Fed Difficulties In Funding National Debt Grow Worse

By Daniel R. Amerman, CFA

TweetThe Federal Reserve says that it is likely to Taper soon, reducing and eventually eliminating the $120 billion a month that it is currently using to fund the growth in the national debt while supporting home prices through mortgage security purchases. The stated reason is to keep the economy from overheating.

When we move beyond the press releases and dig into the underlying financials, a quite different reason for Tapering emerges. The Fed has been borrowing the money to fund the national debt, it is running into problems with its sources of money, it has not yet found stable funding for $1.2 trillion out of the $5.3 trillion of the national debt it has already purchased, and its funding problems become more problematic with each month of borrowing another $120 billion. The easiest solution? Stop borrowing another $120 billion per month.

The question is what then happens to interest rates, the economy, the markets and the funding for the national debt if the Fed withdraws the easy money and its financial support?

As explored in this analysis, limits to the Fed's seemingly endless creation of money have been appearing over the last six months. This presents the Fed - and the investors of the world - with a potentially existential danger, as the Fed could lose its ability to prop the markets up, even while it also has the least financial capability to contain any resulting financial or monetary crises that it has had since 2008. This could all occur before the 2022 U.S. elections, and could indeed become the dominant factor in those elections.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Magical Beliefs

We will be going through this analysis with much more detail and a lot more information at the September workshop, but for those who are unable to attend, this analysis in combination with the four other analyses from this year that are linked below should provide at least a good introduction to these extraordinary and troubling developments.

We live in a world that could be called magical from the perspective of the average voter or investor. The stability of the financial markets, including the stock, bond and real estate markets are all effectively dependent on the Federal Reserve being able to continually come up with over a hundred billion dollars per month in new money to fund the national debt and the mortgage markets, as well as the ability to come up with an extra trillion or more dollars in any given month if needed to stabilize the markets.

The United States government has effectively addicted the nation and the economy to a steady feed of fantastic sums of money that the government doesn't actually have available to spend. The funding for the monthly child tax credit payments, the enhanced unemployment checks and much of the massive "infrastructure" bill are all dependent on running by far the largest deficits in U.S. history, with the Federal Reserve coming up which much of the money, each and every month.

Throughout all of our lifetimes, this was never the case until a new form of money creation, reserves-based money creation by the Federal Reserve, was introduced in the depths of the 2008 crisis. And now, what no serious voter or investor would have believed before 2008 has become the norm, the new default. They believe in magic - the ability of the Federal Reserve to provide endless funding for the spending of the U.S. government, and for the Fed to keep the markets stabilized and insulated from risk, with the highest valuations for stocks, bonds and real estate in history.

What makes these beliefs "magical" is that average voter and investor has no idea where the new money is coming from, or what limits might exist. People who used to understand that free markets have risk, or that the government has limits on what it can spend, have now spent more than a decade learning to suspend those beliefs. The apparent thinking is that the magic, whatever its source, has worked so far, so obviously the experts at the government can keep doing this forever... can't they?

The Limitations Of Borrowing

As explored in the analysis "Counterfeiters, Con Men, Mass Illusions & Funding The National Debt" linked here, there is no magic, but rather the truth is much more mundane. The Federal Reserve gets the money by borrowing the money. That's what banks do, even central banks, is that they borrow money to lend money. When the Fed needs the money to lend to the federal government to finance the trillions in deficit spending, the Fed has to borrow the trillions of dollars from someone else to do so.

So who does the Federal Reserve borrow the money from? Interesting question isn't it?

Something fascinating about the coverage of events since 2008 is that "everyone" - as in the Federal Reserve, Wall Street, the U.S. government and the financial media - frequently talks about the Fed spending trillions upon trillions of dollars, but almost no one ever talks about the Fed needing to borrow the money in order to spend it. Oh, if you know what to look for, the borrowing has always been there in plain sight.

