Eurodollars And The Other Existential Banking Crisis

By Daniel R. Amerman, CFA

TweetThere are multiple threats to the financial system that are currently in play, and one of the biggest is the risk of a Eurodollar crisis or collapse. The world had two close calls with systemic bank failures in 2008, one was derivatives and the other was Eurodollars.

The Federal Reserve contained the Eurodollar crisis by opening up dollar swap lines with foreign central banks. At the peak, the Fed pumped about $600 billion in newly created U.S. dollars out to the world (primarily to save Europe), even as it was creating new dollars to enable about $800 billion in emergency lending to banks, which also had a heavily European component. On a combined basis, it was a $1.4 trillion rescue, most of which went to Europe.

It's 2023 and here we go again. The Federal Reserve is setting up multiple swap lines, possibly getting ready to create hundreds of billions of new real U.S. dollars that it may send around the world to replace hundreds of billions of (mostly) fake dollars in the Eurodollar market, to try to keep the global banking system from crashing.

Explaining those risks in advance was a key part of my October workshop, and in this analysis, I'm including my detailed presentation notes that explain what Eurodollars really are, the inherent risks for that market, and how the Fed may again attempt to rescue the unsecured debts of an overleveraged world. (Credit Suisse was an example in the presentation of what could trigger the crisis).

Eurodollar Presentation Notes (from October 2022 Workshop)

Below are my presentation notes, which were also handouts for workshop attendees. For those who attended, these are from Section 2D of the "Detailed Topic Outline", pages 67-79. Please note that these are not the presentation itself, but are merely the framework for the presentation, with greater detail in the oral presentation as well as the frequent questions from and discussions with the group.

- Eurodollars are a poorly understood hybrid of sorts, they are part currency, part shadow currency and part derivative security

- Eurodollars are a vital part of the international trade system, and they are one of the primary sources for the reserve status of the U.S. dollar

- Most international trade settles in dollars, but they aren’t US dollars, instead they are Eurodollars, and this is central to the reserve status of the dollar

- Eurodollars were the other big risk in 2008, and while not as important as the mortgage and credit derivatives, they could have melted down the global banking system on their own

- Eurodollars are not just in Europe, but are global

- That said, a disproportionate share of Eurodollars are indeed found in the European banking system

- No one knows the exact dollar amount, but Eurodollars are a huge market, many trillions of them exist, and there are also Eurodollars derivatives

- For example, Eurodollar futures are a Eurodollar derivative that are traded in the United States, in a market that is one of the largest and most liquid in the world

- Eurodollar futures are one of the most important markets in the world for determining market beliefs about interest rates

- There are currently systemic financial problems in Europe, that could cause a crash in the Eurodollar market at any time

- What happened with British gilts, and the current somewhat tenuous status of Credit Suisse are good examples, but it could come from anywhere, at any time

- If the Eurodollar market crashes, it could bring the rest of the global financial system down with it, including the U.S. banking system, possibly in a matter of days (note the word choice of “could”, rather than “would”)

- To understand how this could happen, we need to understand what most people do not, which is what Eurodollars really are, and how they create risks

- Technically, Eurodollars are treated as assets, as in U.S. dollars that are deposited in foreign accounts, whether it be European banks, Japanese banks, Cayman Islands offshore banks, or the foreign subsidiaries of U.S. banks

- To follow how Eurodollars actually work, let’s follow a simple example

- Depositor A has $1 million in a US bank, say JP Morgan, and they deposit the dollars in Foreign Bank 1 (FB1), in the United Kingdom (this could also be the UK subsidiary of an American bank)

- The dollars are cleared on the books of the Federal Reserve by reducing the reserves of the US bank by $1 million, and increasing the reserves of FB1 (or its U.S. correspondent bank) by $1 million

- At this stage, the Eurodollars are very real US dollars, thanks to the reserves held at the Fed, although FB1 is not under the regulatory control of the Fed

- This next part is the essential part, and it ties into the entirety of my book, “The Stealthy Raid On Our Bank Accounts”

- Money is debt, all dollars are debt, and US banks as well as the Federal Reserve create money by borrowing and lending money

- Foreign Bank 1 has a customer, Borrower B, who wants to use US dollars to buy something in France (or it could be Japan or Brazil)

- Foreign Bank 1 lends $1 million in US dollars to Borrower B, who uses it to pay Depositor C in France.

