The Misleading "Strength" Of The Dollar

By Daniel R. Amerman, CFA

TweetOne of the biggest financial news stories of 2022 has been the remarkable ongoing strength of the United States dollar. If we look at the popular and widely quoted U.S. Dollar Index (DXY), as of mid-September, it was up by over 18% in the last 12 months, with about 14.4% of that occurring just in 2022 alone. Indeed, the top story in Wall Street Journal on September 19 was about the "once-in-a-generation rally" in the U.S. Dollar, and the stresses this was putting on the global financial system.

This is true. But it isn't the whole truth.

What we are seeing isn't extraordinary strength versus the rest of the world. Instead what we are seeing is the extraordinary weakness of the closest allies of the United States, the other economic powers that make up the West. In this analysis we will dig into what the dollar index rally really measures, and take a look at what is actually happening with the currencies of the West versus the currencies of the BRICS+ nations.

This analysis is a brief outtake from my upcoming workshop on October 22-23 (brochure link here).

Crushing Our Closest Allies

The "once-in-a-generation" rally in the dollar definitely fits the usual narrative about the dollar being the world's reserve currency. During crisis, it is supposed to soar in value relative to other global currencies in a flight to safety. The other nations of the West are also supposed to benefit, as money from South America, Africa and Asia all flows into the secondary reserve currencies of the euro and the yen.

This increase in the value of the dollar means that imports cost less for the United States, reducing the rate of inflation, while the costs of imports jumps upwards for the developing nations, increasing their rate of inflation. In crisis then, the way the global order has been set up by the West is that the developed nations effectively pass some of their inflation onto the less developed nations.

However, that isn't what is currently happening, we are seeing something quite different. While the "U.S. Dollar Index" and related indexes sound quite global - they generally are not. Their purpose is to measure the strength of the dollar versus our traditional six largest trading partners, not the world as a whole. The ICE U.S. Dollar Index (DXY) therefore weights the euro at 57.6%, the yen at 13.6%, and the pound sterling at 11.9% (with Canada, Sweden and Switzerland having lesser percentages).

When we say that the dollar is up 14% year-to-date then, we're not saying the dollar is up versus the world, but rather the dollar is up sharply versus our most important allies in the West, the 83% of the index that is made up of the euro, the yen and the pound.

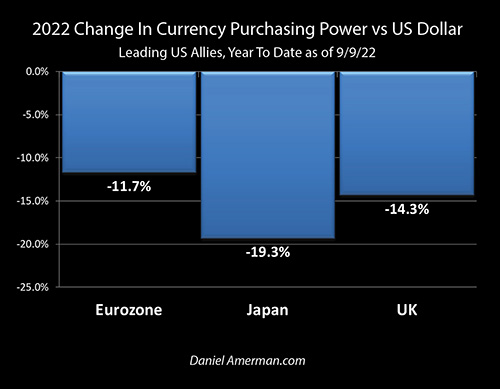

The main source of the dollar being up by 14% this year is that the Eurozone countries have been getting hammered, their 57.6% of the Dollar Index has lost almost 12% of its value versus the dollar (as of 9/9/22, it has since deteriorated further). Japan is getting hit even harder, with the yen having lost almost 20% of its value. The United Kingdom is also reeling, with the pound having lost about 14% of its relative value. For continental Europe, it isn't just the Eurozone nations either, most of the European nations with their own currencies are experiencing similar very poor results, including Denmark, Hungary, Norway, Poland and Sweden.

As a result of the U.S. led sanctions then, the West is experiencing a major decline in the value of its currencies, with the euro now hovering at the parity level with the dollar (and falling below parity with the Russian mobilization announcement). Another way of phrasing this is that the United States is successfully exporting inflation to its closest allies, as the cost of imports in the U.S. falls, even while the cost of imports in the allied nations rise.

How about the rest of the world?

The Opposition

The best known opposition is the BRICS, or BRICS+, and they include Brazil, Russia, India, China and South Africa. They have been trying to achieve a multipolar global financial system that is not dominated by the U.S. dollar for two decades now, and they are currently being joined by such nations as Saudi Arabia and Iran. Collectively, they account for close to half of the world's population, they control extraordinary physical resources, they have vast manufacturing capabilities, they include some of the most powerful nations in Asia, South America, Africa and the Middle East - but yet, under the existing system, they have much less financial wealth than the West.