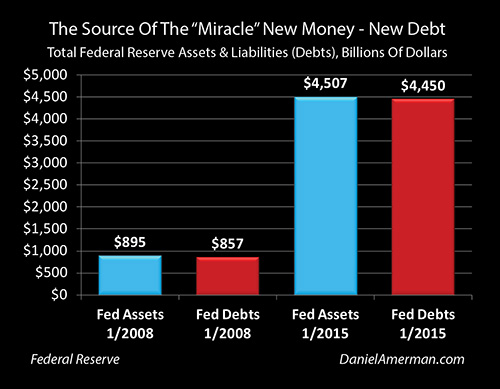

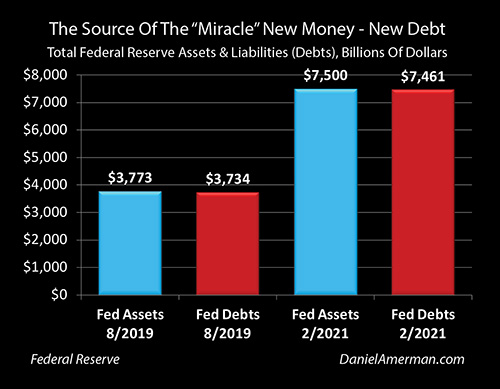

As shown in the graph above, the Federal Reserve's assets grew by about $3.6 trillion between 2008 and 2015, and the Fed financed those trillions in unprecedented "quantitative easings" by borrowing an additional $3.6 trillion. In other words, the Fed got $3.6 trillion more to spend simply by borrowing $3.6 trillion.

And when Federal Reserve threw an emergency $3.7 trillion dollars at the Federal government and U.S. economy between August of 2019 and February of 2021, it got that money by.... borrowing another $3.7 trillion. No fantastic array of printing presses, no pixie dust or magic wands, the Fed simply took on an additional $3.7 trillion in debt.

So simple. So boring. So not magic.

After researching and analyzing how this works for many years, I have come to believe that there are really good reasons that the insiders - the financial establishment - just never seem to talk about where all the trillions of dollars are actually coming from. The issue is that if the average voter or investor understands that this is all simply borrowed money instead of magical mystery money endlessly raining down from the heavens, then a very obvious series of quite practical questions begin to present themselves.

Who lent the Federal Reserve all this money?

Who really paid for the all the stimulus checks? Who is really paying for the monthly child credit checks, the enhanced unemployment checks, the pension bailouts and the college debt forgiveness?

How much more money can the Fed borrow? What's the limit, and what happens after the limit is reached?

If the Federal government can't repay the Federal Reserve, and therefore the Fed can't repay its lenders (except through inflation) - who are the suckers who ultimately get stuck with the trillions in losses? (As the saying goes: "three guesses, and the first two don't count".)

What happens to funding the national debt and unlimited government spending if the Fed runs out of suckers to lend it money at negative real (inflation-adjusted) interest rates?

What happens to the financial markets if the Federal Reserve runs out of the financial firepower to force interest rates that are below the rate of inflation, or to come up with a quick couple trillion to contain a crisis?

Unstable Funding & Wild Gyrations

The biggest difference between borrowing money versus magical mystery money endlessly raining down from the heavens is that there are limits when it comes to borrowing money. There are not infinite trillions of dollars available (except through inflation). If the Fed approaches its limits - then the whole financial world may be getting ready for a change, perhaps the biggest change of our lifetimes.

Of course, the Federal Reserve never talks in those terms. Oh, it knows in precise detail where it gets its money, it knows it has limits, but it does like to talk a game for the public as if it were more or less omnipotent, able to create as many trillions as it likes and all without triggering high rates of inflation.

So, when we understand the Fed does in practice have limits, are there things we can watch to see if the Fed might be approaching its limits, with potential market and life changing results?

As a matter of fact, there are, and they have grown stronger since the May workshop. As reviewed, there are Four Core sources of borrowing for the Federal Reserve, with the largest and steadiest being reserves-based money creation. This drives the lion's share of the funding of the national debt, and as we reviewed in May, the percentage of capacity measures having been getting larger each month, getting still more surreal when it comes to what has been taken from all of us. Based on its actions, the Fed is now apparently either not willing or not able to throw an extra trillion or half trillion on top of its current borrowing from that source, over and above its steady monthly $120 billion purchases of Treasuries and mortgage-backed securities.

Instead, the Federal Reserve was making unprecedented use of another of the Core Four sources of money this past year.

