Bail Ins & Taking Private Wealth

by Daniel R. Amerman, CFA

A new method of taking private sector wealth has been spreading around the world this year. This mechanism is called a "bail in", and it is based on the premise that there are certain entities which are too important for the well-being of the general public to allow them to go into bankruptcy or to be liquidated.

The new "twist" is that the entity – which could be a major bank, or it could be the public retirement system for an entire country – is not bailed out through using outside funds from the general public, even though the protection of the general public is the reason for the intervention. Instead, funds are taken from the inside, on an involuntary basis, from selected classes of private sector investors who are judged as having the ability to pay, and the costs of maintaining the viability of this entity for the "greater good" are thereby concentrated in a small part of the private sector.

This has been seen in Cyprus with the "rescue" of their banking system. It has also been seen in Poland with the taking of assets from the private retirement system for the benefit of the government and the troubled public retirement system. Bail ins have now also been proposed in Canada when it comes to the preservation of "systemically important" banking institutions.

What it all comes down to is governments and international organizations changing the law, leaving investors without the protections which they thought they had. And this is important not only for banking depositors and investors, but also for anyone who is depending on private sources of wealth for their own retirement or long-term financial security. In this article, we will explore the different ways in which "bail ins" have worked or been proposed in these three real world instances.

What Is A "Bail In"?

The term "bail in" describes a quite different way of preserving troubled entities and keeping them from insolvency or bankruptcy. A bail in is best understood by contrasting it to the more traditional "bail out", and it is important to keep in mind that the two can be used together. That is, the rescue of the Cypriot banking system was a combined bail in of depositors, and a bail out by the European Union and International Monetary Fund.

To begin with, there is an entity – again it could be a major bank or banking system, or a government or government retirement fund – that has more claims against it than it has assets available to pay the claims. This deficiency of assets compared to claims is, of course, the traditional source of bankruptcy or insolvency, whether we're talking about individuals, corporations, or in some cases entire nations.

However, the trend since 2008 has been to not allow bankruptcy when an entity is judged as being too important for the good of the public to let it fail (or at least that is the rationale claimed). And a method has been found to close this gap between claims and assets without going through insolvency or formal bankruptcy proceedings.

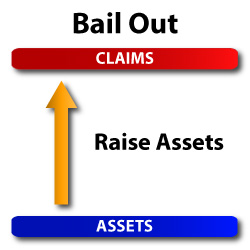

A "bail out" rescues an entity by bringing in outside cash and assets, and raising the level of assets until there are enough available to meet the claims and solvency is thereby achieved. The graph below illustrates how this works.

Examples of bail outs occurring on an overt basis include the TARP program in the United States, as well as the government takeovers of AIG, most of the auto industry, and Fannie Mae and Freddie Mac.

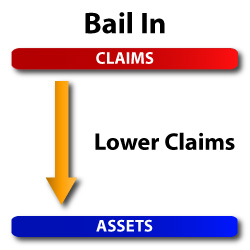

A "bail in" approaches this fundamental mismatch between assets and claims from the opposite direction. In a bail in, as illustrated in the graph below, the entity does not go to the outside for new funds. Rather, the gap is closed by reducing the amount of claims outstanding against the entity, until assets match claims and solvency is achieved.

What matters here is that depositors and investors may have legal claims against a bank, for instance, which the bank should not be able to set aside outside of bankruptcy, which itself brings into play its own investor protections. In a "bail in", the government uses its power over the law to take wealth from these investors, set aside their claims, and thereby either avoid the use of public funds for a bail out altogether, or reduce the amount of that bail out.

Cyprus Bail In

The rescue of the major Cypriot banks was a combination of a bail in and a bail out. The bail in component involved depositors with over €100,000 at the major banks being subject to a 60% "haircut".

Of their deposits exceeding 100,000 euros, 37.5% were involuntarily converted into equity shares in an essentially bankrupt banking corporation. Another 22.5% of those deposits over €100,000 were segregated for possible conversion into equity as well, if the deeply troubled bank were to continue to remain troubled and need to further reduce the claims outstanding against it. And by "claims outstanding", this of course comes down to depositors wanting to get their money back.

