Chapter 2: A 35th Iteration Of A Night & Day Cycle

That a coronavirus pandemic would emerge out of China and wreak global economic havoc starting in early 2020 was highly unpredictable.

That millions of retirement and other investors would be shocked by a recession - from one source or another - should have been entirely expected, for it was the 35th iteration in the 165 years of U.S. economic history that the National Bureau of Economic Research has studied.

Thirty five times the economic and investment sun has gone down - and while it has been for at least a somewhat different reason each time, what every sundown has shared is the numerous people who were caught completely off guard, and just don't see how any reasonable person could have seen that coming. Thirty five shocks in a row - for those who don't understand the complete normality of the cycles and the recessions.

That said, this is a really good time to keep in mind that it is a cycle, and no matter how dark the night gets, we have 165 years of history showing us we should be seeing a glorious sunrise at some point, and that 35th sunrise could be life changing in a very positive way when it comes to building financial security.

One of the most useful parts about understanding history, as we will explore in this analysis, is that it helps to reduce the surprises (understanding that history never exactly repeats itself). What history shows is that the prudent investor who is planning for a long retirement should expect to get "kicked in the gut" - hard - several times after age fifty, and over the course of their retirement.

Those kicks in the gut are the historic normality, they are not pessimism and they are not the exceptional. Based on long term averages since 1854, the average investor should be making their financial plans on the basis of spending almost a third of their retirement in times of recession. Once that need for resilience is understood as a starting expectation, then plans can be made that are not shattered by the 35th, 36th and 37th sundowns, while still fully benefiting from the sunrises and (hopefully) the many long sunny days still to come.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

The Normality Of Recessions

For most people - recessions do not seem like a normal event. Why recessions occur is not intuitive for most people, so there is little reason to expect another one anytime soon. However, what history shows us is that recessions do occur, they are entirely normal and they are common.

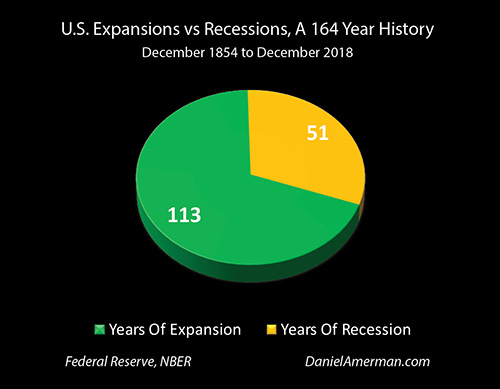

The National Bureau of Economic Research has studied the United States economy back to December of 1854, and has attempted to identify each month of economic expansion and each month of recession during that time.

As we can see in the pie chart above, which is based on their research, the NBER estimates that the United States economy has experienced 113 years of expansion between 1854 and 2018 - and 51 years of recession.

Now, 51 years is an enormous amount of time. So what 164 years of United States history shows us is that recessions are normal, and they are every bit as normal as expansions.

Yes, recessions are not quite as dominant as expansions. The long-term averages are for the nation to be in expansions about 69 percent of the time and in recessions about 31 percent of the time. So, in any given year we are more than twice as likely to be in an expansion than we are to be in a recession.

That said, let me suggest that if someone is on average likely to spend almost a third of their life in recessions - then recessions are not an aberration, they're not the unusual, they're not an uncommon event, but rather recessions are a core part of normality.

Another way of looking at this is that 164 years of history show us that retirement and long-term investors should plan on their portfolios experiencing recessions for almost a third of their retirements. This is a critical perspective, because so many people think about their retirement cash flow in terms of the income they taking in from interest payments and dividends, and the amount for which they are able to sell their assets, with an assumption that this will all be occurring within a period of steady expansion.

But if we simply look at the long-term averages, and use the example of a 20 year financial plan for someone who retires at 65 and expects to live to about age 85 - then their financial plan should arguably be able to handle six years of potentially stressed cash flows and six years of liquidating assets at potentially severely depressed prices, while still having enough money cover living expenses. How many people are prepared for that?

The Cyclical Nature Of Recessions

There is something else that is very well understood about expansions and recessions and that is that they are cyclical.