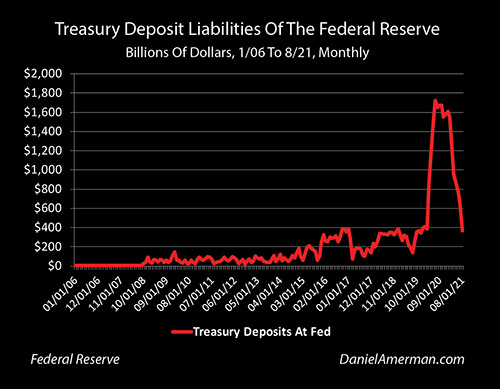

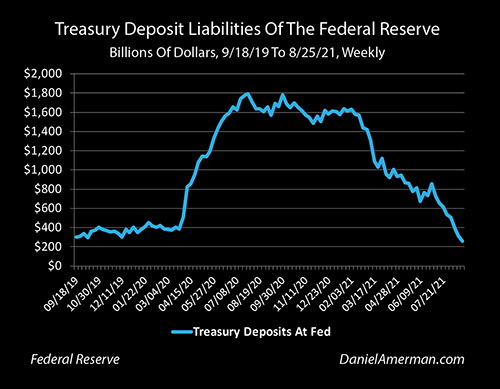

As reviewed in the previously linked “Counterfeiters, Con Men, Mass Illusions & Funding The National Debt” analysis, when the Treasury borrows more money than it is currently spending, it deposits the overage at its account at the Federal Reserve. The Fed then takes that money - and uses it buy Treasury securities.

It's a clever trick, but it's also a short term trick and somewhat risky. Yes, the Fed used $1.6 trillion of the government's own money to fund the national debt, but the government borrowed the money to spend it, and when the government actually spends the money - the Fed has to come up with the cash, that day. We can't have those stimmy checks bouncing, now can we?

As stressed in the April analysis, that part of the national debt had not yet really been funded. As can be seen above, the Treasury did spend the money down this past spring and summer, over a trillion dollars worth. And as it turns out and is still in process, the Fed dealt with the wild $1+ trillion gyration in one of Core Four sources, by creating a different wild $1+ trillion gyration in another of its Core Four sources of borrowing.

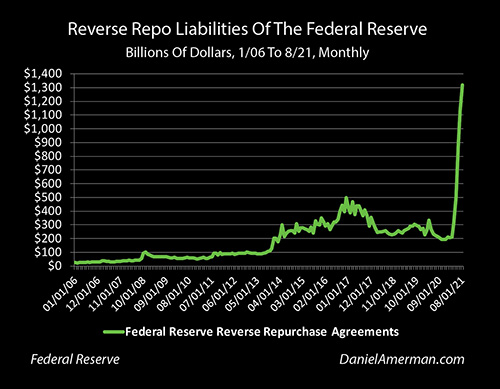

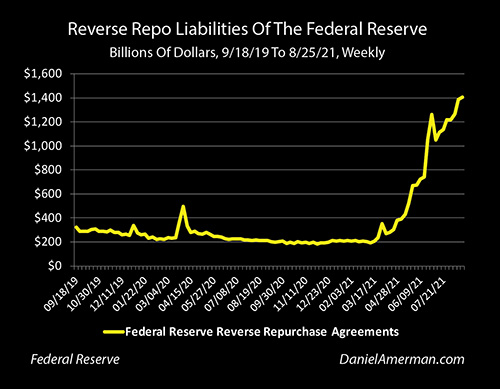

As reviewed in the analysis "The Fed Pawns A Trillion Dollars Of The National Debt To Raise Cash" linked here, the Fed has another trick up its sleeve when it comes to borrowing money to buy Treasuries - the Fed can take the Treasuries it buys, use them as collateral for more loans - i.e. "pawn" them - and then use the money from the pawned Treasuries to fund still more of the national debt. This using Treasuries as the collateral to buy still more Treasuries is more technically known as entering into reverse repurchase agreements, as shown in the graph above.

At the May workshop, when we talked about what could happen when borrowing limits were approached, I explained that the Federal Reserve in theory had an emergency "big gun" it could turn to in case it needed a trillion or trillions in a hurry, and that was to pledge its Treasury securities as collateral, and use them to borrow via reverse repos. As I further explained the Fed hadn't been doing this for very good reasons - but if they ever did so on a major scale and fast - then look out - because the Fed was likely in trouble and using emergency measures to stay funded.

So when you see that massive green spike upwards, yes, it is unprecedented, and it is also the Fed using its emergency "big gun" for borrowing, that it had previously been holding in reserve.

The relationship between the wild gyrations of two of the Core Four sources of borrowing power can also be seen on a weekly basis in the graphs below.

When the Treasury spent down its General Account balance at the Federal Reserve by about $1.2 trillion between the weeks of 3/3/21 and 8/25/21, that meant the Fed had to scramble to quickly come up with the cash to repay $1.2 trillion in borrowing, even while somehow keeping the funding for the $1.2 trillion in Treasuries that it had bought with that borrowed money. The Fed was straining with the extraordinary effort of having already borrowed an historically unprecedented $3.3 trillion in the previous 12 months, it then lost and had to replace $1.2 trillion of that borrowing power, even while it struggled to fund a steady $120 billion a month in new purchases of Treasuries and mortgage-backed securities. The Federal Reserve was truly in a $1+ trillion bind.