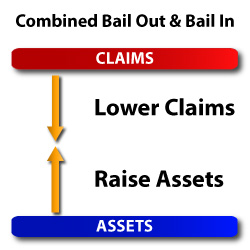

As illustrated in the graph below, what the bail in served to do was to reduce the size of the bail out by the European Union and International Monetary Fund. Claims were brought down, even as assets were brought in, and (hopeful) solvency was reached somewhere in the middle. So a taking from private investors was combined with a rescue by international organizations.

Now most depositors, including the great majority of Cypriot citizens, got all their deposits back. The way this was accomplished was by targeting only the wealthiest depositors, those with the largest deposits, and taking up to 60% of their money above the minimum amount that was protected.

Now, because Cyprus served as a financial haven for Europe, and most particularly for wealthy Russian investors who were seeking an offshore haven for their cash, what the bail in boiled down to in practice was that most of the domestic population – the voters – didn't take any hit at all, while the wealthy foreigners were stuck with the bill.

Proposed Canadian Bail In Rules

While no Canadian bail ins have yet occurred, the government is proposing implementing new rules, as covered on page 145 of the linked document (the PDF page number is 155), which allow for a "very rapid conversion of certain bank liabilities into regulatory capital" for "systemically important banks".

http://www.budget.gc.ca/2013/doc/plan/budget2013-eng.pdf

Of very significant note is that "certain bank liabilities" is not defined. But the structure is set up in advance, and it allows a Cypriot-type solution in the event of (which the government deems "very unlikely") a situation where the largest banks in Canada need to be rescued. And this would at least partially be accomplished through involuntarily taking claims held (their deposits and investments, in other words) from some parties, but not from others.

And again, while we can't say for sure in advance, the chances are that the money will be taken from the largest depositors, while the average depositor/voter might suffer no losses at all. In other words, there is a redistribution of wealth from "those who can afford it" (or so it will be presented), for the good of all.

The Polish Bail In

The Polish bail in of September 4th, 2013, was quite different from the Cypriot bail in or the new Canadian rules allowing for bail ins. This was not a bail in of a troubled banking system, but rather the entities in trouble were the Polish public retirement system and the Polish government itself.

http://www.reuters.com/article/2013/09/04/poland-pensions-idUSL6N0H02UV20130904

There were in Poland, as a matter of law, two separate retirement systems. One was public, the other was private, and both were mandatory. The public retirement system has had real financial difficulties, while the private system was in much better shape.

The investments within the private pensions were also a matter of law, and about 50% of those private pension funds were invested in bonds, and the other 50% was in equities.

What the Polish government did was to take all of the bonds – which were 50% of the assets of the private pension system in Poland – and bring them into the public retirement system. And because these assets consisted of Polish government bonds, this was treated as a reduction in the amount of debt owed by the Polish government that was equal to 8% of the Polish economy. So it was very significant.

Over the next 10 years, the remaining assets in private pension funds will be drawn out – and the private system will be entirely folded into the public system. This could be viewed as a bail in, in two distinct ways. The first is that Polish workers who had rights to a pension from the more solvent private sector, had their claims wiped out – not due to insolvency or bankruptcy, but rather as a matter of law. It was the wiping out of these claims – via the transfer into the public system – that freed up the assets for the taking by the Polish government.

The second form of bail in is that like many governments around the world, the Polish government was heavily in debt. Through forcing private companies to purchase government bonds as part of mandatory pension programs, and then taking those bonds where they could be netted out since they were now held by the government, it reduced its debt problem – not by raising funds through taxing the general population, nor through insolvency, but instead through reducing claims against the government that had been held by the private sector.

One common point between the Polish and Cypriot bail ins, is that they both took monies from foreign investors on a wholesale basis. In Poland, many of the bonds that were seized were taken from large international corporations with Polish operations and Polish employees, such as ING and Allianz.

So private sector wealth was selectively taken for the "common good", i.e. for the good of the Polish government.

Alternatively, one might say that because these funds were set aside for payment of pensions, and weren't really independent assets of these foreign corporations, that there's a question about whether they were truly expropriated or not.

However, the bottom line is that the people who had as a matter of law thought they had good protection for their retirements in the form of private sector pensions that would support them even if the public retirement system couldn't – had the rug pulled out from underneath them as a whole.