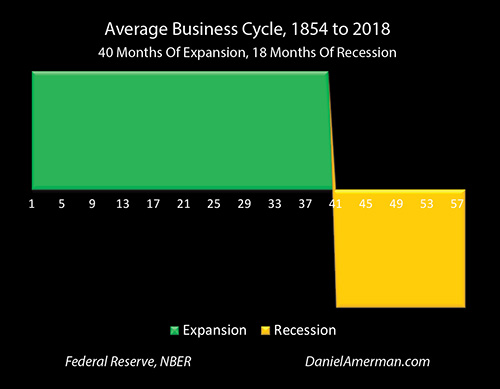

The graph above shows expansions in green and recessions in gold. As can clearly be seen, the long term norm is for the nation to cycle back and forth between the two. According to the National Bureau of Economic Research we've had 34 cycles of recessions and expansions over their 164 year study period (through 2018). This can be looked at as an average of a recession every 4.8 years.

This is also called the "business cycle." It is a highly, highly reliable cycle, the existence of the business cycle is not open for debate, and it is part of the very core of economics and economic history.

Until the pandemic shutdowns, we had a record length of time without a recession, at least according to government statistics. So, we have two components going on here. First, we have a 164-year-old cycle - that of course actually goes back much further than that in time. Recessions and expansions have been occurring for thousands of years, this is just the time period that has been studied and labeled by the National Bureau of Economic Research. Second, we had 34 previous iterations of the cycle over that time and as of the end of 2019 we had already gone twice as far as we should be going - based on long-term averages - without a recession.

Now, as can readily be seen, the pattern has changed since the end of World War II, and this is because of the critical factor of Federal Reserve interventions and attempts to change the cycle. These interventions are not the focus of this particular analysis, but will be the subject of following analyses in this series.

(Words should be able to stand the test of time, and this is particularly true if they are about cycles. I updated the prior sections to include the pandemic, and removed some language that was specific to the economic situation in later 2018. The next two sections of Chapter Two below are unchanged from what was originally published in February of 2019. Time is often not kind to words written about finance or economics, particularly after a radical change has occurred, but I'm hoping that by keeping the exact words from a quite different place in the cycles, the validity of the perspective on the cycles can be better judged.)

A Consistently Counterintuitive Cycle

Many investors are strongly of the opinion that when we look at currently still robust economic data and corporate profits, that a recession is emphatically not on the way. They are certain of this, and they are not particularly interested in having their beliefs challenged. That is fair enough, people should be free to invest their own money based on their own beliefs.

However, there are a lot of other people out there who are uncertain about what to believe, and they have some critically important personal decisions to make when it comes to their investments and the possibility of recession. These decisions could be a major determinant of what happens when it comes to their actual future financial security and standard living in retirement. Therefore, it is very important for them to have an idea whether indeed it is likely that we may be coming into a recession, or whether that possibility can be completely dismissed.

For someone who falls in that category, let me suggest a useful screening mechanism when it comes to sorting out the different arguments. As previously covered, since 1854 we've had 34 recessions in 164 years. Here's the key question: how many of the people who say that they don't see a coming recession can explain the prior 34 recessions? Do they understand the cycle at all over these previous 164 years?

The graph above is of the average length of the business cycle over 164 years of economic experience in the United States. What it shows is that over that time the average expansion was 40 months, the average recession was 18 months and the average total length for each of the cycles was 58 months, or 4.8 years.

Within each 40 month expansion that would mean that on average the middle of the expansion, the very heart of the expansion, would be occurring about 20 months after the expansion started. From the very heart of that prosperity, from the very possible best possible conditions, what history tells us is that the next recession will on average arrive in less than two years.

What 34 iterations over 164 years shows us is that 20 months is on average the midpoint of the expansion, and 20 months after the heart of that expansion is the beginning of the next recession.

What makes this really interesting, as covered in the analysis "Three Beautiful Arbitrages - Why Yield Curve Inversions Happen" (linked here) is that the bond market has been coming very close to making the call that a recession will arrive within the next 1-2 years. When the bond market has made this call in the past, it has been with a remarkable degree of accuracy. And that time period also falls into the 20 month average time interval from the heart of prosperity to the beginning of recession, that we find when looking at 164 years of history.