So out came the emergency big gun of pawning the national debt, and the Fed increased its reverse repo borrowing by about $1.2 trillion between those same weeks of 3/3/21 and 8/25/21, borrowing on a scale that was without historical precedent even while exactly replacing the money that had been borrowed from the Treasury.

Attempting To Get Off The High Wire

Even if almost no one was aware of it as it was happening, one of the most amazing high wire balancing acts in all of financial history was pulled off between March and August. The scale of the dollars involved was staggering. And the problem has not gone away, but rather quite the reverse.

The Federal Reserve is struggling with funding its ownership of the national debt. It already owes about $8.3 trillion, with most of that debt being payable overnight on demand. The money is mostly locked up in long term Treasury and mortgage-backed securities, that can't be sold on a large scale without melting down the stock, bond and real estate markets even while sending interest rates spiking upwards.

The Fed hasn't found a long term home for the $1.2 trillion in borrowing that it is currently doing via the repo market. And it still has to come up with yet another $120 billion every month to fund the continuing growth in the national debt while supporting real estate prices via its purchases of mortgage-backed securities.

As the situation grows worse by the month, there is one obvious way of attempting to reduce the risks. Stop borrowing another $120 billion in new money every month.

By interesting coincidence (???), it was right in the March to August time frame that the talk of the "Taper" increased, the reduction and eventual elimination of the $120 billion in new purchases of Treasuries and mortgage securities. The likely timing of the Taper was also coming forward in time, and it now looks like there is quite a good chance that the Fed will begin reducing its purchasing - and thereby reducing its need to borrow more money - by this fall or early winter.

Of course, the Federal Reserve isn't admitting to any funding difficulties. Instead, the Fed seems to be at least implicitly encouraging the mass illusion/delusion of "magical mystery money endlessly raining down from the heavens". Implicitly - and with the full support of the administration, Wall Street and the financial media - there is no limit to the money that can be created, all without fear of creating of inflation, because they are the ultimate geniuses, the greatest in the history of economics.

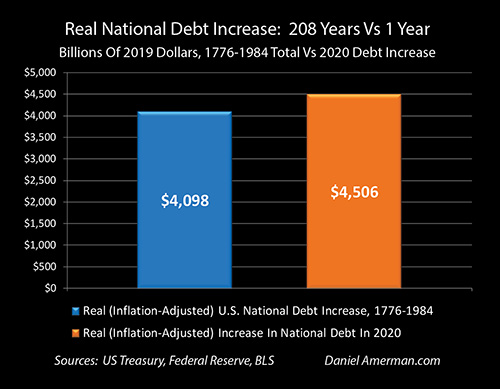

As explored in the analysis "Two Centuries Of National Debt In One Year" linked here, the United States government borrowed more money in 2020 than it did in its first two centuries in existence, and the Federal Reserve provided a little more than half of that money. The government and mainstream media do not want us thinking about the extraordinary efforts that it took to pull that off, but would rather have us believe things like "the experts say there is nothing to worry about, they know what they are doing", or "easy peasy, geniuses at work", or even "fact checkers confirm that the financial system is perfectly safe and the U.S. government is financially sound".

However, as we will be reviewing in detail at the September workshop, we are indeed currently on a high wire, with the highest stakes of our lifetimes, and getting off the high wire is much riskier for mere mortals than it might look. There are multiple systemic risks that have been suppressed by the Federal Reserve borrowing so many trillions of dollars to pump into the system. In the act of borrowing and stripping financial safety from the system to suppress surface risks over the last 13 years - the Fed has created more real risks, more underlying pressure, than we have ever seen before, far more than what was unleashed in 2008.

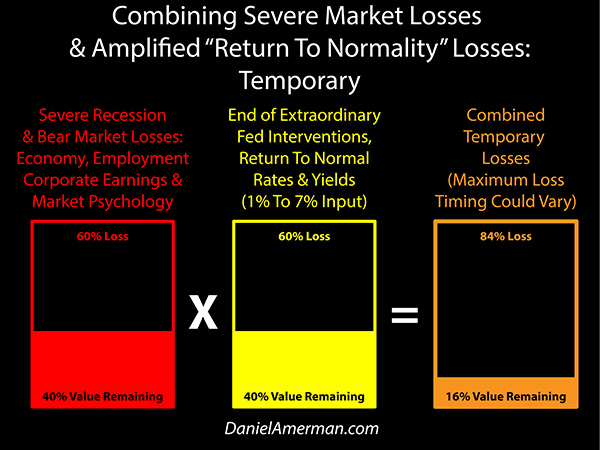

A premature Taper in response to funding risks brings multiple sources of financial market and monetary risks to the surface. These rising risks may occur even as the career bureaucrats at the Federal Reserve find themselves in their weakest position to deal with a financial crisis since 2008, as a result of their mistakes in creating an overextended debt position for the Fed.

