Rising Inflation, The Taylor Rule, Rational Bubbles & The Fatal Flaw

By Daniel R. Amerman, CFA

TweetWe currently have deeply negative real interest rates - meaning that short-term interest rates are far below the current rate of inflation.

The already high rate of inflation is almost certainly in the process of getting much worse, as the Ukraine War and the sanctions thereon are likely to lead to global shortages of many things, including energy, food, and the fertilizer to grow food.

So, that inflation must be controlled. But there is a problem - a built-in Fatal Flaw that has always been there beneath the inflated asset prices of recent years. Based on established economic theory it is probably impossible to stop high and persistent rates of inflation without triggering a catastrophic collapse of asset prices, including stocks and bonds, with a likely powerful recession as well and a potential new global financial crisis.

This is a particularly substantive analysis, that is an outtake from my upcoming workshop (brochure link here). Forty years later, very few people fully realize the specifics of how high rates of inflation are controlled, and the explosive conflict when it comes to asset prices.

Negative Real Interest Rate Update

Negative real interest rates are destroying record amounts of personal wealth right now. How they work and their extraordinary personal impact is explored in detail in a previous analysis I wrote that is linked here.

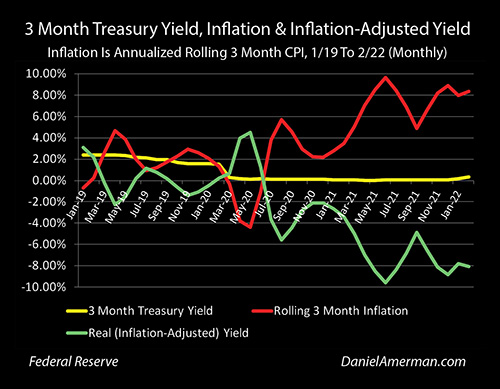

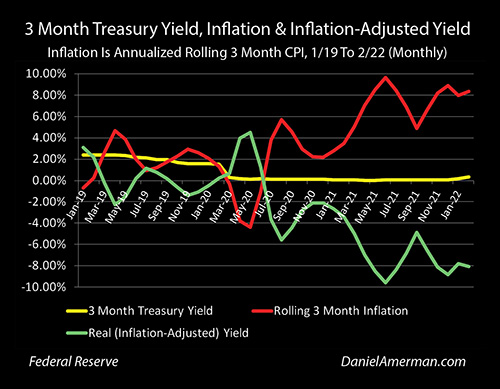

The graph above updates what is really going on with interest rates and inflation. It is through February, which was before the impact of any inflation from the Ukraine War. We won't get the March CPI data until well into April, and once that arrives, we should start to see something much worse.

The yellow line is the three-month Treasury yield, which we are using to represent short-term high-quality interest rates, that are A) above most checking account yields; and B) something the public can actually access, unlike Fed Funds rates. That rate was around two percent before the pandemic shutdowns, and it was slammed down to near zero percent with those shutdowns. It then stayed there until February, when it ticked up to an average of 0.31% for the month. The Fed didn't raise rates 0.25% until March, but the Fed clearly signaled (aka provided "forward guidance"), the market anticipated, and the three-month rate moved up in advance.

The red line represents the rolling three-month rate of inflation, and it is presented in annualized terms. When things are moving fast, the twelve-month comparisons tend not to keep up. The big upwards breakout in inflation occurred in May of 2021 due to the combination of easy money policies and supply chain issues, and has averaged about 7.84% since that time. It is visually obvious that inflation dwarfs interest rates, and the 0.25% increase in interest rates is hardly visible compared to the movement in inflation.

When we take the interest we get and adjust for inflation, then we get our real interest rate, which is the green line. This line represents the value of our money. If inflation is higher than the interest rates we are paid, this means that we are losing value every month and every year. Real interest rates turned strongly negative by July of 2020, and have stayed there since, with an average negative yield of 7.76% between May of 2021 and February of 2022.

Notice that when rates climbed in February - the real yield did not become more positive, but became more negative than ever. That's because inflation rose faster than interest rates. The rate at which the value of their money was being destroyed rose faster than interest rates, so savers were worse off than ever, even after the increase in rates. This is a really important concept to keep in mind as the Fed raises rates even while the war in Ukraine pushes global inflation higher - that doesn't necessarily mean that real interest rates will be becoming less negative.