However, for the average person who isn't a professional investor, this may make no sense at all. How could the heart of prosperity so reliably (on average) flip into financial and economic despair in less than two years?

It just seems completely counterintuitive, but yet it is exactly what has happened - on average - 34 times in a row.

Daylight, Nighttime, And Cycles Of Risks And Opportunities

In the attempt to better understand the cycles - and potentially substantially reduce the risks and increase the rewards for many investors - let's use the analogy of a different cycle which we are all quite familiar with, and that is the daily rising and setting of the sun.

We do have that 164 year cyclical history that is repeated above, and what it shows is the sun going down 34 times - and then the sun coming up 34 times. Unlike our planetary day and night cycles the economic and investment cycle sun is up in the sky for more than twice as long as it is below the horizon, with 113 years of expansion out of the last 164 years.

As introduced in the beginning of this analysis, we have numerous economic and financial indicators that are all beginning to flash red, some of which have been shown to be highly reliable indicators that the sun is getting ready to set again. This was starting by the summer of 2018, and the warning signals grew much stronger by December of 2018.

At the same time - the current expansion in the United States still seems quite robust. We have numerous economic and financial indicators are strongly positive.

So there are numerous commentators and analysts who are using vast numbers of very convincing statistics and charts to show that there's no need to worry about recession. Worrying about a recession just doesn't make any sense from where we are in terms of this robust expansion.

For an average person -- it may seem easier to believe that the overwhelming amount of positive data means that the no recession is imminent. Or at worst, they may believe that it is a toss-up, with even chances of a recession or not.

This is particularly the case because following trend lines is a very intuitive process. There is also the consideration that if following current positive trend lines produces desirable results from an emotional perspective, then this creates a double positive for most people.

Indeed, what tends to happen in each cycle - is that a large number of investors stop believing in nighttime. There are always reams of data to support them. And the results are emotionally comforting as well.

Indeed, they can become quite aggressive in their beliefs, and sometimes label those who believe in the possibility of nighttime as pessimists, doom and gloomers, or even as ghouls or vampires.

This belief system can work pretty well - until the sun goes down, yet again. At that point what can happen to the retirement portfolios of those who are fully invested in the impossibility of nightfall, is not a pretty picture.

That brings us back to the heart of the dilemma. This exact same process of showing that the sun logically will not set could have been done 34 times in a row, and 34 times in a row - the overwhelming trend lines of robust economic and financial statistics found in the very middle of the expansion would have been broken. Thirty-four times in a row a recession would have arrived in (on average) less than two years, and the sun would have gone down.

Each time the process would have been non-intuitive, and what this means is that the average person - with a high degree of reliability - would have been wrong 34 times a row for reasons that would make no sense to them before or afterwards. If that average person had made investment decisions that were based on the easily intuitively understandable case for continued expansion, and were therefore exposed to downside risk with recessions, then they would have been blindsided by unexpected losses - sometimes severe losses - 34 times in a row.

Prudent Investing & The Pandemic

Back to 2020.

The coronavirus pandemic is being presented as a "black swan" event, something no reasonable financial advisor or financial commentator could have seen coming. In my opinion this is not even remotely true, and represents both a logical fallacy and a complete misunderstanding of history, with critical implications for prudent investors seeking genuine financial security.

First, as an illustration of "fat tail" risks, Nassim Taleb, the person who actually wrote "The Black Swan: The Impact Of The Highly Improbable" has been writing about and teaching workshops for years about the likelihood of the next pandemic and how it would almost instantly spread via airplanes around the globe, explicitly as an example of what was not a "black swan" event. A true "black swan" event is something that had existed but never been seen before, as in Europeans arriving in Australia and for the first time, seeing black swans.

Periodic pandemics are the direct opposite, they are core events that have turned societies and civilizations upside down again and again and again over the course of human history, sometimes with death rates of 50% or more for an entire city or nation. (There is also a long history of quarantines, effective shutdowns and borders closing in response.)

That the next major pandemic would almost instantly spread around the planet because of jet airplanes linking together a globalized world was always in the cards as part of the price of a globalized world economy. It could be (and was) mathematically modeled in detail in advance, and the acute exposure of the entire world if a fatal new virus were to arrive that was highly contagious but where the carriers were not necessarily symptomatic - the inherent flaw in the globalized system - was very well understood, and ultimately, the only question was when. Well, now we know.