- Depositor C deposits the $1 million in Foreign Bank 2 in France.

- $1 million in reserves is moved at the Fed from the account of FB1 to the account of FB2 (or between the accounts of the U.S. correspondent banks)

- CRITICAL STEP: the 1 million dollars that Depositor A has on deposit at Foreign Bank 1 in the UK are no longer real U.S. dollars, but are pure Eurodollars

- When FB1 transferred the $1 million dollars in its Fed account to the Fed account of FB2, the bank gave up all rights to the U.S. dollars that were deposited by Depositor A

- What Depositor A now has is a contract with Foreign Bank 1 to repay $1 million U.S. dollars on demand - but FB1 doesn’t have the U.S. dollars anymore, it will have to go get some dollars if Depositor A wants their dollars back

- Again, this goes to heart of banking, what we deposit domestically is not held for us, it is lent out, and when we deposit internationally, the dollars are not held for us but are lent out internationally

- What those Eurodollars really are at the point is a grey area, where the many loose monetary definitions come into play, particularly when we get into shadow banking

- What we have is what is effectively a derivative security, or a derivative currency, where the contracts are tied to the source currency, and satisfying the contract will require delivering the source currency, but the contracts (Eurodollar deposits) are not themselves that currency

- In small doses, this is now the UK’s problem and has nothing to do with the Fed - and the Fed likely does not even know these specific Eurodollars even exist

- It is a UK bank, with UK regulators, and UK law governs what happens if FB1 can’t come up with the U.S. dollars to fulfill its contract

- However, as far as the markets are concerned, what we now have is a highly liquid international dollar substitute, that is conveniently no longer regulated or controlled by Federal Reserve or the U.S. government

- This goes back to the origins of the Eurodollar, which are somewhat in dispute, but the most common story is that it was the Soviet government depositing U.S. dollars in British banks in 1957, specifically to avoid the chance of the U.S. government freezing the dollars (as it did with Russia 65 years later)

- Also note that we have gone from $1 million to $2 million in Eurodollars, with Depositors A & C each having $1 million deposits, albeit with only $1 million in corresponding reserves at the Fed

- This is also where debate can come in about whether Eurodollars are an unregulated part of the dollar money supply, and if so, whether the Federal Reserve actually has control over its own money supply, and if so, whether the Fed actually has control over inflation via the money supply

- Getting back to our example, Foreign Bank 2 in France now has $1 million in reserves in its account (or correspondent US bank’s account) on deposit at the Federal Reserve

- Foreign Bank 2 lends that money to Borrower D

- Borrower D uses the Eurodollar loan to buy $1 million in goods from Depositor E, who deposits the money in Foreign Bank 3 in Switzerland

- Foreign Bank 2 moves $1 million in reserves from its account at the Fed to the account of Foreign Bank 3 (or through correspondent banks)

- There are now $3 million dollars in Eurodollar deposits, but only $1 million in dollar reserves at the Fed

- Depositors A & C each have what are effectively derivative currency contracts with their banks, where the banks have promised to pay them dollars on demand - without actually owning those dollars

- Foreign Bank 3 makes a loan of $1 million dollars to Borrower F.

- Borrower F uses the $1 million to pay for imports from a U.S. company

- The U.S. company deposits the dollars in its domestic account with a U.S. bank

- Foreign Bank 3 transfers $1 million from its account at the Fed to the account of the U.S. bank

- The original $1 million in domestic U.S. dollars has returned to the U.S. banking system and money supply, with no trace of its international travels through Europe

- However, in Europe we now have $3 million in Eurodollar deposits, and $3 million in corresponding Eurodollar loans - but with $0 in actual U.S. dollar reserves

- Depositors A, C & E each have what are effectively derivative currency contracts with their banks, where the banks have promised to pay them real U.S. dollars on demand that could be deposited into the U.S. banking system - but without actually owning those dollars

- Legally, and for regulatory purposes in the U.S. - the Eurodollars in general do not exist, they are not part of the U.S. money supply, they are not under the control of the Fed or the Treasury

- The exception is Eurodollars that are backed by reserves on deposit at the Fed, those remain real dollars even if held overseas

