How Inflation Changes Retirement Benefit Choices

By Daniel R Amerman, CFA, MBA, BSBA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Level Three: Separating Inflation From Benefit Increases

We're not done yet, however, because we have another crucial level of financial reality to consider. Which is that particularly since the Financial Crisis of 2008 and the ensuing Great Recession – the annual increases in payments to Social Security beneficiaries have not been keeping up with the rate of inflation.

Let's also consider the fact that the heavily-indebted US government has some major financial problems. We should thus allow for the possibility that Social Security payment increases may continue to be less than the rate of inflation for potentially decades. How does that affect our decision?

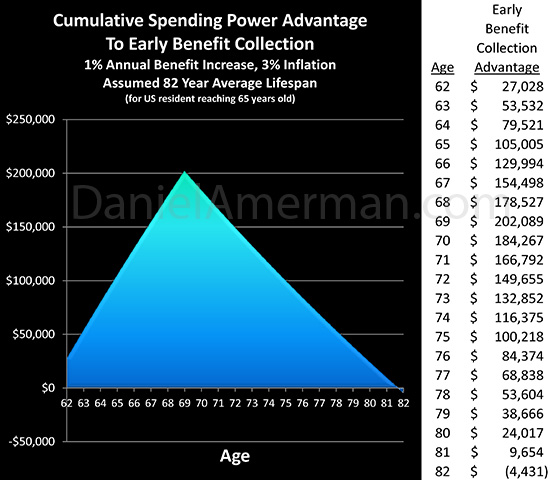

In this next graph and table, we take a look at an average 1% annual increase in benefits, combined with a 3% annual rate of inflation. So inflation is still relatively low – about the historical average – and while there are benefit increases, they just don't quite keep up.

As shown – the triangle representing the advantages to delaying Social Security benefits almost entirely disappears (leaning in and squinting helps, if you want to actually see it).

And with it, so does the "six figure advantage" to deferring collection, with the starting $175,000 advantage having been reduced to a mere $4,000.

In other words, for someone living an average lifespan, if we just more or less assume that the recent past continues to repeat itself – virtually all of the advantages from choosing to defer the collection of benefits have disappeared.

Level Four: Considering The Bigger Picture

There is a much bigger picture as well, that is quite widely accepted among the US population. That is, it's well known that the US government is already in a great deal of trouble with the national debt, and the size of unfunded obligations to meet Social Security and Medicare promises are much larger than the official national debt.

So, many fellow Boomers from my generation have been assuming for many years that we won't benefit from Social Security like our parents' generation did. Oh, we will hopefully get something. But it likely won't be as much, and the further out in time we go, the more true this may become.

How do we take factors like this into account?

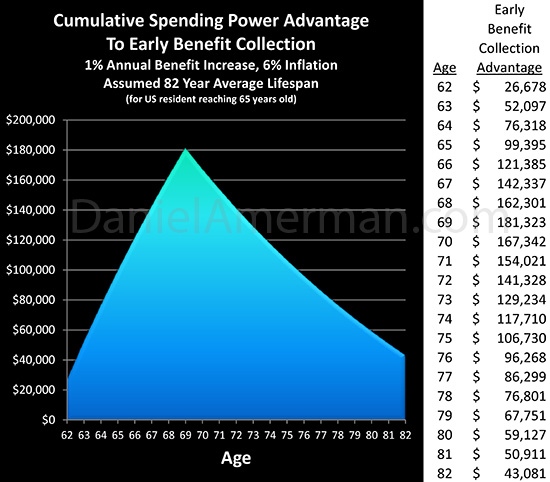

One way is as indicated in the graph and table above. Assume a moderate – but not high – 6% rate of inflation is used to reduce the real cost of the government's otherwise unaffordable retirement promises, and assume that there are 1% annual increases in benefit payments that keep the political lid on, but which are not enough to maintain standards of living.

