Ukraine War Sanctions Double Inflation To 13.9%

By Daniel R. Amerman, CFA

TweetThe widely reported 12 month CPI rate of inflation reached a new high of 9.1% for the year ending in June of 2022.

The Ukraine War and the related sanctions have been sending energy, food, and fertilizer prices spiking upwards around the world. But, the war only started at the end of February. So, when we look at the first 8 of the 12 months that go into the 9.1% inflation rate - those 8 months are all pre-war.

With what is now four months of data on war price levels, we are starting to get a much better look at how the Ukraine War is increasing inflation. As we will develop in this analysis, the impact of the sanctions has been to more than double the already high rate of inflation that existed before the Ukraine War, increasing it to 13.9%.

Inflation is much worse than the 9.1% headline rate, shocking though that is.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Three Distinct Sources Of Inflation

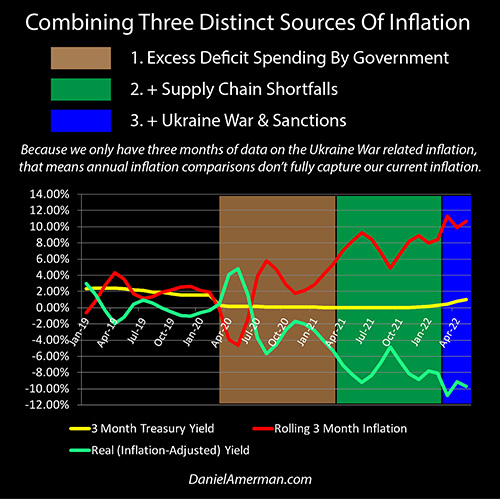

In a previous analysis, "Combining Three Distinct Sources Of Inflation" (link here), I used a rolling three month rate of inflation to break out the three sources of new inflation since the pandemic shutdowns and related stimulus programs began. The graph above updates that analysis for the June 2022 CPI numbers.

The full story is contained in that analysis, but to recap, the brown area shows the time of extraordinary stimulus spending, as the government flooded the United States with trillions of dollars, bringing the rate of inflation up.

Now, while the government was showering the nation (and special interest groups) with unprecedented amounts of cash, a lot of production was shutting down even as supply chain issues were developing, both domestically and internationally. This led to widespread physical goods shortages, including energy, food, semiconductor chips, and automobiles.

As it turns out, if one floods the nation with a purely virtual good - electronic money - even while in the tangible, physical world the supply of goods was falling, then that leads to too many virtual dollars chasing too few physical goods. The result was the highest rates of inflation seen in forty years as shown with the green area.

The inflation situation was already bleak, and then by the end of February, it got much worse. Russia invaded Ukraine, and the decision was made to punish Russia with an unprecedented degree of sanctions - regardless of the cost to consumers and businesses around the world. Energy and food prices were already in trouble - and they are getting worse.

The inflation data for the months after the beginning of the war are shown with the blue background above - and they have become much worse. All four of the rolling averages since the war began are higher than any rate before them - so we are seeing persistence. The economic impact of the Ukraine War is to create a materially higher rate of inflation, in a persistent manner.

The three month rolling averages are doing what they are supposed to, which is to catch changes faster than the widely reported 12 month average. However, the rolling nature of the measure means that it is also pulling in pre-war inflation rates, including January and February for the March three month average, and February for the April three month average. If we're going to isolate what the war and sanctions have really been doing to inflation, then it is desirable to drop those out and focus totally on inflation rates before the war started, and inflation rates after the war started.

Doubling Inflation

The eight months of July of 2021 through February of 2022 are shown with the green area below, and the four months from March through June of 2022 are shown in the red area.

As widely reported, the Consumer Price Index rose by 9.1% between June of 2021 and June of 2022. When we go the underlying data and break it out, prices rose 4.42% in the first eight months, and then by another 4.44% in the last four months. So right there, with just those raw numbers by themselves, we know that prices rising by more in four months than they did in the previous eight months means that the rate of inflation did indeed more than double.

To make the numbers more usable, those inflation rates can then be converted to annualized averages. Prices increasing by 4.42% over eight months are equal to a 6.7% annual rate of inflation. Prices increasing by a further 4.44% over four months are equal to a 13.9% rate of annual inflation. Inflation has indeed doubled as a result of the Ukrainian War and the related sanctions, and it is much worse than the widely reported new 9.1% headline rate.

(It should be noted that the rolling three month graph uses seasonally-adjusted CPI statistics, while the 12 month CPI does not.)

Far Greater Savings & Lifestyle Losses

This much higher inflation rate means that the (domestic) value of the US dollar is falling at a much faster rate than it previously was. The erosion of the value of money in the bank has doubled in speed and is now moving at an almost 14% annual rate.

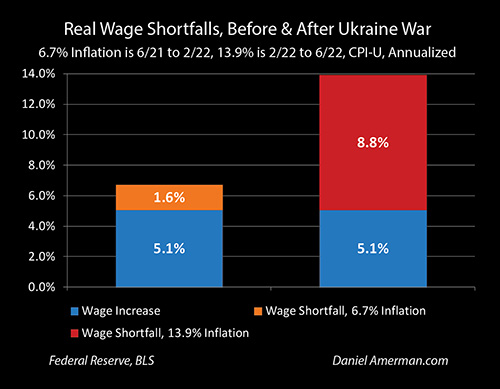

This also means that the impoverishment of the American general public as the result of wages failing to keep up with inflation is much worse than what is being discussed.