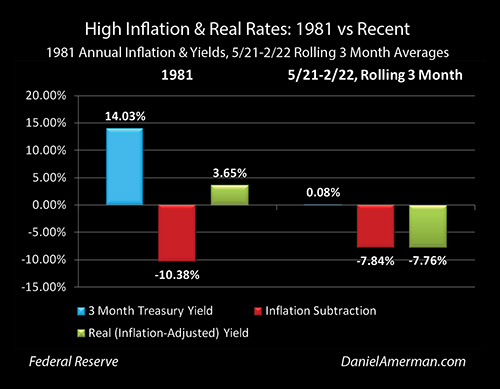

The degree of these negative yields is historically unprecedented. If we compare recent real negative yields to forty years ago, the last time rates of inflation were this high, then we are down 7.76%, compared to being up 3.65% in 1981. That is a shortfall of over 11%, and the difference is in the interest rates.

We have rates that are still near zero percent even as interest rates surge, and that is a historical anomaly that has been created by the Fed's back door access to our bank accounts. As explored in my book The Stealthy Raid On Our Bank Accounts (link to free first chapter here) , the Federal Reserve gained a new access to our money in the bank in the midst of the 2008 crisis, that had not existed in 1981. The Fed has since used/abused this access, using the purchasing power of our money to deny us fair market interest rates on our money. The real source for the stimulus checks is the same as the real source of the almost -8% real yields - it is our own money that is paying for everything.

That is one of the sources for the differences between 1981 and now, there are two others that are of particular importance. One is that the long-term norm in a free market - when the Fed is not overriding the market - is for investors to demand interest rates that are above the rate of inflation. It is irrational to save money in exchange for an interest rate that is less than inflation. So, the fifty-year average between 1959 and 2008 was for three-month Treasury yields to be 1.26% above the rate of inflation. With a hypothetical free market, that would imply that current short-term rates should be 9.1%, and any rate that is less than that is money being taken out of our pockets by the Fed.

The third source of differences between 1981 and now when it comes to inflation and interest rates, is that there is more to interest rates than their just being a response to inflation. Interest rates are not a passive reaction to inflation, they are instead the primary tool that the Federal Reserve uses to try to bring down the rate of inflation. While the Federal Reserve did not have anywhere near the power in 1981 that it has now (thanks to our bank accounts), it could control short-term interest rates in the form of the Fed Funds rate.

How Inflation Gets Broken

We are currently experiencing the highest rates of inflation in over forty years. The average person is completely unprepared for this. The costs of food and energy are already starting to increase at a rate that can be visible on a month by month basis, sometimes even a week by week basis. The destruction of quality of life and financial security - particularly in retirement - from the cumulative costs of the exponential equation that is inflation are still in their very earliest stages, most people really have no idea of how much of a practical impact on their day to day lives that we may see over the coming years.

As we are exploring this weekend, inflation losses whether with money or investments are often permanent. Inflation is a cumulative, one-way process. If protection is not in place beforehand, then once the loss has occurred - there is generally no ability to recover. There is only the ability to attempt to protect what is left after the loss has been taken. The more time that passes, the greater the cumulative losses, the crueler the mathematics of the "vicious circle" (as we will be reviewing tomorrow), and the more difficult it becomes to protect a given standard of living or degree of financial security.

With a high rate of inflation - the immediate future changes. That said, so does the medium-term and long-term future. The best time to understand that is right now, right up front.

Inflation is costly. There is something that can be even more costly, however, and that is what it takes to bring inflation back under control, once it is well established. Long after the initial source of the inflation is gone, whether it be commodity price shocks (such as energy and food), or something else altogether, if a wage/price inflationary cycle gets going - such as the one that is getting started right now - then history shows us it doesn't stop on its own. It needs to be forced down, the cycle needs to be broken through the application of brute force.

We used to know this.

Because it happened before, and it was one of the most economically unpleasant periods in American history. A few of us still remember not just what happened, but why it was deliberately done. For the rest - let's catch up on what happened, right now. Learning about what happened in the past in similar circumstances is the least expensive way of being ready for the future. It is the learning by taking losses while being surprised that is the most expensive form of financial education.

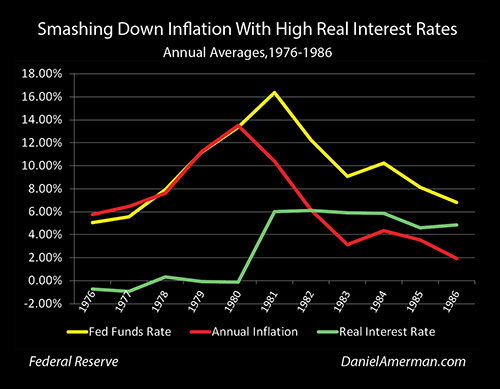

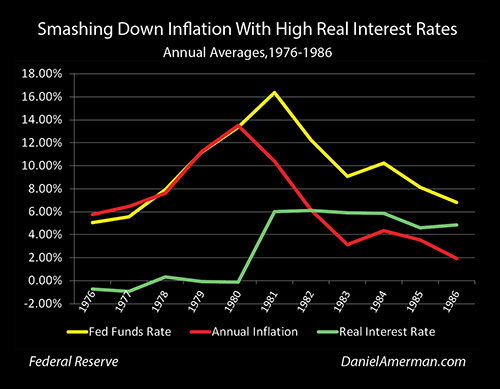

The graph above shows interest rates, inflation, and real (inflation-adjusted) interest rates between 1976 and 1986. The red line of inflation in the early years is not all that different from what we have right now, we are currently very close to where we were in 1978. The yellow line of interest rates, the Fed Funds rate in this case, was very close to the inflation in the 1976 to 1980 period, either very slightly below or very slightly above.

