The Greek Stress Test & The Reality Of Incremental Changes

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Greece & The Dimmer Switch

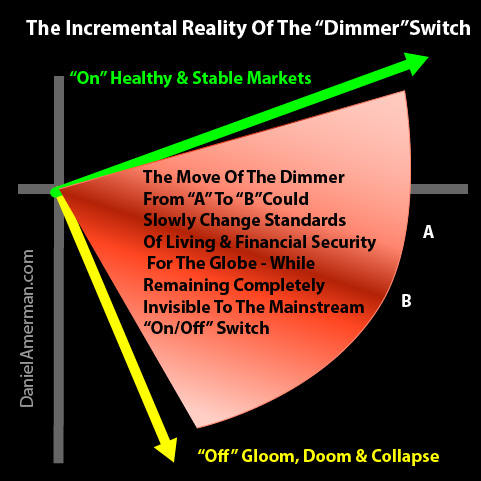

On the other hand, when we allow for the dimmer switch of incremental adjustments that often impact reality – understanding that total state changes are rare but incremental changes occur all the time – then we see a completely different picture.

The very act of increasing the degree of central banking interventions in a number of different ways impacts reality. It does indeed affect investment returns. It makes it more likely that fixed income investors will receive lower investment returns for years to come and even decades to come, as one of a number of incremental factors over that time period.

All else being equal then, the light remains "on" throughout, even while the dimmer has shifted down somewhat, let's say going from point A to point B in the above graphic. That means less income for most fixed income investors, it means a somewhat lower standard of living over the years to come for savers, and it means reduced financial security over that time.

At the very same time, the continuance of major governmental interventions will tend to create an inefficient economy where economic growth is less than it should be, which would also tend to pull us down from A to B.

Again – this is flat-out impossible to see so long as we view things only in terms of the on/off switch, as most people do. Because the switch is clearly on. The crisis quickly recedes in the rearview mirror and is then forgotten about.

But if in fact we have a lower growth economy at the same time that we have more extensive central banking interventions, then it becomes ever more difficult for the central banks to find a place where they can exit. Because the stability of the markets is ever-more reliant on the dysfunctional interventions.

So lower real economic growth means less real resources available to support price gains in stock markets on a fundamental basis. It also means lower real resources available to fund public benefit retirement programs such as Social Security and Medicare in the future, and it means that the future is a little bit bleaker for our collective children and grandchildren. All of which also act to pull us down from A to B when it comes to the realities that may govern our future lives.

The Dimmer Switch & The Redistribution Of Wealth

There is a second and more nuanced level of understanding when it comes to the "dimmer switch", which is that if the switch does slide down from point A to point B as a result of the interventions used to contain crisis – this is not a straight-up loss in wealth. Rather, what is created is a redistribution of wealth.

If we see the dimmer switch, and we understand that the methods used to contain crisis can impact investments in a persistent and powerful way, then we can also see that should the crisis be "successfully" contained, that this may then result in an extension of the length of time that interest rates remain unusually low.

The simple, surface level take-away is that savers and retirees are going to feel more pain for a longer period of time.

The more refined understanding is that interest rates are a redistribution of wealth. And if the dimmer switch moves from A to B, then investment strategies which benefit from low interest rates will prosper, while those which are hurt by low interest rates will do worse.

Similarly, another price for containment can be a reduction in the economic growth rate. Because this increases both unemployment and the national deficit, then per the economic theories that determine current governmental policies, the appropriate response is to increase the differential between inflation and interest rates, by increasing the rate of inflation while keeping interest rates very low.

Again, when viewed on the simplified surface level, this is just plain bad news. After all, 1) higher inflation rates combined with 2) lower interest rates for 3) an extended period of time is a three way recipe for a poor outcome when it comes to many investment strategies.

The more refined understanding is the recognition that inflation and interest rates are both redistributions of wealth, and that double negatives can be turned into double positives. Which means the identification of the movement downward on the dimmer switch from A to B becomes valuable and actionable, as it facilitates the creation of a double positive outcome.

Through no fault of their own, most of the general public will always have a dual blindness when it comes to both crisis and the price of containment. If a crisis arises but is contained, they are unlikely to understand the pervasive cost of that containment, and how it could affect their own lives for years or decades to come.

Even if they do understand the cost in terms of feeling its effects, because the costs of containment are usually viewed as pure negatives, they may not think there is much they can do about it.

This is where two levels of vision can make all of the difference. The ability to see the dimmer switch. And the ability to see the redistributions that happen when the dimmer is moved up or down. Quite simply, the ability to see each with clarity can change everything, when it comes to the current potential crisis as well as what else may come.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.