This had also been discussed in detail as part of the SARS outbreak less than 20 years before COVID-19, and then promptly "memory holed" and ignored when that danger passed and it was no longer convenient for the short term interests of politicians or major corporations.

Indeed, besides the many novels on the subject, there is also a popular board game called "Pandemic", which I have been playing with my family since well before COVID-19. The game has pictures of a coronavirus as one of the four prime threats, and part of the underlying premise of the game is the near instant spread of pandemics into places like New York and San Francisco, via airplane travel from Asia and Europe!

With the near miss of the SARS coronavirus less than 20 years before, with books written in advance discussing the exact mathematics of how globalization radically increased the dangers from the exponential spread of pandemics, with best-selling novels on future pandemics, and with millions of people spending many hours playing a bestselling board game that includes a new coronavirus jumping around the world via airplane while devastating the world, whatever one wants to call COVID-19 - being impossible to foresee should not be the description.

The threat was always there, discussed, analyzed and in plain sight. But. it was just not financially convenient for the medical system or governments to be prepared for it. There was no financial incentive for corporations to be prepared, there were enormous financial incentives for corporations and individuals to make money by (effectively) participating in making the system ever more vulnerable and ever more fragile, and so it went (and this is true for a number of other threats besides pandemics).

Now, does this mean that a prudent retirement investor should have specifically anticipated a coronavirus pandemic coming out of Wuhan and producing a severe recession or potential depression beginning in 2020? Was I writing about that specific scenario in the earlier version of this chapter? Absolutely not, but that is where the logical fallacy comes in when it comes to genuine financial security, and addressing that fallacy was the reason why this chapter was originally written long before the actual pandemic.

Many people would argue that no reasonable person could have anticipated or been financially prepared for COVID-19. These same people would have likely previously argued the "once in a hundred years" event of the financial crisis of 2008 was also something that no reasonable person could have foreseen. Just as they would have argued that no reasonable investor could have anticipated the catastrophic collapse of the tech stock bubble in 2001.

That's an interesting pattern, isn't it? Three impossibly unlikely financial disasters, that no reasonable person could have foreseen, with all three of these "once in a lifetime" or "once in a century" bizarrely improbable events occurring in the space of a mere 20 years.

If we go back not 20 years, but 50 years, then it gets even more interesting, as I explored while doing the detailed 50 year investment analysis that is part of my "Gold Out Of The Box, 2020s Edition" research set.

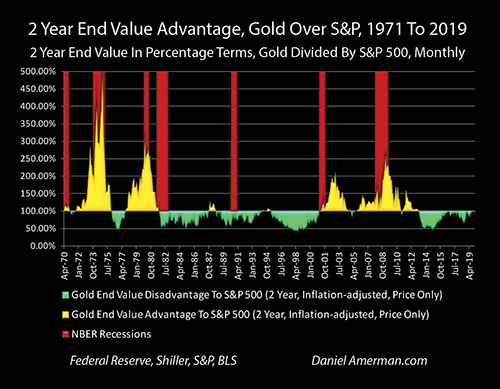

As explained in the introductory analysis (link here), the gold areas are where gold was a superior investment to stocks on a rolling two year inflation-adjusted price basis, and the green areas are where the advantage was to stocks. In the series of secular cycles that occurred over the last fifty years, the advantage was to stocks most of the time - but the advantage was to the contracyclical asset of gold more than 40% of the time.

To most people, that likely just doesn't sound right. Yet, it is actual history. When we go back to the previous 30 years in time before the year 2000, then sure enough, we have another long series of incredibly unlikely bad events. The surge in inflation, the OPEC oil embargo, a series of recessions, stagflation, and inflation and interest rates each peaking near 20% - all were complete surprises. Who could have known?

What reasonable person could have possibly seen from the vantage point of the late 1960s that the next 14 years would wipe out 65% of the value of the dollar while destroying 70% of the inflation-adjusted value of the Dow Jones Industrial Average? But yet, for a retiree in 1968 or 1970 who had built their retirement plans around stocks and the value of money repeating their performance of the 1950s and 1960s, their reality in practice would have been a series of impossible to anticipate events destroying most of their financial security and standard of living in retirement over the long term.