- It can be confusing, but a chain of loans (fractional reserve banking) between domestic banks creates real dollars in a multiplier effect, but loan chains in Eurodollars do not, it is only the dollars on deposit at the Fed that are US dollars

- Keep in mind that in this simplified example with no reserves, the original $1 million in real dollars could have traveled through ten banks, creating $10 million in Eurodollars, before being repatriated to the U.S. and re-entering the U.S. money supply

- Also keep in mind, particularly if you have or know someone who has offshore dollar-denominated accounts, that are funded using US dollar deposits, that in general terms there is a respectable chance that you are on the front-end of a potential Eurodollar chain, with your real dollars having been replaced by what is effectively a derivative currency, a contractual agreement to deliver real U.S. dollars on demand

- Whether we are talking about $3 million or $10 million in Eurodollars, in my opinion, these are definitively not real dollars (so long as they are not held in reserves at the Fed, and the Treasury and Fed share my opinion),

- Yes, there are certainly money supply implications when it comes to the supply and demand for dollars versus Eurodollars

- There are the continuous attempts by institutional investors and banks to find and exploit profitable arbitrages, playing dollars against Eurodollars (or Eurodollar futures) or vice versa, which usually brings the markets into very close alignment when it comes to things like interest rates

- However, while the real dollar and Eurodollar markets are tightly intertwined, and Eurodollars are used as substitute dollars internationally, Eurodollars are nonetheless not real dollars, but rather derivative currencies (or securities) - and that is the source of the risk that could very quickly take down the global financial system next week, next month or next year

- This is just one example of the many problems that have been created for us all by “genius” economists, bankers and corporations over the last few decades

- In the name of maximizing near term profits for banks and corporations, inherently fragile systems are created that cannot handle large systemic risks - and may lead to catastrophic events for the general public

- This can be true of derivative securities in general, it can be true for extended global supply chains - and it is true for the Eurodollar markets

- Eurodollars are a nice way of enhancing financial profits over time so long as the system is stable, and Eurodollars are considered an acceptable substitute for real dollars

- However, in the event of serious instability - nobody wants substitute dollars that are derivative contracts of banks that may be in the process of failing

- People want the real dollars, and the bank that gave them dollar-denominated deposits must (usually) give them actual dollars back - or risk insolvency

- Because this is a system wide event - this demand occurs at the same time across numerous banks

- In our example, the three foreign banks have to redeem $3 million in real dollars - but they have a $0 balance at the Fed, they have to go find the dollars

- This is what happened in 2008 - and it was a contagion event between European SIFIs (Systemically Important Financial Institutions)

- As discussed on page 224 of the manual, per the IMF the language of international financial crisis revolves around SIFIs, direct counterparty risk, liquidity and contagion, words that used to be much more commonly used and that we may be seeing more of

- As a result of the mortgage derivatives crisis - and the much larger credit derivatives crisis that was barely dodged - in a contagion event, liquidity dried up in the Eurodollar market due to the crisis atmosphere, as institutions wanted real dollars, instead of exposure to substitute dollars that were effectively derivatives of Systemically Important Financial Institutions that could be on the urge of failing

- If one major Eurodollar bank had failed due its inability to redeliver dollars on demand, the counterparty risk could have spread to the next Eurodollar bank, and the next Eurodollar bank, until the system failed

- The foreign central banks whose lack of oversight created this situation did not have the excess dollars to bail out their own banks, they could only create more of their own currencies, and while they did have the dollars to deliver in the form of their own reserve holdings of dollars, they would not do so but turned to the Fed instead

- The cascading counterparty failures of the European SIFIs - and the European branches of US SIFIs could have then flashed back over the Atlantic and taken down the US SIFIs, in a general banking collapse

- This Eurodollar crisis was in process - not as a direct part of the derivatives crisis, but as a spin-off, a contagion event, that could once started independently bring down to global financial system

- The Federal Reserve stopped the crisis - before any banks failed - by effectively flooding Europe with dollars

- Some dollars were directly lent from the Fed to European banks

- A much larger amount was provided via swap facilities with foreign central banks, providing the dollars to such banks as the ECB and BOE so that they could lend to dollars to their own banks, thereby preventing delivery failures and cascading counterparty risks