When we subtract inflation from interest rates, then we get the green line of real, inflation-adjusted interest rates. These real rates varied from slightly negative to slightly positive in the early years, there was nothing like the degree of pain that we are currently enduring.

However, even with real rates that were far higher than today - inflation was not under control, and it was continuously growing, from an average of 5.77% in 1976 to 13.50% by 1980. This is an extraordinarily important lesson from the past that is being ignored for short-term benefits in the present, and it could come to dominate all of our futures. Inflation can indeed have a source that turns out to be transitory. Among the other sources of inflation in the 1970s, the Vietnam War ended and the Oil Embargo also ended. But, the inflationary wage/price cycle kept on going and even growing.

In late 1980, the decision was made to pay whatever economic price was necessary, to bear whatever financial pain was needed in the short term, in order to break out of the stagflationary cycle that America was caught in. Under Paul Volcker's leadership, the average Fed Funds rate was raised from 9% in August of 1980 to over 19% by January of 1981. (Looking at that 10% move in five months really puts the recent 0.25% increase in perspective.)

What Volcker was doing was moving the green line of real interest rates up to +6% for 1981 - and leaving it there for four years, through 1984. Watch the near level green line - and see exactly how inflationary cycles are broken in practice. Volcker wasn't doing anything subtle or fancy, he was going after inflation with a sledgehammer, and smashing it down again and again until it was defeated.

In 1981 the average Fed Funds rate was 16.4%, and inflation was smashed down to 10.4%. Keeping real interest rates at around +6%, average annual inflation was smashed down to 6.2% in 1982 and all the way down to 3.2% in 1983. Inflation tried a comeback again in 1984, rising to 4.4%, but Volcker just moved rates up to 10.2% - creating an almost 6% inflation-adjusted yield, and smashed it right back down again. By 1985 inflation was down to 3.5%, and by 1986 it had been knocked down to 1.94%, a level that seemed almost miraculous when compared to where it had been five years before.

The end result was what has been taken for granted for decades afterwards - up until the last year. The relatively low levels of inflation did not come naturally but had been created at great cost. The sledgehammer blows that knocked down inflation were hitting far more than just interest rates. Credit became very expensive for companies and individuals, spending and growth were held down, the markets reeled, mortgage rates went above 15%, there was a deep recession, retirement investors were devastated, and for many younger workers were was no employment because of the rampant job losses.

So, if we look to the future, and we see what it could take to bring our current inflation under control at some future date, then we need to look at is what worked before. What worked was creating very high interest rates - rates that were consistently 6% above the rate of inflation - and leaving them there for year after year, until the inflationary cycle was broken.

Now, what interest rates will be at the time the attempt is made to break a new inflationary cycle is a good question. They could be somewhat lower. With the still developing economic fallout from the Ukraine War and sanctions, the rate of inflation could also be much higher. The simplest assumption is to just go with what it is with the most recent data, or at least what the government says it is (with reality potentially being quite different).

We are supposed to have around an 8% rate of inflation. Add a 6% positive real rate on top of that, and we get 14% interest rates, for what could be four or more years to come. With the accompanying problems for years with credit becoming very expensive, much lower spending and growth, reeling markets, mortgage rates that could be 10% over where they are right now, and a deep recession. If we don't do that - then the inflation just keeps going.

That may sound bleak from the perspective of those who grew up with low inflation and now take it for granted - but we do have the highest inflation in forty years, and it is likely still accelerating. This has happened before. We know what it took to end it before. So, as we look at our new environment, it is important to understand that once high inflation becomes fully established, it is no longer an aberration, but it becomes the natural state - unless great efforts are made to break the cycle.

The Taylor Rule

The field of economics was in great turmoil during the late 1970s and early 1980s. The academic theory continued to evolve for years afterwards, and in 1993, a Stanford professor named John Taylor proposed what is today called the Taylor Rule. This rule reflected the prevailing academic beliefs that while Volcker was ultimately successful, the inflation of the 1970s and early 1980s was mishandled. The blows did not have to be so extreme, and they should have taken place much earlier.

