Bail-Ins & Real Assets vs Liability-Based Assets

by Daniel R. Amerman, CFA

Bail-ins are a new way of "rescuing" banks and other financial organizations that have been sweeping around the world, even as they rewrite the rules for investors and depositors.

Bail-ins have already occurred in Cyprus with their banking system, as well as with the retirement system in Poland. The European Union is on board in rapidly implementing bail-in standards, and they are under intensive scrutiny by regulators in the United States, with ratings on some major US bank securities already being changed in anticipation of the potential for bail-ins. Canada has announced its intentions in this area as well, and Japan is moving rapidly.

This has all been happening so quickly that investors and the financial world have not had a chance to truly figure out what is happening, or to understand the potentially revolutionary implications for investments and savings.

In this analysis we will:

1. Identify two extremely expensive problems facing nations that could threaten the solvency of the global financial system in the event of another crisis.

2. Explore just what exactly a bail-in is, and what is so different about this type of "rescue".

3. Show how from a governmental perspective bail-ins "solve" (and quite cheaply too) the otherwise impossible combination of the two extremely expensive problems, and why this creates powerful financial incentives for nations to use bail-ins in the event of crisis.

4. Explore the saver and investor implications of bail-ins and how transferring the costs of global financial rescues from nations and taxpayers to investors and depositors may sharply impact investment risks and returns.

5. Explore the fundamental conflict between decades of traditional financial wisdom – and this rapidly emerging new reality of bail-ins and risk transfer.

6. Discuss how bail-ins create a very sharp contrast between straight-up assets that are not the liabilities of anyone else – such as real estate, precious metals and stocks – versus the purportedly safer assets such as deposits, bonds and annuities, which are in fact liabilities of the global financial system.

(Please note that this analysis is one part of a group of three resources on bail-ins, which together provide individual investors with an in-depth, straightforward analysis of them. The first resource discusses the bail-ins of banks and retirement systems that have already occurred. The second resource, using an International Monetary Fund staff discussion note as a base, goes into much more detail on the major issues which create the incentive for the use of bail-ins.

This third resource concentrates on the potentially extraordinary future implications of bail-ins for investors, and how they may ultimately turn upside down the conventional wisdom about what "safe investments" truly are.)

Why The Need For Bail-Ins

While positive headlines abound in the media about rising stock markets and improving conditions, as it turns out, the International Monetary Fund staff sees a quite different picture. What they see are serious ongoing threats to the global financial order that are being caused by the major financial institutions around the world – which they refer to as SIFIs (systemically important financial institutions), otherwise known as "too-big-to-fail" institutions.

The first major threat is "direct counterparty risk", with the SIFIs having an extraordinarily complex web of hundreds of trillions of dollars of interlocking commitments and contracts between themselves. The failure of a single SIFI could trigger a chain reaction of losses that would spread like dominoes, knocking down one SIFI after another – as well as other banks and investors around the world.

The second major threat is "liquidity risk". Since SIFIs rely heavily on borrowing, if the sources of their funds flee in the event of trouble, this would leave the SIFIs potentially insolvent unless they could quickly sell assets to cash out departing lenders, which would rapidly drive down prices, and with everyone selling assets together this could create a global "fire sale" on investments that's enough to crash the world's financial system within a matter of days.

The third major threat is one of "contagion risk", where the failure – or even looming failure – of one major institution introduces a psychology of panic into the marketplaces, which by itself is more enough to bring down the global financial order. After all, perception can and does create reality when it comes to financial markets.

Because of those three threats, a serious danger facing the nations of the world is that if there is another round of financial crisis that envelops the world, then the deeply interlinked major financial institutions are all exposed to each other. And if even one or two go into insolvency – they could all go down.

This financial collapse scenario – if allowed to occur – would be extraordinarily expensive for the nations of the world and the global economy.

A second danger is that according to the IMF, there is an even greater consolidation of assets into these "too-big-to-fail" banks and financial institutions than there ever was before the financial crisis of 2008. As a result, this has created "unsustainable public finances", where the extraordinary cost of conventional bail-outs potentially threatens the solvency of the nations themselves.

If multiple major financial institutions need to be rescued in order to prevent a global financial collapse, and conventional bail-out methods are used, the costs could be so high as to create an impossible situation for the already heavily indebted nations of the world.

How Do Bail-Ins Work?

Just as with a bail-out, a "bail-in" is rooted in the premise that there are certain entities which are too important for the well-being of the general public to allow them to go into bankruptcy or to be liquidated. To better understand how bail-ins work and what makes them different from bail-outs, let's begin by considering assets, liabilities and net worth.