- The total was unlimited for G10 nations & the ECB, in practice a little less than $600 billion in dollars were swapped

- As an example, the Fed could swap $100 billion in dollars with the ECB for $100 billion equivalent in Euros at the then exchange, rate and there was also an expiration date where the swap is reversed for the original currency amounts plus a small amount of interest

- Because the Fed contracts to get the same number of dollars back as it lent out, it presents this as riskless

- In practice, the central bank counterparty lends the dollars to its own banks, and has to get the dollars back from those banks to repay the Fed, so not riskless

- This was a “free rider” issue, in that the US had no regulatory control or direct profits from the Eurodollar market, but nonetheless rescued the Eurodollar market from the mess that had been created, by using real dollars

- The Fed is not obliged to do so in the future, substitute dollars are not real dollars, but it is widely expected that in the event of another crisis the Fed will again provide the real dollars to cash out the fake dollars that it does not control

- The Fed & the Treasury acknowledged in 2008 that there was no legal requirement to do this, Eurodollars are not dollars, but as Geithner said at the time, this was one of the responsibilities that come with having the reserve currency for the world, with the Eurodollar market strongly supporting the reserve status of the dollar

- This happened in 2008, and it was a near miss - even if the average US investor has no idea

- The near crisis was averted, in a containment of crisis by the Fed and other central banks, and it is that containment of crisis that then determined the future course of the investment markets

- We could indeed get another round of Eurodollar crisis, and this is being exacerbated by the combination of the coming European economic crisis, and the surging value of the US dollar

- We could have business failures for Eurodollar loans that are exacerbated by the changes in exchange rates between euros (or pounds) and dollars

- When loans are denominated in a sharply appreciating currency, while revenues are based on a sharply depreciating currency, even while a global recession and energy shortages slash business revenues, then there is an inherent pressure that is created between dollars and Eurodollars

- There could be another flight to safety, where depositors withdraw Eurodollar deposits to move to real dollars, and there aren’t enough dollars in the European banking system to go around

- The Eurodollar market remains a vector for crisis, a place where the next financial crisis could start, or it could be a spin-off from a different source, a contagion, that nonetheless takes down European banks

- However, we need to be cautious about expecting a repeat of 2008, because of the many banking and regulatory changes since then - some of which were put in place specifically to prevent another Eurodollar crisis

- Indeed, in my opinion, I don’t see how one can have an informed discussion about Eurodollar risks without discussing the Basel III banking accords

(The rest of the 2D section of the presentation revolved around Basel III, bail-ins, how the new regulations have changed everything since 2008, what Bernanke got his Nobel for (it wasn't QE), the relationship with inflation, the extraordinary interrelationships between Eurodollars and bail-ins for the non-Western world, how risks are now shifted from European banks to the rest of the world in the event of systemic crisis, how BRICS+ changes things, and much more. Also please note that the presentation notes for 2D were particularly thorough, more so than most of the rest of the presentation.)

Five months later, as I look at my presentation notes, I will try another summary, with an eye on what is happening today.

Currently, all dollars are debts. But not all debts are dollars - even if they are denominated in dollar terms. The Federal Reserve and U.S. Treasury have a crystal clear definition of what is a United States dollar, and what is not. The M2 money supply definition is that dollars are deposits of U.S. commercial banks, deposits of regulated other U.S. depository institutions, and physical currency in circulation. Anything that doesn't meet that definition - isn't a dollar. Yes, there are further levels beyond M2, but they have to come back to the center to become actual bank deposits or reserves at the Fed.

What is a deposit? This wraps back around to my previous analysis (link here) of Silicon Valley Bank, insured deposits, uninsured deposits and bail-ins. A deposit is not an asset, not really, but rather it is an unsecured debt of the bank or other depository institution, that may or may not be insured. Similarly, Federal Reserve Notes themselves are the debts of the Federal Reserve. It's all debts, all the way down - but only the particular debts that are under the regulation of the U.S. banking system.

Beneath M2 is the core reality of money in its current form in the United States - and this goes to the heart of monetary economics (but not finance). The monetary base is two very specific types of liabilities of the Federal Reserve - physical currency in circulation, and the reserves of depository institutions held at the Fed. The monetary base is expanded upwards in a multiplier process via bank lending (fractional reserve banking), leading to another very specific type of liability, which is deposits at depository institutions. That's it. Anything beyond that is not dollars.

