The Critical Risk Of Simultaneous Inflation & Deflation

By Daniel R. Amerman, CFA

TweetThe United States is currently experiencing the highest rates of price inflation that it has seen in 13 years. Some market commentators believe that we face a future of fast rising rates of inflation. Others believe that the inflation will be transitory, and will be followed by sustained deflation.

When we look to history for answers about whether it will be inflation or deflation, then one very strong possible alternative is to say - that is the wrong question. To say that it is inflation versus deflation is simple to understand, but it is also quite oversimplified. From an investment perspective one could even say that the whole inflation versus deflation debate is dangerously oversimplified.

We have seen the combination of elevated asset prices and rising price levels many times before, in different nations and asset categories. The consistent historical answer is that asset prices can move quite differently from the price of money. This means that we can simultaneously have both asset deflation and price inflation. It is a historically normal result, and there is a very good argument for it in the current circumstances.

Indeed, to not be able to see the two together, with asset values moving separately from the price of money, is like trying to invest with only one eye open, unable to see half of what is happening.

In this analysis we will look at the current situation, and then examine a historical case study in how a 70% loss in stock values, a 70% asset deflation, was covered over by high levels of price inflation. A catastrophic destruction in the value of stocks was covered over by a catastrophic destruction in the value of money, and to this day the average long term investor has no idea this happened - because they are only looking with one eye open. This means that many have no protection for the 2020s and 2030s, as they are not even aware that the risk exists.

We will then take a look at the impact on sequence of returns risks for investors seeking inflation shields, and show how separating asset inflation and deflation from price inflation and deflation can have life changing implications for gold investors. We will also briefly consider the very direct and even controlling implications for real estate investment.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Rising Inflation

According to the Bureau of Labor Statistics, the year on year rate of inflation (CPI-U) between May of 2020 and May of 2021 was 5%, the highest one year increase seen since August of 2008.

As explored in much more detail in the analysis linked here, the recent high rates of inflation do not result from money creation in isolation, but rather from supply side shocks, shortages and kinks in the global supply chain caused primarily by the shutdowns associated with the pandemic. The next step is that a combination of money creation sustaining purchasing power for the nation even while physical shortages induce scarcity could be called a prescription for inflation, as too many dollars chase too few goods - and that is exactly what we are seeing in multiple categories.

As reviewed in that prior analysis, some of the notable contributors to the national average increase included a 49.6% annual increase in the cost of gasoline, a 10.6% annual increase in the cost of imported goods, a 21% increase in the cost of used vehicles, and a 12.9% increase in the price of single family homes.

It is also worth noting that if we look at just raw prices, what people pay in unadjusted terms, then the government reports that general price levels rose a further 0.8% in May of 2021 alone, which is an annualized rate of just over 10%. This is over and above the already elevated price levels that were seen in April, with a single month seasonally adjusted 0.8% increase in prices over March. In other words - we just saw back to back double digit price increases (in annualized terms) for two months in a row, for the first time in a very long time.

Now, it is true that 10% annualized increases are just barely double digits - but that is also based on the acceptance of government CPI figures as being entirely accurate. Most people seem to experience increases in their personal price levels on an annual basis that are in excess of what the government reports. And if the government itself is admitting to consecutive (annualized) double digit increases - what is the actual increase in cost of living for much of the nation?

This issue is compounded by the difficulty that the Bureau of Labor Statistics had in gathering price data during the pandemic, meaning that the methodology of how inflation was calculated was necessarily different, to a degree that is difficult for outsiders to establish. When what hard numbers there were were replaced by increased guesswork, the government maintained its usual motivation to pick a methodology that understates inflation (and thereby reduce the cost of future Social Security payouts).

Elevated Asset Prices

As explored in detail in the free book, this rising inflation is occurring during a time when Federal Reserve policies have created record low interest rates.

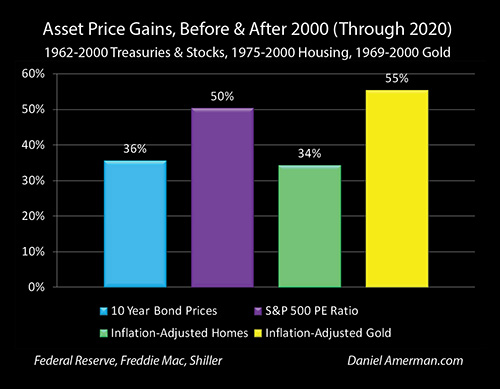

The graph above is from Chapter One (link here), and as explored therein, these very low and artificial interest rates have led to record or near record asset prices across all the major asset categories, including stocks, bonds, and housing. This is true even in inflation-adjusted terms. (Gold is also at near record levels for different but related reasons.)