I realize that this may sound a little esoteric in 2022 - and ordinarily, academic theories from almost 30 years ago and five dollars would just buy you a cup of coffee. However, we don't live in ordinary times. While little understood by most investors, we live in a time of activist central banks and this has created investment markets with risks - and opportunities - that are quite different from previous markets.

Activist central banks such as the Federal Reserve are dominating the markets, they are dominating investments, they are helping to create inflation, and they are responsible for managing inflation. Anticipating what central banks will do could end up being the number one determinant of our collective financial futures, and to do that we've got to do something that is not at all natural for most people - we have to think like a central banker. That's a key part of what we're doing this weekend, the world is in turmoil, events are moving fast, and in some crucial areas, we're looking at the beliefs that may determine the actions that are taken that are likely to change the financial world.

The Taylor Rule is still very important today, it forms a crucial part of the theory that guides the actions of central banks around the world, including the Federal Reserve. When we listen to modern economists at the Fed saying that we don't have to worry about a repeat of the 1970s because we understand how to control inflation much better than we used to - they are primarily talking about the Taylor Rule.

Once we understand the Taylor Rule - then we can understand why the Federal Reserve is in much worse shape than it is letting on when it comes to controlling inflation, as well as why the upcoming round of anticipated rate increases is unlikely to bring inflation under control. The Fed simply doesn't have the arrows in its quiver that its own economic theories say that it needs to have, if inflation is to be controlled.

The Taylor Rule formula is:

Target fed funds rate = Natural rate of interest + Current inflation + 1/2 (Inflation gap) + 1/2 (Output gap)

Now, the output gap portion of the formula is crucial, but for now we're going to set it aside to concentrate on the interest rate and inflation components.

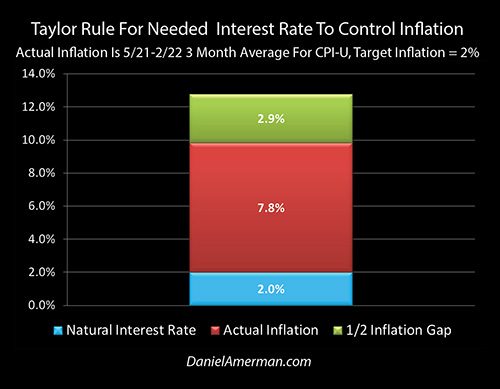

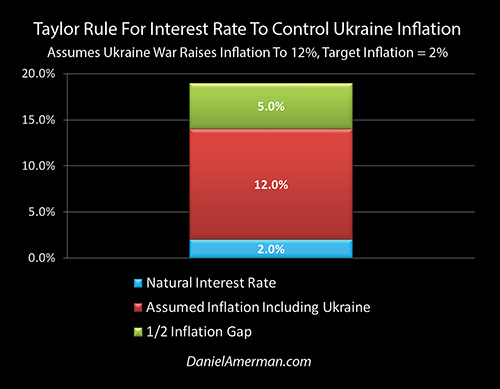

The graph above shows what the Taylor Rule formula says the current Fed Funds rate should be - and short-term interest rates and money market rates in general - for our recent rates of inflation, if we are to control and bring down those rates of inflation.

We start with a natural rate of 2%, which is the interest rate that rational investors should demand over and above the rate of inflation. Rational savers shouldn't accept negative inflation-adjusted yields - unless the central bank intervenes to make them do so.

We then add the current inflation rate of about 7.8%. That takes us up to 9.8% short-term interest rates, and rational investors should accept no less for 7.8% current inflation.

We then need to break the back of inflation by creating a higher interest rate, a more steeply positive real rate, like Volcker did. Taylor's theory (which is the current economic mainstream thinking) is that if the target rate of inflation is 2% and the current inflation is 7.8%, then we have a gap of 5.8%, which needs to be narrowed to 0%. If we take half of that gap, 2.9%, and add it on top of the 2% natural interest rate and the 7.8% current inflation rate, then we get our target Fed Funds rate of 12.7%.

The Fed says it can control inflation as needed, much better than it could in the 1970s. That claim is made on the basis of an economic theory. To control inflation and rescue the value of our savings, this can in theory be reliably accomplished by raising interest rates by a little less than 12.5%. Quickly.

(If we go back to the crucial year of 1981, then the Taylor Rule with the then prevailing ~10% rate of inflation is that the Fed Funds target rate should have been 2% + 10% + (.5 * 8%), or ~16% - which it was. Much of the Taylor Rule came from the study of Volcker with 20/20 hindsight, whether it actually works better with high inflation in the real world is a matter of theory.)

The Taylor Rule & The Ukraine War

There is, of course, a problem with using the rolling average 7.8% rate of inflation through February - it did not include the surge in inflation that is being created by the War in Ukraine. The rate of inflation is likely to climb sharply. I think we are all seeing it already at the gas pump and the grocery store, and we may just be getting started.