One simply can't understand money in its current form without understanding the balance sheet of the central bank, the banking system balance sheets, and the relationships between them. I know, it sounds terribly geeky, very bad for memes, but reality is what it is. That's why we start each workshop with a review of key changes in the balance sheets of the Federal Reserve and the commercial banking system. That's why in my book "The Stealthy Raid On Our Bank Accounts" (link here) I use a series of graphs of key balance sheet items for the Fed and the banks to show how the Fed used a key legal change in 2008 to reach into our deposits at our banks to bail out Wall Street, then to fund the Quantitative Easings that transformed the investment markets, and then to take our money from our own accounts to pay for the stimulus checks that were sent to us (in redistributed form). If one wants to know where the money is coming from to pay for the current $2 trillion potential bank lending program or any potential pivot - that would be us. To see what is happening - and the potential crisis-inducing limits - we have to see the specifics of how the money is borrowed into existence (not printed) and from whom.

Once this is understood, then my apologies, but it is time for a little side trip down the rabbit hole. The U.S. is implicitly now guaranteeing all $17 trillion in banking deposits. Where does the Fed get the money to do that? It's the same $17 trillion in banking deposits - or more accurately, quite a bit less, since the whole $17 trillion can't be accessed without crashing the system. Much like the stimulus checks, this is really a redistribution, as the "good deposits" from the rest of us are taken and used to cash out the "bad deposits". That is exactly what is happening with Silicon Valley Bank. Each time this same "trick" is used, the margin remaining before the "crackup" point is reached is reduced - this is not "infinite printing" by any means.

Those are just the real dollars. Once we get away from real dollars, we do have two vast and highly leveraged but poorly regulated financial ecosystems that are denominated in dollars, but are not dollars. One is the shadow banking system, where financial institutions and corporations that are not banks (such as hedge funds) enter into multiple layers of what can be highly leveraged lending - but that do not appear on the balance sheets of the central bank or depository institutions. An example of shadow banking risks is the repo market that nearly crashed in 2019 (analysis link here), before it was rescued by Federal Reserve intervention. If the Fed had not successfully intervened we would have likely had the Global Financial Crisis of 2019. It could also be argued that the derivatives crisis of 2008 was a form of shadow banking, with participants taking hundreds of trillions of dollars in highly leveraged off balance sheet risks, that were not under the control of financial regulators.

Outside of the United States, you can and do have many trillions of dollars of debts that are denominated in U.S. dollar terms - but they are not actual dollars. Most Eurodollars have no existence in the U.S. financial system, they do not exist on the balance sheets of the Federal Reserve or U.S. depository institutions. They must find a way to become real dollars, if they are to be spent in the United States - or if a Eurodollar counterparty demands payment in actual dollars into their (or their correspondent banks') account at the Fed. That is where the Fed swaps in a Eurodollar rescue come in, new real U.S. dollars are created to replace the fake dollars, so that they can be deposited into the U.S. financial system, thereby avoiding cascading counterparty failures.

Strange and awkward as it may sound, this is how much of international trade works, how payments are made for goods and services between different nations and companies. Eurodollars also have a history of coming within days of potentially crashing the global financial system, in 2008.

The United States not only tolerates this situation, but actively encourages it. World trade occurring in dollars is a critical reason for why the U.S. dollar is the global reserve currency. During times of crisis, the demand for real dollars leads to rapid appreciation versus other currencies, and this creates lower rates of inflation in the United States while increasing the rates of inflation in other nations. Trade occurring in dollars also gives the United States extraordinary international power because it enables the ability to interfere in international trade between other nations around the globe, which is currently being used in the attempt to destroy the Russian economy.

There is a major price when the dollar is being used for highly leveraged and highly profitable risk taking not just by U.S. commercial banks, but also the shadow banking systems around the world and in the Eurodollar market, and that is knowledge and control. It's not just that banking regulators don't control these huge markets, but the Federal Reserve and Treasury don't even know what risks have been taken. Nobody knows.