It turned out that for the greater good of the average Polish retiree (and voter), there couldn't be two systems where a private system was prudently funded and a government system was not, but instead there could only be one system where everyone had equal treatment in the name of "fairness".

And that this approach turned out to dramatically slash government debt levels was of course a bonus, as far as the Polish government was concerned.

Poland & The United States

There are some similarities between Poland, with its former public and private retirement funding systems, and the United States with its corresponding dual retirement systems.

Both nations are heavily indebted when we compare national outstanding debt to the size of the economy, with the US government being almost twice as indebted as the Polish government was prior to the bail in. In the United States, the percentage of federal government debt to GDP is very close to 100%, while the corresponding number for Poland was 57%.

In the United States, the duel retirement systems consist of the public system of Social Security and Medicare, and an array of investment-funded pensions and retirement accounts, including traditional corporate pensions, funded state and local government pensions, as well as individual retirement accounts.

One crucial difference between the United States and Poland is that when we look at the US retirement system, including both Social Security and Medicare, it is in far worse shape than Poland. When we look at the numbers calculated by Archer and Cox – the former chairman of the House Ways and Means Committee and the former chairman of the Securities Exchange Commission respectively – the present value shortfall between the assets available in the form of current tax levels and fund balances, versus total federal government claims including Social Security and Medicare, is a staggering $86.8 trillion.

Does it seem reasonable, then, that at some point in the future – if we take these impossible-to-pay debt burdens for the US government in the form of public retirement promises, and we consider the assets available in private pensions and potentially even private retirement accounts – that we could expect a bail in for the good of the public, for the good of the US government, and for the good of the US public retirement system?

Perhaps. The Polish situation would certainly seem to be an indicator that this is a real world possibility at some point when the crisis is far worse than it is right now (at least in the short term). Last week's development in Russia where the government "temporarily" seized $7.6 billion in assets from non-state pension funds for "inspection" is also worth noting. For governments short on cash, fat private pension portfolio balances do seem to be creating a tempting situation for politicians when it comes to rewriting the rules.

However, there is another major difference between the United States and Poland that goes well beyond the far larger amounts at stake in the United States, which is that the seizure of retirement assets held by millions of individual US retirement investors would ignite a political firestorm. There would likely be far greater resistance than there has been in the seizure of retirement accounts from many foreign corporations in Poland.

Implications

We can't yet be certain what the implications are for the spread around the world of this new concept of "bail ins". In looking at Cyprus and Poland, however, it would seem that at the least we should be aware that if we are holding assets in an "offshore haven" , and that nation runs into economic difficulties, that there is a respectable chance that the rules will be rewritten in such a way that the domestic population is financially kept mostly whole, while most of the damage is inflicted on the wealthy foreigners. This is not a mere possibility, but rather it has been happening out there in real time.

Something else to keep in mind, particularly if you are depending on a private pension or private retirement account in the United States or elsewhere, is whether for the "greater public good", there may be a realistic possibility at some point of a merging of private retirement assets in with the severely underfunded public retirement system.

Now this is of course outrageous under the rules as they have been written, and when it comes to the behavior of corporations and individuals investing for decades for their own private retirement.

However, when we look at it from another perspective, if we have entities that are considered too important to let fail – such as the entire banking system, or the entire public retirement system – what bail ins show us is that in the real world, governments are making decisions, as are multi-government organizations – with the EU and International Monetary Fund participating in the Cyprus decision being crucial to remember – where rather than the general public paying for a bail out, instead the more affluent segments of society are targeted to bear the pain for all, in a potentially politically popular manner.

This is the real world, this year.

And this brings to the forefront the central issue that private pensioners and private retirement account investors may be facing over the decades to come, which is when the pressure builds to the point that there is sufficient political reason to do so – we can anticipate that the rules will be changing. And we can already see one clear direction in which they may be changing.

What you have just read is an "eye-opener" about just one of the ways in which a rapidly shifting world is removing the foundations beneath conventional investing - even while most investors continue to follow the traditional strategies, unware of just how much the financial playing field has changed.

What you have just read is an "eye-opener" about just one of the ways in which a rapidly shifting world is removing the foundations beneath conventional investing - even while most investors continue to follow the traditional strategies, unware of just how much the financial playing field has changed.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.