All else being equal, asset prices tend to move in cycles, and historic highs tend to eventually experience major price corrections, with those corrections being particularly likely during times of economic turmoil.

There would therefore seem to be a strong chance for asset deflation during the 2020s. At the same time, we have fast rising price inflation, and some strong reasons to believe that this inflation will continue to grow over the 2020s, particularly when we have a record high national debt where much of the growth of that debt is being financed with money creation by the Federal Reserve.

If we restrict the debate to inflation versus deflation, then we would seem to have a battle of titans in store for us. Either the value of our assets will be destroyed, OR the value of our money will be destroyed.

This is a false and dangerous dichotomy. It implies that if it is deflation, then the value of our money will be preserved. It implies that if it is inflation, then the value of our assets will be preserved. Neither degree of protection actually exists.

How Inflation Hid A 70% Market Loss: 1968-1982

To see through the false dichotomy of the inflation versus deflation debate, we need to return to a time of elevated asset prices, even as price inflation pressures were increasing rapidly.

As shown in the yellow/orange, the Dow Jones Industrial Average reached 919 in May of 1968, and by August of 1982, had fallen to a level of 777, for a loss of 15%.

Many investors recall this "Lost Decade" for the stock market when the market stayed flat to somewhat down - moving sideways but never persistently up, and what is seen in yellow is consistent with that market perception. It also looks obvious that this overall flat market with a great deal of volatility would have generated some really good opportunities for astute market timers.

However, reality is that a 15% loss in a long-term sideways market isn't what happened at all, not when we look at what a dollar would buy. That is, in 1982 the US dollar was only worth 35 cents compared to what it would have bought in 1968, because the dollar had lost 65% of its value to inflation.

As shown in blue in the graph, when we adjust the August, 1982 Dow index of 777 to account for a dollar being worth 35 cents, then the real value of the Dow drops to 274. So when we consider the purchasing power of the dollar, then our stock portfolio wasn't flat, not even remotely close. Instead, it had dropped by a staggering 70% in fourteen years, from 919 to 274.

Now while this 70% decline in the value of what our assets would buy for us was entirely real, to this day many of us don't realize just how bad it was. That is because inflation in prices was hiding deflation in investment values. The 65% plunge in the value of the dollar "hid" the 70% plunge in the value of stocks, with most of the surface value of the Dow index by 1982 consisting of dollars that were worth far less than what they had been before.

Three False Peaks & Inflation Hiding Deflation

Even though long-term asset deflation of 70% (in real terms) was the result of persistent high unemployment coupled with inflation, many investors and newspaper readers of a certain age may not remember the 1970s that way at all. Instead they may recall three powerful bull markets when the Dow repeatedly flirted with the "magical" 1,000 mark. Each surge filled innumerable financial columns with the hopes that the good times and a long term bull market had returned again, with those hopes being quickly dashed as the market repeatedly proved unable to sustain itself above the 1,000 level.

Perceptions don't change reality, however, which is that there never were three bull markets, but rather only an inflationary illusion fooling the public. Indeed when we look closely, instead of seeing three peaks, we will see three historical object lessons in how destroying the value of money can hide the destruction of the value of assets - and repeatedly fool the headline writers along with much of the investing public.

The cold reality of the Dow adjusted for inflation is shown in blue. There aren't three interim peaks, but merely a market moving steadily and powerfully down.

The "bull market" that peaked in January of 1973 when the Dow hit 1,047 - was in reality a fall to Dow 848 (asset deflation in inflation-adjusted terms), that was masked by the dollar being worth only 81 cents when compared to May of 1968 (price inflation). Inflation had created an almost 200 point illusion in the Dow.

The "bull market" that peaked in September of 1976 at 1,014, really represented the Dow falling by over 300 points - translating to asset deflation of 34% - which was hidden from savers by the illusory profit created as a result of the dollar dropping in value by 40% (price inflation).

The cruelest illusion of all was the "bull market" of April of 1981, when the Dow finally reached 1,024. Because the real value of the market had fallen to 399, and a 57% destruction of the purchasing power of investor assets was being entirely hidden by the 61% destruction of the value of investor dollars.

Fully understanding this relationship of simultaneous price inflation and asset deflation is absolutely essential for financial survival, because there is a reasonable chance that we may all be seeing the greatest "bull market" in stocks that we have ever seen in the 2020s - but it won't necessarily work the way investors today think it will.

