Stubborn Inflation & Zero Percent Real Rates

By Daniel R. Amerman, CFA

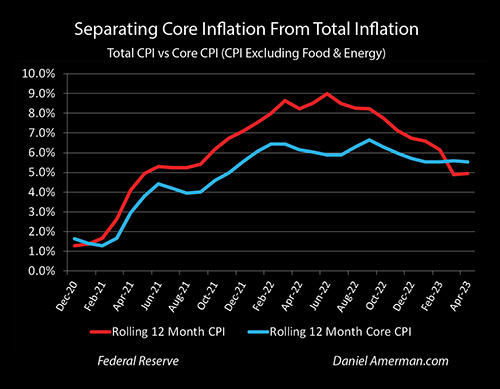

TweetOver the past few months, we have seen two major changes with inflation in the United States. The first is that we have confirmation of an established wage/price spiral, the most persistent type of inflation, as the core CPI is now above the total Consumer Price Index. We have also finally reached breakeven real interest rates as rates have caught up with inflation. As explored in this analysis, the confirmation of established core inflation means that mere breakeven real interest rates are likely to not be nearly high enough.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Stubborn Core CPI

While inflation can be the result of identifiable external causes, once the inflation becomes established, then inflation can become self-sustaining. If this happens, then the removal of the original source of the inflation will not stop the inflation, but rather it can continue and even accelerate long after the original sources are gone.

A wage/price spiral getting established is the classic source of self-sustaining inflation. Prices originally go up because of the external source of inflation. If wages are to keep up with inflation, then wages must go up as well. When wages go up, we get a secondary source of inflation, as prices must then go up to pay for the wage increases. This secondary round of price increases then leads to a secondary round of wage increases - which then leads to a tertiary round of price increases, as the spiral continues.

The next key change that happens with self-sustaining inflation is that behavior changes when future inflation is anticipated. Workers sign multiyear agreements with increases in wages being built in for each year, in order to keep up with inflation. This then means that (all else being equal), there will be price increases (or tax increases for public workers) in each coming year, to pay for wage increases, with this change in behavior then further embedding inflation into the economy.

The core rate of inflation is the overall rate of inflation when the sometimes volatile components of energy and food are removed. We are a little more than two years into the current inflationary cycle, and when we compare the core rate of inflation to the overall Consumer Price Index, then we can see that inflation is now becoming established, where it persists on its own even after the original sources are gone. The supply chain issues are mostly over, the stimulus checks are gone, oil is back down again, but yet the core price increases keep just chugging along.

We have both of the self-sustaining wage-price pressures in process. According to the Bureau of Labor Statistics, average hourly earnings increased by 5.8% in the twelve months ending in April of 2022, and 4.4% for the 12 months ending in April of 2023, for a two year (multiplicative) increase of 10.5%. Even after those hourly increases, weekly real (inflation-adjusted) earnings are still 4.2% below what they were two years ago, so workers are still trying to catch up, and that likely means still more future wage and price increases.

This attempt to catch up and then stay ahead of future price increases is why we are also seeing numerous contracts being announced for everything from teachers to airline pilots to health care workers to dock workers that involve substantial future wage increases in each year, for years to come. These future contractual increases then become a built-in source of future inflation - because of a change in behavior - like we have not seen since the 1970s and early 1980s.

It is also important to note that the disinflation in the overall CPI that we are seeing is purely the result of fossil fuel price decreases for gasoline, fuel oil and natural gas. Literally everything else (with the exception of used car prices) is still going up. Indeed, outside of the core CPI, food prices are still up by 7.7% over the last 12 months, and electricity prices are up by 8.4%. All we are really seeing then is a reduction in prices in some categories of energy, with everything else, including wages, still increasing in an inflationary price spiral.

Breakeven Real Rates

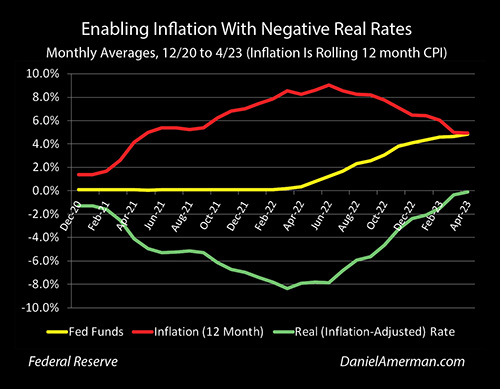

Another major change has just occurred, in that short term interest rates have now (finally) caught up to the rate of inflation, so that the real (inflation-adjusted) interest rate is now about zero, rather than being steeply negative.

As we explored at the May workshop, this process of "catching up" is what has been breaking the U.S. banking system. The increase in interest rates has led to catastrophic (unrecognized) losses on the Treasuries and mortgage-backed securities that are being held on a long term basis by the banks, to an extent that goes well beyond what has been in the headlines so far. At the same time, the increase in interest rates has led to a decrease in the deposits that are the source of funding for the long term assets - which can create bank runs. However, if the banks raise the interest rates on deposits, they will be paying more on the liabilities that are funding the bonds than the interest income on those bonds, creating ongoing losses that must be recognized.

The banking system as a whole is in great trouble, because of what are some elementary mistakes with asset/liability management - they borrowed short to invest long, and it has caught up with them, much like what happened with the savings and loans in the 1970s and early 1980s. This fundamental failure with the basics of financial management by the banking industry was no accident or oversight, but rather it was created by the arrogance of the Federal Reserve, who set up this entire situation out of the mistaken belief that inflation would never be a problem again, so interest rates would never need to increase.