That is one of the themes for the workshop this weekend. The base fundamentals of the world economy are changing in real time. The financial has been in ascendency over the physical, and the Wealth of the West has been in financial domination for many decades. This financial domination is currently in play due to open economic warfare between Russia and the West.

To be clear - the BRICS have their own issues and internal divisions, particularly between China and India. They are much less of an alliance than is the West. However, they do also have their common interests in seeking a world that is not financially dominated by the West. So, while the rest of the BRICS+ are not overtly allying with Russia - and are particularly not supporting the Ukraine War - it is worth noting that a not a single one of them is participating in the sanctions against Russia. Indeed, nations representing 80% of the world's population are not participating in the sanctions, it really is just the West versus Russia.

How are the BRICS+ doing against the dollar and the currencies of the West?

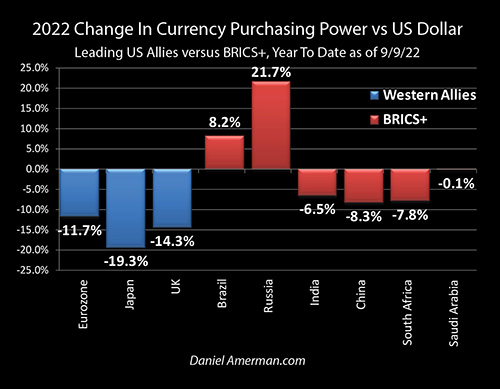

The graph above shows the BRICS (plus Saudi Arabia) and how their currencies have fared in purchasing power versus the United States and its major allies in 2022 to date. The BRICS+ are in fact doing dramatically better than the leading U.S. allies. It takes about 18% fewer rubles to buy a given number of dollars, and that means that the ruble has gained almost 22% in purchasing power versus the dollar. The Brazilian real is also up versus the dollar, while the Saudi Arabian riyal is about breakeven. And while the currencies of India, China, and South Africa are all off versus the dollar, their degree of losses is less than the Western allies of the United States.

Indeed, the single greatest currency loss in the BRICS+, the 8.3% decline in the Chinese yuang, is still substantially less than the smallest loss in the Western allies, the 11.7% relative decline in the value of the Euro. Another way of phrasing this is that all six of the BRICS+ currencies are up when compared to all three of the currencies of the major economic allies of the United States.

Now, the BRICS+ are not the entire rest of the world, and if we look at other currencies we can identify the "basket cases" in terms of reserves and inflation, that are getting hit particularly hard. These include Sri Lanka, Pakistan, Turkey and Argentina. However, in terms of power and population, the BRICS+ are indeed most of the rest of the world.

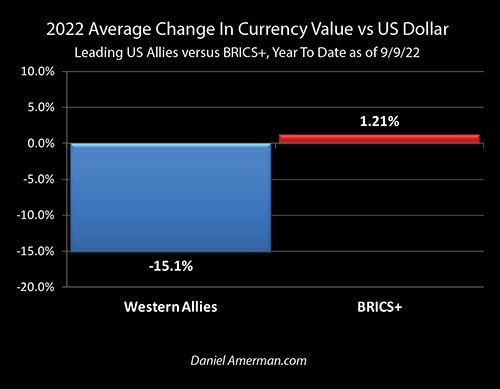

If we take a simple average of the currencies of the three leading Western Allies, then they have lost 15.1% of their value versus the dollar. If we take a simple average of the six BRICS+ currencies, they have gained 1.2% relative to the dollar. If we drop the dollar out of the middle then, the three major Western allies have seen their currencies lose about 16.1% of their value relative to the six BRICS+ nations.

That does not fit the narrative for how crises are supposed to work, the Wealth of the West is supposed to be dominant. How can this be?

Some would say that is simply a commodities cycle. Every now and then commodities prices spike upwards, and the currencies of major suppliers such as Russia and Saudi Arabia spike upwards as well. The cycle moves on, commodities return to their usual low importance, and the wealth moves back to financialization, to the banks, hedge funds, and stock markets of the West.