Three Wealth Destroyers vs "Perfect Timing"

In my opinion, the greatest threat to long-term and retirement investors is the wealth-destroying triple combination of price inflation, asset deflation, and inflation taxes.

One of the most common investor approaches to a truly difficult market is to attempt to "outrun" the problems. Just make better decisions than the rest of the public, and make so much money that the problems can be overcome and wealth kept intact.

How well does that work in practice and just how good do you (or your financial advisor) have to be?

To answer that question, we will go back in history and assume that through the use of a time machine (or peerless skill, or uncanny luck) we did a perfect job of long-term market timing during an environment of asset deflation and monetary inflation.

Aided by this time machine, we put every dollar we had into the market on May 26, 1970, when the Dow closed at 631. What makes this day remarkable is that 631 is the lowest level the Dow index closed at between November 20, 1962 and September 12, 1974. It was the single cheapest day to buy stocks over an almost 12 year time period, and at the time, the lowest that stock prices had been at in more than 7 years. Perfection.

Subject to the conditions that 1) as long-term investors we need to be in the market for ten or more years, and 2) that we want to stay within the 1968 - 1982 period of sustained asset deflation and high price inflation, we instruct our time machine to find the best possible place to sell. This turns out to be April 27, 1981, when the Dow closed at 1,024.

April 27, 1981 was the single highest close for the Dow index between January 22, 1973 and October 19th, 1982. So we buy in on the exact day with the lowest stock prices in an almost 12 year period, and we sell everything out on the exact day with the highest prices over an almost a ten year period. Double perfection!

So then, how did we do? If our returns had exactly tracked the Dow between when we bought and sold, our perfect timing would have taken us from 631 to 1024, for a 62% price gain in the midst of one of the worst markets in memory.

A whopping profit indeed! Before we adjust for inflation, that is, so let's do that. A dollar on our sale date in April of 1981 was only worth 43 cents compared to what it was worth on our purchase date in 1970. When we adjust for what our assets will buy for us - we have Dow 440, not Dow 1024. So even the absolutely perfect timing delivered by our time machine leads to a 30% asset deflation loss in real terms, not a 62% gain.

The Internal Revenue Service did not "see" these losses, however. To the contrary, it was quite impressed by our remarkable investment prowess. Moreover, taxes were higher back then. Assuming that we were in the highest income tax bracket, and traded often enough to pay ordinary income tax rates, then given that the average top income tax rate over that period was 68%, this means that we would have paid out 267 in taxes on our 393 gain.

These taxes on effectively non-existent income are known to economists as "inflation taxes", and they can be devastating.

Subtracting out real taxes on imaginary income leaves us with Dow 757 in after-tax terms, and Dow 325 in after-inflation and after-tax terms. Thus, even with our quite unrealistic assumption of absolutely perfect market timing - which allowed us to radically outperform almost every other investor in the nation - we still lost almost half (48%) of the purchasing power of our net worth.

Sequence Of Returns Risks

The issue with trying to make real (inflation-adjusted) money by trading stocks during the 1968 to 1982 era was that it was fighting the tide, fighting a secular cycle in the stock market. Whatever the long term averages may be, when stocks are in a secular bear cycle in inflation-adjusted terms, then brilliance and even near perfection are just not enough.

This is a particular risk for retirees, especially for those in the very early stages of retirement as well as those in the final years before retirement. Asset deflation is a destruction of wealth. Price inflation is a separate destruction of wealth. If we put the two together, and say that it must be inflation or deflation, then implicitly, inflation protects us from inflation, or deflation protects us from inflation. Both forms of "protection" are false, we have a very long history of asset deflation coexisting with price inflation, with both wealth destroyers operating at the same time - in a hidden manner that the general public simply doesn't understand.

As a round number example, the Dow could hit 40,000, seeming to produce widespread wealth - but if the dollar is worth 50 cents at that time, the reality would be massive losses on a national basis for spending power in retirement, with the real value of the Dow falling to 20,000. The Dow could hit 60,000, but if the dollar is worth 25 cents by that point, then the purchasing power of the Dow would be 15,000, as investors are crippled by the 1-2 punch of asset deflation and price inflation, even while potentially owing major capital gains taxes on their illusory profits. Those scenarios aren't some sort of doomsday fantasies, but rather they are the stuff of history during the lifetimes of many of the readers of this analysis.

