Does The National Debt Supercycle Override The Normal Interest Rate Cycle?

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read the article in single page form, or share via Facebook or Twitter, the one page version for subscribers can be found here:

An understanding of this distant past becomes highly relevant when it comes to one of the big questions of today and the December of 2015 "liftoff": does this mean that savers and retirees will finally start to get a fair deal?

Unfortunately, if we look to the relevant years of the past, then our answer is most likely "no", because the mechanics of the process for reducing effective government debts require creating negative real returns for millions of savers (as explored here). And history shows us that there was a decades long process of interest rate suppression the last time we were at this place in the national debt supercycle.

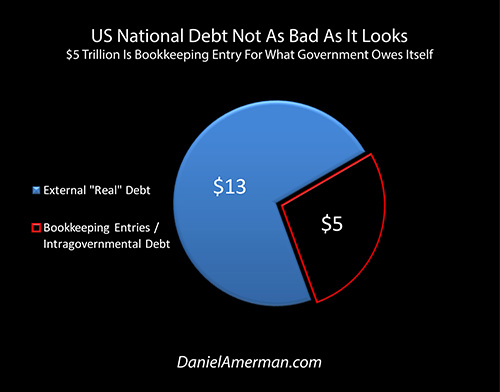

Now, there are some economists and financial authorities who say that the national debt situation isn't nearly as bad as it looks – and therefore, implicitly, there is more room for interest rates to increase than we might think. This perspective is summed up in the graphic below.

The idea is that economics sophisticates know that about $5 trillion of the national debt doesn't really exist; it is rather just a theoretical bookkeeping transaction for money that the federal government owes to itself. Net this out, and the debt is "only" about 72% of the size of the economy, so there is more room for interest rate increases.

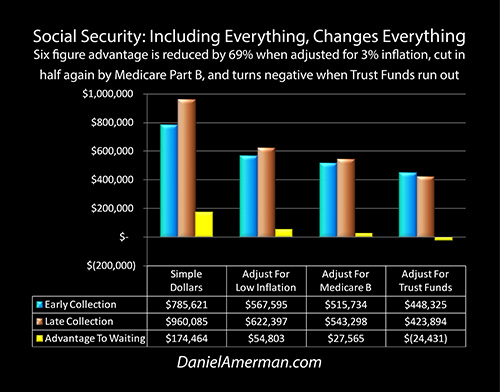

Importantly, these $5 trillion in phantom assets are known by another name, which is the Trust Funds assets securing Social Security, Medicare, and military and civil service retirement programs. As explored here, if these "bookkeeping transactions" for what the government owes to itself don't really exist, then neither does the security for our retirements. However, if they do exist and we will be paid, then yes, we are back to being deep in the danger zone with the national debt equaling about 100% of the size of the US economy.

The Primary Interest Rate Experiment Hasn't Changed

What is being lost in the publicity about the increase in the targeted Fed Funds rate range, is that the most important interest rate intervention by the Feds was never about Fed Funds – but rather Quantitative Easing.

While Quantitative Easing is still generating headlines in Europe and Japan, it seems like we almost never hear about Quantitative Easing (QE) these days, at least in the United States. Indeed, many Americans might be excused for thinking that QE is a historical artifact that is no longer relevant in today's markets.

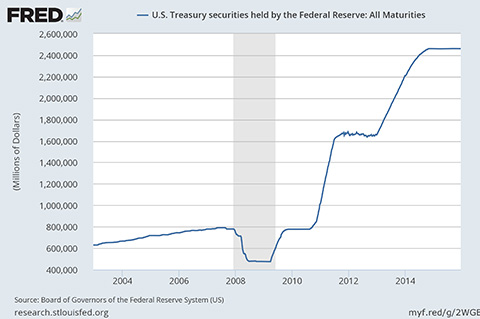

The above graph shows that just the opposite is true – QE is still here in the United States, and unchanged at almost $2.5 trillion in US Treasury securities that are being held by the Federal Reserve. Yes, the rapid growth has been placed on hold. But each month, principal payments from maturing Treasury securities are received by the Fed, and each month the Fed reinvests that money to keep their funding of the national debt at an almost unchanged level.

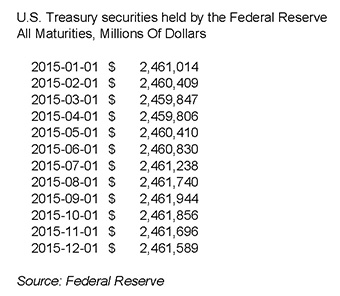

Indeed, the Fed is keeping its Quantitative Easing assets in a remarkably tight range, as shown in the monthly chart for 2015. And the statement of December 16, 2015 which accompanied the increase in Fed Funds rates, indicated that there would be no change in this policy, at least for now.

The "flat-lining" of Fed Funds rates as seen in the first graphic at near zero for many years was not at all normal, it was highly unusual. But it didn't rise to the level of the extraordinary or the fantastic.

What was extraordinary was the Federal Reserve creating over $2 trillion in new money out of thin air and using that money to fund almost 12% of the total national debt.

What was fantastic was the Federal Reserve making those purchases through the secondary markets, which allowed it to effectively take control of medium and long term interest rates, expanding its reach far beyond its traditional control of short term interest rates.

And when it comes to what is truly different about this time around, when it comes to the extraordinary and the fantastic – the Fed isn't changing anything.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

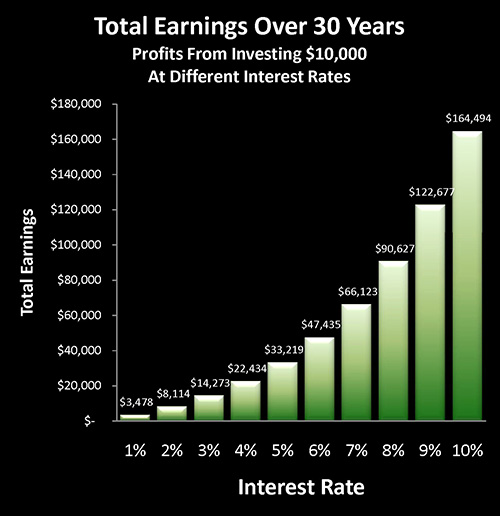

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.