US Regulators Mandate Next Stage Of Textbook Financial Repression

by Daniel R. Amerman, CFA

TweetWith comparatively little fanfare, Fidelity Investments has announced that 100% of their $115 billion Cash Reserves fund, the world's largest money fund, will be invested in US government debt by December 1st of 2015. It is expected that many other money fund companies will also change their policies and invest only in US government and agency securities, because of a change in regulations that will occur in 2016.

Since 2010 the US government has been implementing a textbook example of Financial Repression, when it comes to using private savings to control and even effectively pay down the size of the national debt. Far from slowing down or ending this process, these new policies will expand by many millions the number of people who will effectively be forced to fund the purchase of government debt at artificially low interest rates.

Tightening The Controls On Savers While Lowering Their Returns

As explored in the tutorial "Is There A 'Back Door' Method For The Government To Pay Down The Federal Debt Using Private Savings?" (link here), Financial Repression is an economic process that has been used by many nations around the world to quite successfully reduce the effective size of their national debts relative to their economies, in a manner which the average saver/voter never has understood and likely never will.

The core of financial repression is to create a "negative real interest rate" where interest rates paid are below the real rate of inflation. Over time, savers then lose real wealth as financially modeled here.

While this is highly effective, it does require the public being forced to participate. Whether they realize what is happening or not, if given a choice, any rational person would of course choose to try to avoid these very low interest rates that do not keep up with the rate of inflation and which steadily erode the purchasing power of savings. In other words, not only does an uneven playing field need to be created, but a series of fences need to be put around the field, to keep the savers from escaping.

There are several traditional types of fences that were common in the economies of the West between the end of World War II and the early 1970s, and that have reappeared since 2010. The first of these fences is to encourage or mandate participation by financial institutions.

Most people do not directly own US government debt. But they do keep their money at banks and other financial institutions. The goal for a national government is that if the financial companies can be made to invest the public's money in government debts, then the public has effectively funded the government, even though they do not realize this is happening.

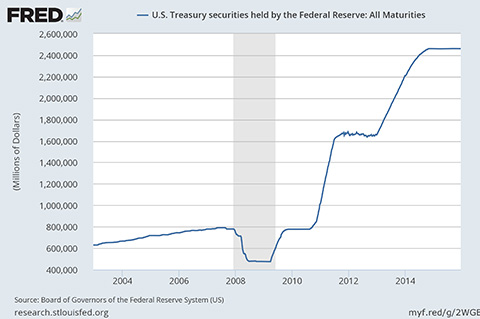

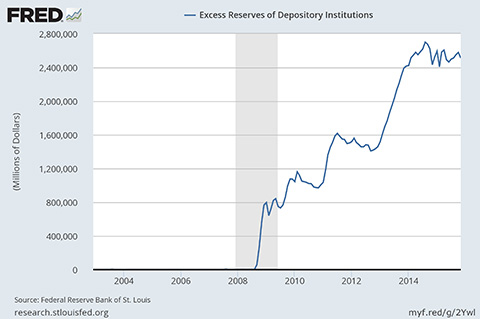

When we look at quantitative easing and the approximately $2.4 trillion dollars in US treasuries that are being held by the Federal Reserve – and are funded by excess asset reserves from the banking system – we have a classic example of the public unknowingly funding the government at extremely low or even zero percent rates.

What happens is that anyone who has a savings account or interest-bearing checking account at a financial institution receives almost no money from their savings, because the financial institution uses their money to make loans to the Fed (in the form of excess asset reserves), for which it receives almost no income, and the Fed uses that borrowed money to buy US government debt, for which it receives very little income.

Effectively the saver lends to the bank, which then lends to the Fed, which then lends to the US government at an extremely low interest rate. As the financial institution and the Federal Reserve are each only intermediaries, they can be netted out, and it is the US savers who provide $2.4 trillion worth of extremely low rate funding to the US government.

The savers have no idea they are doing this, but the overall situation is a matter of quite deliberate design. Indeed, creating that exact relationship is one of the main objectives of Financial Repression.

However, up until now investors were able to partially "escape" the state of Financial Repression by not saving in government insured banks, and instead placing their savings in money funds. This was only a partial escape, because the money funds are generally mostly invested in government debts. But not entirely invested. Instead there is a good possibility that the fund manager was picking up just a little bit of yield by partially investing in high quality, short term, non-governmental debts.

In other words, the fence was mostly complete - but not entirely complete. Per the Wall Street Journal article linked below, about $1 trillion out of the $2.7 trillion in money fund industry assets was still able to leak out and go to places besides the federal government. That loophole will be closed during 2016, and another trillion dollars of the US national debt will be funded at almost no expense - which will also just happen to cover those inconvenient sales of US Treasuries by China.

Mandated "Safety" Raises The Fence

What is also a classic, textbook element of Financial Repression is that the forced funding of government debt is presented as being mandated by the need to increase safety for the public.

In the case of banks, we all know the government considers them risky (as they are), and the government wants the banks to be safer. Legally, the highest quality form of asset that a bank can have is reserves on deposit at the Federal Reserve. So from a regulatory and political perspective, this isn't about forcing depositors to lend money to the government at absurdly low rates. Not at all.

Instead for the good of the public, the banks need to be safer. Which means the banks are encouraged to put trillions of dollars of the public's deposits in the safest place they can, which is the Federal Reserve. Which then puts that money in the safest place it can, which is buying US government debt. So when the public has almost no interest income, and the heavily indebted government has some of the lowest interest costs in financial history, that is just a fortuitous coincidence, so to speak. The real reason is the safety of the public.

Or so the story goes.

The wording in this Wall Street Journal article about the change in money fund investments is quite interesting. These financial companies are not being reluctantly forced to invest their money in US government obligations but rather the headline is that they are clamoring to do so. It turns out that they just can't get enough of these good zero percent returns!

It is only when one gets below the headlines that we learn that the reason for these regulatory changes is (surprise) a need to protect the safety of the public.

"The rules driving the changes aim to protect the $2.7 trillion money-fund industry from a repeat of the 2008 investor withdrawals that resulted in one fund “breaking the buck,” or reporting a net asset value below the full face value of their holdings.

The rule changes won’t apply to funds that invest only in the debt of the federal government and agencies such as Fannie Mae and Freddie Mac."

Wall Street Journal, October 20, 2015

So the fence completes, much more of the $2.7 trillion of money fund industry assets must now be invested in near zero percent government debts, and this is all being done for our own safety.

What is particularly interesting is the contradiction in terms, when it comes to enforcing a move to zero interest rate investments that is supposedly occurring because of the increased risk in the system.

In theory, investors would refuse to accept interest rates below the actual rate of inflation, and in risky environments, they would not be making any investments at all without receiving strong risk premiums for taking on the risk.

However, with a zero percent yield (as some US treasuries are now offering again), the public receives compensation for neither inflation nor systemic risk. There simply isn't room.

Which is exactly why participation needs to be forced. And the textbook way of doing so is in the name of safety.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.