With an individual, we start with the value of our assets, we subtract the value of our debts, and the excess of assets over liabilities is our net worth.

In the case of a corporation, we start with assets, we subtract liabilities, and we are left with shareholder equity.

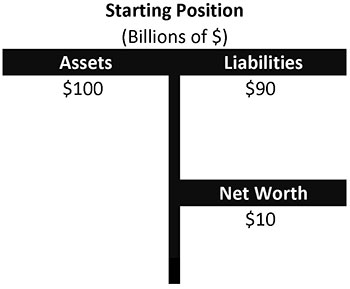

As an example, let's assume a bank has $100 billion in assets. We'll also assume this bank has $90 billion in liabilities. Subtracting $90 billion in liabilities from $100 billion in assets leaves a net worth of $10 billion, or 10% of assets.

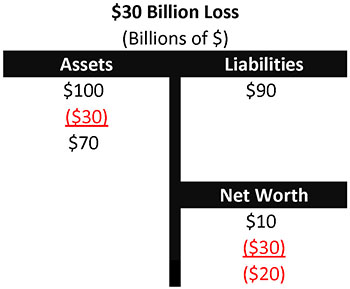

Now what happens if this financial institution, in the throes of a new financial crisis and an environment of counterparty risk, liquidity risk and contagion risk, sees a reduction of $30 billion in the value of its assets?

Well because the assets are now only worth $70 billion, and the liabilities still total $90 billion, all positive net worth is wiped out, and the institution has a negative $20 billion net worth. Without interventions, then, the financial institution is insolvent.

The owners of the liabilities would hope to ultimately recover $70 billion from the proceeds of liquidating the assets in bankruptcy, leaving them with a loss of $20 billion on the $90 billion they had invested.

Now again the concern when it comes to SIFIs, or too-big-to-fail-banks, is that a single bank going down could set off a chain reaction that brings down other large financial institutions, which like dominoes then spread the insolvencies still further around the world.

Of course this seemingly-apocalyptic danger isn't the slightest bit theoretical, for this is what happened in 2008. A full-scale global meltdown was in process until it was stopped by massive monetary creation in the form of quantitative easing to contain the liquidity risk, combined with the bailouts of some of the endangered financial giants which threatened the world with counterparty risk.

Specifically in the United States, financial giants Fannie Mae, Freddie Mac and AIG were bailed-out because their financial failure would have created a cascade of counterparty-induced derivatives losses which could have brought down Wall Street and much of the global financial order in a matter of days or weeks.

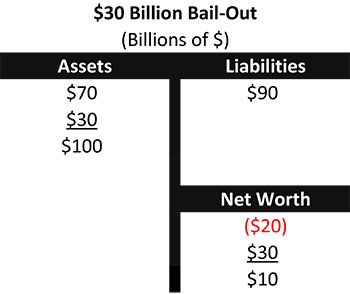

Returning to our example, the traditional method for handling the bank's $20 billion shortfall and averting its insolvency has been to institute a bail-out.

With a bail-out, the government or banking regulator or insurance fund would either inject $30 billion in assets into the failing institution, or purchase $30 billion of assets at non-market levels (as with TARP), or completely takeover and guarantee everything.

And we would once again have $100 billion in assets, $90 billion in liabilities and $10 billion in net worth, with regulatory capital of 10% – and a solvent institution.

But because it requires coming up with $30 billion in this case for asset purchases or to contribute to the bank, an asset-based bail-out is extremely expensive for the government.

And as covered in detail in the IMF paper, when we consider the already severely stressed and heavily indebted sovereign nations around the world, they simply can't afford at this stage to do major bail-outs of too many of their financial institutions.

So that would appear to put the governments as well as the too-big-to-fail financial institutions around the world in an impossible situation.

On the one hand, they can't let an institution go insolvent or it could trigger global financial collapse. Yet on the other hand – they really don't have the money to bail them all out.

For an individual or a corporation, there would seem to be no viable way out.

The Loophole

There is, however, a loophole – if a sovereign nation controls the very rules and laws themselves. Which, of course, they do.

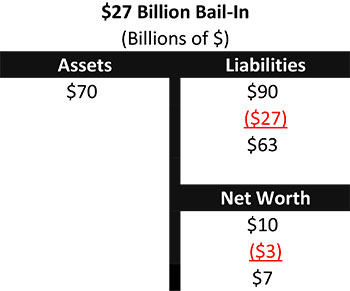

And that is not to increase the assets of the institution, but to reduce its liabilities.