The problem is that we already have an inflation crisis. Political decisions are adding another inflation crisis on top of that. The financial implications of adding a second powerful source of inflation are much more deadly than I think many people realize. This isn't necessarily just a matter of bearing some economic pain for a limited period, that then goes away.

Let's break this down into four levels of added problems for us all.

The first level is that the current inflation crisis is not being solved - which means it is becoming more persistent.

The second level is the increase in inflation. The higher the inflation, the greater the economic damage, and for most savers this damage will be permanent. For someone early in retirement or near to retirement, the damage from the early destruction of the purchasing power of their savings can change their standard of living and degree of financial security for the rest of their lives.

A third level is that a higher rate of inflation that lasts for longer is more likely to set off a self-sustaining inflationary cycle, at a higher rate. History clearly shows that once established, inflationary cycles can not only persist indefinitely but they can even accelerate, even many years after the original sources of the inflation have disappeared.

The fourth level is that once a high rate of inflation gets going, and a wage/price spiral reaches the self-reinforcing stage, then it is likely to go until it is forcibly stopped. What history and the Taylor Rule show is that the higher inflation is at the time the decision is made to break the cycle, then the greater the economic and financial damage that must be endured to stop it.

If we kick the can down the road and let inflation grow worse and more persistent, then using the Taylor Rule, we can estimate today just how much more painful the price will eventually be to bring that inflation back under control.

The next year is likely to be extremely volatile, there is a lot of risk that is loose across the world, and no one can say with certainty where inflation will be in six months or a year. Just for the sake of exploration, however, let's assume that inflation goes up to 12%, about 4% higher than the February numbers, and that is also the rate at the time when the decision is made to bring inflation back under control. Now, on the one hand, that is very high compared to recent decades, and it would be excruciatingly painful on a year by year basis for those without effective inflation strategies - which is most of the population. On the other hand, given everything in play right now, inflation could still go way above 12% before we are done.

Our starting point is to again set aside the output gap (which is crucial) for the moment, in order to focus on the inflation and interest rate components. We start with a 2% natural interest rate, we add the assumed 12% inflation, and we have a 14% interest rate. The inflation gap is the difference between the 12% then current inflation, and the target inflation of 2%, which is 10%. When we divide the inflation gap by two we get 5%. Add the 5% to the 14%, and the Taylor Rule says that the Federal Reserve would need to raise Fed Funds rates to 19% in order to break a 12% rate of inflation.

Whenever short-term decisions are made to create inflation, or to allow inflation to continue, or to substantially increase the rate of inflation - it is never free, there are always costs, even if the narrative is to never consider or discuss the long-term costs.

What most people are quite naturally focused on is current prices, the here and the now. Current prices are not fun when it comes to filling up a gas tank, or buying some hamburger, or purchasing a home.

What we are seeing now, however, is trivial, almost meaningless, compared to what is on the way if we get a new inflationary cycle, at rates that are above anything that we have seen in the last four decades. Inflation is a relentless mathematical and cumulative process of impoverishment, for those whose assets or current incomes are not able to keep up with the rate of inflation. Each year, the starting point is the pain from the year before, and a new level of financial pain is experienced over that year - then setting the stage for the following year, that will be worse. It is a fairly straightforward but quite powerful progression that is based on exponential mathematics. Because retirees or those near to retirement tend to have the most assets, and the least ability to rely on current income to offset inflation, history shows that this group bears the worst of the pain.

Most people are not at all prepared for this. It might seem like terribly bad luck. Yet, it is the long-term process that is being set in motion, right now. The current price of a tank of gasoline is not the problem, it is nothing compared to what could be on the way unless different near term choices are made.

What may seem even more improbable is the possibility of having to then deal with 12% or 19% interest rates some time down the road. That combination might seem like a case of Murphy's Law in action, something so pessimistic as to be absurd!

Can you imagine? First, someone has to deal with a rate of inflation eroding their standard of living and financial security to a degree that far exceeds anything projected or modeled by their financial planner. And then after call it five or ten years - interest rates go to 19%! There is carnage in the markets as the real prices for what is left of their assets plunge. The economy goes into a major recession. And as a matter of deliberate policy, the Federal Reserve keeps interest rates at punishing levels for year after year. The sledgehammer blows that are knocking down inflation persist for multiple years, even as the same sledgehammer blows unavoidably hit the markets and the economy.

For all of our sakes - I hope that nothing remotely like that happens. The financial consequences could be devastating for the nation. But yet, this is not some wildly improbable doomsday scenario - it is just the natural result of economic history and current mainstream economic theory.

