Euroskeptic Victories Raise Global Risk Of Return To 2012 Crisis

by Daniel R. Amerman, CFA

Overview

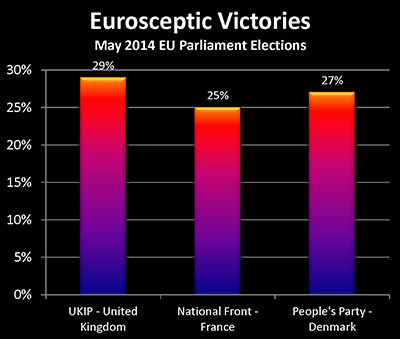

In one of the most stunning political developments in recent decades, the group of political parties that are being collectively called "Euroskeptics" won more votes than any other individual party in several major European nations in the May elections for the EU Parliament.

In the UK, Nigel Farage's UK Independence Party, which advocates immediate withdrawal from the European Union, led all other political parties by winning 29% of the vote. In France, Marine Le Pen's anti-euro and anti-immigration National Front party, with their slogan of "France for the French", also received the highest percentage with 25% of the votes. In Denmark, the anti-EU and anti-immigration People's Party received the most votes as well, with 27% of the total.

According to Reuter's:

"Across the continent, anti-establishment parties of the far right and hard left more than doubled their representation, harnessing a mood of anger with Brussels over austerity, mass unemployment and immigration."

The direct and immediate implications of these results may not be that great, given that the combined votes of the establishment center-left and center-right parties will still be sufficient to control the EU parliament on any matters where they agree to act as a coalition. However, as explored herein, there has been a shifting of the odds when it comes to the likelihood of different possible financial futures occurring, with global financial implications over the long term that could be just as powerful as the potential political earthquake in Europe.

The economies of individual European nations such as Spain and Italy are every bit as "sick" as they were in the spring of 2012, when Europe was in a deep financial crisis. What has changed is the increased powers of the European Central Bank to intervene, which has allowed for an artificial stability to be forced into the markets that is not based on fundamental economics or returns – but rather on the strength of the central banking actions.

However, the rise of the Eurosceptics imperils the tools by which this artificial and dysfunctional stability is maintained, which means that the chances of Europe's returning to where it was in 2012 – or worse – are up sharply. If this were to happen, it would in turn sharply increase economic and financial risks in the United States, as well as Canada and Australia.

A Potential Developing Political Crisis

In the eyes of national governments and Eurozone bureaucrats, the "script" for the future of the EU was supposed to be following a quite different path. The plan has been an ever tighter integration of Europe politically, economically and financially as over time more and more of the individual member states' sovereignty was yielded to an ever more powerful centralized European government.

That election results indicated voter rebellion against these objectives on a stunning scale must be quite a shock to those who had been assuming that there was an inevitability to this path.

Though of course, as was immediately pointed out by media outlets as well as political commentators, an extraordinary rise in the polls and winning the largest votes of any single party is not at all the same thing as taking power. Indeed, while these Eurosceptic parties won more votes than any other single party, they're still a long ways away from the majority. And as long as the more mainstream parties are willing to work together in the EU Parliament, the Eurosceptics may have very little effective power at all. At least in this round.

That notwithstanding, let me suggest that the bigger and far more fundamental issue is that the voters have not only spoken, but shouted. And when it comes to something arguably much more important, which is not the elections for the EU parliament, but rather the future domestic elections which will determine the national governments of the countries in which the Eurosceptics did so well – we may be just starting to see what the implications will be.

That is, what truly matters may be not who the United Kingdom voted for as their EU parliament representatives, but rather who the UK votes for in the election of the next UK parliament, and the French in their next national election, and so forth.

Even with not having won majorities in any nation, there are two fundamental ways in which these parties can change the course of Europe to a quite different direction than where the EU leadership has been envisioning.

One possibility is that at a future point, one or more of the European powers will have the Euroskeptics in a coalition party on the national level.

Which could give them a very great say indeed, not necessarily on an immediate outright withdrawal from the EU or the euro, but on a reduction in power and a reduction in integration rather than moving towards further integration.

The other impact can be seen immediately in France, where President Francoise Hollande, who was all in favor of raising as many taxes as possible two years ago, is now quickly backing away from that position in view of what voters are indicating.

So as the more established parties within the European governments jockey for electoral control, there will be a powerful temptation to shift platforms, at least to some degree, towards the demands of the Euroskeptics, in trying to capture as many of those angry voters as they can for their own party, and their own ability to rule in their particular nations.