So let's come back to our prior example. If there are $30 billion in losses, they are taken and the institution shrinks to $70 billion in assets. Assuming 10% in equity is still needed to make it financially sound, we take $70 billion in assets, we subtract $7 billion in equities which maintains our 10% regulatory capital, and that means we can't have any more than $63 billion in liabilities.

The loophole consists of simply wiping out $27 billion in liabilities, such as bonds and deposits. This reduces the liabilities from $90 billion to $63 billion. And when we compare $70 billion in assets with $63 billion in liabilities, this means there is $7 billion in equity, which is 10% of assets, and the institution is considered to be financially sound again. (The $7 billion in new equity may be given to the liability holders in exchange for the loss of their $27 billion in investments.)

Now from the perspective of the sovereign nations, the banking regulators and the major financial institutions themselves, this is more or less of a miracle solution, and possibly the only way out for them.

The banks don't have the assets anymore; that's the problem.

The nations don't have the assets; that's the problem too.

Given that net worth is the difference between assets and liabilities, the loophole is using the power of the law to wipe out part of the liabilities – without going through bankruptcy (as bankruptcies trigger global counterparty risk).

Going From Impossibly Expensive To Free

Simply put, then, with a bail-out the government has to come up with $30 billion. This can be a major limitation when it comes to actions, particularly when there are dozens of institutions at risk, with many of them being much larger than our example.

With a bail-in on the other hand, the government doesn't have to come up with anything.

The difference is so extraordinarily important it bears repeating:

With a bail-in, the government doesn't have to come up with anything!

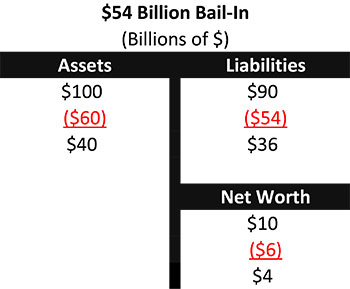

If the loss incurred is $60 billion instead of $30 billion, then just wipe out $54 billion in liabilities and you are left with a safe and sound financial institution: $40 billion in assets, $36 billion in remaining liabilities, and a nice, safe 10% or $4 billion in equity.

So, there aren't any limits.

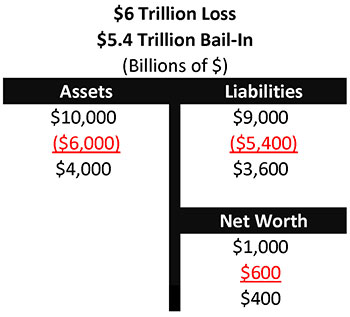

Even if one hundred financial institutions lose an average of $60 billion each for a total of $6 trillion – there is no cost to the government for the rescue. Just reduce the liabilities by $5.4 trillion, and problem solved – with no need to increase the deficit or raise taxes.

To understand this is to understand why bail-ins have so rapidly gone from theory in 2012, to the first real-world bail-in in Cyprus in 2013, to the rapid development of bail-in methodologies on a global basis in 2013 and 2014.

The Source Of The "Free" Miracle

Now let's more closely examine the real source for this miracle cure for financial crises, which allows for rescues without limit, and which doesn't require raising taxes or increasing the deficit.

We'll do so by considering something most people rarely do, which is what savings really are.

When we make a deposit at a bank, we are taking our assets and providing them to the bank for its use.

What most of us usually don't think about is that the moment that deposit occurs, a new liability is created – for the bank. It's a liability simply because they will have to pay us back. So it is their promise to pay us back – their liability – that is our asset, that is our savings, and is our source of security.

This is how banking generally works – it is all based on OPM, or other people's money. That is, the bank takes people's money in through various means such as savings deposits, checking accounts, certificates of deposit and bonds – each of which becomes a liability for the bank – and it invests that money.

Our money is gone at that point – it has been spent on investments. Those investments, whether loans or securities, then become the assets of the bank.

And traditionally – absent a bail-out – if the bank does a bad job of it and the investment assets become worth less than the liabilities, then the financial institution becomes insolvent, everyone there loses their jobs, the shareholder's stock investments get wiped out, and depositors and other lenders (or the bank deposit insurance fund) take a hit.

Now with bail-ins, the drastic shift in the traditional perspective is that it is our assets that are recognized as being the threat to the too-big-to-fail banks.

With the old bail-out paradigm, bankruptcies are triggered by assets falling in value. With the new bail-in paradigm, it's not falling asset prices that cause bankruptcies – but instead it is having too many liabilities that causes the bankruptcy.

And because of the importance of these financial institutions and their extremely powerful political connections, what has been figured out is that governments can deal with the threat of insolvent banks by dealing with the threat posed by their liabilities.