However, if that was all that was happening, then China, India and Brazil should not be doing as well as they are. They are getting hit by inflation like everyone else. Why are their currencies doing so well relative to the traditional economic powers of the West?

Real Interest Rates

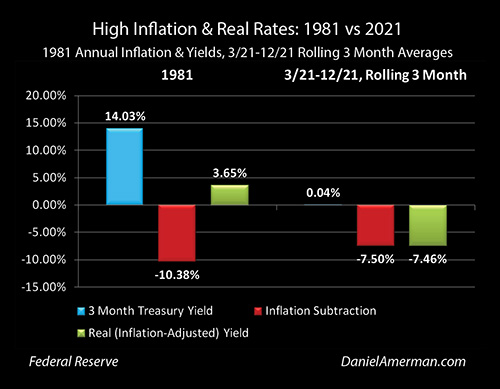

As regular readers know, since the beginning of this round of increased inflation I've been pointing out the big difference between inflation now and inflation 40+ years ago. The graph above is from an analysis from earlier this year (linked here), and as can be seen, while inflation was over 10% - interest rates were about 14%. So, those who held the currency could come out ahead even after inflation.

This applied to domestic savers - and it also applied to trade partners. When a foreign nation or company sold goods to the United States, and took dollars in exchange that it held in the form of short term Treasuries, then the interest on Treasuries would more than offset the loss of value on the dollars.

In contrast, on the right side of the graph we can see the situation from last year and earlier this year. Inflation jumped up to the highest levels in 40 years - but interest rates did not.

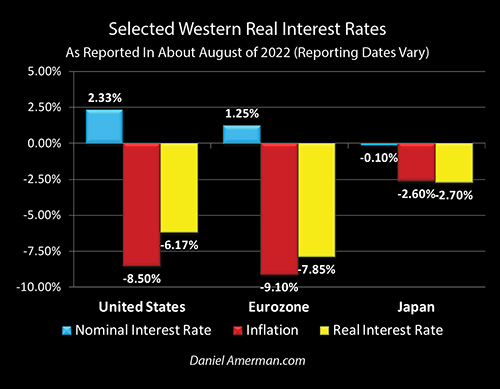

The U.S. is not alone when it comes to negative real interest rates. Europe and Japan had their own very low interest policies, with actual negative rate interest rates for them. Indeed, Japan still has a negative 0.10% nominal interest rate, and the European Central Bank had negative nominal interest rates until very recently.

The graph above shows recent central bank interest rates, rates of inflation and the resulting approximate real interest rates for the three major Western currencies. For the citizens of the United States holding money in most bank accounts, the official policy of the government is to force an outrageous 8.5% annual loss on the value of our money - and there hasn't been much we can do about it. However, even after the interest rate increases through August, the U.S. was still forcing a little over a 6% loss on our trading partners. Send exports to the U.S. that are part of the trade deficit, take short term Treasuries in exchange - and lose about 6% per year for the privilege of doing so.

The Eurozone is in even worse shape, with higher inflation, lower interest rates, and an almost 8% annual loss on the value of money. European consumers are therefore seeing the value of their savings plummet while their utility bills go through the roof. Now the governments can do that to their own populations, but they don't have the same power over other nations. Nations heading into likely deep recessions have trouble forcing near negative 8% returns onto their trading partners - that is downright insulting - and the euro is paying the price (as is the pound).

Japan has a lower official rate of inflation - so far - but for domestic reasons it is refusing to even raise interest rates to zero percent. The value of the yen is paying the price internationally. (Note the "about" in the title above, the data involves inflation and interest rates for six nations, with different reporting times, so the idea is to generate ballpark results that are _mostly_ for August reports of July inflation data, as well as mostly August interest rates. It does not include the Fed September rate increase.)

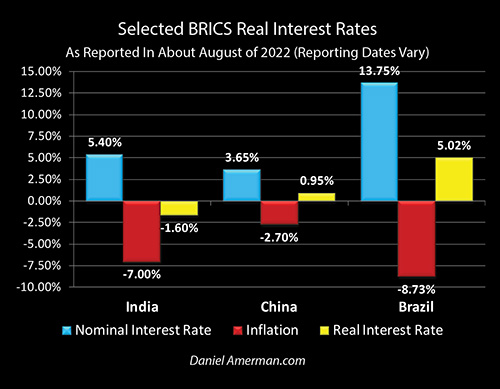

Now in contrast, let's look at what is happening with the three major BRICS nations of India, China and Brazil.