With this approach, which many would find to be realistic – the whole analysis changes. There is no advantage whatsoever to waiting until such time when the system can no longer afford to pay us. Quite to the contrary, there is a strong advantage to immediately collecting every dollar we are legally entitled to, until such time as the rules do change.

Now it should be noted that with this way of looking at the future – chances are we won't get the smoothed lines shown in the graph. Instead there is more likely to be a series of quite sharp changes in the rules, when the economic realities require it.

But the bottom line remains the same: the simple Level One analysis assumes a financially healthy government that can meet every penny of retirement promises, with no changes in the benefit rules in the years ahead. Remove that assumption, and the six figure advantage to waiting disappears, yet again.

Better Information Means Better Decisions

While I take issue with the "Simple Dollar" approach that we started with at Level One, I also do recognize that this type of analysis is the current norm, and will likely remain the norm for how information is presented to the general public.

If you read about stock market averages, or real estate prices, or financial records in almost any category – they are typically not adjusted for inflation. As reviewed here for multiple asset categories and here for stocks in particular, this means that the public is continually presented with information about record markets and record prices, when in reality what they are really reading about is record lows for the purchasing power of the dollar.

As someone with over 30 years of professional experience and 9 years of formal financial and economics training, this is quite troubling, because I believe that this common practice delivers consistently bad information to the general public, which creates misleading perceptions and in turn leads to bad financial decisions. That said, like many of you who are reading this analysis, I have reached the age of accepting that the world is the way it is, and is exceedingly unlikely to function in what in my personal opinion would be a more logical manner.

Yet, there is nothing theoretical or academic about what we have just reviewed – for it doesn't get any more real or personal than the decision about what age to begin collecting benefits and how that will affect the daily standard of living for the rest of one's lifetime.

Retirees on fixed incomes which are substantially lower than their pre-retirement income are intimately familiar with the concept of spending power. More than any other age group, they feel the tangible effects in their daily life from what happens when the number of dollars in their retirement checks don't rise, and the number of dollars in their savings account don't increase – but their expenses do.

There is no fooling a retiree on a low and fixed income about what happens when the government decides that there isn't quite the room in the budget to give retirees an increase this year that fully keeps up with the rate of inflation. And it makes the same decision the next year. And the next year after that.

Given that even low levels of inflation can have a significant impact on the bottom line of the actual standard of living in retirement – accurately including the effects of inflation is indispensable when it comes to gathering the best information and making informed decisions. It is unfortunate that millions of people are unknowingly relying upon simple analyses which are incapable of accurately capturing the corrosive effects of inflation over time, but instead use inflation to create a phantom income that doesn't really exist in spending power terms.

I strongly believe that better analytical methods support better decisions, and I hope that you have found this analysis to be of help to you.

What you have just read is an "eye-opener" about critically important retirement decisions. In this case it was about how explicitly including the number one threat to future retirement standards of living – inflation – inside the benefit decision process, can change everything.

What you have just read is an "eye-opener" about critically important retirement decisions. In this case it was about how explicitly including the number one threat to future retirement standards of living – inflation – inside the benefit decision process, can change everything.

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

Another investment-related "eye-opener" (linked here) explores a hidden and powerful redistribution of wealth, showing how governments can use the 1-2 combination of their control over not only interest rates but also inflation, to actually take wealth from unsuspecting private savers in order to pay down massive public debts.

Another investment-related "eye-opener" (linked here) explores a hidden and powerful redistribution of wealth, showing how governments can use the 1-2 combination of their control over not only interest rates but also inflation, to actually take wealth from unsuspecting private savers in order to pay down massive public debts.

An "eye-opener"

tutorial of yet another kind is linked here, and it shows how much of what the public believes to be true about stock market history - is merely an illusion, which also just happens to facilitate the redistribution of wealth.

An "eye-opener"

tutorial of yet another kind is linked here, and it shows how much of what the public believes to be true about stock market history - is merely an illusion, which also just happens to facilitate the redistribution of wealth.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.