This makes it very difficult – given the need for unanimity and the number of nations that are involved in this revolt – for the European Union or the European Central Bank to further expand their powers. Indeed, there is a quite respectable chance that as part of the price of a coalition government, or a changing of party platforms to try to attract these voters, that the powers of the EU and the powers of ECB may start to lose strength.

Remembering Europe In 2012

It is all too easy to forget just how bleak things were looking for Europe – and the rest of the world economy and financial system – in May of 2012. Spain, Italy and Greece were all in enormous trouble. There was considered to be a sharp risk that one or more of those nations faced an economic and financial system meltdown because they simply owed more money than they could afford to repay, even while their economies were very weak.

Now bailing out Greece is one thing. But as was being frequently discussed two years ago, bailing out Italy or Spain (at least in the usual sense) could be near impossible for the rest of Europe to do. Thus a crisis was rapidly building which seemed to have no viable answers that many could see.

Many gloom & doom commentators were at full volume about the purportedly inevitable collapse that was rapidly approaching, even while an increasing number of mainstream commentators were sharing their growing unease about the possibility of something very bad indeed happening to the global financial system in the coming weeks and months.

At the very same time, I was showing attendees in my Overcoming Monetary & Political Risk workshops how the whole crisis could be made to "go away in a day".

I explained in advance what the solution would likely be, which was a radical increase in the powers of the European Central Bank and its ability to intervene in national bond markets – with a potentially limitless creation of money to finance it – much like the way that the Federal Reserve has been holding the United States' dysfunctional financial system together for several years.

And to make a long story short, that is exactly what happened.

The effective monetary and financial powers of the ECB and EU rose sharply, enabling them to override national debt and banking crisis more or less at will. And this atmosphere of crisis evaporated in a matter of months, to the extent that it may be difficult to remember just how bad it was a couple of years ago.

But while financial catastrophe has been averted these last two years, the dysfunctional fundamentals haven't changed.

The European economy remains in poor condition.

This is particularly true when it comes to the still weak economies of Spain and Italy, which remain heavily, even overwhelmingly, in debt.

Both nations have extreme youth unemployment crises as well, which exist as but one part of the unemployment problem in Europe as a whole.

It is no coincidence that two of the nations in which the Euroskeptic parties performed the worst were Spain and Italy. After all, they know they need the help of the European Union.

What many investors as well as commentators did not understand in 2012 is the extraordinary power of governments and central banks to "change the rules" of how markets and money work, to make a seemingly unsolvable crisis evaporate in a period of months.

If one doesn't fully understand the "cure" (even if deeply flawed and limited), then one may not understand the acute dangers that arise if the basis for this "cure" collapses or is unwound.

What the Euroskeptics fundamentally threaten is the power of the EU and ECB to bring artificial stability to the markets. Without which, a raging market crisis threatening potential meltdown such as we saw in 2012 could quickly return – but without the ability to override market forces this time.

Artificial Stability & The Underlying Reality

When considering Europe – as well as the United States – we need to keep in mind that there is an often sharp distinction between the seemingly placid surface, and the underlying economic and financial reality.

In the United States, we have the underlying reality of a nation that is over $17 trillion in officially recognized debt. And if the current artificially-low interest rates were to return to historic levels, as explained here, it would pose an existential risk to the financial solvency of the US government.

And if we include "off-balance sheet items" such as unfunded future liabilities (which only the use of special governmental accounting standards lets the US government avoid taking into account) , then even as agreed to by Cox and Archer the former chairman of the House Ways and Means committee and the former head of the Securities and Exchange Commission respectively, the US is actually over $87 trillion in debt.

When we look at the fundamental economics, we have that increasingly bizarre creature of the official unemployment rate, which has been improving rapidly despite the highest real unemployment rates since the Great Depression remaining in place, thanks to the statistical methodologies of changing workforce participation rates as explained here.

We still have a world of "too-big-to-fail" financial institutions that are interlocked in a massive web of counterparty risk and other exposures, facing the possibility on a daily basis that some combination of counterparty risk, contagion risk and liquidity risk could bring down the whole system, as explained here – absent the power of central banks to prevent that from happening.

However, as I've been writing about for some years now, the dysfunctional fundamentals do not translate to some sort of collapse being inevitable. Far from it.