Gold should not outperform stocks on an inflation-adjusted price basis according to the conventional wisdom, that would make no sense. It takes a series of unexpected and bad events for that to happen, each of which would catch the experts by surprise. So, in practice, with more than 40% of the last 50 years consisting of gold prices outperforming stock prices due to a series of bad events slamming into the markets that were each so unlikely and so unexpected that supposedly no one could have reasonably anticipated them... that 40% is a really interesting number to let roll around in one's head for a bit, in terms of evaluating what is reality and what isn't when it comes to making prudent long term financial plans.

(The over 40% number is also before the pandemic, the question is what the percentage over 60 years will be when looking back in another 10 years?)

And then when we step back even further in time, as previously covered in this analysis and can be plainly seen by the frequency and width of the yellow bars, going all the way back to 1854, financial and economic history is dominated by a long series of unexpected and bad events, that no reasonable person could have foreseen from within the economic expansion that was (on average) at its peak a mere 20 months before the bizarre and inexplicable happened, yet again.

For what is now 35 times in a row, no reasonable person could have been expected to see what was on the way. And for what is now 35 times in a row, such a reasonable person would have been blind-sided by reality.

This gets us to the heart of the common logical fallacy. The idea is that if an intelligent, well educated person who follows the mainstream experts is surprised by a shocking event - then they are allowed to write themselves an "excuse note" of sorts, and then go right back to what they are doing. After all, none of the experts (or at least, those that they follow) saw it coming, it was therefore an aberration, and it can therefore be safely discounted for future decision making.

The tech stock bubble collapse of 2001, the financial crisis of 2008 and now the coronavirus pandemic of 2020 too? Just aberration, aberration, aberration, what prudent and reasonable person could have possibly expected something like that?

The completely unexpected economic stagnation, high rates of inflation and devastating investor losses (in purchasing power terms) of the 1968 to 1982 period? A quaint aberration, no relevance. The extraordinary economic and investment damage from the completely unexpected Great Depression of the 1930s? The much more lethal and completely unexpected Spanish Flu pandemic of the late 1910s? Both ancient aberrations, no relevance.

But yet, if we don't dismiss much of history as a series of aberrations because it doesn't fit with what we want to believe, and instead look what history actually shows, then a long series of completely unexpected shocks and surprises is what we see. A prudent investor seeking financial security over the long term should expect to have to withstand a series of devastating financial blows that none of the most quoted experts saw coming, it should be the baseline expectation - because the so-called aberrations are not deviations from the norm, but they are themselves the true historical norm.

From that long term perspective, as surprising as they each were to investors when they happened, the crisis of the tech stocks bubble popping, the financial crisis of 2008, and the coronavirus pandemic economic crisis of 2020 - are each instances of a core component of normality, they are not the aberrations. The specifics always differ, but the periodic domination of markets by shocking surprises that seem to come out of nowhere is a recurring theme at the very heart of financial history.

Based on long term history, someone planning to support themselves in retirement through income from their portfolio and the gradual sale of assets, should fully expect that an average of about 30% of their assumed income receipts and 30% of their asset sales will occur during unanticipated periods of financial distress, and possibly severe financial distress. That was true when the original chapter was written in 2019, and well - here we are.

The flip side to keep in mind of course, in these gloomy times, is that over the long term and on average - almost 70% of the time, the economy is in expansion and not recession. The cycle will turn again, and there will be massive price movements in the other direction.

Either way, the key term there is "average", because there is a large range, and depending on the timing and the length of the retirement, what history shows is that the periods of financial distress can be much more than just 30% of a retirement.

People who are aligned with the cycles, and buy low and sell high with one type of investment strategy in the down cycle, and then buy low and sell high with another type of investment strategy in the up cycle, can do really, really well. Those who are misaligned and do the opposite, can have very poor results.

This has always been the case. What is different this time around is that markets and the Federal Reserve are acting very differently than they did back in the 20th Century. We are no way in a traditional business cycle.

(An introduction to the cycles of crisis and containment of crisis is linked here.)

