Are Roth IRA Owners Likely To Be Subject To Double Taxation?

by Daniel R. Amerman, CFA, MBA, BSBA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

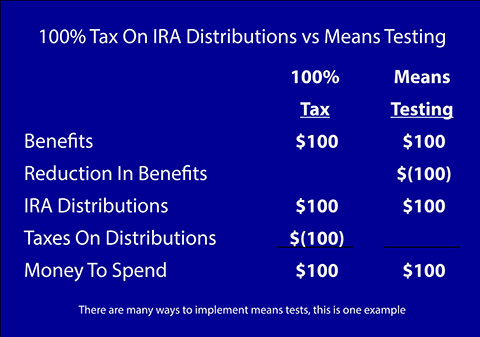

As shown in the graphic, if we have $100 in IRA distributions and we qualify for $100 in benefits, then we should have $200 to spend. However, if we have a 100% income tax, then we lose all the distributions, and we are left with the $100 in benefits to spend.

Conversely, if we do not qualify for the benefits because of means testing on either assets or distributions, then while we pay no tax on the $100 in distributions, we still have only $100 to spend. Economically then, the result is identical with this example between means testing and a 100% income tax – we are still left with only $100 to spend either way.

So when it comes to the dollar bottom line for retirement account owners (this could incidentally go well beyond Roth IRAs), it may look like a tax. It may smell like a tax. It may bark like a tax.

But because the particulars of the mechanism for wealth transfer are a withholding of benefits rather than a taking of cash, it won't be called a tax. And if means testing of this kind comes to be, I think we can count on some pundits and politicians waxing quite indignant at the suggestion that this is some kind of tax.

So Roth IRA investors do face the possibility of what is effectively a most cruel and onerous double taxation – where they are fully taxed on their original income at the time they make their contribution.

And then later, even if they are technically never taxed on their future IRA distributions, means testing can effectively become a second round of taxation.

It's also important to understand that the possibility of an explicit future tax on Roth IRA distributions is a separate risk, and is not mutually exclusive when it comes to the risk of means testing – both could happen together. This would then effectively create three levels of taxation: 1) taxes on initial earnings before the contribution is made; 2) taxes on Roth IRA distributions; and 3) means testing on asset amounts and/or distributions leading to a reduction in retirement entitlements.

Using All Available Information

"Under current law, what Roth IRAs deliver is a freedom from future taxes."

The above statement started the analysis of Roth IRA advantages herein, and it is clear cut. That is, the central premise behind investing through a Roth IRA is that it is a tax shelter which uses current law to achieve freedom from future taxes.

The inherent flaw with Roth IRAs is that this simply can't done with any reliability. Current law does not govern what the tax code will be in 2020, 2030, 2040 or 2050. Sure we can analyze, we can make estimates, we can guess – but what it all comes down to is that we simply don't know what the rules for tax shelters will be at that time.

This uncertainty does not mean that Roth IRAs are doomed to be an unsuccessful investment vehicle. They could in fact end up performing brilliantly, and there is a chance that investing in a Roth IRA could indeed work out to be one of the best financial choices a person could make today.

But yet, one must also recognize that there is a chance that such a decision could end up leading to a particularly poor outcome.

To properly evaluate Roth IRAs, then, we have to remove the false certainty, and understand that it effectively comes down to making a judgment call that involves both economic and political considerations.

Will there be future economic pressures or political changes that result in wholesale changes in the tax code?

If so, will a fear of offending Roth IRA voters be sufficient to fully protect their tax shelters as future political environments develop and tax code changes are made, or will there be modifications to them in one or more of those environments?

Will there be means testing? If so, will future laws be written specifically to give Roth IRA owners statutory protection from means testing?

Now to be fair, these kinds of questions could apply to almost all financial decisions involving the future. We don't know with certainty what the future economic, political and monetary environment will be, or what the future tax code will be – so we do the best we can and make our judgment calls based on what we know today.

But what separates Roth IRAs from the wider universe of investment decisions is their particular status as a deferred tax shelter with compelling advantages which can only be realized in the future, and which may or may not exist in the future. This gives them a particularly concentrated exposure to both political risk and to general risk of the future being different from today, relative to many other investment decisions.

As presented in this analysis, Roth IRAs represent a tax shelter with a fascinating risk/reward relationship. The rewards could be significant and even life-altering – but so could the risks. The danger lies in making a decision based purely on the rewards but without a proper consideration of the risks, and unfortunately – that is how Roth IRAs are usually presented.

The more information that we have to work with, the better the decisions we can make. And hopefully this analysis has been of help to you in that regard.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.