Vast sums of money are made because of this setup, with the politically connected wealthy insiders benefiting the most. So, it never gets fixed, and here we are again, with the financial safety of the vast majority of the U.S. population covering the risks from shadow banking, Silicon Valley venture capital, and Eurodollars around the world - but without participating in the lucrative profits that are the result of those risks. The current international financial world doesn't just have moral hazards, the world is arguably based on those hazards.

********************************************

I'm considering putting on a workshop in the Indianapolis area on one of three weekends: April 29-30, May 6-7, or May 13-14. If you are interested, please let me know, including weekends that do work for you and weekends that do not. The actual weekend selected would depend on participant requests - with the requests of regular attendees having particular importance - as well as venue availability.

During 2008, I gave four workshops. Three were before the crisis, and a lot of value was delivered. One was the week after the Federal Reserve rescued the system by initiating Quantitative Easing - and that workshop was particularly good. For those who were there, I explained how the Federal Reserve had just fundamentally changed the nature of the U.S. dollar the previous week, the rules that govern how money works, and that remains true 15 years later even if most people are still not aware. I'm still hoping 2023 will end up being "no major crisis", but there is a great deal to be concerned about, and that will be true either before or immediately after any potential crisis.

This would be a two day workshop, with the first day being entirely devoted to understanding what is then currently happening in the economic and financial world, as well as the related threat analysis (numerous threats analysis might be better wording). We will start with money and the Federal Reserve balance sheet - because that is how we can see what the Fed is actually doing, and is what determines the limits of what the Fed can do. As we will explore, even in these past two weeks the Federal Reserve has undertaken an emergency rescue every bit as large (on a weekly basis) as it did in the fall of 2008, but in a different form at this time, with different risks.

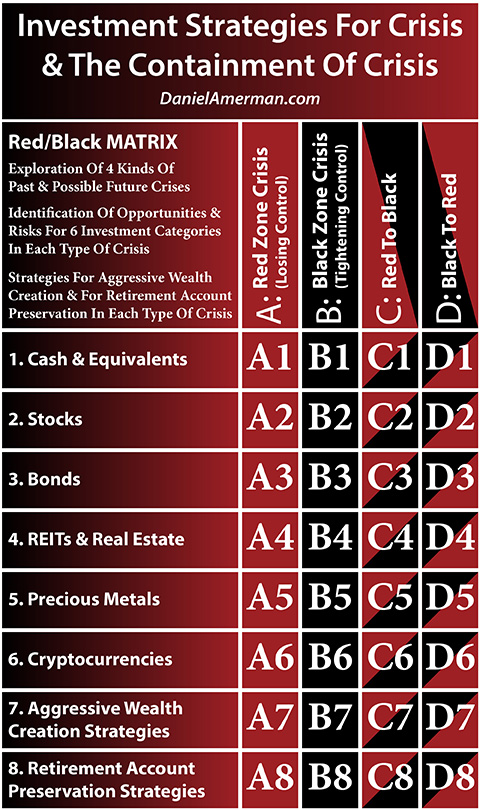

The second day would be entirely devoted to solutions, and this type of situation is why I developed the Red/Black Matrix (shown below) and the "Investment Strategies For Crisis & The Containment Of Crisis" educational videos. We are in a crisis - and global central banks are attempting to contain the crisis. If the crisis "wins" then everything changes for stocks, bonds, real estate and precious metals, as well as potentially cash itself when it comes to the reserve currencies. If the containment of crisis "wins", then the tools used by the governments to contain crisis are likely to profoundly impact and change investment markets from 2023 forward.

Indeed, there is a strong case to be made that there were not any "normal" markets between 2008 and 2023, as the central banking containment of crisis interventions with quantitative easing, very low interest rates, and the assumption of a "Fed Put" have fundamentally distorted investment prices and returns, while creating a "rational bubble" of elevated asset prices that is now in jeopardy. In my opinion, there is simply no way to understand the risks and opportunities without understanding how the attempts to contain crisis - and the limitations on those attempts - will distort the investment markets.

We will use the Red/Black matrix to take a broad look at what is happening with all the major asset categories, including wargaming how both crisis and the attempts to contain crisis may be not only creating major risks, but are also creating potentially exceptional opportunities. We will also take close looks at real estate asset/liability management strategies in 2023, as well as the use of hedge/ratio strategies for gold and stocks.