Put the two wealth destroyers of asset deflation and price inflation together in a long term cycle, and the combination can be a recipe for the destruction of financial security in retirement - and this is true whether or not those at risk understand the true sources of their diminished security or standard of living.

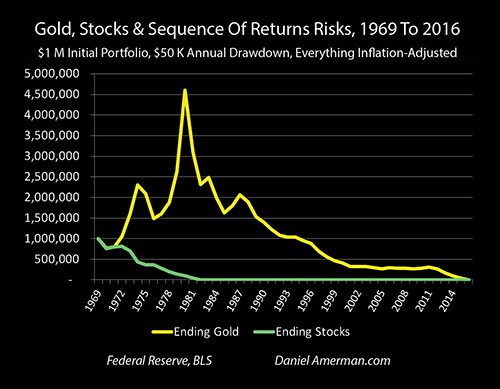

A relevant perspective on the risk of secular cycles in inflation-adjusted terms can be seen in the graph above from Chapter Twenty of the free book (link here). As explored in the book, what the historical data shows is that entering retirement while being in the wrong asset for the secular cycle can create a vicious circle. When someone is spending down assets to maintain a constant inflation-adjusted standard of living, then the early liquidation of ever larger amounts of assets than expected - because inflation-adjusted asset prices are lower than expected - can make recovery almost impossible. Indeed, what history shows is that tens of millions of current and future Boomer retirees in particular have a potentially acute risk exposure to a secular cycle of simultaneous asset deflation and price inflation, even if on the surface the stock indexes were to continue climbing over the next 10-20 years.

Conversely, for those in the correct asset class for the secular cycle, such as gold in the historical example above, then a virtuous circle can be created by sequence of returns risks, with lesser early liquidations of assets at higher real prices. With a virtuous circle, retirement investing in gold during a time of high inflation could be called a multi-decade walk in the park, with a planned 20 year retirement stretching out to a very comfortable almost 50 years of retirement, even with zero trading or even opening the financial pages of the newspaper (or websites).

Housing Prices

Understanding simultaneous asset deflation (or inflation) and price inflation could be called the cornerstone principle underlying housing investment as well, even if relatively few homeowners or investors fully understand how this works.

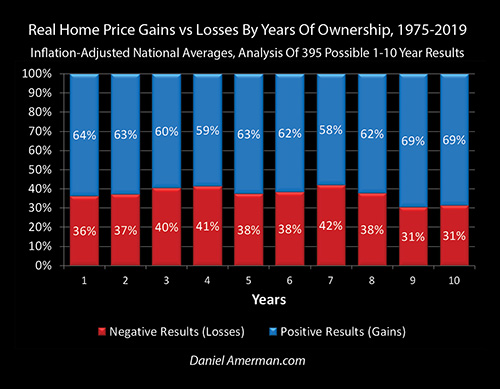

As shown in the graph from Book 2 of the Homeowner Wealth Formula series (link here), what a detailed examination of almost 50 years of inflation-adjusted national average home prices shows us is that homeowners and investors can expect to experience simultaneous asset deflation and price inflation about 40% of the time for properties held 3-8 years, and about 30% of the time for properties held 10 years.

History also shows that home investment with a mortgage can be the single best way to profit from price inflation, even during cycles of asset deflation. But to see how this can be true - investors and homeowners need to be able to see with both eyes wide open. We need to be able to see both the deflation and the inflation, and how to flip two wealth destroyers into a potent wealth building formula. Hopefully this analysis has been helpful in seeing how using both eyes can produce very different perspectives than the overly simplified inflation versus deflation debate.

Learn more about the free book.

********************************************

Properly understanding the relationship between 1) asset inflation and deflation; 2) price inflation and deflation; and 3) asset liability management when a home is purchased with a mortgage is not something that can be done in a single analysis. Indeed, it takes not just a book but two books, with Book #1 (link here) being devoted to understanding the wealth formula that is created by the combination of price inflation and asset liability management, while Book #2 provides the critically needed information for incorporating asset inflation and deflation.

These three factors are likely to be the primary determinants of income property investment returns for the 2020s and beyond, even as they have been in previous decades. The "Homeowner Wealth Formula For Investors" workshop that will be presented on September 18th & 19th (brochure link here), will be a master class in how to not only understand but to take advantage of the potential intersections between 1) the money creation driven and supply driven sources of inflation over the coming years; and 2) housing asset deflation and inflation; when 3) the property has been purchased with a mortgage.

For those who are interested in learning more but not in attending the workshop, alternative financial education resources for distance learning include the books, DVD courses, and online video courses linked here.