Yes, India has a major inflation problem, primarily because of its energy imports. However, India has much higher interest rates than the West, so it is at least giving some respect to its own people and to its trading partners, with a lesser negative real interest rate of only 1.60%. It takes about 6.9% more rupees to buy a dollar than it did on January 1st, so the purchasing power of the rupee is off about 6.5% versus the dollar, but it is strongly outperforming the euro, yen and pound.

China has a similar rate of inflation to Japan - but has a short term rate of 3.65%. So, even as the Chinese economy slows, it is paying a positive real interest rate of 0.95%. This is one of the reasons why the yen has lost almost 20% of its value versus the dollar, while the yuan has lost a little over 8%.

Brazil is a fascinating case that shows how the world is changing. As a Latin American country with a history of issues, the old stereotypes might be that in a time of global crisis, the Brazilian real should be crumbling compared to the almighty dollar, as well as such major industrial powers as Germany, France and Britain. Instead, however, the real is up sharply versus the dollar, and even more so compared to the very weak euro and pound.

As shown in the graph, Brazil is acting in a very different way than the West. Yes, Brazil also has a major inflation problem, with an almost 9% rate of inflation. However, Brazil's short term central bank interest rate is 13.75% - which is a little over 5% above the rate of inflation. Brazil is doing exactly what a responsible nation is supposed to do when confronted with a high rate of inflation.

1. By raising interest rates well above the rate of inflation - unlike the U.S. & Europe - Brazil is using the number one proven economic tool for bringing down inflation.

2. Brazil is treating its population with respect, by allowing them to earn returns that are well above the rate of inflation.

3. Brazil is treating its trading partners with respect, by paying interest rates that are well above the rate of inflation.

A Common But Fragile Path

What the United States, Europe and Japan all have in common is that our markets, economies and banking systems went down the quantitative easing path together. As explored in my book "The Stealthy Raid On Our Bank Accounts" (Chapter One link here), the funding mechanism was to open up backdoor access to the spending power in our bank accounts. This allowed the central banks to swell to many times their previous sizes, and they used our money to take an unprecedented degree of control over interest rates, even while funding government debts with very low interest rates.

When the central banks forced the very low interest rates, they created unusually high values for stocks, bonds and real estate in their nations. As explored in the analysis "Rising Inflation, The Taylor Rule, Rational Bubbles & The Fatal Flaw" linked here, through a process that was well understood in advance, when central banks force persistent artificially low interest rates, then "rational bubbles" are created.

As we have reviewed this weekend, the "Fatal Flaw" that was built in right from the beginning was that if interest rates go up by too much - then the asset bubbles become irrational, and could pop. If that happens, then much of the paper wealth of the West could more or less disappear - and there is no reason to think this is a cycle, the real (inflation-adjusted) losses could be permanent absent a return to very low interest rates.

When the United States flooded the economy with stimulus dollars while shutting down much of the economy and global supply chain - an enormous error was made that quickly produced the highest rates of inflation in forty years. This brought the Fatal Flaw into being, as we discussed in April and are again exploring in October. The Federal Reserve is truly stuck between a rock and a hard place, as it can't raise interest rates high enough (10%+) to control inflation without crashing the markets and the economy, but unless it does so, it lacks the proven tools to bring down inflation.

This is an extraordinary dilemma on a domestic basis, but as reviewed in this analysis it gets much worse when we bring in an externality in the form of currency exchange rates. The United States, Europe and Japan can and are forcing ruinous negative real interest rates on the people of their nations, rapidly wiping out the value of savings. While this creates major pressures, on a domestic basis they have been able to get away with it.

However, forcing major negative real interest rates on sovereign nations that are your trading partners is a very different issue. Due to the unique status of the dollar, the United States has been able to do this - but there is no overwhelming strength, and this may not continue. What the "once-in-a-generation" strength of the dollar is really measuring is the fastest collapse that we have seen in the value of the currencies of our closest allies and largest trading partners. The overwhelming financial wealth of the West is indeed in jeopardy - and there are no good solutions without making some very different choices.

