy, rates of inflation and investment markets over the coming years. Hopefully, this analysis has been helpful to you in understanding one of the critical underlying sources of what is changing the markets and why.

********************************************

As to why inflation has been so high - I believe that there are a number of sources for the differences between the failure of the standard theories and my more accurate assessments over the last 13 months. One could say that the pandemic-related consumer stimulus spending, while government purchases were increasing, and while real interest rates were being lowered all acted together to (quite intentionally) sharply shift the Dynamic Aggregate Demand Curve to the right, even while the pandemic-related national and international business shutdowns and other business disturbances created a negative supply shock that (accidentally) simultaneously sharply shifted the Short-Run Aggregate Supply Curve to the left, thereby creating a historically fast increase in the rate of inflation as the combined result of the two curves moving sharply away from each other. Even as the Fed frantically tries to reverse directions by moving the AD curve sharply back to the left, crashing the markets and causing a recession if need be, it is chasing a moving target as a series of geopolitically-induced energy and food supply shocks from the Ukraine War ripple through the world, quickly moving the SRAS curve still further to the left, potentially thwarting the Fed’s attempts to bring down inflation. This simultaneous rapid movement of both supply and demand curves to the left could cause inflation to climb still higher, even after the interest rate increases, falling markets, a potential recession, and falling average standards of living. (This situation is potentially much worse for Europe than the U.S.)

To understand what is happening right now with energy and food supply shocks, the changes in real interest rates, the coming potential recession, and how that is likely to come together to box the Fed policymakers into an increasingly dysfunctional corner - we need to be to be able to graphically move those curves around, and explore what happens with inflation, the economy and likely the markets. If the Fed is going to dominate the markets while attempting to control inflation - then there is simply no substitute for being able to see the world like the Fed does, while replacing fragile theoretical assumptions with more robust real world assumptions.

Give me a couple of dozen graphs and some time to verbally walk someone through them, and I think this can all come alive and become understandable for the average person. I'm currently working on some new relevant financial education explanations and graphical illustrations, that could be part of a future workshop, or could be presented in online form before then.