As was introduced in the previous chapter, and as we will be reviewing in the coming chapters, the Federal Reserve via massive interventions has completely changed how it responds to crises, taking unprecedented steps with interest rates and monetary creation to create cycles of the containment of crisis. This meant that coming into this crisis, interest rates were extremely low, and as a result, asset prices were highly elevated. All else being equal, a crisis of this magnitude hitting unusually elevated asset prices should be producing catastrophic losses, far worse than what has been seen in the first months (though that could change).

What is keeping that from happening, even in the face of stunningly bad news coming out on a weekly basis - is a fantastic degree of monetary creation funding a fantastic degree of spending by the Federal Reserve and a fantastic degree of spending by the United States government.

Without this fantastic rate of monetary creation, the economy collapses into a likely a far deeper depression than it may already be in anyway. Without a fantastic degree of monetary creation - there is no money for the taxpayer checks, or the higher unemployment payments, or small business payments, or the corporate bailouts. Keep in mind that the federal government doesn’t have any of that money to spend, the government is broke and extraordinary in debt. Every dollar of the money is (effectively) coming from the Federal Reserve creating the money and buying the debt that funds the U.S government deficit spending.

Without a fantastic degree of monetary creation there would likely be a stock market collapse and corporate bond market collapse that dwarfs what has been seen to date. These collapses would trigger collapses in the value of state and local pension funds, which in combination with radically lower tax collections and higher spending, would likely trigger bankruptcies for many states and cities, including Illinois and California (and may still do so).

Quite literally the standards of living of most of the people reading this could be changed for a decade or more, possibly for the rest of their lives, if this fantastic degree of monetary creation being used to fund unprecedented market and economic interventions fails.

Another way of phrasing is that the difference between financial ruination for many millions of investors, and potentially higher asset prices than ever at some point - is a process that very few people understand, which is the domination of stock, bond, real estate and gold prices by Federal Reserve interventions and monetary creation. The old days are long gone, and it is getting increasingly difficult for anyone to pretend at this point that a free market is setting prices completely independent of what the Fed does.

Fortunately, there is a book on this, it is free (at least for now), and you are reading the revised second chapter of it. It will likely take some months for the chapters that were written before the pandemic to be updated, and subscribers will be receiving the revised chapters as they are released.

However, unlike many pre-pandemic financial books written in 2018 and 2019 - the existing book is in no way obsolete. Yes, the reason this 2nd chapter was originally written in early 2019, almost ten years into an economic expansion, was to make clear to readers right at the very beginning of the book that the historical norm was for the cycle to turn, regardless of how good the situation might look at the time, that history showed that most people would not be able to see it coming with the information they had at the time, and that the average over the previous 34 iterations was that this could happen quite quickly.

Well, for a 35th time, it did happen, and everyone was again caught off guard, albeit with the specifics varying each time and taking a particularly bad form in this case. The pandemic is not a one-off event that is behind us, but is still developing and we are still in the very early stages of the new cycle. As always - the next developments in the cycles and most of the Fed's new attempts at a third round of the containment of crisis are still ahead of us, and the market effects of these coming interventions may still dominate stock, bond, real estate and gold prices for many years to come.

Learn more about the free book.

********************************************

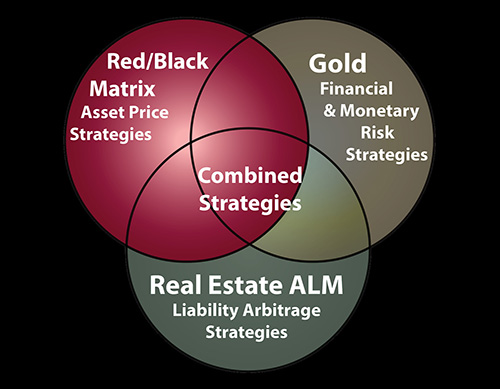

This analysis relates to the Red/Black Matrix group of asset price strategies, which are introduced in the free book, and which are explored in depth in the "Investment Strategies For Cycles of Crisis & The Containment Of Crisis" DVD set (brochure link here).

The Red/Black Matrix strategies are one of the three categories of solutions found in the Triple Strategies solutions sets. More information on all three of the Triple Strategies is available here.