Rather, central banks and governments working in combination have extraordinary powers which can be used to force artificial stability on the system. Creating dollars by the trillions out of nothingness in the form of quantitative easing is one tool, even while changing the very laws and rules as needed to maintain that stability is another tool.

But the caveat with this type of crisis containment is that while there is nothing inevitable about severe financial crises or monetary collapse, there remains a certain kind of risk that could blow the whole system apart in virtually no time at all.

The Deadliest Risk

What is the most dangerous form of risk for dysfunctional economies and financial systems that are being held together through artificial governmental and central bank interventions?

It is exactly what we are seeing in Europe.

Given that money is ultimately political in nature, and it is politics that are holding the system together right now, the deadliest form of risk to this artificial stability is political risk.

And what we are seeing in Europe may be the best example of this risk that we've seen since the European financial crisis of 2012.

29% of the voters in the UK voted in favor of a party that wants to leave the EU.

25% of the electorate in France just voted in favor of a party that would exit the euro and drastically change the political landscape of Europe.

These fundamental political changes have the potential of slashing the power of the EU and the ECB to maintain artificial economic stability.

And if they do lose control, then the crisis of 2012 could be right back upon us in no time at all, as suddenly the daily headlines become filled again with the potential unraveling of the Spanish and Italian financial and economic systems.

And if the Eurozone were to go down in terms of financial stability, an effective tsunami would flash across the Atlantic Ocean in a matter of hours.

And when it hits the United States and the rest of globe, where is the greatest risk in the financial system concentrated?

As explained here the global financial system continues to have an extraordinary risk exposure to interest-rate derivatives. For a sense of scale, consider the graph above. The barely visible left column is the amount of subprime mortgage derivatives that nearly destroyed the global financial order in 2008, and the towering column next to it is that of interest-rate derivatives exposure.

If central banks lose control of the systems, one of the most likely consequences is that interest rates soar – which could collapse the entire global financial order on a scale like we have never seen before.

Changing Odds Mean Rising Uncertainty

Now does this mean that it is straight to gloom, doom and preparing for imminent and inevitable global financial collapse?

No, such an event is still most certainly not inevitable.

Nor does it even mean that some sort of currency or financial disaster scenario just became the most likely path.

The future remains very much in play, with different paths it can go down, and many of these paths do not involve any form of financial collapse. The EU parliament election results by themselves do not automatically translate to this current climate of artificial stability being doomed to fail.

Instead what we have is a shifting of the odds. That is, whatever the chances had been of a financial meltdown scenario occurring before the election was held – they just went up.

If the EU parliament election results prove to be persistent rather than a mere temporary display of voter anger, and maintain traction when it comes to the national elections that will determine the succeeding governments of the UK, France and other member nations, then the odds that the EU and ECB will lose control just rose sharply.

And if that were to occur, it sharply raises the chances of let's say a return to the situation of 2012 or worse, that ends up leading to a collapse in the value of the euro and the bankruptcies of one or more member nations.

Which could flash across the Atlantic and devastate the US economy – which would then create a doubled crisis for Canada and Australia – potentially in very short order indeed.

When we look at the extraordinary paper wealth creation in global stock markets, particularly in the United States, it's based on essentially close-to-perfect valuation when it comes to being assured that we have a healthy economy in front of us.

Now how much of the stock market value would be there if it had not been for all these years of aggressive Federal Reserve interventions and creation of cheap money is a very good question.

But the stock market remains acutely exposed to systemic financial risk. And as the interest rate derivatives graph above illustrates, the drop that we saw in 2008 is nothing compared to what could happen if the global financial system were to actually go down simultaneously with collapsing economies in Europe and the United States (along with Canada and Australia), pushing each continent deep into depression.

Therefore, the rise of the Eurosceptics does raise the risks of failure for traditional stock and bond strategies – but this event alone does not guarantee their failure.

The victories of the Eurosceptic parties increase the risk that the mechanisms being used by governments and central banks to maintain artificial financial stability could fail on a global basis – although it does not mean that such failure is at all inevitable.

The political seismic shift in Europe increases the risk of future global financial crisis or even collapse – but in no way guarantees such an outcome.

Instead, what can be said with confidence, is that the European Union parliamentary election results have – at least for now – increased the volatility of the future.

This shifting of the odds and increase in uncertainty means that the dangers associated with strategies based upon a purported ability to know the path the future will take – whether of healthy markets or financial meltdown – just increased. As did the advantages to seeking out truly robust wealth protection strategies that are built specifically for volatility and uncertainty.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.