Brexit & The Precipice

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read the article in single page form, or share via Facebook or Twitter, the one page version for subscribers can be found here:

The animations in the video below show how this works in graphic form. We had a systemic crisis before in 2008, it was contained by the firewalls. As explored in the video, most of those firewalls probably can't be used again, or at least there are big issues with doing so. If Brexit leads to the destruction of the euro, then as illustrated, we have systemic risk that instantly collapses the firewalls.

The Coming Battle

Now, none of this means that going over the precipice is inevitable. We are still on the edge at this point, not over it.

First, Brexit is not yet certain. It was a non-binding referendum, with a substantial majority of Parliament strongly opposed to it. The current treatment is that it is politically unimaginable that the politicians would ignore the will of the voters. On the other hand, politicians and the media do that almost every day around the world, particularly when the margin is only 4%, and it is perhaps equally politically unimaginable that they would go through with it.

Indeed, I think we can expect an ever growing coalition of media, government and business elites seeking a way to steal the election results back from the Leave camp over the coming days and weeks, and there is a good chance they will succeed.

Even if Brexit does go through, it does not mean that any other members of the EU will drop out. Or that the euro is necessarily doomed. Or that the ECB might not be printing euros by the trillions and paying negative interest rates for many years to come.

For now, what we have is another and particularly dangerous round of battle between market forces and the forces of financial containment and government enforced artificial stability. Which side represents the forces of Good, and which side the forces of Evil, I will leave up to the reader.

The governments and forces of financial containment may still win this round. The cost could be very high for investors and savers when it comes to wealth creation and future standards of living, but it could happen, and we may pull back from the precipice. Indeed, if that were to happen, many would have us believe that the precipice is gone or was never there.

All It Takes Is One Election

However, the fundamentals will still be there. Brexit could be contained, and every other key election "won" for the next six months, or year, or two years.

Until as covered in the "All It Takes Is One Election" section of the June of 2015 article, there is another single election where the voters refuse to do what they are told - and we could right back here again. On the edge of a precipice, with an acute risk of the kind that could collapse the firewalls, and possibly do so around the world.

___________________________________________

One thing I do know is that we are going to be having one heck of a good workshop in the Chicago area at the end of July (brochure here). Brexit will be part of a much larger list of topics in this extraordinary year of 2016. We will talk about exactly what is happening, why it is happening, the attempts that are likely to be made to hold things together, a potential new generation of radical monetary interventions by the central banks, and how either risk or the containment of risk could transform investment results for stocks, bonds, gold, real estate and asset/liability management strategies.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

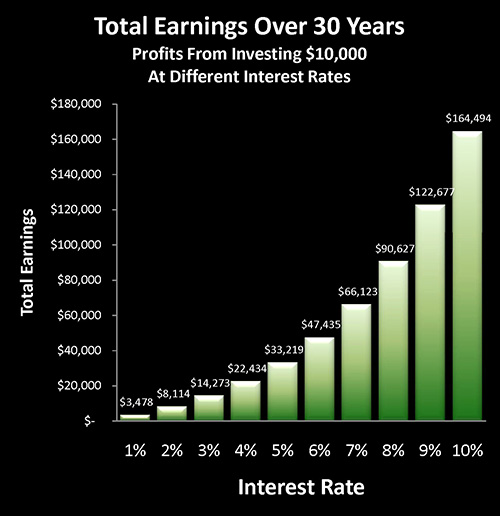

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

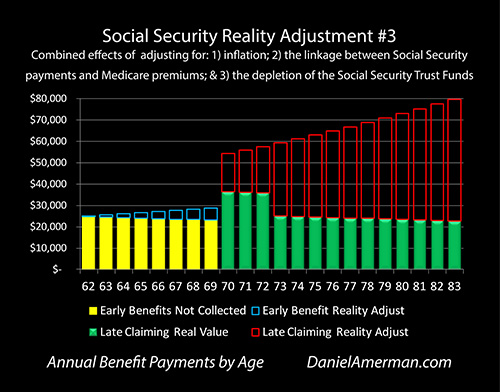

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.