History shows us that persistent high rates of inflation can create self-reinforcing cycles. that can continue and even grow stronger, long after the original sources of that inflation are gone. History shows us that the last time the United States had this problem, the solution used was to create very high interest rates, that averaged 6% above the rate of inflation for a number of years. The current textbook solution for central banks seeking to control inflation is to use a mathematical formula that calls for 12.7% short-term interest rates for 7.8% inflation, and 19% interest rates for 12% inflation. There is nothing improbable or fringe about any of those statements.

Preventing The Inflationary Cycle

Fortunately, we no longer need to worry about a return to the high inflation of the 1970s and 1980s because of the enormous advances in economic theory since that time. The economists with the best credentials at the most elite universities in the nation and the world have through a process of writing peer-reviewed papers that agree with other, worked out a reliable method to stop inflation. Every time.

When we look at the Fed chairpersons in recent years all saying that there is no need to worry about inflation, this is what they were talking about.

The answer is not just the Taylor Rule, but the timing of the application of the Taylor Rule. Now, for transitory inflation, there is no need to invoke the rule - which is why the Fed insisting last spring and summer that the inflation was transitory was so important. However, if it is indeed looking like persistent inflation, then the way to prevent it at the least cost to the nation is to act quickly. Get ahead of the problem, do it in a major way, don't let the damage get done, don't let the cycle get established, just throttle it down as fast as possible. The early timing is critical for controlling inflation at the least cost!

It is very well established how that needs to be done.

The green line in the graph above, that of recent real (inflation-adjusted) interest rates, just needs to be turned into the green line in the graph below, as shown for the years 1981 and later.

Real interest rates of about negative 8% just need to get flipped into real interest rates of about positive 6%. Pronto!

A quick, blunt 14% increase in interest rates could make this happen. Or, if we want to use the more theoretically refined mathematics of the Taylor Rule, we could limit the increase in interest rates to only about 12.5%.

Stepping aside from the theory, this intuitively makes a lot of sense. Once a self-reinforcing inflationary cycle gets going - pain is going to happen, whatever the choice. One choice is to defer, to just take the pain for year after year - the inflation, the recessions, the job losses, the impoverishment of many retirees, with this being ultimately followed by a long market-busting cycle of breaking the inflation. As we saw in the 1970s and early 1980s. Or just accept the temporary pain, deal with the problem immediately, break the inflation - and then have year after year without the inflation, the recessions, or the impoverishment of the retirees. In theory - without political considerations - the choice is crystal clear, and this is one of the main reasons why the Federal Reserve is supposed to be independent of the U.S. government.

The Federal Reserve is keenly aware of the need for speed.

Once they finally, reluctantly accepted that the higher inflation was persistent, the Taper began along with the signaling for the March increase in the Fed Funds rate. The Federal Reserve is making clear that they are just getting started, that they will be moving with great urgency, and that they may also soon begin selling Treasuries into the markets, instead of funding the U.S. government. The speed, the resolve, the commitment to major moves are all part of the new playbook for keeping high rates of inflation in the distant past, where they belong.

There is, however, a problem.

According to most current estimates, the Fed intends to increase interest rates until they reach around 2.75% sometime next year, using a schedule of frequent increases that may involve some 0.50% rate hikes as well as more 0.25% increases. Now, on the one hand, that seems awfully aggressive to many market participants, who are betting that the Fed will be forced to back off well before that level is reached.

On the other hand, a 2.75% Fed Funds rate is still 5% below our recent rate of inflation of 7.84%. This would be a negative 5% real interest rate, and while it is better than what we have right now, it is still 11% below the historically proven use of +6% real rates to bring inflation down, and it is about 10% below the Taylor Rule. Indeed, substantively negative real interest rates in an environment of supply shortfalls help to create new inflation, they don't control existing inflation.

Then we need to take into account the huge unknown that is coming straight at us, and that is just how high the inflation will be that is caused by the Ukraine War and the sanctions response thereto. If this new inflation adds 2.75% per year to price levels - then the higher inflation will cancel out the higher interest rates, and it will be as if interest rates were never raised at all. But, if there is a 4% increase in inflation, then the new negative real interest rate is -9% (-7.75% current inflation - 4% inflation increase + 2.75% interest rate increase), which is worse than ever.

And if there is a 6% increase in inflation, we would be at a 13.75% rate of inflation, which means that even after a 2.75% increase in interest rates, we would still be at a negative 11% real interest rate. Per the Taylor Rule, breaking a 13.75% rate of inflation and bringing it down to the target 2%, would require a 21.6% Fed Funds rate - which is about 18.9% higher than the Fed's plans.