Once we accept that the liabilities which threaten the global financial order are the same thing as our assets and our deposits – then we need to accept that with the new bail-in paradigm, in the event of a major financial crisis things may not work at all like they used to, and it could be our savings that pay the price.

Five Steps To Understanding The Twisted Logic Of Bail-Ins

To help more clearly understand just how completely bail-ins can invert the traditional wisdom when it comes to "safe investments", consider the five steps below.

1. The reason that liability-based assets such as bank deposits, bonds and annuities are considered so very safe for investors – and particularly suitable for older savers – is that the financial institution is absolutely obligated to pay us back.

2. In the event of a crisis, if the financial organization runs into difficulties and no longer has the assets to pay its obligations – then that very obligation to pay us back our money in full directly threatens the survival of the organization.

3. When faced with a global financial crisis, the heavily indebted and financially stressed nations of the world have an overwhelming incentive to prevent a collapse of the financial system – but lack the assets to bail out the financial system.

4. An alternative – and cost-free – method of saving the global financial order is to remove the source of the risk, which is that absolute obligation to pay us all our money back.

5. It may therefore be presented as being in the best interests of mankind for depositors, bondholders and annuity owners to give up their expectations of getting all their money back.

Rethinking Assets & Safety

The global movement towards bail-ins in dealing with financial crisis obviously creates a fundamental conflict between the needs of society in this case, versus decades of almost unquestioned assumptions among the financial community and individual investors.

It also creates a sharp bifurcation between two entirely different categories of assets.

The first category of assets has value in a fundamental sense, but no fixed value. A financial asset like a stock which represents an ownership interest in a corporation is one example.

Tangible assets are another example, where the asset is something we can physically reach out and touch, such as real estate or precious metals.

What they all have in common is that you own an actual asset. What they also all have in common is that you never know for sure what you can sell them for in the future – as the price of the asset is likely to bounce up and down with the markets.

The second category of assets is when somebody – often a large financial corporation – owes you money. This could be a deposit, or a bond, or an annuity. It is the promise to pay you that is the source of value to your asset.

Now we might on a common sense basis say that we would rather own an asset that's real, instead of relying on the promise of someone else to pay us back.

But with the traditional financial theory of recent decades, what have been considered the safest of all assets for investors have been assets that are really the liabilities of other organizations, the promises to pay us back. And the reason they're deemed to be so particularly safe is that this promise to pay us back has a fixed value (in nominal terms at least, before inflation).

We know the principal amount that will be paid to us. And in some cases, we know the interest that will be paid to us. And this is intended to bring a certain amount of security to us when it comes to covering calculated monthly expenses like housing, or food or transportation in retirement.

However there's an inherent assumption with that, which is that it is highly reliable – indeed practically guaranteed – that we will be repaid.

That is, assuming that we're investing our money conservatively, perhaps through a highly rated financial organization, or in using a large mutual fund to achieve a high degree of diversification through our 401(k) accounts – if done properly, it is supposed to be near certain that we're going to get our money back.

But when it comes to preserving the financial order, what has been recognized by the governments of the world is that the cheapest form of financial rescue is quite simply to wipe out the value of some of the liabilities – without going through bankruptcy.

So what this tells us is that when we provide our money to major financial corporations, we may now be inadvertently entering into a direct and powerful conflict of interest, where in the event of crisis the government has very strong financial incentives to rewrite the rules so that we don't get repaid all of our money.

On the other hand, when we purchase a straight-up asset such as real estate, precious metals or stocks – which have fundamental value, and more importantly are not the liability of anyone else– then there is no conflict of interest.

Therein lies the stark contrast between the two categories of assets that may turn out to be the most crucial consideration of all in the years ahead - choosing assets where it is not in the direct financial interests of governments and corporations to reduce the value of our investments in the event of crisis.

Unfortunately, these potentially deep conflicts of interest between governments and investors are not even considered by most conventional investment strategies. To a large extent traditional financial theory is instead basically moving along on inertia and autopilot at this point. We have unquestioned assumptions with regard to the safety and security of the overall financial order that have been driving traditional financial planning for many decades.

Meanwhile, the governments tell us through words and press releases that everything is fine, but when it comes to actions, procedures enabling bail-ins are spreading rapidly around the world because the governments know that's not truly the case.

And what may seem like this minor technical distinction between "real assets" and "liability-based assets" could be one of the major determinants of investment security – or insecurity – for many tens of millions of investors around the world.

(Please note, however, that having a liability outstanding as part of an asset/liability management strategy is 180 degrees different from owning a liability-based asset. Indeed, there are some real assets which if financed with a liability, have the ability to strongly outperform either a liability-based asset or a real asset with no liability.)

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.