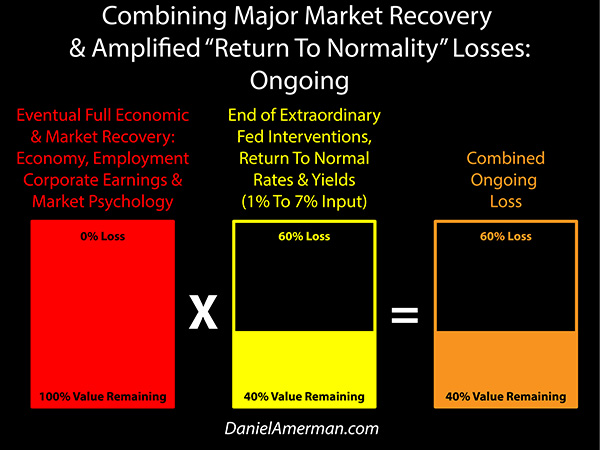

For an overview of some of the risks to asset prices for stocks, bond and real estate if the Fed loses its control over interest rates due to borrowing difficulties, Chapter 12 of my free book is worth reviewing, it is linked here. The losses would not only potentially be the biggest of our lifetimes, but they wouldn't all be cyclical - there would be no reason for retirees and retirement investors to ever expect to fully recoup their losses in inflation-adjusted terms.

What is new about the last six months is that we are seeing what could be limits, when it comes to the seeming endless magical stream of new money that the economy, financial markets and U.S. government have all come to depend on. The fantastic $4.5 trillion dollars in new debt that the Federal Reserve has taken on over the last two years is causing borrowing strains that we never saw with the much smaller series of quantitative easings / borrowings over the last decade and more.

Now, limits are a different thing for a central bank than a corporation or individual. Could the Federal Reserve come up with another trillion dollars next week if it really had to? Sure, almost certainly. But the issue is that the easy sources of borrowing have been effectively depleted, we are well past that stage, and there are increasingly high costs and difficult choices when it comes to health and safety of the financial system as the Fed rapidly drains still more money out of its Core Four sources. Relying on overnight reverse repos for the ongoing funding of long term government debts is the most dangerous borrowing source of all, as it makes it much more difficult for the Fed to contain any potential future liquidity, monetary or financial markets crisis. But yet - that is where we currently are.

While there are no guarantees on the timing, limits can bring ends, particularly if politicians keep the fantastic growth in government spending going - and at this point it looks like they will. Because the combination of Tapering and raising market risks while simultaneously having a strained borrowing capacity is inherently risky, the enhanced risks could begin with the start of the Taper. This means that the end of our current investment price levels and monetary order may be in sight, and it could reasonably arrive before the 2022 U.S. elections, with an even greater likelihood before the 2024 elections, perhaps becoming the dominant feature of one or both elections.

Hidden beneath the mass delusion of the government passing out endless free money is one of the wildest, most unethical, most irresponsible and most dangerous financial rides in history. Hopefully this analysis has been useful to you in seeing what is actually happening, as it is happening.

Learn more about the free book.

********************************************

The September 18-19 workshop (brochure link here) is primarily not about problems but solutions, and arguably the best solution for the current financial dangers is real estate asset/liability management strategies. If we want to understand why so much institutional money is pouring into singe family rentals on a national basis - we have to think like an institutional investor looking at monetary and financial risks, someone with a staff of MBAs/CFAs running sophisticated financial analyses, rather than through the lens of a traditional income property investor.

We will do this at the workshop, and achieve what will be for most individual investors an entirely different perspective on current single family home prices. Institutional investors now dominate, and if we look at the issues raised in this and related analyses - current home prices are not necessarily overpriced at all as a matter of financial mathematics when viewed from an institutional asset/liability management perspective.

That said, making informed decisions about real estate cannot currently be done without including the impact of the Fed on current prices, as well as what could happen if the Fed loses control. We will therefore spend a good part of Sunday morning with a much more detailed back and forth discussion in a classroom atmosphere about what is contained in this analysis, and then in the afternoon look at the numerous implications for future single family rental returns, potential opportunities, protection from crisis, and buy/sell decisions.

There is still space available.

For those who are interested in learning more but not in attending the workshop, alternative financial education resources for distance learning include the books, DVD courses, and online video courses linked here.