According to the U.S. Bureau of Labor Statistics (BLS), real weekly income has been falling at a 4.4% annual rate, due to a combination of hourly earnings not keeping up with the rate of inflation (-3.6%), and slightly fewer hours being worked on average (-0.9%).

For the purposes of that calculation, the BLS shows inflation to be 9.0%, while wages rose on average by 5.1%, leaving workers 3.6% short (1.051 / 1.09 = 96.4%, 100% - 96.4% = 3.6%).

As the Ukraine War and related sanctions have increased the rate of inflation to 13.9%, this raises the shortfall in real hourly earnings from 3.6% to 7.7% (1.051 / 1.139 = 92.3%). That then means that real incomes for average households are currently falling at more than twice the speed of what is being captured by the year-on-year statistics.

Another way of phrasing this is that the 6.7% inflation rate we saw for the first 8 months before the war, when combined with a 5.1% increase in hourly earnings, reduces real (inflation-adjusted) income by 1.5%. The inflation rate after the war began was 13.9%, and that in combination with a 5.1% increase in hourly earnings reduces incomes by 7.7%. So, the net effect of the war and sanctions is to increase the loss in real hourly earnings by about five times, from 1.5% to 7.7%. This is all on the margin, and that increases the relative damage.

This can be seen visually in the graph above, which uses a simpler methodology than that used by the BLS. If wages are not quite keeping up with inflation, and then inflation doubles, the shortfall in wages does far more than just double.

Now granted, we haven't had time for the new war inflation levels to filter through to increased wages. However, once that happens - if that happens - then a higher wage/price inflationary cycle is set off, which makes inflation both higher and more persistent. In turn, this increases the needed interest rate increases to bring inflation under control, which then increases the market and economic damage.

It needs to be emphasized that when inflation persistently goes over 8% or 10% - there are no quick or easy ways out. It's an excruciatingly painful situation, with no choices that don't involve more pain. The only way to avoid the pain is to not make choices that trigger the inflation in the first place. So, this idea that the nation can take a little bit of inflation for the common good for just a year or two is a fallacy - the price is much higher than that and much longer term than just a year or two.

For the average household, losing real income at a 7.7% annual rate instead of a 1.5% rate is indeed very painful, given that most lower and middle income households don't have an extra 7.7% in cash available in the first place. This is particularly true given that the base costs of rent, food, transportation, and utility bills are a higher percentage of income for lower income households than with higher income households. And that assumes that income is rising by 5.1%, which is certainly not true for all households.

Of course, this is all based on accepting the CPI numbers at face value. For most people, it seems their personal experience is higher than the official rates, which could mean that financial security and lifestyles are falling at an even faster rate.

It also needs to be noted that this is a US-centric analysis. There is a good chance that Europe will be experiencing much worse, and perhaps quite soon. Even worse, there are many developing nations that are entering or will be entering crisis mode, as they are hit by the six-way combination of:

1) Sharply rising debt costs for borrowings denominated in US dollars;

2) Sharply higher domestic interest rates because of inflation;

3) Sharply rising energy costs;

4) Energy scarcities being exacerbated by the wealthy European nations outbidding poorer nations for what international energy supplies are available (particularly liquefied natural gas, this is already happening);

5) Food shortages for imported grains; and

6) Fertilizer shortages for domestic food production.

The first-order effects are hunger, misery, and financial ruination for many hundreds of millions of people - who have nothing to do with Europe, Ukraine, Russia, or the United States political establishment. The second-order effects are still just getting started, with Sri Lanka leading the way, but we could see the largest geopolitical turmoil of our lifetimes on a global basis.

Soaring inflation has become a political football in the United States, with the fall elections less than four months away. The left is saying inflation is the result of Russia's invasion and the Ukraine War. The right is saying inflation was high long before the war. Unfortunately, the existential problem for us all is that there is truth to both sides. Inflation was already at 40 year highs before the war. The war and sanctions thereon have doubled those previous 40 year highs over the last four months. Copious amounts of gasoline are being fed to an already raging fire.

Financial security and lifestyles are falling much faster than what is currently being officially acknowledged. This is minor compared to what is underway in many other nations. Unless there is a major change in direction - from whatever the political source - this process may still just be getting underway, and the rate of financial and geopolitical change over the coming year and beyond could exceed anything that we have seen in the modern era.

********************************************

At the April workshop, we went through the relevant first, second, and third order effects domestically and internationally, economically and financially. Since that time, the rate of change has only accelerated. The October workshop will be held the weekend of October 22-23, again in Carmel, Indiana (Indianapolis suburbs). Please look for a new workshop brochure to be released in the next few weeks.

It is difficult to find solutions for inflation - but it is not impossible. I've spent over fifteen years doing original research on the best strategies for overcoming inflation. The best solutions that I found over the course of my research are explained in the financial education materials linked here.