A Major Shortfall & Rational Bubbles

Whether we are looking at a 12.7% short-term rate, or 19% rate, or a 21.6% rate - they are all grossly in excess of the 2.75% increase that the Federal Reserve appears to be considering. In every case, there would still be a strongly negative real interest rate, even after the full increase in rates. This means that there would be no control of inflation, and indeed, the easy money aspect of deeply negative interest rates would continue to accelerate inflation in the face of persistent supply and supply chain issues.

So, why not just increase interest rates to 12% or 13%, do it fast, accept a period of pain, and then get on with our lives? That is after all, exactly what the Taylor Rule calls for, it is the best and most accepted economic belief for how inflation can be quickly and effectively controlled.

This is a good time to do some more integrations with what we went over earlier today, and explorations of the implications of those integrations.

A key part of this morning was going over current asset prices and the "Fatal Flaw" of Rational Bubbles, in much more detail than we will now repeat. While even fewer people have likely heard of Rational Bubbles than they have the Taylor Rule, this is also part of modern economic theory, and it is in fact older than the Taylor Rule. If you know what to listen for, you will even hear Federal Reserve officials making references to this critical investment factor on an ongoing basis, even if they don't use that exact term.

In an influential paper published by Jean Tirole in 1985, while he was a professor at MIT, he established that very low interest rates - such as negative real interest rates - will in a mathematical process, feed the growth of asset bubbles, that are not only rational but can be stable for so long as the very low interest rates persist.

For those of you who have been following my work for a while, we've been talking about Rational Bubbles at the workshops in particular since 2014. Instead of Doom & Gloom, we were exploring how persistent artificially low interest rates could create massive asset bubbles in stocks, bonds, and real estate, that unlike ordinary bubbles, would be rational and could exist in a stable fashion for years, even a decade or more. Investors could be very pleased with their paper wealth for many years, believing it to be entirely stable in some kind of new normal.

This is indeed what has happened since 2014, there has been an extraordinary growth in asset values fed by abnormally low interest rates.

There was, however, a catch - a Fatal Flaw - that has been built-in since the beginning. If interest rates were to cease being artificially low, particularly if they were to return to the historic norms of being well above the rate of inflation - then the asset bubbles would change from being rational to deeply irrational. This could then be expected to lead to a catastrophic collapse in real market values that would not be cyclical, but permanent (unless there were to be a later return to persistent very low interest rates).

So, someone could have invested in stocks (as one example) for the last ten years, and they would have seen results that were not only been spectacularly good, but relatively stable as well. So long as they didn't exit during the downturns, and stuck with it, the investor would have been amply rewarded every time, as they participated in the growth of the Rational Bubble.

However, whether they knew it or not, their results were dependent on the indefinite continuation of some of the lowest interest rates in history. Should interest rates substantially rise, particularly if they become significantly higher than the rate of inflation, then these investors are likely to be blindsided by catastrophic losses, where sticking with it does not mean riding the recovery but rather riding the losses all the way down to the bottom and the new rational valuations.

For the relatively small minority of investors who were well aware of these issues, the counterargument was that so long as the Federal Reserve was in control, it would never permit that to happen. Reap the extraordinary artificial profits from the short term, and let the long term - and the general welfare of generations of individual investors - take care of themselves!

Once we understand both Rational Bubbles and the Taylor Rule together, then we start to understand the extent to which the Federal Reserve is stuck between a rock and hard place, and just how much trouble we are all currently in.

The markets cannot handle the Taylor Rule and its ongoing application for multiple years (as required), there would be catastrophic damage to the investors and retirement investors of the nation, quite likely accompanied by a new global financial crisis. This is why the discussed interest rate changes are likely woefully inadequate, only a small fraction of what economic history and theory say is needed to deal with persistent inflationary cycles. But, if high rates of inflation are not contained, then we get the debilitating damage from high rates of inflation being dealt to savers, workers, retirees, and the economy for year after year, until such time as the decision is made to end it - and then we still get the catastrophic market damage anyway at that point.

It is also worth noting that this problem is likely worse in Europe than it is in the United States, which increases the chances of a global financial crisis that could be much worse than the 2008 crisis.

This is not random bad luck, but rather it was always baked in at some point in the future. The fundamental, market-breaking conflict between rational bubbles being dependent on negative real rates, while the bringing down of high rates of inflation is dependent on steeply positive real interest rates - has always been there. It was just a question of when. Our current situation is that the pandemic shutdowns, the massive government stimulus, the supply chain issues, and the Ukraine War are in combination creating inflationary pressures like we have not seen in decades - which means that the when could be now.

Wrapping around another level, this is all ultimately based on what we also went over this morning, the Federal Reserve using its new powers - as proposed in the influential economic theories of a Princeton professor named Ben Bernanke - to tap into the spending power in our bank accounts, and become far more powerful than it had ever been before.