As we went over at the workshop, it would be a major mistake to think that we've seen the worst up to this point. To reduce the problem would require lowering interest rates - but that requires either achieving a lower core rate of inflation - or just letting inflation run wild.

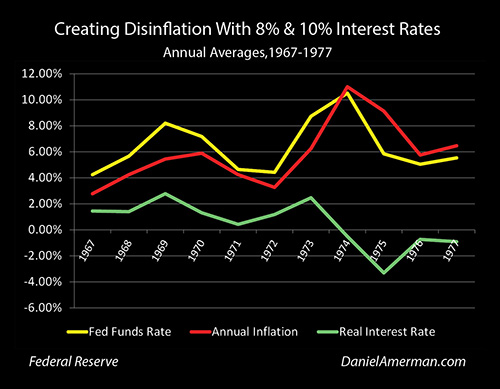

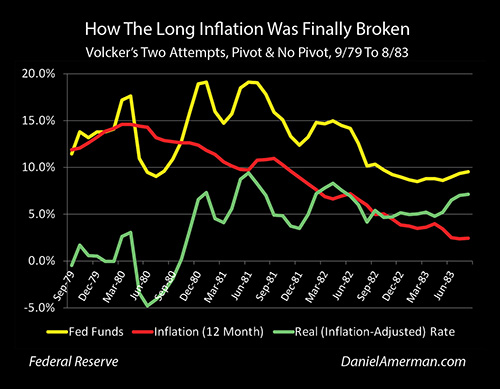

As covered in my analysis "An Evidence-Based Look At Inflation, Recessions And Pivots" (link here), we've seen this movie before, even if most of Wall Street and the financial media seem to be taking a history-free approach to discussing inflation and interest rates. Beginning in the late 1960s and then running all the way through the 1970s and early 1980s, core inflation was allowed to get established, and it persisted long after the original sources of the Vietnam War, and later the oil embargo, had ended. So, the first part of the movie was very similar.

The Fed tried to finesse the situation and get rid of the core inflation without too much economic or market damage. This can be seen by looking at the green line of real interest rates, which stayed relatively low on an annual basis. Look at the yellow line and see how much higher interest rates were for much of that time than they are today. We do not have punishingly high interest rates, that is a myth from people who do not know our past, our current interest rates are still in the "toe in the water" range compared to what was deployed in the past. And yet - even those much higher interest rates were not enough to break an inflationary cycle that was worsening over time.

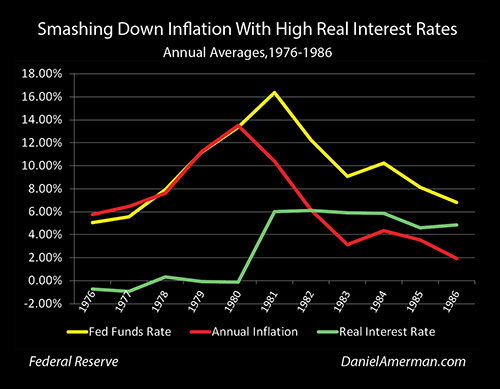

We know what worked. It was raising real inflation-adjusted interest rates to the near 6% range for five straight years.

As explored in detail in my analysis "An Evidence-Based Look At Inflation, Recessions And Pivots, Part Two" (link here), what can be seen in the graph above is what ultimately broke inflation. Take the red line of inflation, add to it the green line of real inflation-adjusted rates, and we get the yellow line of total (nominal) interest rates. Keep the pressure up with the green line almost continuously above 5%, don't pivot in the recession that follows, and ride the red line of inflation down until it is broken (the full linked analyses provide much more detail).

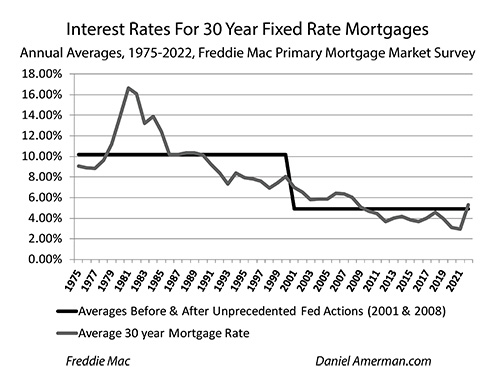

What would happen to the banking system, the markets, retirement accounts - and the interest payments on the national debt - if we saw interest rates (including mortgages) go above 10% for years to come? Good question?

Most "reputable" commentators would say that scenario is so far outside the group consensus, that such a possibility can be dismissed out of hand. But yet, if we don't, history shows the current inflationary cycle is likely just getting started - and that possibility is also far outside of the current group consensus among experts.

When the reality on the ground is outside of what the group consensus is willing to consider - and also outside the pricing of all current investment markets - then times of both great peril and great opportunities are likely to be ahead.

********************************************

When people with the mindset of 2010s income property investors look at the possibility of 10%+ mortgage rates, they likely see the danger of a catastrophic outcome. Yet, when we look at the past and put ourselves in the mindset of a 1970s investor, then we see some of the best markets for wealth creation that have existed in our lifetimes.

Hundreds of thousands of words of real estate analysis are being put out by 2010s thinkers who are straining to adapt their 2010s mindsets to logically anticipate what would happen in the mind-blowing scenario - that many might dismiss out of hand - that we get much higher mortgage rates.

There is another name for that fantastic scenario, as can be seen above: history. An alternative to adapting 2010s thinking is to read two relatively short books that show exactly what did happen when 10%+ mortgage rates were the norm, and to learn the eight level historical formula for wealth creation in such times.

"The Homeowner Wealth Formula" (Chapter One free link here)

"The Eight Levels Of Homeowner Wealth Multiplication" (Chapter One free link here)