Much of Europe's real economy is based on cheap and abundant fossil fuels - and that economy is in danger not only this winter, but also through 2023 and potentially 2024. This is particularly the case given Russia's partial mobilization, which may increase its troops in Ukraine by about 2.7 times. An economic implication of this choice to escalate with major reinforcements is that the chances are now up sharply for a drawn-out war that devastates European economies for multiple years - while potentially pulling down the U.S. economy via Europe for years as well.

There is a case to be made that rather than trying for an outright military win, Putin is now just trying to keep Russia from losing militarily, for a long enough time to destroy much of the economy and financial wealth of Europe - unless he is offered a deal. The blackmail can succeed, so long as the indefinite military stalemate is credible. There is also a case to be made that the common objective of Xi and Putin is to bring forward in time the end of the dollar as the unipolar reserve currency (this is their stated goal), rather than risky and expensive military conquests. Their economists are very good, and likely understand the weakness in the West created by the "fatal flaw" quite well, as well as the opening that creates for the weaponization of inflation. This is an economic war. The stakes are the wealth and power of the world. Conventional peacetime investment strategies that ignore the possibility of "gray zone" economic war - once that war is already underway - carry the risk of failing in a major way.

If Europe raises interest rates to the extent needed to control inflation and pays real positive returns to trading partners - doing something like Brazil with its 13.75% rates - then all the rational bubbles in Europe go "pop", leading to crashed markets and likely an insolvent banking system. But, if Europe doesn't do that, and attempts to pawn off its steeply negative real rates on trading partners, then the decline of the euro may still just be getting started - along with the craziness in the Eurodollar markets. It is the fatal flaw - creating rational bubbles based on very low interest rates also creates an inherent risk of devastating long-term losses if rates go up - and it was ultimately created by the European Central Bank, which has no effective solutions for this situation. And the Russian economists are well aware of this.

This is brings us back to Externalities 4 through 8, in pages of 14-18 of the workshop overview (link here). We are currently in stage 4. Stage 5 is the externality of what the European economy and banking system could do to the U.S. this winter and beyond. Our financial and banking systems are tightly intertwined, as are our supply chains, and the profits of many of our largest corporations. Europe's problems will become our problems, even if the U.S. markets have not yet started to price in the full implications.

Fed Chair Powell is making more clear than ever that he is prepared to push the U.S. economy into recession if that is what it takes to bring down inflation. This brings us to Externality 6, and the much anticipated pivot, that is the current reason for inverted yield curves. This will be an attempted Pivot like none before it, as we will be exploring. Something to consider is what happens to negative real yields and the value of the dollar - as well as the euro, yen and pound - if the advanced economies all slam rates down to zero or below, even as inflation persists while their economies are reeling? The time to work through all of this is right now, this weekend, before it happens.

**********************************

Exchange rates are an externality for the U.S. and other Western economies. The Russo-Ukrainian war, the related sanctions and the developments in that war are externalities. Physical issues such as international supply chain shortfalls and increases in energy and food prices are all externalities.

The central banks of the United States, Europe and Japan have all built high debt financial systems, with massive government debts and inflated values for securities markets, through the use of purely financial tools. The financial systems are controlled by creating plentiful supplies of cheap money, rearranging money and moving interest rates. If the supply of cheap debt runs into trouble - it can be system failure. But, yet relying on creating massive amounts of additional cheap debt as the cure for all problems creates its own potentially existential risks. This is particularly the case when it comes to external factors that aren't impressed by the prolific creation of new money, such as physical supplies and sovereign trading partners.

These types of developments were theoretical problems for years, but they have now become a multiplying group in the present. As the situation continues to worsen, we could still just be getting started compared to what is on the way in 2023. The fundamentals are changing in a way that we have not seen before in our lives, creating new risks and opportunities along the way. This is where many doom & gloomers will jump straight to a destination, as in collapse. However, the reality is more likely to be a long-term process, that will be rewriting the investment and retirement investment playbooks for us all through the 2020s - as we will be exploring at the October 22-23 "End of Abundance (?) & Eight Externalities" workshop (brochure link here).