The Fed used this vast new power to force interest rates down to levels beneath the rate of inflation, meaning it would be systematically stripping wealth from the citizens of the nation - as was known in advance.

This created exceptionally low interest rates that Wall Street and major investors could use to borrow very cheaply and load up on assets.

With persistent artificially low interest rates, as a matter of well-established economic theory the assets could then be expected to eventually become rational bubbles, creating extraordinary profits - as they did.

In combination, it was a formula for making money through artificially shaping the markets by controlling the spending power of our bank accounts - that has created extraordinary wealth for Wall Street and other institutional investors. Now, many individual investors might have been just fine with this, because that stock wealth was going to them as well. They loved it and still do! However, that brings us back to the Fatal Flaw - the long-term effects of this short-term pursuit of maximum wealth are to at some point crush the investment expectations and the seemingly secure retirement dreams of potentially tens of millions of investors.

What is now missing is the compounded cash flows of many years of fair market interest rates and dividend rates. It is those compounded cash flows that are historically the largest and most reliable source of building wealth over the long term, as well as the most reliable source of cash in retirement. Denied that cash, investors have had to substitute, and accept the price gains from the building of the Rational Bubbles instead - with many people thinking they are fine with the trade-off. However, those price gains are necessarily at high risk of collapse with a return to higher interest rates, which would leave the investors of the nation with neither the price gains nor the compounded cash flows, and much worse off than what they would have been if none of this had happened.

Are we at that point for sure? I really hope not. I try to be an optimist in most areas of my life. I don't want to see that kind of damage for those I know, or the rest of the nation.

But yet, while we don't know anything for sure, we've got a lot of problems, including some that we've never seen before. We have a number of unproven economic theories that are based on simplifying assumptions and first order effects, that have been used to put us in an unprecedented situation, with a highly leveraged global financial system under acute stress that may be simply incapable of handling the current complexity as well as the second and third order effects.

Indeed, as we've been reviewing, these problems go well beyond the Taylor Rule and Rational Bubbles. When we look at the four core sources of funding for the Federal Reserve, and how they intersect with the market pressures of rapidly rising interest rates, as well as the ongoing funding of the $30 trillion national debt, then we might be lucky to make it up to 2.75% without things flying apart. There are good reasons why so many institutional investors think that the Fed will back off well before then - even if that leaves the nation defenseless against the current high and rising rates of inflation.

So, what to do? As we will be reviewing for much of tomorrow, a detailed examination of history shows that there are four fundamentally different ways of protecting against inflation, that involve four different categories of investments. In different situations - each can be highly effective. However, they tend to not work together and the peak times for some asset classes are the worst times for other assets, as we have seen in secular cycles over the last fifty years.

Historical results from times of high inflation and economic turmoil are good to know. What happens is that a lot of the most popular theories from before the turmoil get shredded in practice, and the time to understand this is before it happens. So, we will be studying what history has to show us in detail.

At the same time, we need to be aware that the 1970s will not be repeating themselves. We do live not just in a time of financial turmoil, but also a time of activist central banks - whose actions dominate the markets. The extraordinary market distortions created by the Federal Reserve, in combination with a very different geopolitical situation, mean that we are in all new territory.

What the works of professors Taylor, Tirole, and Bernanke have in common is that they identified what would decades later, in a time of activist central banks, become some of the largest potential sources of profits and losses in the markets. Whether we are talking about sledgehammer interest rate interventions, or the ability or inability to contain inflation, or the formation and collapse of rational bubbles, or the ability or inability of the Fed to fund trillions in an attempted future market rescue - each has the capability to create devastating losses or extraordinary profits for individual investors.

As a group, they could be key determinants of financial quality of life for a nation over the coming years and decades. There are also some strong generational implications - what is generally devastating for one generation can be a source of great individual opportunity for another generation. Yet these factors are poorly understood, to the extent that the public knows they exist at all.

At the workshop, we will work through the practical investment implications in detail. We will integrate the unprecedented distortions and risks, and the implications of the Fatal Flaw, as we examine the strengths and weaknesses of each of the four types of strategies for the current situation, as well as for some of the potential paths ahead.

For those of you who will be at the workshop - I look forward to seeing you soon, and we have a lot of ground to cover in two days. This analysis is only a small part of what we will be going over, but it is an important component with a number of implications for these extraordinary times that are unfolding with such speed. I am hopeful that it will be helpful for you to have a chance to think this over in advance and come up with questions, before we discuss it in person.

For those of you who will not be at the workshop, this is just an outtake, but it is meant to be a substantive outtake, that has the potential to provide real value on its own. There should be a great deal of food for thought here. Hopefully, this analysis has been helpful in your understanding of these issues that could become life-changing for us all.

*******************************************

Workshop brochure link here (there is still space available).